Naphthalene Sulfonate Market Size (2024 – 2030)

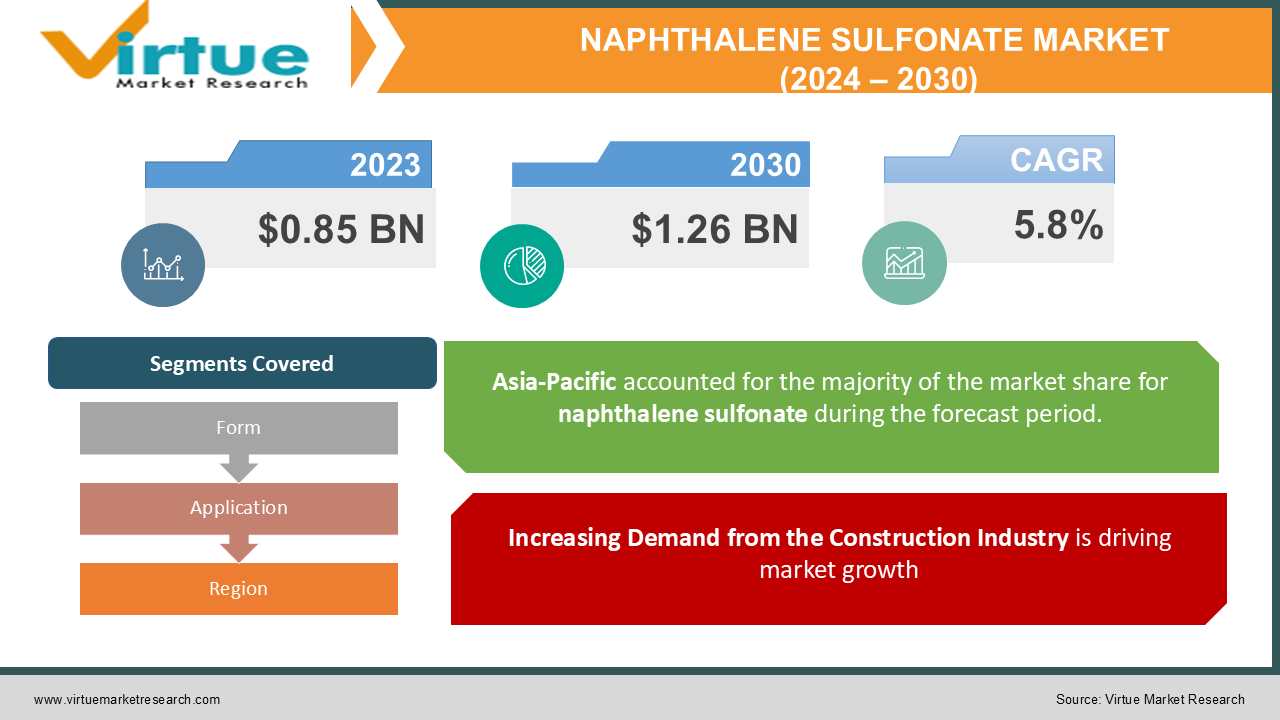

The Global Naphthalene Sulfonate Market was valued at USD 0.85 billion in 2023 and will grow at a CAGR of 5.8% from 2024 to 2030. The market is expected to reach USD 1.26 billion by 2030.

Naphthalene sulfonates, derived from naphthalene, are widely used in various industries, including construction, textiles, and agriculture. They are primarily utilized as dispersants, wetting agents, and superplasticizers in concrete to improve workability. Increasing infrastructure development projects, rising demand for efficient agrochemical solutions, and growing awareness of eco-friendly surfactants are driving the growth of this market. The market also benefits from advancements in sustainable product formulations and regulations promoting the use of non-toxic chemicals.

Key Market Insights

-

The Asia-Pacific region shares the highest market share because of rapid industrialization and urbanization in such countries as China and India, which boosts construction activities and the demand for chemical additives.

-

Naphthalene sulfonates are an excellent wetting agent and dispersant, especially in dyeing, where even color application is ensured within the textile segment. This segment's growth is steady.

-

Within the agriculture sector, there is a rising demand for more water-soluble fertilizers and pesticides. Formulations of agrochemicals improved by naphthalene sulfonates enhance efficiency.

-

Leader companies are researching this sector to formulate their new products that are more green and environmentally friendly and expand their product portfolio in step with products that could replace toxic and biodegradable chemicals.

Global Naphthalene Sulfonate Market Drivers

Increasing Demand from the Construction Industry is driving market growth: Naphthalene sulfonates play a crucial role as superplasticizers in the construction industry, improving concrete fluidity and reducing the amount of water required without compromising the strength and durability of structures. The rising number of infrastructure projects globally, including residential and commercial buildings, transportation networks, and public infrastructure, has created a surge in demand for advanced construction chemicals. Governments in developing countries are focusing on infrastructure modernization, further driving the market. The preference for high-strength concrete and the growing trend of sustainable construction practices are also key contributors to market growth. These developments highlight the essential role of naphthalene sulfonate-based additives in meeting the requirements of modern construction.

Adoption in Agriculture and Agrochemical Applications is driving market growth: In the agriculture industry, naphthalene sulfonates are essential for improving the efficiency of pesticide and fertilizer formulations. They enhance the dispersion of active ingredients, ensuring better absorption by plants and improving crop yield. With the growing global population, there is a rising need for sustainable agricultural practices, including the adoption of agrochemicals that enhance productivity while minimizing environmental impact. Naphthalene sulfonates’ role as dispersants in water-soluble fertilizers makes them indispensable in modern agriculture. This increasing reliance on agrochemical solutions, particularly in regions facing water scarcity, is a major driver of the market.

Growing Focus on Sustainable and Eco-friendly Solutions is driving market growth: The chemical industry is undergoing a transition towards more sustainable and environmentally friendly products. Governments and regulatory bodies are imposing stringent environmental regulations to limit the use of toxic chemicals, encouraging manufacturers to explore alternatives like bio-based naphthalene sulfonates. These sustainable solutions are gaining traction across industries, including construction, textiles, and agriculture, as companies align their products with environmental standards. Additionally, consumers' growing preference for green and non-toxic products has created significant opportunities for innovation in the market. This trend toward sustainability will shape the future growth of the naphthalene sulfonate market.

Global Naphthalene Sulfonate Market Challenges and Restraints

Fluctuating Raw Material Prices are restricting market growth: Naphthalene sulfonates are derived from naphthalene, a byproduct of coal tar processing. Fluctuations in the prices of crude oil and coal impact the production costs of naphthalene, posing a significant challenge for manufacturers. Volatile raw material prices can also affect the profitability of companies operating in the market. Furthermore, geopolitical tensions and trade restrictions can disrupt the global supply chain, increasing uncertainty in raw material availability. These challenges make it imperative for manufacturers to adopt cost-efficient processes and secure multiple sourcing options to maintain production stability.

Environmental Concerns and Regulatory Constraints are restricting market growth: Despite their usefulness, naphthalene sulfonates are subject to environmental scrutiny due to concerns about chemical runoff and potential toxicity. Several regions have introduced regulations to limit the use of synthetic chemicals in industrial and agricultural applications, encouraging the adoption of biodegradable alternatives. These regulatory pressures create compliance challenges for companies and necessitate additional investments in research and development. Companies operating in regions with strict environmental norms need to focus on developing eco-friendly formulations, which can increase production costs and impact profitability in the short term.

Market Opportunities

Growth in sustainability worldwide is unlocking open ends with a lot of money for the naphthalene sulfonate market. Environmental-friendly product generations across industries are being encouraged by governments and organizations, creating a higher demand for bio-based and non-toxic chemical solutions. This trend can be completely tapped into by producers to create innovative naphthalene sulfonate formulations to answer regulatory requirements along with appeal to eco-conscious consumers. The construction industry has high growth opportunities, especially within developing countries that have infrastructure development as a backbone. Continued investments into smart cities, green buildings, and transportation infrastructure will drive the demand for performance-oriented construction chemicals - in this case, naphthalene sulfonate-based superplasticizers. The agricultural sector is also evolving and becoming mainstream with precision farming applications. Naphthalene sulfonates are efficient dispersants. This can be quite important in formulating agrochemical products optimized for the requirements of modern farming. Companies with R&D directed to developing products that enhance performance in both agricultural and construction industries may benefit more in terms of competitive advantage.

NAPHTHALENE SULFONATE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.8% |

|

Segments Covered |

By Form, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF SE, Kao Corporation, Huntsman Corporation, GCP Applied Technologies, Clariant AG, AkzoNobel N.V., Arkema Group, Eastman Chemical Company, Nippon Shokubai Co., Ltd., King Industries, Inc. |

Naphthalene Sulfonate Market Segmentation - By Form

-

Liquid Naphthalene Sulfonate

-

Powdered Naphthalene Sulfonate

Powdered naphthalene sulfonates dominate this segment due to their easy handling, high solubility, and longer shelf life. These characteristics make them more popular in construction and agrochemical applications, where precise dosing and storage stability are essential.

Naphthalene Sulfonate Market Segmentation - By Application

-

Construction

-

Agriculture

-

Textile

-

Chemicals

-

Others

The construction sector is the most dominant application segment, accounting for the highest share due to the widespread use of naphthalene sulfonates as superplasticizers. The demand is driven by infrastructure development and the need for high-performance concrete in modern construction projects.

Naphthalene Sulfonate Market Segmentation - By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific leads the global naphthalene sulfonate market, driven by rapid urbanization, industrialization, and growing infrastructure projects in countries like China and India. The region’s robust construction industry, supported by government initiatives and private investments, significantly boosts the demand for naphthalene sulfonate-based products. In addition, the textile and agriculture sectors in Asia-Pacific contribute to the market’s growth, further solidifying its dominance.

COVID-19 Impact Analysis on the Naphthalene Sulfonate Market

The pandemic fell differently on various sectors of the global naphthalene sulfonate market. Lockdowns and lack of labor force severely delayed or halted construction projects temporarily and thereby temporarily curtailed the demand for superplasticizers based on naphthalene sulfonates. In addition, stalled projects also led to a decrease in market activity. However, with the revival of economies and resumption of the infrastructure projects, the demand for naphthalene sulfonates again started. It is more apparent now that good infrastructure is a support backbone to economic growth, and thus, the investment into construction works has also been restored. The superplasticizers and any other applications in construction are therefore likely to regain demand and usage as suspended projects are restarted. The pandemic brought food security to the forefront, and with that, efficient agrochemicals, such as those involving naphthalene sulfonates, gained higher acceptance. Higher demand for these chemicals is seen in increased focus on more sustainable and effective agricultural practices: improved crop yields and increased resource efficiency. In addition, this pandemic motivated significant supply chain disruptions that influenced companies to restructure their sourcing practices. However, this shift has emphasized the need for local production and sourcing to ensure continuity and minimize reliance on imported products. Going forward, the stabilization of the global economy, coupled with renewed growth, is expected to drive naphthalene sulfonate back into the fray. The market would see significant growth within the coming years, a reflection of the rising need for innovative solutions in these critical sectors: infrastructure and agriculture, both of which require considerably heavy investments.

Latest Trends/Developments

Several trends are currently dictating the future of the naphthalene sulfonate market. These include the push for developing bio-based formulations, enhanced by stringent rules, and changing consumer preferences towards sustainable products. The resulting trend is one that meets regulatory demand but also resonates with the environmentally aware consumer. Advances in nanotechnology are allowing access to high-performance additives for construction and agriculture. These products increase naphthalene sulfonate-based products' efficiency and performance, making them more appealing for various uses. The employment of digital tools and intelligent technologies in construction has also increased the demand for high-performance chemical solutions that improve material performance. With the growing influence of technology on building processes, these revolutionary additives, which can be compatible with these systems, are in greater demand. Manufacturers are further encouraging innovation by collaborating with research institutions to assist in the development of sustainable formulations. In doing so, the partner increases naphthalene sulfonate-based chemicals portfolio through the development of new applications that are supposed to change the demand in the market. Regional localization is also on the rise in the supply chains. Firms are increasingly looking at sourcing as a strategy to build resilience for possible disruption and to get a stable supply of naphthalene sulfonate products. These trends indicate that sustainability, technology, and collaboration would be key drivers of growth and innovation for the naphthalene sulfonate industry, in such a dynamic and evolving market landscape.

Key Players

-

BASF SE

-

Kao Corporation

-

Huntsman Corporation

-

GCP Applied Technologies

-

Clariant AG

-

AkzoNobel N.V.

-

Arkema Group

-

Eastman Chemical Company

-

Nippon Shokubai Co., Ltd.

-

King Industries, Inc.

Chapter 1. Naphthalene Sulfonate Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Naphthalene Sulfonate Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Naphthalene Sulfonate Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Naphthalene Sulfonate Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Naphthalene Sulfonate Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Naphthalene Sulfonate Market – By Form

6.1 Introduction/Key Findings

6.2 Liquid Naphthalene Sulfonate

6.3 Powdered Naphthalene Sulfonate

6.4 Y-O-Y Growth trend Analysis By Form

6.5 Absolute $ Opportunity Analysis By Form, 2024-2030

Chapter 7. Naphthalene Sulfonate Market – By Application

7.1 Introduction/Key Findings

7.2 Construction

7.3 Agriculture

7.4 Textile

7.5 Chemicals

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Naphthalene Sulfonate Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Form

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Form

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Form

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Form

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Form

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Naphthalene Sulfonate Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 BASF SE

9.2 Kao Corporation

9.3 Huntsman Corporation

9.4 GCP Applied Technologies

9.5 Clariant AG

9.6 AkzoNobel N.V.

9.7 Arkema Group

9.8 Eastman Chemical Company

9.9 Nippon Shokubai Co., Ltd.

9.10 King Industries, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Naphthalene Sulfonate Market was valued at USD 0.85 billion in 2023 and is projected to reach USD 1.26 billion by 2030, growing at a CAGR of 5.8%.

Key drivers include growing demand from the construction industry, increasing adoption in agriculture, and the shift toward sustainable and eco-friendly chemical solutions.

The market is segmented by form (liquid and powdered) and by application (construction, agriculture, textile, chemicals, and others).

Asia-Pacific is the most dominant region due to rapid urbanization, industrialization, and infrastructure development.

Leading players include BASF SE, Kao Corporation, Huntsman Corporation, GCP Applied Technologies, and Clariant AG