Mushroom Packaging Market Size (2025 – 2030)

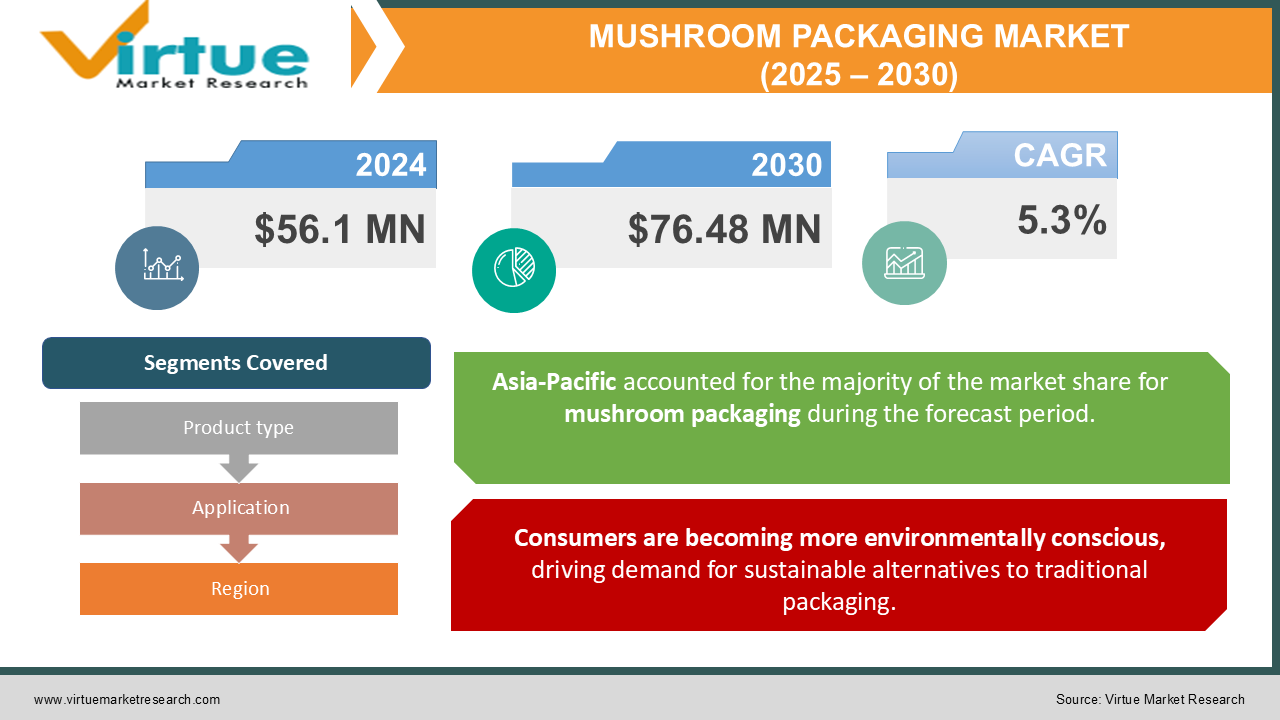

The Mushroom Packaging Market was valued at USD 56.1 Million in 2024 and is projected to reach a market size of USD 76.48 Million by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 5.3%.

The mushroom packaging market represents a transformative approach to sustainable packaging solutions by leveraging the unique properties of mycelium, the root structure of mushrooms. Mycelium-based packaging is not only biodegradable but also provides a viable alternative to traditional materials like plastic and polystyrene, which are known for their adverse environmental impact. Mushroom packaging combines agricultural waste and fungal spores to create a durable, lightweight, and eco-friendly material that decomposes naturally within weeks. This innovative packaging is gaining traction across various industries, including food and beverage, cosmetics, healthcare, and furniture, due to its ability to address increasing environmental concerns and regulatory pressures surrounding non-biodegradable waste.

Key Market Insights:

-

Over 75 million units of mushroom-based packaging products were sold in 2023. Approximately 12% of global packaging companies adopted mushroom-based solutions for at least one product line.

-

Mushroom packaging production utilized over 500,000 tons of agricultural waste in 2023.

-

The average decomposition time for mushroom packaging in landfills was reported as just 30 days.

-

The food and beverage sector accounted for 42% of the total demand for mushroom packaging in 2023. Cosmetic and personal care applications constituted 15% of the market demand. Healthcare applications represented a 10% market share in 2023.

-

Online retail channels saw a 38% increase in mushroom packaging adoption compared to 2022.

-

Over 2,000 companies worldwide integrated mushroom packaging into their operations.

-

The market reduced an estimated 1.2 million tons of plastic waste in 2023. Over 4 million tons of carbon emissions were saved due to the adoption of mushroom packaging.

Market Drivers:

Consumers are becoming more environmentally conscious, driving demand for sustainable alternatives to traditional packaging.

Mushroom packaging, with its compostable properties and low environmental footprint, aligns with these shifting preferences. With rising global awareness about the harmful effects of plastic waste on ecosystems, consumers are prioritizing brands that adopt sustainable practices. This has led to a surge in demand for biodegradable and eco-friendly materials, making mushroom packaging a key focus for environmentally responsible companies.

Governments worldwide are imposing strict regulations to curb single-use plastics, creating a favorable environment for mushroom packaging.

Bans on polystyrene and other non-biodegradable materials in several countries have encouraged businesses to explore alternatives like mushroom packaging. Policies supporting circular economies and waste reduction are further incentivizing companies to invest in biodegradable materials, providing a significant boost to the mushroom packaging market.

Market Restraints and Challenges:

One of the most significant challenges facing the mushroom packaging market is the high cost associated with production. Mushroom packaging requires specific agricultural waste inputs and carefully controlled environments for mycelium growth. These requirements make the process labor-intensive and resource-dependent, leading to higher costs compared to traditional packaging materials like plastics or polystyrene. Moreover, scalability remains a pressing issue. While small-scale production is feasible and environmentally sound, scaling up operations to meet global demand is challenging due to infrastructure limitations and the time-intensive nature of cultivating mycelium. Although awareness about sustainable packaging is growing, many consumers remain unfamiliar with mushroom packaging. This lack of awareness can hinder widespread adoption, especially in regions where sustainability is not a primary concern. Additionally, some consumers may perceive mushroom packaging as fragile or unsuitable for certain applications, even though it offers comparable durability and functionality to traditional materials. Overcoming these misconceptions through effective marketing and education is critical for market growth. The production of mushroom packaging relies heavily on agricultural waste as a primary raw material. Variability in the availability and cost of these inputs can disrupt production schedules and impact profitability. For instance, a poor harvest or supply chain disruptions can lead to shortages of essential feedstocks, creating bottlenecks in the manufacturing process. While mushroom packaging offers distinct advantages, it competes with other sustainable packaging solutions such as recycled paper, biodegradable plastics, and plant-based materials like cornstarch or bamboo. These alternatives are often more established in the market and can be produced at a scale with lower costs, posing a significant threat to the growth of mushroom packaging.

Market Opportunities:

The versatility of mushroom packaging offers immense potential for expansion into new industries. While it has found a strong foothold in food and beverage, cosmetics, and e-commerce, opportunities exist in sectors such as electronics, automotive, and luxury goods. For example, mushroom packaging can be used to create custom-molded solutions for fragile electronics, offering protection without environmental harm. Additionally, luxury brands can leverage mushroom packaging as a sustainable way to package high-end products, aligning with their corporate social responsibility goals. Investments in research and development are paving the way for innovations in mushroom packaging production. Technological advancements in mycelium growth and processing are expected to reduce production costs and improve scalability. Automation improved growing conditions, and the use of alternative feedstocks can make the manufacturing process more efficient and cost-effective, enabling companies to compete with traditional packaging materials. The e-commerce boom presents a significant opportunity for mushroom packaging. Online retailers are increasingly under pressure to adopt eco-friendly packaging solutions to meet customer expectations and comply with sustainability regulations. Mushroom packaging’s lightweight and shock-absorbing properties make it an ideal choice for protecting goods during transit, further enhancing its appeal in the e-commerce space. Collaborations between packaging companies, agricultural producers, and technology providers can unlock new growth avenues for the mushroom packaging market. Strategic partnerships can help overcome challenges related to raw material sourcing, scalability, and distribution, allowing companies to reach wider markets and accelerate adoption.

MUSHROOM PACKAGING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.3% |

|

Segments Covered |

By Product type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Ecovative Design, Sealed Air Corporation, Dell Technologies, IKEA, Biohm, Mycotech Lab, Grow. Bio, Mushroom Material, MycoWorks, Life Pack |

Mushroom Packaging Market Segmentation: By Product Type

-

Cups & Bowls

-

Trays

-

Boxes

-

Bins

-

Clamshells

Clamshells are witnessing rapid growth due to their popularity in food service and fresh produce packaging. Their ability to offer secure, eco-friendly containment makes them highly attractive to consumers and businesses alike.

Boxes lead the market, driven by their versatility and widespread use across industries, from e-commerce to food and beverage applications.

Mushroom Packaging Market Segmentation: By Application

-

Food & Beverage Packaging

-

Fresh Produce

-

Ready-to-Eat Meals

-

Beverages

-

Pharmaceutical Packaging

-

Cosmetic & Personal Care Packaging

-

Furniture & Homecare Packaging

-

Others

Fresh produce packaging is expanding rapidly as consumers and retailers seek sustainable ways to minimize plastic usage while ensuring food safety and freshness.

This application dominates due to its broad applicability and the global demand for sustainable alternatives in food-related industries.

Mushroom Packaging Market Segmentation: By End-User

-

Retail

-

Food Service

-

Healthcare

-

Personal Care & Cosmetics

-

Others

The healthcare industry is increasingly adopting mushroom packaging to meet stringent safety and sustainability standards for pharmaceutical products.

Retail holds the largest share, driven by its use across e-commerce platforms and physical stores that prioritize environmentally friendly practices.

Mushroom Packaging Market Segmentation: By Distribution Channel

-

Direct Sales

-

Distributors

-

Online Retail

The online retail channel is growing at an accelerated pace due to the increasing preference for digital marketplaces and the rising demand for eco-friendly packaging in e-commerce logistics.

Direct sales dominate, with businesses sourcing mushroom packaging directly from manufacturers to maintain control over quality and customization.

Mushroom Packaging Market Segmentation: by Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

North America leads due to high consumer awareness, advanced manufacturing capabilities, and strong government support for sustainable materials.

Asia-Pacific is the fastest-growing region, driven by increasing industrialization, urbanization, and environmental concerns in countries like China and India.

COVID-19 Impact Analysis:

The COVID-19 pandemic reshaped the mushroom packaging market as businesses and consumers prioritized health, hygiene, and sustainability. The pandemic exposed vulnerabilities in traditional supply chains, increasing interest in locally produced and biodegradable materials. Mushroom packaging, being biodegradable and non-toxic, gained traction as a safer alternative, especially in food and pharmaceutical applications.

Latest Trends and Developments:

Innovations in mushroom packaging are revolutionizing the market. Companies are integrating AI and automation to streamline production and reduce costs. Moreover, collaborations between biotech firms and packaging companies are enabling the development of custom solutions for niche industries. The rise of smart packaging, with embedded sensors for tracking and monitoring, represents another key trend. Additionally, mushroom packaging is now being used for luxury items, signaling its versatility and growing consumer appeal

Key Players in the Market:

-

Ecovative Design

-

Sealed Air Corporation

-

Dell Technologies

-

IKEA

-

Biohm

-

Mycotech Lab

-

Grow. Bio

-

Mushroom Material

-

MycoWorks

-

Life Pack

Chapter 1. Mushroom Packaging Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Mushroom Packaging Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Mushroom Packaging Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Mushroom Packaging Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Mushroom Packaging Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Mushroom Packaging Market – By Product Type

6.1 Introduction/Key Findings

6.2 Cups & Bowls

6.3 Trays

6.4 Boxes

6.5 Bins

6.6 Clamshells

6.7 Y-O-Y Growth trend Analysis By Product Type

6.8 Absolute $ Opportunity Analysis By Product Type, 2025-2030

Chapter 7. Mushroom Packaging Market – By Application

7.1 Introduction/Key Findings

7.2 Food & Beverage Packaging

7.3 Fresh Produce

7.4 Ready-to-Eat Meals

7.5 Beverages

7.6 Pharmaceutical Packaging

7.7 Cosmetic & Personal Care Packaging

7.8 Furniture & Homecare Packaging

7.9 Others

7.10 Y-O-Y Growth trend Analysis By Application

7.11 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Mushroom Packaging Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Direct Sales

8.3 Distributors

8.4 Online Retail

8.5 Y-O-Y Growth trend Analysis By Distribution Channel

8.6 Absolute $ Opportunity Analysis By Distribution Channel, 2025-2030

Chapter 9. Mushroom Packaging Market – By End User

9.1 Introduction/Key Findings

9.2 Retail

9.3 Food Service

9.4 Healthcare

9.5 Personal Care & Cosmetics

9.6 Others

9.7 Y-O-Y Growth trend Analysis By End User

9.8 Absolute $ Opportunity Analysis By End User, 2025-2030

Chapter 10. Mushroom Packaging Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Product Type

10.1.2.1 By Application

10.1.3 By By Distribution Channel

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Product Type

10.2.3 By Application

10.2.4 By By Distribution Channel

10.2.5 By By End User

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Product Type

10.3.3 By Application

10.3.4 By By Distribution Channel

10.3.5 By By End User

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Product Type

10.4.3 By Application

10.4.4 By By Distribution Channel

10.4.5 By By End User

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Product Type

10.5.3 By Application

10.5.4 By By Distribution Channel

10.5.5 By By End User

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Mushroom Packaging Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Ecovative Design

11.2 Sealed Air Corporation

11.3 Dell Technologies

11.4 IKEA

11.5 Biohm

11.6 Mycotech Lab

11.7 Grow. Bio

11.8 Mushroom Material

11.9 MycoWorks

11.10 Life Pack

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Key factors driving the growth of the mushroom packaging market include increasing environmental awareness, stringent government regulations on plastic usage, and the rising demand for sustainable packaging solutions across industries like food, beverages, and e-commerce. Additionally, mushroom packaging's biodegradability, durability, and adaptability to various applications make it an attractive alternative to conventional materials, aligning with global sustainability goals.

Main concerns about the mushroom packaging market include high production costs, limited scalability, and dependence on agricultural waste availability. Consumer awareness and acceptance remain low, with misconceptions about durability and usability. Additionally, competition from established sustainable alternatives like recycled paper and biodegradable plastics poses challenges, alongside logistical issues in scaling production to meet global demand.

Ecovative Design, Sealed Air Corporation, Dell Technologies, IKEA, Biohm, Mycotech Lab, Grow. Bio

North America currently holds the largest market share, estimated around 35%.

Asia pacific has shown significant room for growth in specific segments.