Multi-Tasking Industrial Robots Market Size (2023 – 2030)

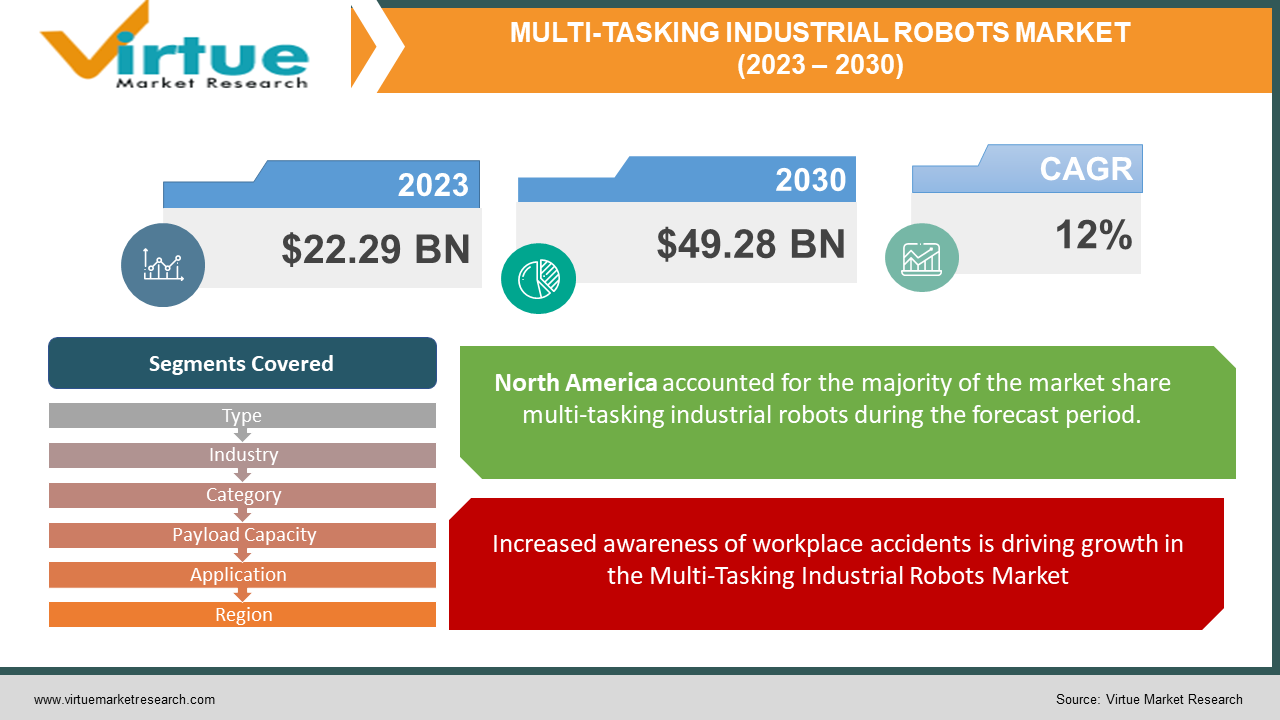

The Global Multi-Tasking Industrial Robots Market was estimated to be worth USD 22.29 Billion in 2023 and is anticipated to reach a value of USD 49.28 Billion by 2030, growing at a fast CAGR of 12% during the outlook period 2024-2030.

Robotic devices used in manufacturing are called industrial robots. These can move along three or more axes and are automated. It is defined as a mechanical tool that may be programmed and operated on a person's behalf to carry out risky or repetitive activities with high accuracy. They are specially made for a variety of tasks like welding, painting, pick-and-place, installing PCBs, packaging and labeling, palletizing, product inspection, and production testing. Industrial robots have several benefits, such as lower costs, quicker operating speeds, smaller sizes, greater quality, and increased industrial flexibility and efficiency. Positive market effects are anticipated as more people become aware of the advantages they provide.

According to estimates, the industry will rise as more robots with integrated vision and touch systems arrive on the scene to boost delivery systems' effectiveness and speed. The next generation of robots contains human traits including intelligence, adaptability, memory, learning capacity, and object recognition, in contrast to its predecessor. By using robotic technology, the sector can gain various financial advantages, including lower overhead costs, increased productivity, less waste, and greater flexibility. Deep learning and the creation of self-programming robots are two examples of artificial intelligence developments that are anticipated to boost the market throughout the projected period.

Global Multi-Tasking Industrial Robots Market Drivers:

Increased awareness of workplace accidents is driving growth in the Multi-Tasking Industrial Robots Market.

The market is growing due to elements such as rising consumer spending, employee safety, and awareness of workplace accidents. Manufacturers concentrate on research and development efforts to integrate artificial intelligence and create cutting-edge sensors. This will stimulate market expansion. Venture capital businesses are extremely interested in funding manufacturers to develop, test, and produce these robots since they are aware of market trends. To expand their global reach and address market capitalization, manufacturers also employ a range of business methods, such as mergers, acquisitions, and collaborations.

Manufacturers, particularly in the automotive, electrical, electronic, and pharmaceutical industries, are attempting to significantly lower operational costs for approved processes by decreasing operational errors and material waste. These industries have relatively high raw material costs and process failures raise operating costs. As a result, OEM profitability and operational flexibility are ultimately increased. In such situations, manufacturers adopt robotic solutions to lower these operational costs. This market's potential is increased by rising demand from the rubber, plastics, food, and beverage industries.

Increasing Industrial Automation with drive growth in the Multi-Tasking Industrial Robots Market.

The concept of Industry 4.0 has grown as a result of increased technical development and an emerging economy. Manufacturers are implementing an integrated strategy that uses hybrid cloud, automation, and Al to drive their digital transformation to reach new levels of agility, efficiency, quality, and sustainability. In several industry verticals, including FMCG, automotive, healthcare, aerospace, and defense, among others, Industry 4.0 is accelerating the development of smart factories around the world.

By utilizing connected and intelligent digital technology, which increases productivity, profitability, compliance, and customer satisfaction, smart factories are further made possible. Digitization and automation are therefore the game-changing technologies for getting beyond these roadblocks on the way to Industry 4.0. The Industrial Internet of Things (IoT) generates enormous amounts of data that must be captured, comprehended, and exploited.

Labor shortage will increase the demand in the Multi-Tasking Industrial Robots Market.

The pandemic's profound effects on the American labor force are known as "The Great Resignation." In 2021, more than 47 million people quit their jobs, many of them in search of greater freedom and work-life balance, higher income, and a robust corporate culture.

During the pandemic reorganization, it has been more difficult to retain employees for jobs that require in-person attendance and generally pay less. For instance, the sector of leisure and hospitality has consistently had a quit rate of 5.4%, the highest level since July 2021. The quit rate in the retail trade industry is not far behind, with sum time rates often hovering around 4%. As a result, there will be a major increase in demand for installation robots in the coming year.

Global Multi-Tasking Industrial Robots Market Challenges:

Customers may now shop online from a wide variety of merchants thanks to the emergence of electronic commerce, which is made possible by the increased accessibility of mobile devices. Retailers must deliver to customers within a working window of three to five days, therefore this has led to a proliferation of stock-keeping units (SKUs) and caseloads. This situation frequently becomes difficult in the food and beverage industry since businesses must respond to consumer demand much more quickly. The robots employed in manufacturing operations that only need a minimal amount of flexibility when handling pallets are the ones used in process industries. Although robots have improved in their ability to handle SKUs with greater precision and accuracy over time, they still need to undergo significant development to manage mixed SKUs with the same level of consistency in speed and accuracy without causing product damage.

COVID-19 Impact on Global Multi-Tasking Industrial Robots Market:

The COVID-19 pandemic had a substantial effect on the market's expansion. Following the epidemic, there has been an increase in the need for robotics and automated systems, which has led to new business prospects. The risk of the virus spreading remained low because the robots require little to no human interaction. The market for industrial robotics was also boosted by businesses expanding their future automation plans in the wake of unexpected shutdowns brought on by the epidemic.

Global Multi-Tasking Industrial Robots Market Recent Developments:

-

The i4 series SCARA robot, a new industrial robot, was introduced in January 2021 according to an announcement by OMRON Corporation. The robot has an easy-to-install and transport high-speed automatic high-precision assembly. These robots from the i4 series are designed to be small and lightweight.

-

The installation of a domestic automated polymerase chain reaction (PCR) test system in Japan that utilizes Kawasaki robots at Fujita Medical University in Aichi Prefecture was finished, according to Kawasaki Heavy Industries, Ltd., in February 2021.

-

The launch of the new operating system iiQKA.OS, which vastly eases the use of robots, was announced by Kuka AG in April 2021. The new operating system serves as the backbone of the ecosystem as a whole and provides a robust range of applications, components, devices, and services.

-

Yaskawa Motoman launched the HC20XP collaborative robot in March 2020. The 20 kg payload HC20XP cooperative robot is perfect for situations where robots must work comfortably or close to people. It emphasizes hand-guided preparation for the usage of a robot framework.

MULTI-TASKING INDUSTRIAL ROBOTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

12% |

|

Segments Covered |

By Type, Industry, Category, Payload Capacity, Application and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ABB Ltd., Yaskawa Electric Corporation, Mitsubishi Electric Corporation, Nachi-Fujikoshi Corp., Comau SpA, KUKA AG, Fanuc Corporation, Denso Corporation, Kawasaki Heavy Industries, Ltd., Omron Corporation |

Global Multi-Tasking Industrial Robots Market Segmentation:

Global Multi-Tasking Industrial Robots Market Segmentation: By Type

-

Traditional Industrial Robots

-

Collaborative Robots

The market is divided into Traditional Industrial Robots and Collaborative Robots based on type. Because of its high adaptability in assembly, palletizing, welding, painting, and other processes, the Traditional Industrial Robots sub-segment of Articulated Robots holds a sizable market share. These systems are adaptable because they are not restricted to movement along the corresponding axis.

To stop or alter human actions to prevent accidents and injuries, players in the industry have linked these systems with sensors and cameras. These systems, which are relatively less expensive than conventional ones, complement human workers to cut down on idle time and speed up operations that call for human involvement, which accelerates the expansion of the industrial robotics market.

Global Multi-Tasking Industrial Robots Market Segmentation: By Industry

-

Automotive

-

Electrical And Electronics

-

Plastics, Rubber, And Chemicals

-

Metals And Machinery

-

Food And Beverages

-

Others

The market is divided into automotive, electrical and electronic, plastics, rubber, and chemicals, metals and machinery, food and beverage, and other categories based on industry. Due to shifting market trends, such as the creation of electric vehicles and energy-efficient drive systems, which are also encouraging people to replace their old cars with more contemporary ones, the automotive category currently has a sizable market share.

Players in the market are also seeking automation at a highly competitive rate to satisfy consumer demand. Pharmaceuticals, food, and beverage industries, as well as other industries where the quality and accuracy of raw materials/products are crucial, are some of the industries that companies in the industrial robot market are concentrating on. This will help the market for industrial robots grow.

Global Multi-Tasking Industrial Robots Market Segmentation: By Category

-

Articulated Robot

-

Cylindrical Robot

-

Linear Robots

-

Cartesian & Gantry

-

Parallel Robot

-

SCARA Robot

-

Spherical Robots

-

Dual arm

-

Others

Market growth for parallel robots is predicted to be 11.8% CAGR. These Robots, sometimes known as spider-like robots, will be created by joining parallelograms on a common basis. These robots are mostly utilized in the food, drug, and electronics industries. They can move with finesse and accuracy. Similar to other robots, these employ three servo motors, are extremely fast, and are ideal for light-duty duties inside limited working zones. These are the primary explanations for why the food, pharmaceutical, and electrical sectors frequently adopt high-speed sorting and packing.

Additionally, the trend toward miniaturization in the manufacturing sector is likely to stimulate demand for delta robots. Smaller object sizes can lead to additional difficulties with various microassembly tasks. Additionally, delta robots are being equipped with cutting-edge machine vision 3D cameras to boost their effectiveness and precision. Additionally, Delta robots with vision systems can complete tedious, dull, and repetitive operations quickly, precisely, and with a minimum amount of scrap. As a result, delta robots will operate more effectively and be adopted by more end-user industries. Several businesses are also making significant investments in the research and development of this robot.

Global Multi-Tasking Industrial Robots Market Segmentation: By Payload Capacity

-

Below 100kg

-

100kg - 300kg

-

300kg - 600kg

-

Above 600kg

Due to the longer performance, demand for robots with bigger payload capacities is rising internationally. You'll be able to draw the same current for longer without a doubt, which should increase the operation time proportionally. Future payload capacities exceeding 600 kg will be very profitable because they can support more loads. The automotive sector may make extensive use of robots with payload capacities over 600 kg since automotive components often contain metals and other heavy materials that would be difficult for a person to handle.

Due to their higher performance capacity than other industrial robots, payload capacities exceeding 600 kg will have the largest market growth in the next years.

Global Multi-Tasking Industrial Robots Market Segmentation: By Application

-

Handling

-

Assembling & Disassembling

-

Welding & Soldering

-

Cleanroom

-

Dispensing

-

Processing

-

Others

In 2022, the handling application segment controlled the market share and generated more than 40% of the total revenue. The increased popularity of e-commerce purchasing and speedy deliveries is blamed for the segment rise. For instance, Amazon.com, Inc. launched an autonomous robot in June 2022 to handle and transport items inside of company buildings. Without human assistance, robots can handle materials, greatly lowering the mistake rate. Furthermore, handling robots are used in quickly evolving industries like automotive and electronics to swiftly and safely move around small or heavy objects on the manufacturing floor.

Over the projected period from 2023 to 2030, the processing application category is expected to develop at the fastest CAGR of over 20%. The slight faults in their use in painting, cutting, and other procedures can be blamed for the segment's expansion. These kinds of robots are becoming more popular because they can work continuously thanks to their predetermined programming. Robots can also work in places where human labor cannot, such as tiny areas.

Global Multi-Tasking Industrial Robots Market Segmentation: By Region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East and Africa

With a market share of almost 35% in 2022, North America led the market and had the biggest percentage of it. The market in this area is expanding as a result of elements like the availability of qualified people, a strong research infrastructure, and government attempts to support technical improvement in the sector by providing investments and money. Additionally, it is anticipated that faster adoption of technologically improved items in the area will further accelerate market expansion.

With a CAGR of 14.0%, the Asia Pacific region is anticipated to grow at the fastest rate during the forecast period. This is because conducting research is not expensive, there are good regulatory rules in place, and there are more elderly people who are more likely to get chronic illnesses. Another element influencing the category growth during the predicted period is the government's growing attention to the healthcare industry.

Global Multi-Tasking Industrial Robots Market Key Players:

-

ABB Ltd.

-

Yaskawa Electric Corporation

-

Mitsubishi Electric Corporation

-

Nachi-Fujikoshi Corp.

-

Comau SpA

-

KUKA AG

-

Fanuc Corporation

-

Denso Corporation

-

Kawasaki Heavy Industries, Ltd.

-

Omron Corporation

Chapter 1. Multi Tasking Industrial Robots Market – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Multi Tasking Industrial Robots Market – Executive Summary

2.1. Market Size & Forecast – (2022 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. Multi Tasking Industrial Robots Market – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Multi Tasking Industrial Robots Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Multi Tasking Industrial Robots Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Multi Tasking Industrial Robots Market – By Type

6.1. Introduction/Key Findings

6.2 Traditional Industrial Robots

6.3 Collaborative Robots

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2023-2030

Chapter 7. Multi Tasking Industrial Robots Market – By Industry

7.1. Introduction/Key Findings

7.2 Automotive

7.3 Electrical And Electronics

7.4 Plastics, Rubber, And Chemicals

7.5 Metals And Machinery

7.6 Food And Beverages

7.7 Others

7.8 Y-O-Y Growth trend Analysis By Industry

7.9 Absolute $ Opportunity Analysis By Industry, 2023-2030

Chapter 8. Multi Tasking Industrial Robots Market - By Category

8.1. Introduction/Key Findings

8.2 Articulated Robot

8.3 Cylindrical Robot

8.4 Linear Robots

8.5 Cartesian & Gantry

8.6 Parallel Robot

8.7 SCARA Robot

8.8 Spherical Robots

8.9 Dual arm

8.10 Others

8.11 Y-O-Y Growth trend Analysis By Category

8.12 Absolute $ Opportunity Analysis By Category, 2023-2030

Chapter 9. Multi Tasking Industrial Robots Market - By Payload Capacity

9.1. Introduction/Key Findings

9.2 Below 100kg

9.3 100kg - 300kg

9.4 300kg - 600kg

9.5 Above 600kg

9.6 Y-O-Y Growth trend Analysis By Category

9.7 Absolute $ Opportunity Analysis By Category, 2023-2030

Chapter 10. Multi Tasking Industrial Robots Market - By Application

10.1. Introduction/Key Findings

10.2 Handling

10.3 Assembling & Disassembling

10.4 Welding & Soldering

10.5 Cleanroom

10.6 Dispensing

10.7 Processing

10.8 Others

10.9 Y-O-Y Growth trend Analysis By Category

10.10 Absolute $ Opportunity Analysis By Category, 2023-2030

Chapter 11. Multi Tasking Industrial Robots Market, By Geography – Market Size, Forecast, Trends & Insights

11.1. North America

11.1.1. By Country

11.1.1.1. U.S.A.

11.1.1.2. Canada

11.1.1.3. Mexico

11.1.2 By Type

11.1.3 By Industry

11.1.4. By Category

11.2.5. By Payload Capacity

11.2.6. By Application

11.1.7. Countries & Segments - Market Attractiveness Analysis

11.2. Europe

11.2.1. By Country

11.2.1. U.K.

11.2.2. Germany

11.2.3. France

11.2.4. Italy

11.2.5. Spain

11.2.6. Rest of Europe

11.2.2 By Type

11.2.3 By Industry

11.2.4. By Category

11.2.5. By Payload Capacity

By Application

11.2.5. Countries & Segments - Market Attractiveness Analysis

11.3. Asia Pacific

11.3.1. By Country

11.3.1. China

11.3.2. Japan

11.3.3. South Korea

11.3.4. India

11.3.5. Australia & New Zealand

11.3.6. Rest of Asia-Pacific

11.3.2 By Type

11.3.3. By Industry

11.3.4. By Category

11.3.5. By Payload Capacity

11.3.6. By Application

11.3.7. Countries & Segments - Market Attractiveness Analysis

11.3.4. South America

11.4.1. By Country

11.4.1. Brazil

11.4.2. Argentina

11.4.3. Colombia

11.4.4. Chile

11.4.5. Rest of South America

11.4.2 By Type

11.4.3. By Industry

11.4.4. By Category

11.4.5. By Payload Capacity

11.4.6. By Application

11.4.7. Countries & Segments - Market Attractiveness Analysis

11.4.5. Middle East & Africa

11.5.1. By Country

11.5.1. United Arab Emirates (UAE)

11.5.2. Saudi Arabia

11.5.3. Qatar

11.5.4. Israel

11.5.5. South Africa

11.5.6. Nigeria

11.5.7. Kenya

11.5.8. Egypt

11.5.9. Rest of MEA

11.5.2. By Type

11.5.3. By Charge Density

11.5.4. By Category

11.5.5 By Payload Capacity

11.5.6. By Application

11.5.7. Countries & Segments - Market Attractiveness Analysis

Chapter 12. Multi Tasking Industrial Robots Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

12.1 ABB Ltd.

12.2 Yaskawa Electric Corporation

12.3 Mitsubishi Electric Corporation

12.4 Nachi-Fujikoshi Corp.

12.5 Comau SpA

12.6 KUKA AG

12.7 Fanuc Corporation

12.8 Denso Corporation

12.9 Kawasaki Heavy Industries, Ltd.

12.10 Omron Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Multi-Tasking Industrial Robots Market was estimated to be worth USD 19.9 Billion in 2022 and is anticipated to reach a value of USD 49.27 Billion by 2030, growing at a fast CAGR of 12% during the outlook period 2023-2030.

The Segments under the Global Multi-Tasking Industrial Robots Market by Product are Handling, Assembling and disassembling, Welding and soldering, Cleanroom, Dispensing, Processing, and Others.

Some of the top industry players in the Multi-Tasking Industrial Robots Market are ABB Ltd., Yaskawa Electric Corporation, Mitsubishi Electric Corporation, Nachi-Fujikoshi Corp., Comau SpA Etc

The Global Multi-Tasking Industrial Robots market is segmented based on Type, Industry, Payload Capacity, category, Application, and region.

North America region held the highest share in the Global Multi-Tasking Industrial Robots market.