Nanofiber for Textile Market Size (2024 – 2030)

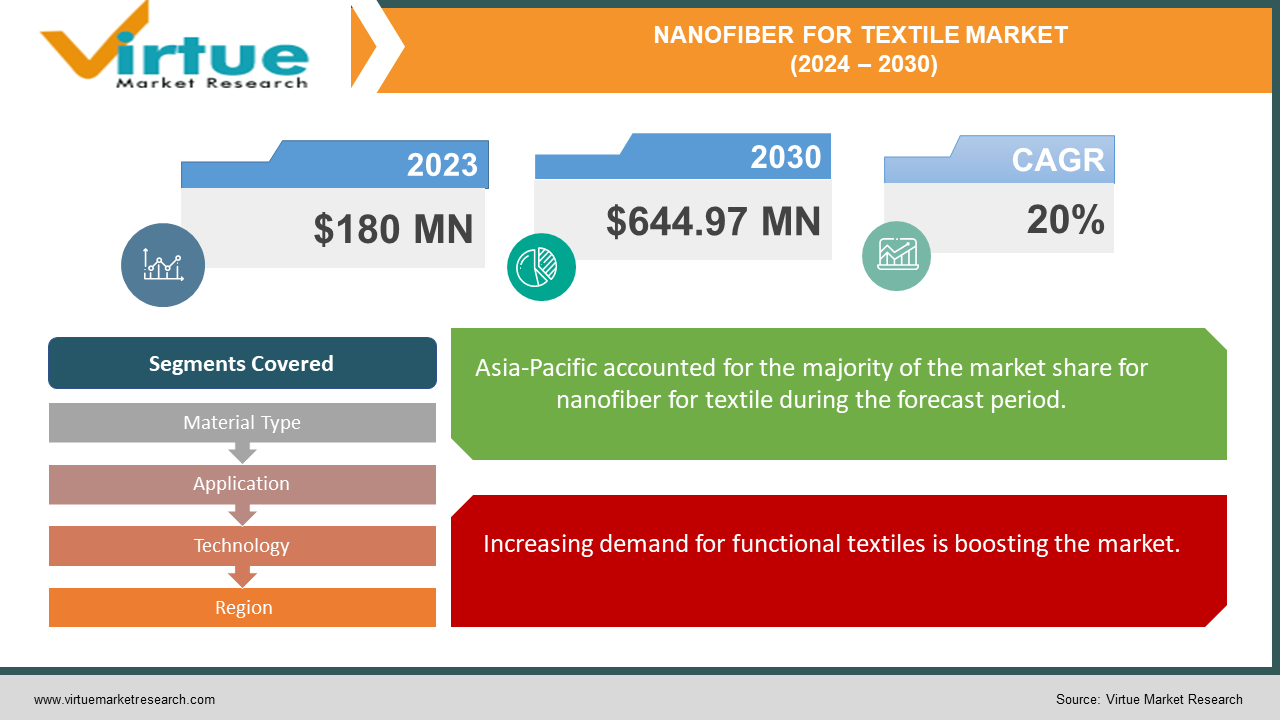

The global nanofiber for the textile market was valued at USD 180 million and is projected to reach a market size of USD 644.97 million by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 20%.

Synthetic polymer filaments with a width of 100 nanometers or less are known as nanofibers. They are made via a technique known as electrospinning, which entails subjecting a polymer solution to electrostatic forces while spinning it quickly. The resultant fibers include a molecular structure that is largely devoid of defects and a high surface area-to-volume ratio.

Nanofibers can be utilized in textiles as a filler or reinforcement in the bulk of the fabric or as a functional layer on the fabric's surface. They may be made to do a variety of tasks, including transmitting heat, resisting heat, and being rigid and powerful. The concept of nanofibers started emerging around the end of the 20th century. Initially, electrospinning was the main method that was used for their production. However, commercialization was limited. Presently, the market has witnessed an expansion owing to its superior characteristics and commercial applications. In the future, with an extensive focus on innovations and customization, immense growth is anticipated.

Key Market Insights:

The rip strength of nanofiber/woven composites is three times that of market-available woven mesh, while that of nanofiber/knitted composites is 2.5 times that of market-available knitted mesh.

The bursting strength of nanofiber/woven composites is 613.1 Kpa, whereas the bursting strength of nanofiber/knitted composites is 751.1 Kpa.

Tensile strength values for nanofiber/woven and nanofiber/knitted composites are 195.76 N and 227.85 N, respectively.

The market for the manufacture of nanofibers is anticipated to expand at a compound annual growth rate (CAGR) of almost 6% and reach USD 26 million by 2028.

It is anticipated that the market for goods made from electrospun nanofiber will expand at a compound annual growth rate of 25% to 35% starting in 2025.

Nanofibers have a variety of applications.

Nanofiber for Textile Market Drivers:

Increasing demand for functional textiles is boosting the market.

Nanofibers can be added directly to existing textiles to increase their quality. The special qualities of nanofibers, such as their strength, flexibility, conductivity, waterproofing, filtration, and breathability, can improve textiles. They can also be used to provide materials with flame-retardant, water-repellent, antimicrobial, or self-cleaning properties. Nanofibers have a high surface-to-volume ratio, tiny diameters, and are lightweight. They also have small pore diameters and are quite porous. Sportswear, medical apparel, and military uniforms are perfect applications for nanofibers. These can support weight, improve toughness, and resist abrasion. Because they are made of a huge surface area, nanofibers can effectively cover metal substrates. Due to these exceptional mechanical qualities, nanofibers are used in the textile industry.

Rising awareness about sustainability has been accelerating the growth rate.

With elevating concerns about our environment, there is an upsurge in the demand for eco-friendly textile production materials. Nanofibers align with this ongoing trend by enabling less use of resources and reducing waste generated. Firstly, water pollution can be decreased by making fabrics composed of nanofibers water-repellent. Besides, textiles made of nanofibers can be utilized for liquid and air filtration, lowering the pollution of the air and water. Secondly, textiles made of nanofibers can be utilized to remove industrial pollutants and wastewater. In addition to being harmless, they biodegrade satisfactorily. A higher surface area is offered by nanofibers, which decrease chain mobility when utilized as nanofillers. As a result, there is an expanding interest in this material as a sustainable alternative. Scientists and producers are creating nanofibers from biodegradable and renewable resources, including chitosan, polylactic acid (PLA), and cellulose. Reduced environmental effects from textile manufacture and disposal are the goal of these eco-friendly nanofibers.

Nanofiber for Textile Market Restraints and Challenges:

Cost constraints, technological limitations, and a lack of efficiency are the main issues that the market is currently facing.

The production process for nanofibers is often time-consuming and complex. Electrospinning is widely used in the process. This method is expensive and requires advanced technologies and infrastructure. Small and medium-sized companies with tight budgets might face obstacles in this regard. Secondly, the poor yield, high operating voltage, and challenges in manufacturing nanofibers on various substrates are some of the drawbacks of electrospinning technology. Because of their weak crystallinity, electrospun nanofibers also have low mechanical strength. The cellulose nanofibers produced by electrospinning are not soluble in ordinary solvents and cannot melt. Thirdly, these fibers' low mechanical strength, quick deterioration, and total breakdown prevent them from being widely used in biomedicine. Furthermore, limited toughness, surface adherence, and difficult-to-control release of antibacterial active ingredients are exhibited by them. Abrasion, washing, and exposure to the environment are some of the variables that can cause nanofiber coatings or structures to deteriorate over time. This could restrict their use for specific applications that need long-term performance.

Nanofiber for Textile Market Opportunities:

Smart textiles provide the market with an ample number of opportunities. Smart textiles may be made by utilizing nanofibers to produce microscopic electrically conducting strands, enabling the integration of clothes with other technology. Properties like hydrophilicity, antibacterial qualities, conductivity, antiwrinkle qualities, antistatic behavior, light guidance and scattering, antimicrobial qualities, ultraviolet resistance, optical qualities, and flame-retardant qualities can all be added to textiles and clothing through the use of nanotechnology. Smart textiles may also be combined with nanomaterial-based devices to carry out a range of tasks, including optics, drug release, sensing, energy harvesting and storage, and sensing. Secondly, the sports industry is growing. Nanofiber-based textiles can be used in sportswear for athletes to create fabrics with breathability, moisture-wicking, and durability properties. By promoting their products and collaborating with sports companies, greater revenue can be achieved. Moreover, the health industry has been beneficial. Researchers are working on creating advanced wound dressings, antimicrobial fabrics, and drug delivery systems. This is because of their high surface area and porosity, which makes them an ideal choice. Apart from this, increased investments are being made in R&D activities to develop advanced textiles with UV protection, energy storage, and self-cleaning properties.

NANOFIBER FOR TEXTILE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

20% |

|

Segments Covered |

By Material Type, Application, Technology, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Ahlstrom-Munksjö, Donaldson Company Inc., Asahi Kasei Corporation, Teijin Limited, Toray Industries, Inc., Sefar AG, Hollingsworth & Vose Company, Johns Manville, Nanovia s.r.o., FibeRio Technology Corporation |

Nanofiber for Textile Market Segmentation: By Material Type

-

Polymer Nanofiber

-

Carbon Nanofiber

-

Ceramic Nanofiber

-

Composite Nanofiber

-

Natural and Biodegradable Nanofiber

Polymer nanofibers are the largest growing material type. The most popular material for creating nanofibers is polymer because of its special qualities, which include high mechanical strength, flexibility, and a large surface area-to-volume ratio. Because of these characteristics, adding functions to the surface of polymer nanofibers for particular uses is simple. Natural and biodegradable nanofibers are the fastest-growing category. This is because of the increasing emphasis on natural and sustainable products. Materials such as cellulose and chitosan are the most prominent. They are renewable, have minimal environmental impact, and are biodegradable. Many businesses are coming up with innovative solutions to incorporate advanced properties in them for superior characteristics.

Nanofiber for Textile Market Segmentation: By Application

-

Protective Clothing

-

Performance Apparel and Sportswear

-

Smart Fibers

-

Filtration

-

Healthcare & Medical

-

Automotive & Aerospace

Filtration is the largest growing application in this market. Compared to traditional filters, nanofibers have smaller fiber sizes. This eliminates the requirement for electrostatic attraction and enables the nanofibers to physically block PMs from entering the air stream. This property makes them have extremely high filtering efficiencies. Secondly, they require less energy for air to breathe through them because of their low-pressure drop and less obstruction over time. Furthermore, the large specific surface area of the fibers and the homogenous, interconnected, tiny pore size of nanofiber-based filter materials enhance mechanical filtering. The healthcare & medical segment is the fastest-growing application. Researchers have created wound dressings made of nanofibers. This material creates an environment that is favorable for tissue regeneration and might hasten the healing of wounds. Because of their similarities to the extracellular matrix, nanofibers are increasingly being used as wound dressings. Because of their high surface area-to-volume ratio, nanofibers help drugs dissolve more quickly. Secondly, scaffolds with interconnected pore architectures that promote biological tissue adhesion and growth are made using nanofibers. Apart from this, they are being used in dental caries prevention, wound healing, and tooth regeneration because of their anti-microbial properties.

Nanofiber for Textile Market Segmentation: By Technology

-

Electrospinning

-

Forcespinning

-

Meltblowing

-

Solution Blowing

-

Template Synthesis

Electrospinning is the largest growing technology. This is a large-scale, cost-effective, and efficient technique for creating nanofibers with special mechanical and electrical characteristics. Porosity, surface area, conductivity, transparency, flexibility, and a high surface-to-volume ratio are some of these characteristics. Electrospinning makes it possible to manage both fiber size, porosity, and breathable membranes with excellent filtering effectiveness. Composite fabrics can also be made by directly incorporating electrospun fibers into textiles. Furthermore, biodegradable fabrics with limited porosity that are capable of capturing dangerous nanoparticles may be made using electrospinning. Forcespinning is the fastest-growing technology. Centrifugal force is used in the forcespinning process to produce ultrafine nanofibers. Because it doesn't require dangerous polymer solvents and may work with molten materials or polymer solutions, it is utilized in textiles based on nanofibers. Moreover, force spinning is more economical, safer, and quicker than electrospinning, which makes use of electrostatic force.

Nanofiber for Textile Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific is the largest and fastest-growing market. The primary reason for this is the vast manufacturing hub in China. India, Japan, and South Korea are the major regions responsible for the import and export of these textiles. The growing population elevates the demand for more textiles. Industrialization in these countries has led to better investments. This has resulted in R&D activities prioritizing advanced materials and properties. Filtration and healthcare are the two major applications. Nanofiber-based textiles are mainly used in drug delivery, wound dressings, and water treatment. Besides this, governmental initiatives aimed at promoting sustainable materials have boosted production activities.

COVID-19 Impact Analysis on the Global Nanofiber for Textile Market:

The outbreak of the virus had a mixed impact on the market. Lockdowns, mobility limitations, and social isolation were all part of the new normal. This affected supply chain management, logistics, and transportation. The tight implementation of rules and regulations resulted in the closure of most businesses. The production and manufacturing processes were disrupted as a result. Operators were hampered by safety regulations. Working remotely was the primary objective. Many people lost their jobs. The majority of funds were allotted to initiatives about healthcare. These materials saw a decline in the sports industry as most of the events were canceled or postponed. This led to a sharp downturn in the economy. According to Statista, the apparel industry in Europe had a 37.4% decrease during the first half of the pandemic. However, on the other hand, the healthcare industry started to see an augmentation for nanofiber-based textiles. PPE kits were essential for the staff and medical professionals to protect themselves against the virus. This material was used in masks and protective clothing due to its ability to improve breathability and filtration efficiency. Their antimicrobial properties made them a popular choice, elevating their demand. A lot of research studies were conducted to determine the efficiency of nanoparticles in preventing contamination. According to a report by Infection Control Today, cotton masks in the study were able to block 43–73% of coronavirus aerosols. 99.9% of the particles were prevented using masks with nanofiber filters. Post-pandemic, the market has continued to grow owing to the upliftment of guidelines that have allowed normal functioning.

Latest Trends/ Developments:

Materials that are high-performing, long-lasting, and lightweight are needed in the aerospace and automotive industries. The qualities of composites, insulating materials, and interior fabrics may all be improved with the use of nanofiber textiles. There is a rapid adoption of nanofiber textiles created by these industries' drive for fuel economy and performance enhancements.

Key Players:

-

Ahlstrom-Munksjö

-

Donaldson Company Inc.

-

Asahi Kasei Corporation

-

Teijin Limited

-

Toray Industries, Inc.

-

Sefar AG

-

Hollingsworth & Vose Company

-

Johns Manville

-

Nanovia s.r.o.

-

FibeRio Technology Corporation

Chapter 1. Nanofiber for Textile Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Nanofiber for Textile Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Nanofiber for Textile Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Nanofiber for Textile Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Nanofiber for Textile Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Nanofiber for Textile Market – By Material Type

6.1 Introduction/Key Findings

6.2 Polymer Nanofiber

6.3 Carbon Nanofiber

6.4 Ceramic Nanofiber

6.5 Composite Nanofiber

6.6 Natural and Biodegradable Nanofiber

6.7 Y-O-Y Growth trend Analysis By Material Type

6.8 Absolute $ Opportunity Analysis By Material Type, 2024-2030

Chapter 7. Nanofiber for Textile Market – By Application

7.1 Introduction/Key Findings

7.2 Protective Clothing

7.3 Performance Apparel and Sportswear

7.4 Smart Fibers

7.5 Filtration

7.6 Healthcare & Medical

7.7 Automotive & Aerospace

7.8 Y-O-Y Growth trend Analysis By Application

7.9 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Nanofiber for Textile Market – By Technology

8.1 Introduction/Key Findings

8.2 Electrospinning

8.3 Forcespinning

8.4 Meltblowing

8.5 Solution Blowing

8.6 Template Synthesis

8.7 Y-O-Y Growth trend Analysis By Technology

8.8 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 9. Nanofiber for Textile Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Material Type

9.1.3 By Application

9.1.4 By By Technology

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Material Type

9.2.3 By Application

9.2.4 By Technology

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Material Type

9.3.3 By Application

9.3.4 By Technology

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Material Type

9.4.3 By Application

9.4.4 By Technology

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Material Type

9.5.3 By Application

9.5.4 By Technology

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Nanofiber for Textile Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Ahlstrom-Munksjö

10.2 Donaldson Company Inc.

10.3 Asahi Kasei Corporation

10.4 Teijin Limited

10.5 Toray Industries, Inc.

10.6 Sefar AG

10.7 Hollingsworth & Vose Company

10.8 Johns Manville

10.9 Nanovia s.r.o.

10.10 FibeRio Technology Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global nanofiber market for textiles was valued at USD 180 million and is projected to reach a market size of USD 644.97 million by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 20%.

Increasing demand for functional textiles and raising awareness about sustainability are the main factors propelling the market.

Based on technology, the global nanofiber market for textiles is segmented into electrospinning, force spinning, melt blowing, solution blowing, and template synthesis.

Asia-Pacific is the most dominant region for the global nanofiber textile market.

Ahlstrom-Munksjö, Donaldson Company Inc., and Asahi Kasei Corporation are the key players operating in the global nanofiber for the textile market.