Mutual Fund Market Size (2025-2030)

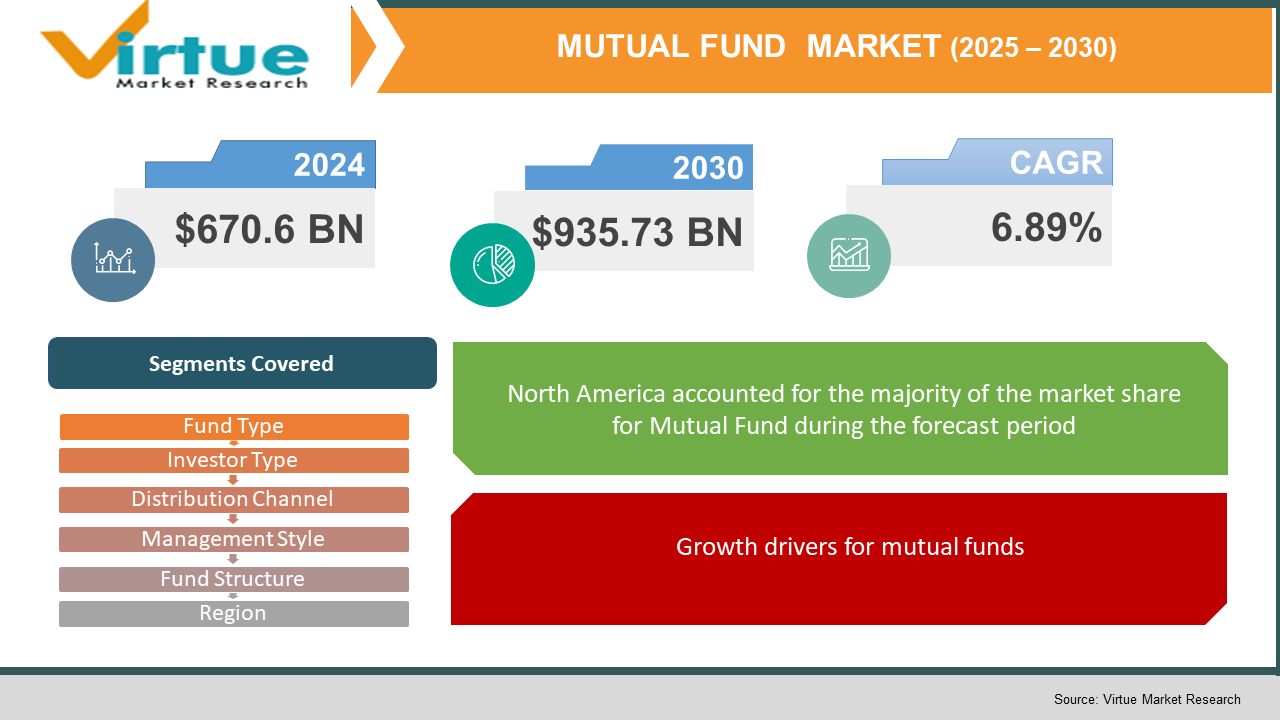

The Mutual Fund Market was valued at $670.6 billion in 2024 and is projected to reach a market size of $935.73 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 6.89%.

Mutual funds are important in the finance world because they let people join together to invest in different types of assets like stocks, bonds, and other options. As investing gets more complicated and what investors want changes, mutual funds become key for everyday folks and big institutions looking for help managing their money and keeping risks in check. Nowadays, many mutual fund platforms use cool technology like AI and data analysis, which help track investments in real time and understand how investors behave. This makes it easier to make smart choices and see what is going on with different strategies. The rise of online platforms and robo-advisors also makes it simpler for people to invest in mutual funds. This digital shift means investors have better access to these products. Plus, mutual funds help with following regulations by automatically checking risks and reporting, which is increasingly important due to stricter laws. Whether someone wants to grow their money, earn income, or keep it safe, mutual funds have options that fit those needs. Also, many fund managers are now considering factors like environmental and social responsibility when investing, which is changing how they create long-term value. As old systems in finance move to the cloud and more modern setups, mutual funds provide a solid base for building flexible investment portfolios. They allow for smaller investments, quick access to cash, and professional management, making it easier for everyone to get into investing. In the end, mutual funds help people spread out their investments and grow their wealth while also pushing innovations in how money is managed.

Key Market Insights:

Since 2020, more than 65% of asset management firms have stepped up their investments in digital tools. They’re linking mutual fund platforms with real-time data, robo-advisors, and AI suggestions for managing portfolios. This push is making it easier to run operations and reach more people through online channels.

By 2024, passive mutual funds are expected to make up 45% of all equity fund assets in North America, up from 37% in 2020. This change shows that investors are leaning towards low-cost options that track indexes. At the same time, mutual funds focused on environmental, social, and governance (ESG) criteria have seen a 31% growth year-over-year, showing that more investors care about sustainable investments.

Due to financial education programs and mobile apps, retail investors now make up nearly 54% of new mutual fund investments in developed markets. Younger folks aged 25 to 40 are especially engaged, choosing mutual funds to build wealth and plan for retirement.

About 48% of fund managers are now using artificial intelligence and machine learning to help with asset allocation, predict market risks, and customize client advice. These tools are making investments more transparent and improving overall performance.

Mutual Fund Market Key Drivers:

Digital and AI-powered platforms.

Mutual funds are starting to use tech tools like robo-advisors and Big Data to help with things like building and managing portfolios and keeping in touch with investors. This not only cuts down costs but also helps firms keep clients happy by providing smooth, data-focused experiences and making operations run more smoothly.

Diverse, managed strategies.

More people are choosing mutual funds because they want quick access to well-managed portfolios that include different asset types. This diversity helps reduce risks from single stocks, while experienced fund managers handle smart asset choices and research-backed decisions—making it a good option for those who don’t have the time or know-how to invest in stocks or bonds themselves.

Growth drivers for mutual funds.

In fast-growing economies, especially in Asia-Pacific, there’s more interest in mutual funds as more middle-class folks become financially savvy, thanks to better internet and mobile access and supportive fintech rules. The connection with e-wallets and online shopping platforms is helping remove barriers to accessing mutual funds, allowing investors to get involved more easily.

Mutual Fund Market Restraints and Challenges:

Challenges Facing Mutual Funds Today.

Mutual funds are dealing with a bunch of challenges right now. They've got stricter rules to follow and rising costs because of compliance. On top of that, managing liquidity during tough market times has become tricky, and there’s increasing pressure from expenses and competition for investors’ attention. New regulations, like liquidity coverage ratios and redemption gates, aim to protect investors but can complicate things for funds, especially when the market gets bumpy. Investors are also looking closely at fees, pushing funds to offer lower-cost options. Those holding fewer liquid assets must keep more cash in hand, which can be eaten in return. Figuring out the right value for less frequently traded assets is another headache. Big fund companies have advantages that make it hard for smaller firms to compete, and technology is moving fast, meaning funds need to constantly invest in things like digital tools and security. Additionally, investors today want more personalized options, ESG features, and transparency, which means fund managers have to keep improving and engaging with them, often leading to higher costs. All of this shows that mutual fund companies must find a way to balance meeting regulations, managing costs, ensuring liquidity, valuing assets accurately, staying updated with tech, and focusing on what investors want to stay competitive and grow.

Mutual Fund Market Opportunities:

New Opportunities in the Mutual Fund Market Due to Innovation, Policy Changes, and Changing Investor Attitudes.

Right now, mutual fund opportunities are growing thanks to more people investing through SIPs and direct digital plans, especially younger, tech-savvy folks. We've seen some good changes in regulations and more people getting smarter about finances. The total assets under management are on the rise, with global AUM coming close to $29 trillion for long-term funds as of January 2025. There have been strong inflows into bonds and money-market funds too, giving investors stable options even when the market gets shaky. Thematic and sector-focused funds are catching attention—especially in healthcare, local financials, ESG, and niche strategies. Fund managers are adapting their investments based on market trends, digital changes, and sustainability goals. At the same time, the competition between passive and active funds is pushing for new ideas: passive funds are grabbing more market share, which is making active funds work harder on personalization, transparency, and keeping costs low. All of these factors point to mutual fund companies that focus on digital distribution, specific themes, cost management, and putting investors first as the ones likely to succeed in this fast-changing investment world.

MUTUAL FUND MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6.89% |

|

Segments Covered |

By FUND TYPE, investor type, distribution channel, management style, fund structure, Investment Objective / Strategy , and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BlackRock , Vanguard Group , Fidelity Investments , State Street Global Advisors , JPMorgan Chase Asset Management , Goldman Sachs Asset Management , Capital Group , Amundi , UBS Asset Management , Morgan Stanley Investment Management |

Mutual Fund Market Segmentation:

Mutual Fund Market Segmentation: By Fund Type

- Equity Funds

- Bond Funds

- Money Market Funds

- Hybrid / Balanced Funds

- Other/Niche Funds

Equity funds are quickly becoming the top choice in the mutual fund world, thanks to positive market vibes and strong money flow from both regular folks and big investors. People are eager for long-term wealth and are turning to digital investment platforms. This rising interest, along with recent stock market gains, has led to impressive growth in equity funds over the last year.

Still, hybrid or balanced funds are the real heavyweight in terms of market share. They combine stocks and bonds, giving investors both growth and income stability. Their mix of risk and reward appeals to those who prefer a more cautious approach. That’s why hybrid funds have the most assets managed, keeping them at the forefront of the mutual fund scene.

Mutual Fund Market Segmentation: By Investor Type

- Households / Individual Investors

- Institutional Investors

Household and individual investors are the fastest-growing group in the mutual fund market, thanks to better financial knowledge, more retirement accounts, and easy access through online platforms and robo-advisors. As of 2024, over 71 million U.S. households, about 54%, own mutual funds, especially middle-income folks aged 35-64. The rise of digital investment channels, low-cost index funds, and incentives like 401(k)s and IRAs has led to quick adoption, making households the main source of new investments in both stocks and bonds.

While institutional investors are also growing, households hold around 79% of all mutual fund assets—about $29 trillion of the $36.6 trillion total. This shows how important individual investors are, even as pension funds and insurance companies play key roles in larger investments. The large number of household investments, driven by employer-sponsored retirement accounts, keeps individual investors at the heart of the market.

Mutual Fund Market Segmentation: By Distribution Channel

- Banks

- Financial Advisors / Brokers

- Direct Sellers

Direct distribution—where investors buy mutual funds directly from fund houses through online platforms—is the fastest-growing option worldwide. This is mainly because people want cheaper choices (no commissions), ease of using digital tools, and clear fee structures. More investors, especially millennials and tech-savvy folks, are skipping middlemen for better returns and quick access. Regulators in places like India and Europe are also backing direct plans, boosting interest among retail investors.

Even with the rise of direct channels, traditional bank branches and financial advisors still manage most assets. Banks have strong customer ties, package deals (like savings accounts with investment advice), and are trusted by older clients. In many countries, financial advisors and brokers maintain a big share by providing tailored support, managing portfolios, and offering a wider range of products. Their established networks and advisory services still capture a majority of mutual fund investments globally.

Mutual Fund Market Segmentation: By Management Style

- Active Funds

- Passive Funds

Passive funds are becoming the fastest-growing area in the mutual fund market, thanks to their low costs, ease of use, and wide index exposure. Recent data shows that from 2014 to the end of 2023, passive investments like index mutual funds and ETFs jumped 248%, while active funds only grew by 36%. In the U.S., passive funds gained $538 billion in new assets in 2023, while active funds lost $459 billion. Passive strategies rose by 22.6% this year compared to just 10.6% for active funds. A notable milestone occurred in late 2023 when passive fund assets topped active assets, $13.252 trillion vs. $13.244 trillion, showing a clear shift in what investors prefer.

Globally, passive funds now make up about 40% of the total mutual fund assets, up from 21% in 2014. In North America, the share rose from 45% to 47% in 2023, and the global passive market share reached 40% by the end of 2023. Projections suggest that by 2030, passive funds could account for 58% of U.S. mutual fund and ETF assets. This year, passive funds drew in $820 billion globally, while active funds faced $747 billion in outflows. With this kind of growth, passive funds are now at the forefront of the industry.

Mutual Fund Market Segmentation: By Investment Objective / Strategy

- Growth Funds

- Income Funds

- Tax‑Saving Funds

- Liquid Funds

- Sector Funds

- High‑Yield Bond Funds

- ESG/SRI Funds

Growth-focused strategies, especially equity and ESG/SRI funds, are making big strides in the mutual fund market. In the Asia Pacific, which is the fastest-growing area, equity funds are the largest, but sustainable funds are gaining traction with $3.56 trillion expected by the end of 2024. Equity funds hold a strong 28.1% share worldwide, thanks to their good return potential. The popularity of these funds is increasing, driven by retail interest, especially in tech, healthcare, and responsible investing, aided by digital platforms and supportive policies.

Even with the rise of niche strategies, equity and growth funds still lead the pack globally, making up over a quarter of all mutual fund assets. Equity strategies are key for investors seeking long-term growth. While index funds are taking a growing share of the market, the size and established presence of equity funds keep them at the forefront.

Mutual Fund Market Segmentation: By Fund Structure

- Open‑Ended Funds

- Closed‑Ended Funds / Interval Funds

Open-ended funds are the fastest-growing type of mutual fund because they offer great liquidity and flexibility. They keep issuing and redeeming shares, which makes them a good choice for investors who want easy entry and exit. This setup allows for quick asset growth, especially in liquid markets like stocks and bonds. New ideas like ETF-wrapped open-ended funds and various liquidity options have made them even more attractive to tech-savvy younger investors who prefer digital investments.

When it comes to market presence, open-ended funds dominate globally, managing a huge amount of assets. They are the most popular type of mutual fund, far outpacing closed-ended and interval funds. Their daily pricing and ability to adapt to what investors want, like themed and sustainable options, keep them at the top. While closed-ended funds have some unique benefits, like leverage and access to less liquid securities, they’re just a smaller, specialized choice compared to open-ended funds.

Mutual Fund Market Segmentation: By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

The global mutual fund market is concentrated in a few places. North America leads with about 38% of the total assets, thanks to solid existing institutions and high investor participation. Europe comes next at around 26%, benefiting from cross-border funds and a growing interest in ESG investments. The Asia-Pacific region holds about 24% and is the fastest-growing area, with a rising middle class, more digital tech usage, and efforts from governments to include more people in finance. Latin America makes up roughly 6%, getting a boost from pension changes and fintech, though it still deals with economic ups and downs. Lastly, the Middle East and Africa account for about 6%, with growth supported by things like sovereign wealth funds and Islamic finance, plus more retail investors joining in. This all shows that while North America is still on top, the shift is toward Asia-Pacific and other emerging markets.

COVID-19 Impact Analysis on the Mutual Fund Market:

The COVID-19 pandemic kicked off a big financial mess in March 2020, which hit mutual funds hard, especially open-ended equity and fixed-income funds. These open-ended funds saw a lot of investors pulling out their money, so many had to dip into their cash and Treasury assets to keep up with the demand. This made things a bit tougher with their liquidity and risk levels. Active equity funds didn't do well compared to passive funds; about 74% trailed the S&P 500, with an average return of -5.6% from February 20 to April 30. Many also fell short against specific benchmarks, even in smaller amounts. Interestingly, during this tough time, investors started putting their money into funds that showed strong sustainability practices, favoring those with high ESG ratings and star ratings. In the bond market, funds began cutting back on liquid assets and cash reserves—some went from about 4.3% to around 3% of their total assets. Luckily, central banks stepped in with measures to stabilize things and ease price drops. While some funds used tactics like swing pricing or temporary redemption limits, the industry as a whole managed to keep up with investor needs, even though it came with increased operational and liquidity risks.

Trends/Developments:

In February 2025, Advanced Technology Services (ATS) rolled out a new service called Reliability 360 Machine Health Monitoring. They also promised a 3× ROI guarantee, showing they really care about keeping machines running and making maintenance better.

In July 2024, I-care Group picked up assets and licenses from Sensirion Connected Solutions' AiSight predictive maintenance line. This move strengthens their position in Germany and ensures their customers won’t miss a beat.

In June 2024, SPM Instrument AB from Sweden bought Status Pro Maschinenmesstechnik GmbH, a German expert in machine-tool alignment and condition monitoring. This helps them improve their presence and service in Germany.

In March 2024, KCF Technologies introduced Piezo Sensing as part of its SMARTsensing suite. This new tech provides detailed, high-speed data for machines, helping catch problems earlier and making operations run smoother.

Key Players:

- BlackRock

- Vanguard Group

- Fidelity Investments

- State Street Global Advisors

- JPMorgan Chase Asset Management

- Goldman Sachs Asset Management

- Capital Group

- Amundi

- UBS Asset Management

- Morgan Stanley Investment Management

Chapter 1. Mutual Fund Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources`

1.5. Secondary Sources

Chapter 2. Mutual Fund Market– Executive Summary

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Mutual Fund Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Mutual Fund Market- Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Mutual Fund Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Mutual Fund Market – By Fund Type

6.1 Introduction/Key Findings

6.2 Equity Funds

6.3 Bond Funds

6.4 Money Market Funds

6.5 Hybrid / Balanced Funds

6.6 Other/Niche Funds

6.7 Y-O-Y Growth trend Analysis By Fund Type

6.8 Absolute $ Opportunity Analysis By Fund Type Fund Type , 2025-2030

Chapter 7. Mutual Fund Market – By Investor Type

7.1 Introduction/Key Findings

7.2 Households / Individual Investors

7.3 Institutional Investors

7.4 Y-O-Y Growth trend Analysis By Investor Type

7.5 Absolute $ Opportunity Analysis By Investor Type , 2025-2030

Chapter 8. Mutual Fund Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Banks

8.3 Financial Advisors / Brokers

8.4 Direct Sellers

8.5 Y-O-Y Growth trend Analysis Distribution Channel

8.6 Absolute $ Opportunity Analysis Distribution Channel , 2025-2030

Chapter 9. Mutual Fund Market – By Management Style

9.1 Introduction/Key Findings

9.2 Active Funds

9.3 Passive Funds

9.4 Y-O-Y Growth trend Analysis Management Style

9.5 Absolute $ Opportunity Analysis Management Style , 2025-2030

Chapter 10. Mutual Fund Market – By Investment Objective / Strategy

10.1 Introduction/Key Findings

10.2 Growth Funds

10.3 Income Funds

10.4 Tax‑Saving Funds

10.5 Liquid Funds

10.6 Sector Funds

10.7 High‑Yield Bond Funds

10.8 ESG/SRI Funds

10.9 Y-O-Y Growth trend Analysis Investment Objective / Strategy

10.10 Absolute $ Opportunity Analysis Investment Objective / Strategy , 2025-2030

Chapter 11. Mutual Fund Market – By Fund Structure

11.1 Introduction/Key Findings

11.2 Open‑Ended Funds

11.3 Closed‑Ended Funds / Interval Funds

11.4 Y-O-Y Growth trend Analysis Fund Structure

11.5 Absolute $ Opportunity Analysis Fund Structure , 2025-2030

Chapter 12. Mutual Fund Market , By Geography – Market Size, Forecast, Trends & Insights

12.1. North America

12.1.1. By Country

12.1.1.1. U.S.A.

12.1.1.2. Canada

12.1.1.3. Mexico

12.1.2. By Fund Type

12.1.3. By Investor Type

12.1.4. By Fund Structure

12.1.5. Distribution Channel

12.1.6. Management Style

12.1.7. Investment Objective / Strategy

12.1.8. Countries & Segments - Market Attractiveness Analysis

12.2. Europe

12.2.1. By Country

12.2.1.1. U.K.

12.2.1.2. Germany

12.2.1.3. France

12.2.1.4. Italy

12.2.1.5. Spain

12.2.1.6. Rest of Europe

12.2.2. By Fund Type

12.2.3. By Fund Structure

12.2.4. By Management Style

12.2.5. Distribution Channel

12.2.6. Investor Type

12.2.7. Investment Objective / Strategy

12.2.8. Countries & Segments - Market Attractiveness Analysis

12.3. Asia Pacific

12.3.1. By Country

12.3.2.1. China

12.3.2.2. Japan

12.3.2.3. South Korea

12.3.2.4. India

12.3.2.5. Australia & New Zealand

12.3.2.6. Rest of Asia-Pacific

12.3.2. By Fund Type

12.3.3. By Fund Structure

12.3.4. By Investor Type

12.3.5. Investment Objective / Strategy

12.3.6. Distribution Channel

12.3.7. Management Style

12.3.8. Countries & Segments - Market Attractiveness Analysis

12.4. South America

12.4.3. By Country

12.4.3.3. Brazil

12.4.3.2. Argentina

12.4.3.3. Colombia

12.4.3.4. Chile

12.4.3.5. Rest of South America

12.4.2. By Fund Type

12.4.3. By Fund Structure

12.4.4. By Investor Type

12.4.5. Distribution Channel

12.4.6. Investment Objective / Strategy

12.4.7. Management Style

12.4.8. Countries & Segments - Market Attractiveness Analysis

12.5. Middle East & Africa

12.5.4. By Country

12.5.4.4. United Arab Emirates (UAE)

12.5.4.2. Saudi Arabia

12.5.4.3. Qatar

12.5.4.4. Israel

12.5.4.5. South Africa

12.5.4.6. Nigeria

12.5.4.7. Kenya

12.5.4.12. Egypt

12.5.4.12. Rest of MEA

12.5.2. By Fund Type

12.5.3. By Investor Type

12.5.4. By Fund Structure

12.6.5. Management Style

12.5.6. Investment Objective / Strategy

12.5.7. Distribution Channel

12.5.8. Countries & Segments - Market Attractiveness Analysis

Chapter 13. Mutual Fund Market – Company Profiles – (Overview, Fund Type Portfolio, Financials, Strategies & Developments)

13.1 BlackRock

13.2 Vanguard Group

13.3 Fidelity Investments

13.4 State Street Global Advisors

13.5 JPMorgan Chase Asset Management

13.6 Goldman Sachs Asset Management

13.7 Capital Group

13.8 Amundi

13.9 UBS Asset Management

13.10 Morgan Stanley Investment Management

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The growth is fueled by more people having extra money, better financial knowledge, more digital investment options, support from regulations to protect investors, and a greater interest in diverse and professionally managed investment choices.

Retail investors, big institutions like pension funds and insurance companies, and wealthy individuals are the main users. They rely on mutual funds for building wealth over time, planning for retirement, and keeping their money safe.

AI is helping improve fund performance by predicting market trends, automating how assets are managed, refining trading strategies, and offering better investor services through tools like robo-advisors and custom portfolio suggestions.

North America is leading in growth, thanks to a stronger middle class, easy access through fintech, and greater awareness. Europe and some parts of the Asia-Pacific are also growing quickly as more people get involved in mutual funds.

Notable trends include the popularity of passive and ESG investing, the use of AI and machine learning in managing funds, more digital sales platforms, and the growth of thematic and target-date funds.