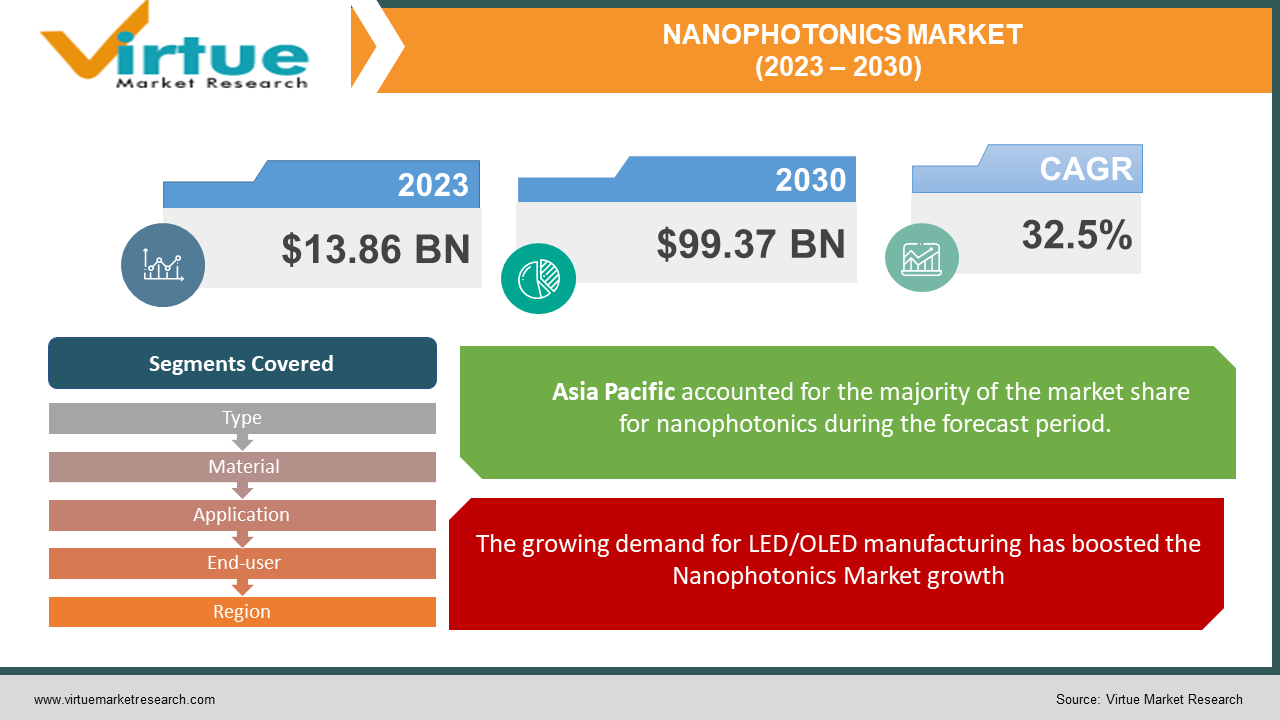

Global Nanophotonics Market Size (2023 – 2030)

The Global Nanophotonics Market was valued at USD 13.86 Billion and is projected to reach a market size of USD 99.37 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 32.5%.

Industry Overview:

The study of the behavior of light on the nanoscale scale, as well as the interaction of nanometer-scale objects with light, is known as nanophotonics or nano-optics. Optics, optical engineering, electrical engineering, and nanotechnology are all branches of this field. It frequently involves dielectric structures, such as nanoantennas or metallic components that use surface plasmon polaritons to transport and focus light. Nanomaterials occupy a significant space in nanophotonics, and as we'll see in this and subsequent sections, nanoscale optical materials cover a wide range of optical applications and have an extraordinarily rich range of nanostructure design. Modifying these nanostructures' optical properties allows for the improvement of one photonic function while presenting another photonic manifestation, as well as the convergence of many functions to create multifunctionality.

Nanophotonics enables solid-state lighting with high thermal conductivity and modulation rate, hence increasing device efficiency and enhancing light quality. Furthermore, nanophotonic device manufacturers are combining small-scale power electronics and transistors on a single chip to increase bandwidth and data transmission speed. This allows nanophotonic integrated circuits (ICs) to interface with other devices directly through light. Various product advances, such as the development of ultra-thin nanomaterials and atomic-thin metal halides, are also working as growth stimulants. These nanoparticles are found in sensitive optical sensors that detect gases in the environment. Other factors, such as the widespread use of nanophotonics in chemical, biosensing, and information technology (IT) applications, as well as intensive research and development (R&D) efforts, are estimated to propel the market forward.

COVID-19 Impact on Nanophotonics Market:

The recent COVID-19 outbreak started in Wuhan (China) in December 2019 and has rapidly spread around the world since then. As of March 2020, China, Italy, Iran, Spain, the Republic of Korea, France, Germany, and the United States were among the countries with the highest number of positive cases and reported deaths. Due to lockdowns, travel bans, and company closures, the COVID-19 epidemic has impacted economies and businesses in several countries. As a result of the outbreak, the global nanophotonics industry is one of the major businesses experiencing substantial disruptions such as supply chain disruptions, technology event cancellations, and office closures. With the presence of and the largest raw material suppliers, China is the global industrial powerhouse. Due to factory closures, supply chain obstacles, and the global economic slump, the general market breakdown caused by COVID-19 is also harming the expansion of the nanophotonics market.

Market Drivers:

The growing demand for LED/OLED manufacturing has boosted the Nanophotonics Market growth

One of the primary drivers for the global nanophotonics market is LED/OLED makers' ongoing focus on developing products that consume less energy and have great brightness efficiency. Increased reliance on optical communication, as well as increased interest in the development of optoelectronic nanomaterials for screens, lasers, and low-cost photovoltaic (PV) photodetectors using quantum dots and nanophosphors, are expected to drive the global nanophotonics market forward in the future. The world market for nanophotonic equipment is growing due to increased investment in research and development on the manipulation of electron-photons in nanoscale materials to produce new photonic devices and other developing technologies.

The rise in application in various industries due to technological advancements in Nanophotonics Market has propelled the market growth

Nanophotonics products are in more demand as their applications in diverse end-use sectors expand. The nanophotonics market is projected to benefit from this. Nanophotonics devices are being employed in a growing number of applications in the healthcare, information technology, and automotive industries. Nanophotonics is increasingly being used in consumer electronics to manufacture electrical components, which is driving the global industry. Nanophotonics science benefits a wide range of businesses. Nanophotonics is the study of matter and light interactions at the nanoscale scale. It is the scientific method of employing nanotechnology in photonics or nanotechnology in photonics. Many developing countries are investing in nanophotonics research and development. Digitalization, advancements in telecommunications and biotechnology, increased artificial intelligence adoption, and an increase in worldwide Internet penetration are some of the reasons driving the nanophotonics market.

Increasing demand for consumer electronics driving the rise of the Nanophotonics Market

Due to the lengthy lockdown and quick spread of the coronavirus around the world, several businesses and manufacturing industries have temporarily ceased operations. Manufacturers are embracing new trends and technology to create nanophotonics products that may be used in a variety of applications. Increasing government attempts to promote manufacturing industries, as well as a strong presence of manufacturers in the nanophotonics industry, are boosting market expansion in the face of the coronavirus pandemic. The nanophotonics industry is being driven by an expansion in the number of manufacturers in consumer electronics due to increased consumer demand. During the coronavirus epidemic, sales of cellphones, laptops, smart gadgets, PCs, tablets, wearable devices, and other electronic devices increased dramatically. Electronic components such as LEDs, OLEDs, sensors, memory, and photovoltaic cells can all benefit from nanophotonics devices. Furthermore, continuous nanophotonics research and development is propelling global expansion.

Market Restraints:

Lack of research and development costs is hampering the Nanophotonics Market

Lack of understanding of the potential benefits of nanophotonic technology, as well as high research and development costs, have been recognized as roadblocks to the global Nanophotonics Market's growth.

NANOPHOTONICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

32.5% |

|

Segments Covered |

By Type, Material, Application, End-user, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

OSRAM Opto Semiconductors GmbH, Hamamatsu Photonics K.K., Nanosys Inc., QD Solar Inc., Agiltron Inc., Seoul Semiconductor Co., Ltd., Jenoptik AG, Thorlabs, Inc., ROHM CO., LTD., OLEDWorks |

This research report on the global Nanophotonics Market has been segmented based on type, material, application, end-user, and regions.

Nanophotonics Market- By Type

-

LED and OLEDs

-

Sensors

-

Photovoltaic Cells

-

Near Field Optics

-

Optical Switches

-

Others (Optical Amplifiers, Holographic Memory, etc.)

The largest segment, nanophotonics LEDs, is projected to lead the market segment, representing a 91.3 percent compound annual growth rate (CAGR). According to the business, the optical amplifier and holographic memory device segments are estimated to grow at a CAGR of 23.9 percent and 23.6 percent, respectively, from 2023 - 2030. Lighting and traffic signaling, backlighting in electronic displays, artificial photosynthesis, medical technology, UV curing, and counterfeit detection are among the key application areas for these components, according to the business.

Nanophotonics Market- By Material

-

Quantum Dots

-

Photonic Crystals

-

Plasmonic

-

Nanotubes

-

Nanoribbons

Quantum dots can be employed in a variety of applications, including single-electron transistors, solar cells, second-harmonic generation, LEDs, lasers, single-photon sources, quantum computing, cell biology research, microscopy, and medical imaging, due to their unique features. These nanometer-sized semiconductor particles are made of cadmium, indium, lead, and other materials, and when energy is given to them, they produce light of particular wavelengths. The dimensions of quantum dots make them popular. Nanomaterials such as quantum dots are becoming increasingly popular in nanophotonics. Quantum dots are used in surveys and detection, data communication, image capture and display, medical equipment, illumination, instrumentation, and research, among other things. This factor has recently boosted the global nanophotonics industry.

Nanophotonics Market- By Application

-

Surveying and Detection

-

Data Communication

-

Image Capture and Display

-

Medical Equipment

-

Lighting

-

Others (Instrumentation, Research, Academia, etc.)

Nanophotonics Market- By End-User

-

Consumer Electronics

-

Healthcare (Biotechnology)

-

IT & Telecommunication

-

Others (Automotive, Defense, etc.)

Nanophotonics Market- By Region

-

North America

-

Europe

-

Asia-Pacific

-

Rest of the World

The Asia Pacific, followed by North America and Europe, is predicted to lead the worldwide nanophotonics market during the forecast period. This is owing to the area's continued concentration on commercializing nanophotonic technology in numerous applications, as well as the presence of significant manufacturers.

Major Key Players in the Market

- OSRAM Opto Semiconductors GmbH

- Hamamatsu Photonics K.K.

- Nanosys Inc.

- QD Solar Inc.

- Agiltron Inc.

- Seoul Semiconductor Co., Ltd.

- Jenoptik AG

- Thorlabs, Inc.

- ROHM CO., LTD.

- OLEDWorks

The nanophotonics market is seeing increased profitability as top market players compete for market share. Furthermore, the global market is being driven by the growing need for nanophotonics devices. To create and manufacture energy-efficient products, market participants are incorporating new technologies such as cloud services and artificial intelligence. To keep ahead of the competition, market players are focused on innovations and research. The high cost of nanophotonics research is a major impediment to the global market's expansion. Market participants and governments from various nations are examining various options for dealing with the high investment costs associated with R&D. Manufacturers operating in Asia Pacific countries such as China, India, Japan, and South Korea have plenty of opportunities. This can be due to rising consumer electronics demand, fast industry expansion, technological advancements, and digitalization.

Market Insights and Developments

- Hamamatsu Photonics created the 'MiNYTM PL micro-LED PL' inspection system in March 2021. This inspection system can inspect micro-LEDs for next-generation displays at a speed of 100 percent. The newly created display is utilized to detect irregularities in their outward appearance, light emission strength, and wavelength. Fast pass/fail judgments are made using the MiNYTM PL micro-LED PL inspection technology. This new introduction adds to better micro-LED R&D efficiency as well as increased product yield for display applications.

- Thorlabs Inc announced the debut of the SPDC810 product line in January 2021, which is planned to cater to the fast-growing quantum photonics area. Quantum photonics requires high-intensity photon sources for a variety of applications, ranging from basic photon-matter interactions to devise characterization. To generate photon pairs above 450 kHz at 810 nm, designers use a fully integrated 405 nm pump source that is tunable at the front end of a spontaneous parametric downconversion (SPDC) device.

- Jenoptik purchased Trioptics in July 2020. Trioptics provides optical sensors and component measuring and testing equipment. This purchase is estimated to strengthen the company's position in the photonics market.

Chapter 1. Global Nanophotonics Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Nanophotonics Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Global Nanophotonics Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Global Nanophotonics Market Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Global Nanophotonics Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Nanophotonics Market – By Type

6.1. LED and OLEDs

6.2. Sensors

6.3. Photovoltaic Cells

6.4. Near Field Optics

6.5. Optical Switches

6.6. Others (Optical Amplifiers, Holographic Memory, etc.)

Chapter 7. Global Nanophotonics Market – By Material

7.1. Quantum Dots

7.2. Photonic Crystals

7.3. Plasmonic

7.4. Nanotubes

7.5. Nanoribbons

Chapter 8. Global Nanophotonics Market – By Application

8.1. Surveying and Detection

8.2. Data Communication

8.3. Image Capture and Display

8.4. Medical Equipment

8.5. Lighting

8.6. Others (Instrumentation, Research, Academia, etc.)

Chapter 9. Global Nanophotonics Market – By End-User

9.1. Consumer Electronics

9.2. Healthcare (Biotechnology)

9.3. IT & Telecommunication

9.4. Others (Automotive, Defense, etc.)

Chapter10. Global Nanophotonics Market- By Region

10.1. North America

10.2. Europe

10.3. Asia-Pacific

10.4. Latin America

10.5. The Middle East

10.6. Africa

Chapter 11. Global Nanophotonics Market – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

11.1 OSRAM Opto Semiconductors GmbH

11.2 Hamamatsu Photonics K.K.

11.3 Nanosys Inc.

11.4 QD Solar Inc.

11.5 Agiltron Inc.

11.6 Seoul Semiconductor Co., Ltd.

11.7 Jenoptik AG

11.8 Thorlabs, Inc.

11.9 ROHM CO., LTD.

11.10 OLEDWorks

Download Sample

Choose License Type

2500

4250

5250

6900