Naphthenic Base Process Oil Market Size (2024 – 2030)

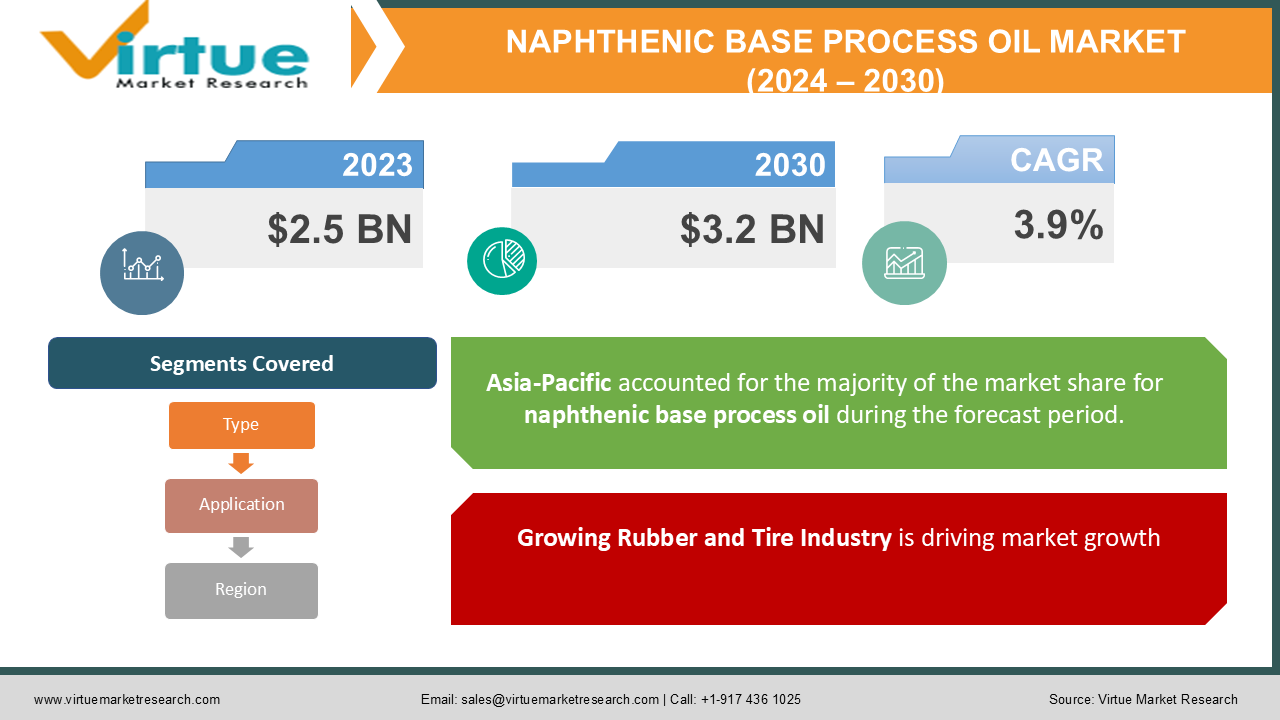

The Global Naphthenic Base Process Oil Market was valued at approximately USD 2.5 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 3.9% from 2024 to 2030, reaching a market size of USD 3.2 billion by 2030.

Naphthenic base process oils are petroleum-derived oils that have a high level of solvency and low pour points, making them ideal for applications in the tire, rubber, adhesives, and chemical industries. These oils have excellent compatibility with various materials, which makes them widely used as process oils in different industrial applications. The demand for naphthenic base oils is increasing due to their environmental advantages over aromatic oils, especially in regulatory environments that emphasize safety and sustainability. The market is driven by demand from end-user industries, particularly in emerging markets, and is expected to grow consistently due to their wide range of industrial applications.

Key Market Insights

Naphthenic oils are considered to be safer than paraffinic oils, particularly in terms of safety for performance and environment. Due to the concept of global safety compliance with rubber, tire, and adhesive applications, manufacturers now prefer naphthenic oil for lubricant purposes

The automotive industry, the greatest consumer of rubber and lubricants, widely employs naphthenic base oils. The continuing shift in the global automobile industry toward electric vehicles will positively support the growth of the naphthenic base oil market, as it creates demand for high-performance materials and process oils.

Tires, adhesives, and lubricants would be another industry that would be in greater demand as the region-industrializes and urbanizes rapidly-within China, India, and Southeast Asia. This is creating a greater market for naphthenic base oils in the three markets.

Global Naphthenic Base Process Oil Market Drivers

Growing Rubber and Tire Industry is driving market growth:

The rubber and tire industries are mainly growth drivers for this market. The rubber and tire industry is one of the major main consuming sectors of naphthenic base process oils. Naphthenic oils act as plasticizers in rubber manufacture, thereby making the rubber compounds flexible, durable, and resilient. These oils are critically important for the enhancement of grips and overall performance in tire manufacturing; hence, their importance is critical in consumer and industrial applications. The rubber industry is poised to push up the naphthenic process oil market as the automotive industry rebounds from the pandemic and with increased demand for high-performance and sustainable tires. Second, with an emphasis on electric vehicles, a low-weight and low-energy-consuming tire is now in demand, further opening the way for naphthenic process oils.

Stringent Environmental Regulations is driving market growth:

Environmental regulations regarding the use of process oils especially those containing high aromatic content have deeply influenced the demand for naphthenic base oils. Over the past decade, these oils have been more preferred due to their lower toxicity, lesser environmental impact, and adherence to international safety standards. Aromatic oils, especially, have been under stricter controls from restrictions like REACH in the European Union and comparative regulations across North America and the Asia-Pacific, resulting in naphthenic oils taking a larger market share. In addition, growing awareness about the hazards related to the polycyclic aromatic hydrocarbons (PAHs) with naphthenic oil has not only made it safer but also more environmental-friendly.

Advancements in Industrial Applications is driving market growth:

The industrial naphthenic base oils used in rubber and tires and a wide variety of other industrial applications including adhesives, paints, coatings, and lubricants. These oils have excellent solvency and compatibility with a wide variety of polymers, resins, and materials and, therefore, are preferred by many industries. The demand for specialty lubricants and transformer oils is rising due to their superior cooling, stability, and performance under extreme conditions, which are offered by naphthenic oils. Technological advancements in industrial machinery and equipment have also increased the demand for high-performance lubricants, which increases the market growth.

Global Naphthenic Base Process Oil Market Challenges and Restraints

Volatility in Crude Oil Prices is restricting market growth: The growth in the market is crude oil price volatility. The naphthenic-based process oil market is heavily interrelated with the general global industry of crude oil in that these oils are refined from petroleum. Crude oil price volatility can directly impact the cost of production of naphthenic oils, hence exposing them to price shocks. Geopolitical tensions, changes in demand patterns and disruptions to supply chains further create uncertainty in markets, which is reflected in profitability and pricing models for producers. Rising prices of crude oils also lead to an increase in the price of raw materials consumed by naphthenic oils, with a knock-on impact that could be an increase in selling prices to end-users and thus lowering demand.

Competition from Paraffinic and Synthetic Alternatives is restricting market growth:

Naphthenic base oils are matched by growth in paraffinic and synthetic alternatives. While naphthenic base oils have many properties that are particularly well suited for a variety of applications, they also face competition from paraffinic oils and synthetic process oils. The higher viscosity index and the better thermal stability of paraffinic oils have made them the preferred product in certain applications like engine oils and industrial lubricants. In addition, synthetic oils are gaining further acceptance because of their better operating performance under extreme conditions in most specialized industrial applications. Such alternatives challenge the growth in the naphthenic base process oil market, which is faced with competition from regional leaders about the availability of paraffinic or synthetic oil.

Market Opportunities

This is one of the processes for base oil of naphthenics, which render huge opportunities with the rising electric vehicle sales and a global shift toward renewable sources of energy. The growth in the electrical vehicle sector is going to increase high-performance tires and rubber materials, which will demand more process oils, strengthening the development of better fuel efficiency and durability of tires. Furthermore, investment in the upgrading of power infrastructure along with renewable energy projects would spur demand in transformer oils. Transformer oils used in the transformer industry with naphthenic properties, as they possess a cooling characteristic and are oxidation-resistant, are likely to follow the trend. In addition, the growing adoption of the use of ecofriendly products across various industries is expected to increase the opportunities for manufacturers in the production of bio-based or low-aromatic naphthenic oils towards the increasing demand for sustainable solutions.

NAPHTHENIC BASE PROCESS OIL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.9% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Calumet Specialty Products Partners, L.P., Nynas AB, Ergon, Inc., Royal Dutch Shell PLC, PetroChina Company Limited, Lubline LLC, Avista Oil AG, Chevron Corporation, Idemitsu Kosan Co., Ltd., Lukoil |

Naphthenic Base Process Oil Market Segmentation - By Type

-

Light Naphthenic Oils

-

Heavy Naphthenic Oils

-

Ultra-Low Aromatic Naphthenic Oils

The Heavy Naphthenic Oils segment dominates the type category in the global naphthenic base process oil market. This segment holds a significant share due to its extensive use in industrial applications such as rubber processing, lubricants, and transformer oils. Heavy naphthenic oils offer excellent solvency, low volatility, and superior compatibility with various additives and polymers, making them ideal for demanding applications.

Naphthenic Base Process Oil Market Segmentation - By Application

-

Rubber and Tire

-

Adhesives and Sealants

-

Lubricants and Transformer Oils

-

Paints and Coatings

-

Textile Processing

-

Polymer Manufacturing

The Rubber and Tire segment commanded the application segments in the naphthenic base process oil market. That segment shared the largest share of the market, mainly due to massive consumption in the rubber industry for tire manufacturing. Naphthenic oils are used as a plasticizer in the rubber compounds so that they can offer flexibility and performance. This market will see the tire segment at the top, on account of increased demand for the tires in the coming period from the automotive and transportation industries. Apart from this, sustainable tires which are used in electric vehicles prop up demand naphthenic process oils in this segment.

Naphthenic Base Process Oil Market Segmentation - By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

Naphthenic base process oil market in Asia-Pacific leads the global market. This is mainly due to industrialization and urbanization, which are on a roll in countries such as China, India, and Japan. These countries are heavy consumers of naphthenic oils in the rubber, tire, and lubricant industries. Automobile manufacturing in these countries is on the rise and consequently driving demand for naphthenic process oils. Advancement of raw material availability, large manufacturing facilities based within the region, etc. are the growth drivers for this market. Rising investments in infrastructure and energy projects add momentum to the demand for transformer oils and industrial lubricants especially in India and Southeast Asia, furthering the prospects for this market in the region.

COVID-19 Impact Analysis on the Naphthenic Base Process Oil Market

This has led to the COVID-19 pandemic having mixed impacts on the process naphthenic base oil market. The early lockdown and subsequent restrictions caused supply chain disruption and ceased several key productions in automobile, rubber, and manufacturing industries that lower the demand levels for naphthenic oils. However, a rebound in the market was achieved when the economy started to recover along with industries beginning. The pandemic further boosted the transition towards digitalization and automation, thus driving up the demand for lubricants and oils used in machinery and equipment maintenance. Further, with the focus on sustainable and ecologically friendly products during the pandemic, the low-aromatic environment-friendly naphthenic oil scope for entry became available in the market.

Latest Trends/Developments

There is a significant trend in naphthenic base process oil: a growing demand for more environmentally friendly oils and increased focus on sustainability. Manufacturers are constructing low-aromatic and bio-based naphthenic oils that correspond to the strong increasing demand for green products throughout various sectors. The trend toward electric vehicles in the automotive industry has also increased demand for high-performance tires and rubber materials and, therefore, stimulated naphthenic process oils demand. Increased advanced rubber compounds and adhesives used to require a higher degree of solvency and compatibility, further boosting demand in the market. Along with these developments, the increasing presence of automation and digitalization in industries is further deepening the growing requirement for industrial lubricants, where naphthenic oils have a critical role to play in enhancing performance and durability.

Key Players

-

Calumet Specialty Products Partners, L.P.

-

Nynas AB

-

Ergon, Inc.

-

Royal Dutch Shell PLC

-

PetroChina Company Limited

-

Lubline LLC

-

Avista Oil AG

-

Chevron Corporation

-

Idemitsu Kosan Co., Ltd.

-

Lukoil

Chapter 1. Naphthenic Base Process Oil Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Naphthenic Base Process Oil Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Naphthenic Base Process Oil Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Naphthenic Base Process Oil Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Naphthenic Base Process Oil Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Naphthenic Base Process Oil Market – By Type

6.1 Introduction/Key Findings

6.2 Light Naphthenic Oils

6.3 Heavy Naphthenic Oils

6.4 Ultra-Low Aromatic Naphthenic Oils

6.5 Y-O-Y Growth trend Analysis By Type

6.6 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Naphthenic Base Process Oil Market – By Application

7.1 Introduction/Key Findings

7.2 Rubber and Tire

7.3 Adhesives and Sealants

7.4 Lubricants and Transformer Oils

7.5 Paints and Coatings

7.6 Textile Processing

7.7 Polymer Manufacturing

7.8 Y-O-Y Growth trend Analysis By Application

7.9 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Naphthenic Base Process Oil Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Naphthenic Base Process Oil Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Calumet Specialty Products Partners, L.P.

9.2 Nynas AB

9.3 Ergon, Inc.

9.4 Royal Dutch Shell PLC

9.5 PetroChina Company Limited

9.6 Lubline LLC

9.7 Avista Oil AG

9.8 Chevron Corporation

9.9 Idemitsu Kosan Co., Ltd.

9.10 Lukoil

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global naphthenic base process oil market was valued at USD 2.5 billion in 2023 and is projected to reach USD 3.2 billion by 2030, growing at a CAGR of 3.9%.

The key drivers include the growing demand for naphthenic oils in the rubber and tire industry, stringent environmental regulations, and advancements in industrial applications such as adhesives, lubricants, and transformer oils.

The market is segmented by product type into light naphthenic oils, heavy naphthenic oils, and ultra-low aromatic naphthenic oils. By application, it is segmented into rubber and tire, adhesives and sealants, lubricants and transformer oils, paints and coatings, textile processing, and polymer manufacturing.

Asia-Pacific is the dominant region, driven by the growing demand from the automotive, rubber, and lubricant industries in countries such as China, India, and Japan.

Leading players include Calumet Specialty Products Partners, Nynas AB, Ergon, Inc., Royal Dutch Shell PLC, and PetroChina Company Limited.