Natural Clouding Agents Market Size (2024 – 2030)

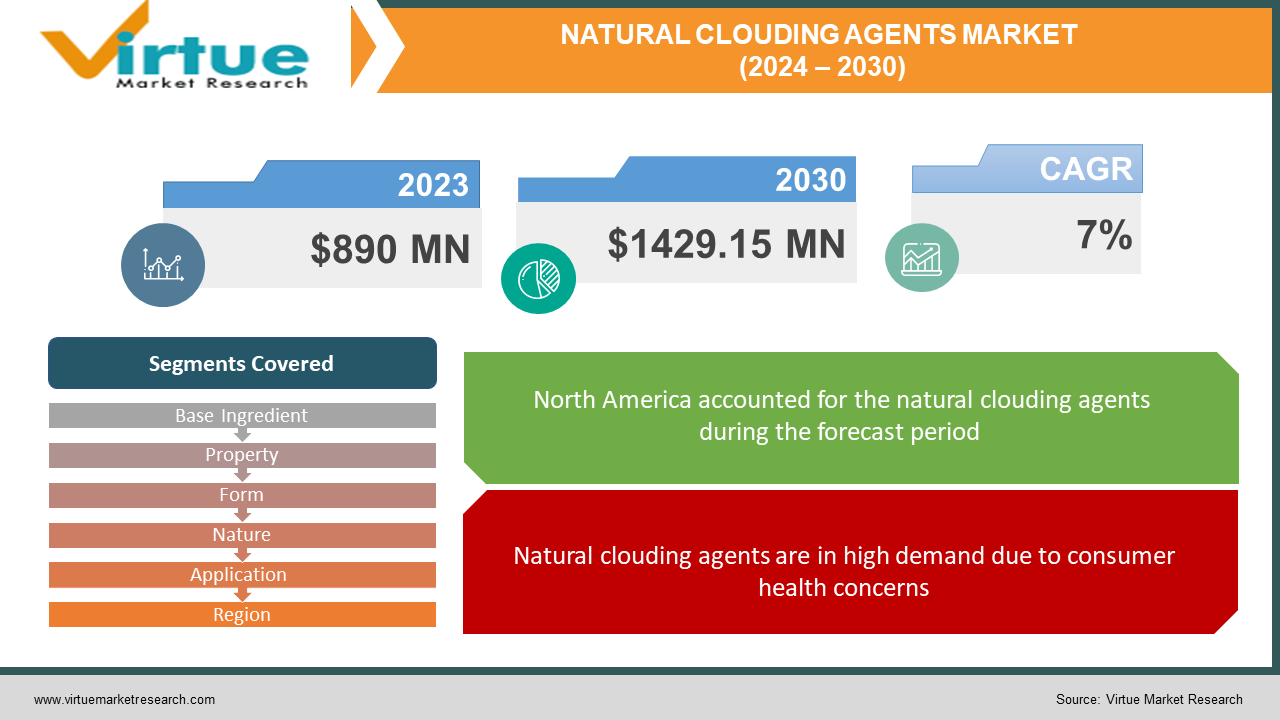

The global natural clouding agent market was valued at USD 890 million and is projected to reach a market size of USD 1429.15 million by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 7%.

Natural clouding agents come in a variety of forms and are used to add or increase turbidity to liquids, including drinks and food items. Fruits, especially citrus fruits, are a natural source of pectin, a polysaccharide that naturally causes cloudiness in fruit juices. Arabic gum improves the mouthfeel of drinks by stabilizing and thickening them. It is derived from the sap of the Acacia tree. The bacteria Sphingomonas elodea produces gellan gum, which has two uses: it acts as a gelling agent and gives an appearance of cloudiness. Guar gum, which is made from guar beans, contributes to cloudiness by stabilizing and thickening. Seaweed is the source of agar, which is mostly used as a gelling agent but can also cause cloudiness.

Key Market Insights:

The market for natural clouding agents has expanded significantly due to the growing demand from consumers for clean-label and natural products. These natural coloring agents derived from fruits and plants are becoming more common in the beverage sector as a means of improving the appearance of drinks. Natural clouding agents frequently include adaptable qualities like thickening and stabilizing in addition to their main purpose of creating cloudiness, which adds to their appeal to food and beverage producers. Improvements in extraction technologies, which allow for economical and efficient production, are driving the market's growth. The market environment has been further affected by sustainability trends, legal considerations that emphasize clean labels, and a global desire for a variety of product compositions. However, there are still issues with maintaining performance and uniformity between batches.

Natural Clouding Agents Market Drivers:

Natural clouding agents are in high demand due to consumer health concerns.

A key factor driving the market for natural clouding agents is the growing customer preference for natural and clean-label products, which is driven by a greater concern for one's health and a need for visible ingredient lists. Because they are thought to be healthier and more in line with clean label standards, these natural agents are in high demand as replacements for synthetic ones. Demand for natural clouding agents reflects a larger trend in customer preferences within the food and beverage sector towards clean, minimally processed ingredients as people grow more discriminating about the items they eat.

Because of growing knowledge, natural clouding agents are highly sought after in food and beverage compositions.

The incorporation of natural clouding agents into different formulations is motivated by the growing awareness of health and wellness. The increased awareness and preferences of customers for healthier food and beverage options have given rise to this trend. Natural clouding agents that come from healthy substances meet the changing needs of consumers, who want options that are both wholesome and clean. The addition of these agents demonstrates an industry commitment to satisfying consumers' demands for products that improve taste and nutritional value, as consumers place a premium on well-being. Thus, the focus on health and wellness highlights a paradigm shift in the food and beverage industry towards natural and advantageous components.

The growth of the beverage sector, particularly in fruit juices and soft drinks, is a major factor driving the need for natural clouding agents. These agents are necessary ingredients that are deftly employed to enhance the visual appeal and overall sensory experience of drinks. The industry's efforts to accommodate changing customer tastes are in line with the use of these agents, as consumers are looking for more visually appealing and natural solutions. The beverage industry is seeing a wider trend towards healthier and more transparent product options, which is reflected in the demand for delightful-tasting beverages with clear labels.

Growing interest in sustainable natural clouding agents due to eco-conscious trends is fueling the growth.

The food industry's increased emphasis on sustainability is fueling demand for natural clouding agents made from sustainable and environmentally friendly raw materials. Customers who are concerned about the environment are looking for products that follow sustainable practices. In addition to lowering the overall carbon footprint, natural clouding agents sourced ethically also appeal to consumers who value transparency and environmental responsibility, carving out a space for themselves in the market and boosting their brand's attractiveness.

Natural Clouding Agents Market Restraints and Challenges

The market for natural clouding agents is facing obstacles and limitations despite its encouraging rise. The widespread use of this technology is impacted by the substantial difficulty of ensuring consistent quality and performance across batches. Natural component variations can make it harder to maintain consistency, which would prevent the standardization of products. Problems with cost arise from the fact that natural resources might occasionally be more expensive to source and extract than manufactured ones. Furthermore, the perception and acceptance of cloudiness by consumers towards specific items may restrict the growth of the industry. Continuous compliance activities may be necessary due to regulatory complexity and changing labeling standards. To overcome these obstacles, industry players must carefully balance innovation, cost-effectiveness, and quality assurance while navigating the difficulties of satisfying customer expectations and legal requirements in the market for natural clouding agents.

Natural Clouding Agent Market Opportunities:

The market for natural clouding agents is full of prospects, driven by industry changes and customer preferences. Businesses can get creative by creating a variety of formulas that cater to dietary requirements and open previously unexplored geographic markets. Partnerships between manufacturers, suppliers, and academic institutions can spur innovation and quicken the development of new products. Opportunities for sustainable sourcing are created by the demand for organic products. The functional qualities of natural clouding agents serve the growing market for functional and healthy foods, and industry customization targets niche markets. Prospects for expansion are further enhanced by developments in extraction technology, transparent sourcing, and the use of Internet retail channels. The market position of natural clouding agents can be strengthened and awareness raised through educational initiatives, providing a dynamic environment for industry participants.

NATURAL CLOUDING AGENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7% |

|

Segments Covered |

By Base Ingredient, Property, Form, Nature, Application and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ADM Wild Flavors, Cargill, Chr. Hansen Holding, Danisco (DuPont), Eastman Chemical, Flachsmann Flavors and Extracts, Gat Foods, GLCC, Kerry Ingredients Givaudan Canada |

Natural Clouding Agents Market Segmentation: By Base Ingredient

-

Fruit-Based Clouding Agents

-

Tree-Sap-Based Clouding Agents

-

Seaweed-Based Clouding Agents

-

Microbial-Based Clouding Agents

Fruit-based clouding agents have the largest market share in 2023. They leverage the use of ingredients that are taken from a variety of fruits, such as citrus, berries, and tropical fruits. Pectin, citrus fiber, and cloudberry extract are among the most widely used options in this market, giving drinks a pleasingly hazy look. The category of seaweed-based clouding agents is the one with the fastest rate of growth. Seaweed-based clouding agents are gaining popularity due to consumer demand for innovative and environmentally friendly ingredients. These agents take advantage of seaweed's special functional qualities, which include thickening, gelling, and stabilizing characteristics.

Natural Clouding Agents Market Segmentation: By Property

-

Stabilizing Agents

-

Thickening Agents

-

Gelling Agents

-

Emulsifying Agents

Stabilizing agents have the largest market share. They maintain product consistency by avoiding cloud separation in a variety of beverages, such as dairy substitutes and fruit juices. Citrus fruit pectin and microbially fermented gellan gum are two common examples that meet the growing need for natural and clean-label stabilizers. Their extensive use is partly due to their vital function in preserving quality and preventing spoilage, especially in shelf-stable drinks. The fastest-growing market for gelling agents, such as agar and seaweed-derived carrageenan, is expected to expand significantly because of consumers' growing preference for decadent textures, especially in plant-based drinks. The dynamic beverage market is driven by innovation and adoption due to the variety of seaweed extracts, which may create varied textures. Additionally, the fiber content of seaweed extracts may offer health advantages.

Natural Clouding Agents Market Segmentation: By Form

-

Liquid Form

-

Powder Form

-

Other Forms

The liquid form makes up the largest category and offers producers a convenient and easily dispersible choice. Concentrated solutions that are easy to use, save time, and require fewer stages in processing include fruit extracts and seaweed hydrocolloid solutions. The liquid form offers versatility across categories and is appropriate for a broad range of beverage applications, guaranteeing constant product quality through precise dosage management. The powder form is the one that is expanding the fastest. It is made up of concentrated dry ingredients such as fruit powders, pectin powders, and gellan gum powder. With longer shelf lives and lower costs, there is a growing interest in homebrewing and DIY food products where powdered forms are convenient.

Natural Clouding Agents Market Segmentation: By Nature

-

Organic Clouding Agents

-

Conventional Clouding Agents

-

Non-GMO Clouding Agents

Conventional clouding agents, which are made using conventional farming methods that may include synthetic fertilizers, pesticides, and GMO substances, make up the majority of the market. Carrageenan and non-organic citrus fiber are two examples. Because it is less expensive than alternatives that are organic and non-GMO, cost-conscious producers are drawn to this market. On the other hand, organic clouding agents, which include agents that are certified organic, follow stringent guidelines for sustainable farming techniques, refrain from using synthetic inputs, and forbid genetically modified organisms, are the fastest-growing market. Organic agar-agar and organic pectin are two examples. Because of the opportunity for premium pricing and the growing consumer desire for natural and organic products, this category is in high demand.

Natural Clouding Agents Market Segmentation: By Application

-

Beverages

-

Sauces and Dressings

-

Dairy Products

-

Other Food Applications

Beverages, which include fruit juices, smoothies, sports drinks, plant-based beverages, and functional drinks, make up the largest market for clouding agents. To meet the increasing demand for visually appealing and texturally intriguing beverages, clouding agents are essential for improving mouthfeel, stability, and visual appeal. Their adaptability allows them to replicate natural textures and produce desirable mouthfeel profiles in a variety of beverage categories. Sauces and Dressings is the fastest-growing category, with a sharp increase in the use of natural clouding agents to guarantee uniform texture, avoid separation, and enhance the appearance of condiments including spreads, salad dressings, vinaigrettes, and dips. Due to growing customer preferences for natural and clean-label products, this market is expected to grow rapidly.

Natural Clouding Agents Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Due to its high beverage consumption, high level of consumer awareness, and the presence of major market participants, North America leads the world in the clouding agent industry. With a firmly developed food and beverage sector, the US leads the world in the use of clouding agents to extend shelf life and improve beverage stability. The market is growing because new clouding agents are always being developed. The fastest expansion is in the Asia-Pacific region, driven by the region's rapid population growth, rising disposable income, and beverage appeal. With their thriving food and beverage industries, China and India are experiencing an increase in demand for clouding agents, which is being helped by the introduction of new manufacturers. The food and beverage industries benefit from the region's permissive rules, which ensure steady market expansion.

COVID-19 Impact Analysis on the Global Natural Clouding Agents Market:

The market for natural clouding agents has been influenced by the COVID-19 epidemic in several ways. The industry has been affected by lockdowns, supply chain problems, and shifts in customer behavior. The demand for natural and clean-label products has been fueled by consumers' growing health concerns, but the epidemic has created difficulties for the supply chain and manufacturing procedures. The demand for some items containing natural clouding agents has been impacted by the closure of restaurants and food service operations, which has caused customer tastes to move towards packaged and home-cooked meals. In addition, purchase patterns have been impacted by economic uncertainty. Despite these obstacles, the pandemic has expedited the uptake of e-commerce platforms for food and beverage items, providing novel opportunities for industry participants. The market for natural clouding agents has been impacted overall, which highlights flexibility and resilience.

Latest Trends and Developments:

-

In May 2023, the Kerry Group formally announced the launch of Innopearl, a new organic clouding solution intended for use with dairy beverages.

-

In April 2023, Cargill announced that it had expanded its manufacturing capacity for ClearFlo, an organic clouding agent.

-

In March 2023, ADM officially announced the release of TruCalm, their newest organic clouding agent. TruCalm. It is claimed to be beneficial for lowering heart rate, reducing anxiety, relaxing, sleeping, reducing stress, and improving heart health.

Key Players:

-

ADM Wild Flavors

-

Cargill

-

Chr. Hansen Holding

-

Danisco (DuPont)

-

Eastman Chemical

-

Flachsmann Flavors and Extracts

-

Gat Foods

-

GLCC

-

Kerry Ingredients Givaudan Canada

Chapter 1. Natural Clouding Agents Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Natural Clouding Agents Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Natural Clouding Agents Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Natural Clouding Agents Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Natural Clouding Agents Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Natural Clouding Agents Market – By Base Ingredient

6.1 Introduction/Key Findings

6.2 Fruit-Based Clouding Agents

6.3 Tree-Sap-Based Clouding Agents

6.4 Seaweed-Based Clouding Agents

6.5 Microbial-Based Clouding Agents

6.6 Y-O-Y Growth trend Analysis By Base Ingredient

6.7 Absolute $ Opportunity Analysis By Base Ingredient, 2024-2030

Chapter 7. Natural Clouding Agents Market – By Application

7.1 Introduction/Key Findings

7.2 Beverages

7.3 Sauces and Dressings

7.4 Dairy Products

7.5 Other Food Applications

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Natural Clouding Agents Market – By Property

8.1 Introduction/Key Findings

8.2 Stabilizing Agents

8.3 Thickening Agents

8.4 Gelling Agents

8.5 Emulsifying Agents

8.6 Y-O-Y Growth trend Analysis By Property

8.7 Absolute $ Opportunity Analysis By Property, 2024-2030

Chapter 9. Natural Clouding Agents Market – By Form

9.1 Introduction/Key Findings

9.2 Liquid Form

9.3 Powder Form

9.4 Other Forms

9.5 Y-O-Y Growth trend Analysis End-User

9.6 Absolute $ Opportunity Analysis End-User, 2024-2030

Chapter 10. Natural Clouding Agents Market – By Nature

10.1 Introduction/Key Findings

10.2 Organic Clouding Agents

10.3 Conventional Clouding Agents

10.4 Non-GMO Clouding Agents

10.5 Y-O-Y Growth trend Analysis By Nature

10.6 Absolute $ Opportunity Analysis By Nature, 2024-2030

Chapter 11. Natural Clouding Agents Market, By Geography – Market Size, Forecast, Trends & Insights

11.1 North America

11.1.1 By Country

11.1.1.1 U.S.A.

11.1.1.2 Canada

11.1.1.3 Mexico

11.1.2 By Base Ingredient

11.1.2.1 By Application

11.1.3 By Property

11.1.4 By Texture

11.1.5 By Nature

11.1.6 Countries & Segments - Market Attractiveness Analysis

11.2 Europe

11.2.1 By Country

11.2.1.1 U.K

11.2.1.2 Germany

11.2.1.3 France

11.2.1.4 Italy

11.2.1.5 Spain

11.2.1.6 Rest of Europe

11.2.2 By Base Ingredient

11.2.3 By Application

11.2.4 By Property

11.2.5 By Form

11.2.6 By Texture

11.2.7 By Nature

11.2.8 Countries & Segments - Market Attractiveness Analysis

11.3 Asia Pacific

11.3.1 By Country

11.3.1.1 China

11.3.1.2 Japan

11.3.1.3 South Korea

11.3.1.4 India

11.3.1.5 Australia & New Zealand

11.3.1.6 Rest of Asia-Pacific

11.3.2 By Base Ingredient

11.3.3 By Application

11.3.4 By Property

11.3.5 By Form

11.3.6 By Texture

11.3.7 By Nature

11.3.8 Countries & Segments - Market Attractiveness Analysis

11.4 South America

11.4.1 By Country

11.4.1.1 Brazil

11.4.1.2 Argentina

11.4.1.3 Colombia

11.4.1.4 Chile

11.4.1.5 Rest of South America

11.4.2 By Base Ingredient

11.4.3 By Application

11.4.4 By Property

11.4.5 By Form

11.4.6 By Texture

11.4.7 By Nature

11.4.8 Countries & Segments - Market Attractiveness Analysis

11.5 Middle East & Africa

11.5.1 By Country

11.5.1.1 United Arab Emirates (UAE)

11.5.1.2 Saudi Arabia

11.5.1.3 Qatar

11.5.1.4 Israel

11.5.1.5 South Africa

11.5.1.6 Nigeria

11.5.1.7 Kenya

11.5.1.8 Egypt

11.5.1.9 Rest of MEA

11.5.2 By Base Ingredient

11.5.3 By Application

11.5.4 By Property

11.5.5 By Form

11.5.6 By Texture

11.5.7 By Nature

11.5.8 Countries & Segments - Market Attractiveness Analysis

Chapter 12. Natural Clouding Agents Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

12.1 ADM Wild Flavors

12.2 Cargill

12.3 Chr. Hansen Holding

12.4 Danisco (DuPont)

12.5 Eastman Chemical

12.6 Flachsmann Flavors and Extracts

12.7 Gat Foods

12.8 GLCC

12.9 Kerry Ingredients Givaudan Canada

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global natural cloud agent market was valued at USD 890 million and is projected to reach a market size of USD 1429.15 million by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 7%.

Natural clouding agents are in high demand due to consumer health concerns, use in food and beverage formulations, and growing interest in sustainable agents due to eco-conscious trends.

Base ingredient, property, form, nature, application, and region are the segments under the global natural cloud agent market.

North America is the most dominant region for the global natural cloud agent market.

Eastman Chemical, Cargill, ADM Wild Flavours, Gat Foods, GLCC, Kerry Ingredients, Givaudan Canada, Danisco (DuPont), Chr., and Hansen Holding are some of the key players in the global natural cloud agent market.