Nanotechnology in Medical Devices Market Size (2024 – 2030)

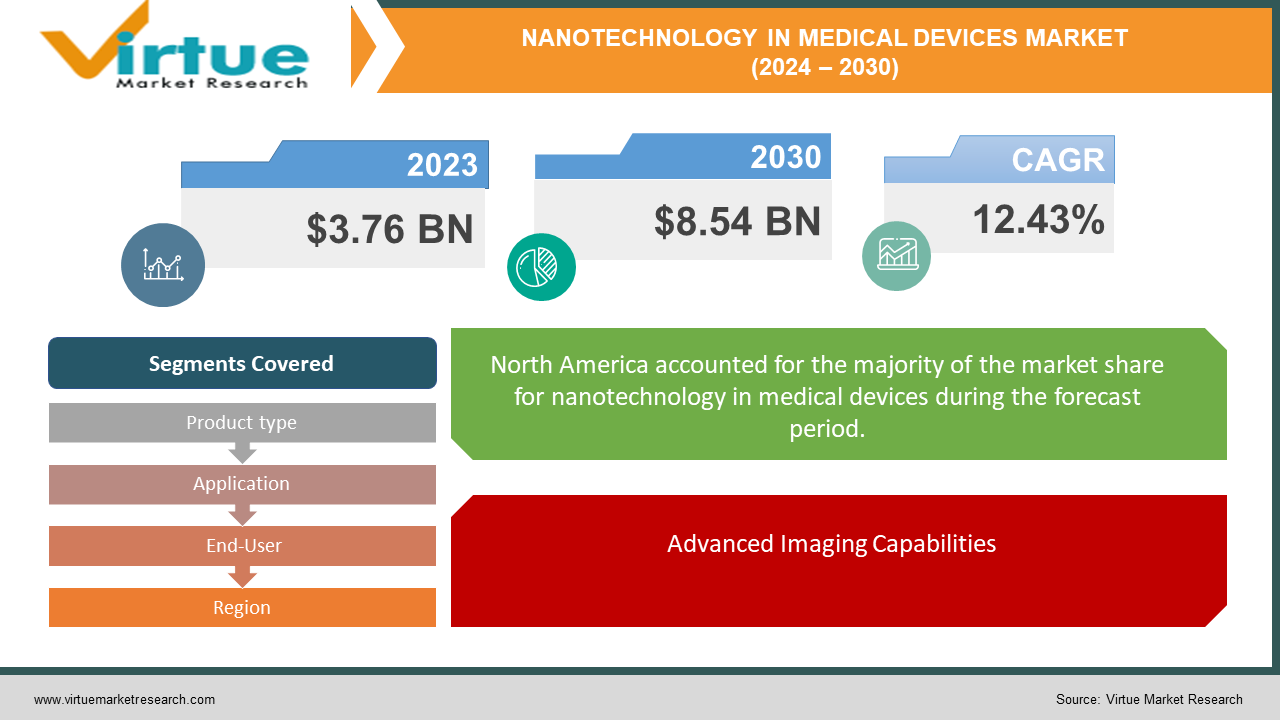

The market for nanotechnology in medical devices was estimated to be worth USD 3.76 billion in 2023 and is expected to increase to USD 8.54 billion by 2030, with a projected compound annual growth rate (CAGR) of 12.43% from 2024 to 2030.

The nanotechnology in the medical devices market is experiencing significant growth, driven by advancements in technology that enhance the performance and functionality of medical devices. Valued at USD 3.76 billion in 2023, the market is expected to grow at a compound annual growth rate (CAGR) of 12.43%, reaching USD 8.54 billion by 2030. This growth is fueled by the increasing application of nanotechnology in targeted drug delivery systems, which improve the precision and effectiveness of treatments while minimizing side effects. Additionally, nanotechnology is revolutionizing diagnostic procedures through enhanced imaging technologies that offer superior resolution and sensitivity. Major product segments benefiting from nanotechnology include active implantable devices, biochips, and advanced wound dressings. Geographically, North America dominates the market due to its advanced healthcare infrastructure and substantial investments in research and development, followed by Europe and the Asia Pacific. Overall, the integration of nanotechnology in medical devices is poised to significantly impact the healthcare industry by improving patient outcomes and advancing medical treatments.

Key Insights:

North America leads the market due to significant R&D investments, with the region accounting for over 35% of the global market share in 2023.

Biochips and lab-on-chip technologies are projected to grow at a CAGR of 13% over the forecast period, driven by their increasing application in diagnostics and personalized medicine.

The market for nanotechnology-based targeted drug delivery systems is expected to grow by 15% annually, highlighting the demand for precise and effective treatment options.

Global Nanotechnology in Medical Devices Market Drivers:

Advanced Imaging Capabilities.

One of the primary drivers of the nanotechnology in medical devices market is the enhancement of imaging technologies. Nanoparticles are being increasingly used as contrast agents in various imaging modalities, such as magnetic resonance imaging (MRI) and computed tomography (CT) scans. These nanoparticles provide superior resolution and sensitivity, enabling early and accurate disease detection. This capability not only improves diagnostic accuracy but also facilitates better monitoring of disease progression and response to treatment.

Targeted Drug Delivery Systems.

Nanotechnology is revolutionizing drug delivery systems by enabling targeted delivery of therapeutic agents. Nanoparticles can be engineered to carry drugs directly to specific cells or tissues, thereby increasing the efficacy of treatments while minimizing side effects. This targeted approach is particularly beneficial in the treatment of cancer, where it allows for higher drug concentrations at the tumor site with reduced systemic toxicity. The demand for such precise and effective treatments is driving significant growth in this market segment.

Rising R&D Investments.

The continuous growth in research and development (R&D) investments is another key driver for the nanotechnology in medical devices market. Companies and research institutions are investing heavily in the development of new nanomaterials and nanodevices that offer improved performance and novel functionalities. This surge in R&D activities is leading to the commercialization of innovative products and expanding the applications of nanotechnology in various medical fields. North America, in particular, is leading this trend due to its robust healthcare infrastructure and substantial funding for medical research.

Global Nanotechnology in Medical Devices Market Restraints and Challenges:

Regulatory and Approval Challenges.

One of the major restraints in the global nanotechnology in the medical devices market is the regulatory and approval challenges. Due to the novel nature of nanotechnology, regulatory bodies are often cautious and require extensive testing and validation to ensure safety and efficacy. This results in prolonged approval times, with over 40% of nanotechnology-based medical devices facing delays in market entry. Streamlining the regulatory process through standardized testing protocols and enhanced collaboration between industry stakeholders and regulatory agencies can help mitigate these delays and facilitate faster market access.

High Development Costs.

The high costs associated with the research and development (R&D) of nanotechnology-based medical devices pose a significant challenge. Developing these advanced technologies requires substantial investment in specialized equipment, materials, and skilled personnel. As a result, the cost of bringing a nanotechnology-based medical device to market is significantly higher compared to traditional medical devices. This financial barrier can limit the entry of new players into the market and slow down the overall pace of innovation.

Technical and Manufacturing Complexities.

Manufacturing nanotechnology-based medical devices involve complex processes that require precision and advanced technological capabilities. The production of nanoparticles and their integration into medical devices must meet stringent quality and safety standards, which can be technically challenging. Additionally, scaling up these manufacturing processes from the laboratory to commercial production often presents further difficulties. These technical and manufacturing complexities can hinder the large-scale adoption of nanotechnology in medical devices and pose ongoing challenges for manufacturers.

Global Nanotechnology in Medical Devices Market Opportunities:

Emerging Markets.

The expansion of healthcare infrastructure and increasing investments in emerging markets, such as Asia Pacific and Latin America, present substantial opportunities for the growth of nanotechnology in medical devices. These regions are witnessing a rising demand for advanced medical technologies due to growing healthcare needs, improving economic conditions, and increased awareness of innovative medical treatments. Companies focusing on these markets can tap into the large patient populations and unmet medical needs, driving significant market growth.

Collaborations and Partnerships.

Collaborations between academic institutions, research organizations, and industry players are crucial for accelerating the development and commercialization of nanotechnology-based medical devices. These partnerships facilitate knowledge exchange, share R&D costs, and combine expertise from various fields, leading to innovative solutions and faster market entry. Strategic alliances and joint ventures also help in navigating regulatory landscapes and expanding market reach, thereby driving growth and adoption of nanotechnology in medical devices.

NANOTECHNOLOGY IN MEDICAL DEVICES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

12.43% |

|

Segments Covered |

By Product type, Application, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Abbott Laboratories, Thermo Fisher Scientific Inc., Johnson & Johnson, Siemens Healthineers, General Electric Company (GE Healthcare), Stryker Corporation, Philips Healthcare, NanoString Technologies, Inc., Bruker Corporation, 3M Company, Illumina, Inc., Medtronic plc |

Nanotechnology in Medical Devices Market Segmentation: By Product Type

-

Active Implantable Devices

-

Biochips

-

Implantable Materials

-

Medical Devices

Among the various product types in the global nanotechnology in the medical devices market, biochips stand out as one of the most effective innovations. Biochips, leveraging nanotechnology, offer a versatile platform for numerous medical applications, including diagnostics, drug delivery, and personalized medicine. These miniature devices integrate biological molecules, such as DNA, proteins, or cells, onto a solid substrate at nanoscale dimensions. Their high sensitivity, multiplexing capability, and rapid analysis make them invaluable tools for early disease detection, monitoring treatment efficacy, and understanding disease mechanisms at the molecular level. Furthermore, biochips facilitate point-of-care testing, enabling healthcare providers to deliver timely interventions and improve patient outcomes. As the healthcare industry continues to prioritize precision medicine and personalized treatment approaches, biochips empowered by nanotechnology are poised to play a pivotal role in driving innovation and transforming patient care worldwide.

Nanotechnology in Medical Devices Market Segmentation: By Application

-

Therapeutic

-

Diagnostic

-

Research

Among the diverse applications of nanotechnology in the medical field, therapeutic applications emerge as the most effective and promising. Nanotechnology has revolutionized therapeutic approaches by enabling targeted drug delivery, enhancing therapeutic efficacy, and minimizing adverse effects. Nanoparticles, such as liposomes, polymeric nanoparticles, and dendrimers, can encapsulate drugs, protecting them from degradation and enabling controlled release at specific sites within the body. This targeted delivery enhances drug accumulation in diseased tissues while reducing systemic exposure, thus minimizing side effects. Additionally, nanotechnology facilitates the development of novel therapeutics, including gene therapy vectors and nanoscale biomaterials for tissue engineering and regenerative medicine. These advancements hold immense potential for addressing unmet medical needs, such as cancer, neurological disorders, and infectious diseases. With ongoing research and development efforts, nanotechnology-driven therapeutics are poised to significantly impact patient outcomes, offering tailored and effective treatment options for various health conditions.

Nanotechnology in Medical Devices Market Segmentation: By End-User

-

Hospitals & Clinics

-

Long Term Care Centers

-

Households and Home Care Settings

-

Ambulatory Surgical Centers and Urgent Care Centers

Among the diverse end-users of nanotechnology in the medical domain, hospitals and clinics emerge as the most effective and impactful. These institutions serve as pivotal hubs for delivering comprehensive healthcare services, ranging from routine check-ups to complex surgical procedures. Nanotechnology-enabled advancements in medical devices, diagnostics, and therapeutics play a crucial role in enhancing the quality of care and patient outcomes within hospital and clinic settings. For instance, nanomaterial-based implants offer innovative solutions for orthopedic surgeries, while nanoparticle-based contrast agents enhance the sensitivity and accuracy of medical imaging modalities like MRI and CT scans. Moreover, nanotechnology facilitates the development of point-of-care diagnostic devices, enabling rapid and accurate disease detection within hospital and clinic premises. With the increasing adoption of precision medicine and minimally invasive procedures, nanotechnology-driven innovations empower healthcare professionals in hospitals and clinics to deliver personalized and efficient care to a diverse patient population. This underscores the pivotal role of hospitals and clinics as primary adopters and beneficiaries of nanotechnology advancements in the medical landscape.

Nanotechnology in Medical Devices Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

In the global landscape of nanotechnology in the medical sector, regional market shares exhibit a diverse distribution, with North America leading at 35%. Renowned for its advanced healthcare infrastructure and robust research ecosystem, North America continues to spearhead innovation and adoption of nanotechnology in medical applications. Following closely behind, Europe commands a significant share of 27%, leveraging its strong scientific base and collaborative networks to drive progress in nanomedical research and development. In the dynamic Asia-Pacific region, comprising rapidly developing economies such as China, Japan, and India, the market share stands at 23%, fueled by increasing investments in healthcare infrastructure and a burgeoning demand for advanced medical technologies. South America the Middle East and Africa regions contribute 9% and 6%, respectively, to the global market share, reflecting growing awareness and adoption of nanotechnology-enabled medical solutions amidst evolving healthcare landscapes. These regional variations underscore the global nature of nanomedicine innovation and the importance of collaborative efforts to address healthcare challenges worldwide.

COVID-19 Impact Analysis on the Global Nanotechnology in Medical Devices Market:

The COVID-19 pandemic has significantly impacted global nanotechnology in the medical devices market, reshaping priorities and accelerating innovation to address emerging healthcare challenges. Amidst the crisis, nanotechnology has emerged as a critical enabler of rapid diagnostics, effective therapeutics, and advanced vaccine development. Nanoparticle-based diagnostic assays have facilitated sensitive and rapid detection of the SARS-CoV-2 virus, aiding in early containment efforts and disease management. Moreover, nanotechnology has played a pivotal role in vaccine development, with nanoparticle-based vaccine platforms offering improved stability, enhanced immune response, and potential for targeted delivery. Additionally, nanomaterials have been instrumental in enhancing personal protective equipment (PPE), antimicrobial coatings, and disinfection technologies, bolstering infection control measures in healthcare settings. However, the pandemic has also presented challenges such as disruptions in supply chains, delays in clinical trials, and economic uncertainties, impacting market growth to some extent. Nevertheless, the crisis has underscored the resilience and adaptability of the nanomedicine sector, driving collaborations, investments, and innovation to mitigate the impact of COVID-19 and advance the global response to future healthcare crises.

Latest Trends/ Developments:

The latest trends and developments in the field of nanotechnology in medical devices are poised to revolutionize healthcare by offering innovative solutions to longstanding challenges. One prominent trend is the convergence of nanotechnology with other cutting-edge fields such as artificial intelligence (AI) and machine learning (ML), facilitating the development of smart nanomedical devices capable of real-time monitoring, data analysis, and personalized treatment optimization. Furthermore, there's a growing focus on bioinspired and biomimetic nanotechnologies, drawing inspiration from natural systems to design functional materials and devices with enhanced biocompatibility, specificity, and therapeutic efficacy. Nanomedicine is also witnessing a surge in the development of targeted drug delivery systems and theranostic platforms, enabling precise delivery of therapeutics to diseased tissues while simultaneously monitoring treatment response. Additionally, there's increasing exploration of nanotechnology in regenerative medicine and tissue engineering, leveraging nanomaterials and scaffolds to mimic the extracellular matrix and facilitate tissue repair and regeneration. Lastly, the rise of nanosensors and wearable nanodevices is enabling continuous health monitoring and early disease detection, empowering individuals to take proactive measures to maintain their health. These trends collectively underscore the transformative potential of nanotechnology in reshaping the future of healthcare delivery and personalized medicine.

Key Players:

-

Abbott Laboratories

-

Thermo Fisher Scientific Inc.

-

Johnson & Johnson

-

Siemens Healthineers

-

General Electric Company (GE Healthcare)

-

Stryker Corporation

-

Philips Healthcare

-

NanoString Technologies, Inc.

-

Bruker Corporation

-

3M Company

-

Illumina, Inc.

-

Medtronic plc

Chapter 1. Nanotechnology in Medical Devices Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Nanotechnology in Medical Devices Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Nanotechnology in Medical Devices Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Nanotechnology in Medical Devices Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Nanotechnology in Medical Devices Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Nanotechnology in Medical Devices Market – By Product Type

6.1 Introduction/Key Findings

6.2 Active Implantable Devices

6.3 Biochips

6.4 Implantable Materials

6.5 Medical Devices

6.6 Y-O-Y Growth trend Analysis By Product Type

6.7 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Nanotechnology in Medical Devices Market – By End-User

7.1 Introduction/Key Findings

7.2 Hospitals & Clinics

7.3 Long Term Care Centers

7.4 Households and Home Care Settings

7.5 Ambulatory Surgical Centers and Urgent Care Centers

7.6 Y-O-Y Growth trend Analysis By End-User

7.7 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 8. Nanotechnology in Medical Devices Market – By Application

8.1 Introduction/Key Findings

8.2 Therapeutic

8.3 Diagnostic

8.4 Research

8.5 Y-O-Y Growth trend Analysis By Application

8.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Nanotechnology in Medical Devices Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By End-User

9.1.4 By By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By End-User

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By End-User

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By End-User

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By End-User

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Nanotechnology in Medical Devices Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Abbott Laboratories

10.2 Thermo Fisher Scientific Inc.

10.3 Johnson & Johnson

10.4 Siemens Healthineers

10.5 General Electric Company (GE Healthcare)

10.6 Stryker Corporation

10.7 Philips Healthcare

10.8 NanoString Technologies, Inc.

10.9 Bruker Corporation

10.10 3M Company

10.11 Illumina, Inc.

10.12 Medtronic plc

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market for nanotechnology in medical devices was estimated to be worth USD 3.76 billion in 2023 and is expected to increase to USD 8.54 billion by 2030, with a projected compound annual growth rate (CAGR) of 12.43% from 2024 to 2030.

The primary drivers of global nanotechnology in the medical devices market include increasing demand for personalized medicine, advancements in nanomaterials, and the growing prevalence of chronic diseases.

The key challenges facing global nanotechnology in the medical devices market include regulatory hurdles, safety concerns, and the need for standardized manufacturing processes.

In 2023, North America held the largest share of the global nanotechnology in the medical devices market.

Abbott Laboratories, Thermo Fisher Scientific Inc., Johnson & Johnson, Siemens Healthineers, General Electric Company (GE Healthcare), Stryker Corporation, Philips Healthcare, NanoString Technologies, Inc., Bruker Corporation, 3M Company, Illumina, Inc., Medtronic plc are the main players.