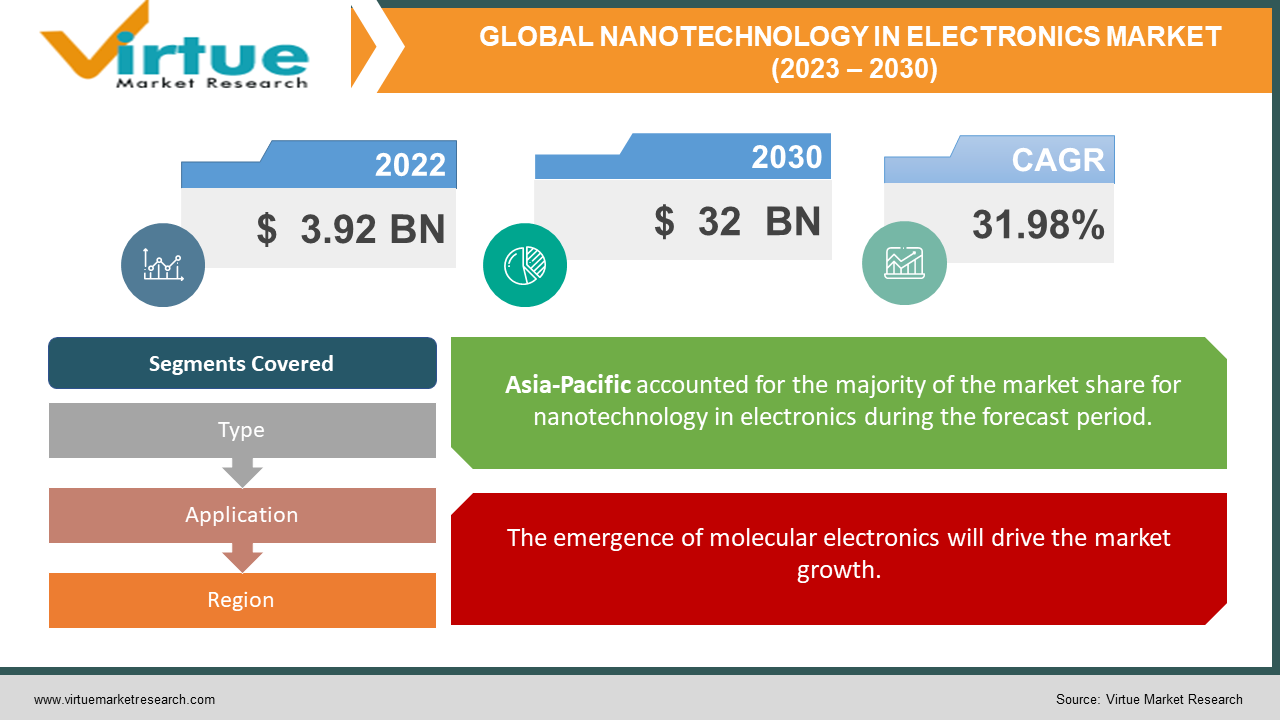

Global Nanotechnology in Electronics Market Size (2023 – 2030)

According to our research report, the global nanotechnology in the electronics market was values at USD 3.92 billion in 2022 and is estimated to grow to USD 32 billion by 2030. The market is projected to witness a CAGR of 31.98% per annum during the period of analysis (2023 - 2030).

Industry Overview

The study of nanoparticles and devices is a component of nanoscience and nanotechnology, which have applications in all branches of science including, but not limited to, chemical, biomedical, mechanical, and material research. The manufacture and deployment of physical, chemical, and biological systems and devices at scales ranging from individual atoms or molecules to about 100 nanometers are included in the field of nanotechnology.

Due to the growing range of applications for nanoparticles in sectors like biomedicine, energy, electronics, and wastewater treatment, the U.S. market for nanomaterials is predicted to experience the strongest growth in the area. The U.S. government makes significant investments in nanotechnology to lead global technological advancement. The National Nanotechnology Initiative (NNI) initiative, organizes the development of nanomaterials.

Due to the vast range of applications for nanomaterials, the market is anticipated to expand at a phenomenal rate; as a result, the danger of new competitors is anticipated to be significant. New market entrants would initially have to fight with businesses that have a solid grasp on the sector and a sizable client base. As a result of enterprises operating in the parent market integrating backward or forward, the threat of new entrants is also anticipated.

The introduction of strict laws is anticipated to be prompted by factors like the anticipated increase in the population exposed to these nanoparticles, occupational exposure, and the anticipated evolution of possibly detrimental consequences in the upcoming years. Thus, future industrial growth is anticipated to be hampered by the anticipated increased stringency in the regulations relating to nanomaterials and nanotechnology.

Impact of Covid-19 on the Industry

Nanotechnology, a versatile technology with several uses in many different end-use industries, is currently confronting a variety of difficulties and chances as the COVID-19 epidemic spreads over the world. The focus on nano intervention in terms of creating efficient ways to identify, diagnose, treat, and stop the spread of COVID-19 infections is driving attention to nanotechnology healthcare applications as the globe battles its greatest public health crisis in history. Designing risk-free and efficient immunization procedures may be possible because of their function as nanocarriers. The usage of nanotechnology solutions in the manufacture of several technologies and products will increase in the years following COVID-19.

Market Drivers

The emergence of molecular electronics will drive the market growth

The market for nanoelectronics is primarily driven by molecular electronics. This market is expanding significantly as a result of the advancement of this technology and the rise of spin-based computing. The development of Spintronics with Nano Electronics, which will aid in the development of spin-based computing in the upcoming year, is another driver driving this market for Nanoelectronics.

Various applications of Nanoelectronics such as wearable devices will drive the market growth

Nanowire-based electrodes may allow for the creation of flexible flat panel displays that are also thinner than currently available flat panel displays. A thin, millimeter-thick display could be made possible by using carbon nanotubes to transmit electrons to the pixels that illuminate the image.

A nanomaterial called quantum dots has the potential to take the place of the fluorescent dots used in current display technologies. Additionally, it's expected that manufacturing quantum dot displays will be simpler and use less energy.

The next generation of personal health gadgets and the rapidly expanding selection of smartwatches demonstrate that the wearable electronics era has arrived. These devices are currently under development, to combine physical flexibility, a straightforward manufacturing process, and low power requirements. Cadmium selenide nanocrystals were deposited on plastic sheets to make flexible electrical circuits in one promising research project.

Market Restraints

This technology is still in the introductory phase

Since this technology is still in its infancy, manufacturers of electronics products are less aware of it, which slows the expansion of the Nanoelectronics market. Furthermore, because some components' scaling may differ, it is difficult to apply this technology to a variety of components.

NANOTECHNOLOGY IN ELECTRONICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

30% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Strem Chemicals, Inc., American Elements, US Research Nanomaterials, Inc., Nanocomposix, Inc., Frontier Carbon Corporation, Nanoshel LLC, SkySpring Nanomaterials, Inc., Nanophase Technologies Corporation, Cytodiagnostics, Inc., Quantum Materials Corp |

This research report on the global nanotechnology in the electronics market has been segmented and sub-segmented based on, and Geography & region.

Global Nanotechnology in Electronics Market- By Types

- Nanotubes

- Graphene

- Nanofibers

- Nanosilver

- Nanowires

- Nanobuds

- Others.

Since they have the maximum reversible capacity, carbon nanotubes, which accounted for the largest revenue share of 23.7 percent in 2020, are frequently employed in lithium-ion batteries. The use of carbon nanotubes in a variety of pharmaceutical and medical applications has been made possible by their vast surface area and capacity to absorb and conjugate diagnostic and therapeutic substances, including medicines, genes, vaccines, biosensors, and antibodies.

In 2020, the titanium nanoparticles market contributed a sizeable 22.2 percent of total revenue. Its expanding applications in the aerospace, chemical, medicinal, petrochemical, and architectural industries might be blamed for the increase. As antimicrobial, antibiotic, and antifungal agents, these are also utilized in textiles, soaps, nanofibers, bandages, and textiles.

In 2020, the silver nanoparticles segment had the second-highest revenue share with 13.5 percent. Due to their distinctive qualities like high electrical conductivity, discrete physical and optical properties, and biochemical functionality, these are used in a wide range of applications as antimicrobial agents, biomedical device coatings, drug-delivery carriers, imaging probes, and diagnostic and optoelectronic platforms.

Global Nanotechnology in Electronics Market- By Application

- Aerospace

- Automotive

- Medical

- Energy & power

- Electronics

- Paints & Coatings

- Others

In 2020, the medical application segment dominated the market and held a 29.98 percent revenue share. This expansion can be ascribed to a variety of uses for the technology, such as imaging, targeted drug administration, surgical nanorobots, nanodiagnostics, cell healing, and nanobiosensors.

Due to the advancement of contemporary methods for customizing the production and application of nanomaterials in the coating sector for particular demands, the paints and coatings segment is predicted to have significant growth. Paints and coatings with nanomaterials perform better in terms of UV light absorption, biocide, and hardness. The main nanomaterials used in paints are silicon dioxide and titanium dioxide (TiO2). Additionally, nanosilver is being utilized in paints more frequently because of its improved antibacterial and deodorizing qualities.

Due to nanomaterials' growing use in nanoelectronics products like nanowires, spintronics, and quantum dots, the demand for them in electronics applications is expanding significantly. Additionally, due to the growing need for high-tech goods, the electronics industry is experiencing significant growth, which is projected to have a beneficial effect on product demand over the forecast period.

Due to the growing use of nanomaterials in batteries, fuel cells, and solar film coatings, the energy and power industry is anticipated to have a considerable demand for these materials and is predicted to grow at a CAGR of 14.9 percent over the projection period. Nanoparticles are widely employed in scientific study to create prototype solar panels, thermoelectric materials, and enzymes through nano-bioengineering.

Global Nanotechnology in Electronics Market- By Geography & Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

In 2020, Asia Pacific held the greatest revenue share (35.5%) in the global market for nanomaterials. The expansion can be linked to the expanding usage of nanomaterials in the electronics, aerospace and defense, textiles, automotive, medical equipment, and electronics industries. The market's expansion in North America can be attributed to the region's standing as a global leader in manufacturing. Throughout the projection period, the regional market is anticipated to be driven by ongoing efforts in nanomaterials and nanotechnology R&D to investigate possible applications in various end-use sectors. Microelectronics and nanoelectronics are expected to see increased product demand as a result of the rising usage of cutting-edge technology.

Due to assistance from the national governments and investment in the various home markets in the area, the market in Europe is anticipated to reach USD 4.5 billion by 2028. The European Commission launched the 2D-Experimental Pilot Line (2D-EPL), a new USD 23 million cooperative projects, to investigate the production of ground-breaking electrical gadgets, photonic devices, and sensors that incorporate graphene and layered nanomaterials in the area.

The market in Central and South America is expected to experience significant growth over the next years as several multinational corporations concentrate on growing their operations in the region's unexplored marketplaces. Brazil is regarded as a leader in the field of nanomaterials research in all of South America. Universities and other research institutions conduct technological research in the nation with good public funding.

Technology advancements in a variety of industries, including electronics, medicine, and the automobile industry, have considerably improved the average person's standard of living in the Middle Eastern and African economies. Rising middle-class disposable income and soaring desire for opulent goods like mobile phones, laptops, and other electronic gadgets have led to a surge in the demand for electrical equipment in the area.

Global Nanotechnology in Electronics Market- By Companies

- Strem Chemicals, Inc.

- American Elements

- US Research Nanomaterials, Inc.

- Nanocomposix, Inc.

- Frontier Carbon Corporation

- Nanoshel LLC

- SkySpring Nanomaterials, Inc.

- Nanophase Technologies Corporation

- Cytodiagnostics, Inc.

- Quantum Materials Corp

NOTABLE HAPPENINGS IN THE GLOBAL NANOTECHNOLOGY IN ELECTRONICS MARKET IN THE RECENT PAST:

- Merger & Acquisition: - In 2021, The purchase of nanocomposites by Fortis Life Sciences has been finalized. This premium nanomaterials business specializes in solutions for assay development and diagnostics. Since 2004, nanocomposite has developed one of the industry's most complete portfolios of nanomaterials. Nanomaterials from nanocomposite are employed in numerous Life Sciences applications, including drug delivery, imaging, and diagnostics, as well as in industrial settings.

- Merger & Acquisition: - In 2019, Quantum Materials Corp, a top-tier American maker of cadmium-free quantum dots and nanomaterials, stated today that it has acquired several Capstan Platform, Inc.'s assets. Capstan Platform, Inc. specialised in developing blockchain technology for commercial organizations.

Chapter 1. GLOBAL NANOTECHNOLOGY IN ELECTRONICS MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL NANOTECHNOLOGY IN ELECTRONICS MARKET – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. GLOBAL NANOTECHNOLOGY IN ELECTRONICS MARKET – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. GLOBAL NANOTECHNOLOGY IN ELECTRONICS MARKET - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL NANOTECHNOLOGY IN ELECTRONICS MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL NANOTECHNOLOGY IN ELECTRONICS MARKET – By Types

6.1. Nanotubes

6.2. Graphene

6.3. Nanofibers

6.4. Nanosilver

6.5. Nanowires

6.6. Nanobuds

6.7. Others.

Chapter 7. GLOBAL NANOTECHNOLOGY IN ELECTRONICS MARKET – By APPLICATION

7.1. Aerospace

7.2. Automotive

7.3. Medical

7.4. Energy & power

7.5. Electronics

7.6. Paints & Coatings

7.7. Others

Chapter 8. GLOBAL NANOTECHNOLOGY IN ELECTRONICS MARKET - By Region

8.1. North America

8.2. Europe

8.3. Asia-Pacific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9. GLOBAL NANOTECHNOLOGY IN ELECTRONICS MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

9.1. Strem Chemicals, Inc.

9.2. American Elements

9.3. US Research Nanomaterials, Inc.

9.4. Nanocomposix, Inc.

9.5. Frontier Carbon Corporation

9.6. Nanoshel LLC

9.7. SkySpring Nanomaterials, Inc.

9.8. Nanophase Technologies Corporation

9.9. Cytodiagnostics, Inc.

9.10 Quantum Materials Corp

Download Sample

Choose License Type

2500

4250

5250

6900