Global Multi-dimensional Perception Security System Market Size (2024 - 2030)

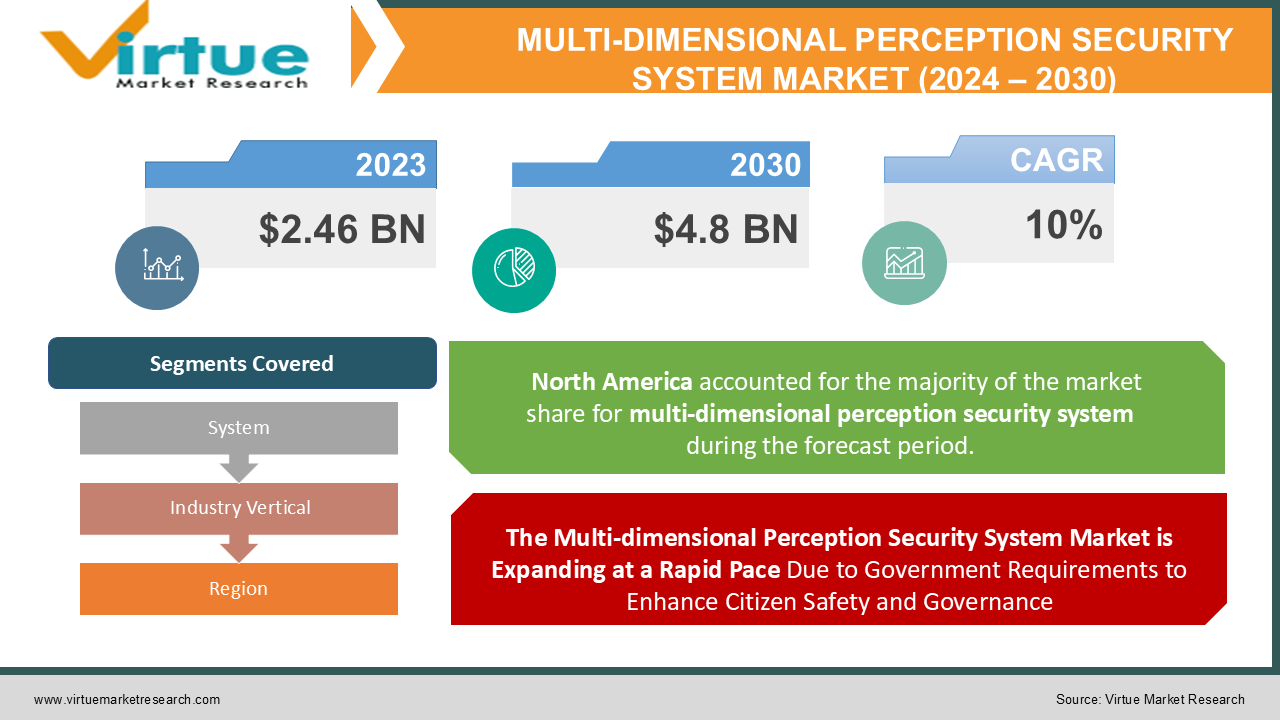

The Global Multi-dimensional Perception Security System Market was valued at USD 2.46 billion and is projected to reach a market size of USD 4.8 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 10%.

Industry Overview

Attributed to expanding technology developments in monitoring and security, the government's mission to support citizen safety and governance, the rise in criminal activity, planned crimes, terrorism, and other factors. The Multi-dimensional Perception Security System makes sure that an organization's overall security needs are satisfied. It consists of intelligent video management software that offers comprehensive security information via data collecting and analytics that serve as the foundation for intrusion detection. Technology advancements in the creation of these systems, as well as the incorporation of IoT and AI, have made it possible to remotely monitor systems and identify sophisticated security breaches.

With the help of these technologies, intrusion detection findings are more reliable, and the frequency of erroneous security warnings brought on by wind, rain, and traffic is decreased. The outlook for the Multi-dimensional Perception Security System industry is also estimated to change shortly due to the growing demand for real-time surveillance systems combined with the extensive installation of advanced security systems like security alarms in homes, commercial workspaces, and other locations.

Impact of Covid-19 on the industry

The COVID-19 pandemic had a significant negative influence on the market share growth for home security systems globally in 2020. Due to manufacturing interruptions and the temporary closure of non-essential transport, global revenues fell by 5–10% in 2020. Due to supply chain disruption in China, the demand for home security systems decreased, which has had a substantial negative impact on major markets including the US and China. Some of the variables that had an impact on demand in China included the reduction in the number of new development projects and the closure of manufacturing operations. The market did, however, rebound in 2021, and it is anticipated that the US and China will continue to dominate the global market for home security systems.

Market Drivers

The Multi-dimensional Perception Security System Market is Expanding at a Rapid Pace Due to Government Requirements to Enhance Citizen Safety and Governance

The Multi-dimensional Perception Security System market is expanding due to government initiatives to enhance public safety and governance. Governmental organizations are using more pan-tilt-zoom cameras, smart cameras, and surveillance systems to protect residents in public areas. The demand for multi-dimensional perception security systems is increasing as AI and IoT technologies are being implemented in airports, train stations, and other public facilities, as well as using robots and drones for border security and surveillance. They are employed to maintain public safety, manage traffic, and offer security against terrorist attacks and potential security threats.

West Central Railway stations will receive a Video Surveillance System (VSS) (a network of CCTV cameras) installation by RailTel, a Central Public Sector Undertaking (CPSU), in July 2022. (WCR). CCTV camera feeds can be recorded and kept for up to 30 days. The task is anticipated to be finished by January 2023. By the end of 2022, over 40% of police departments will be using digital technologies, such as live video streaming and shared workflows, to promote community safety and an alternative response framework, according to a report released by The International Data Corporation (IDC) in 2021. In the long run, these elements will contribute to the Multi-dimensional Perception Security System industry's growth.

The need for multi-dimensional perception security systems is accelerating as more advanced security alarms and cameras are being installed in residential buildings

The need for multi-dimensional perception security systems is rising as a result of the increasing usage of high-tech security alarms and cameras in residential structures. To enable more control and monitoring, residential building security solutions contain several sensors, pan-tilt-zoom cameras, and controllers. Yard signs, alarms, and window stickers have become more effective security elements because of the Internet of Things (IoT) integration in home security systems. When IoT and cloud computing are combined, it is simpler to access the system from many locations, data exchange is more effective, and there is more storage available. The Multi-dimensional Perception Security System is also compatible with Amazon Alexa and/or Google Assistant.

Along with Google Assistants and Alexa, they also include smart locks, cameras, doorbells, wall-mounted touchscreen displays, and smartphone apps. These devices are connected and offer residential protection around-the-clock. The need for security systems with multi-dimensional perception has increased as a result of recent security systems that incorporate smoke, fire, flood, freeze, and carbon monoxide (CO) listeners. The Vivint Doorbell Camera Pro was introduced by Vivint, Inc. in March 2020. It is the first camera to have a 1:1 aspect ratio with a 180-degree vertical and horizontal field of view. To suit the needs of the consumer, this camera blends optics, deterrent features, and intelligence. There were around 44.5 million professionally monitored security systems worldwide in 2020, with a predicted increase to 54 million by 2024, according to India's remote monitoring research in 2021.

Market Restraints

The Multi-dimensional Perception Security System's High Implementation Costs are Limiting Market Growth

Multi-dimensional perception security system market growth is being constrained by high installation costs. Modern sensors, cameras, and controllers are included in the multi-dimensional Perception Security System. They include doorbells, pan-tilt-zoom cameras, smart locks, and thermostats, which drive up the price of making such security systems. To facilitate machine-to-machine communication and data analytics, these systems also make use of cutting-edge AI and IoT technology. These innovations increase the safety of the structure, home, or another area where such systems are installed by assisting in the early detection of security threats and attacks.

The typical cost of a Multi-dimensional Perception security system is $25 to $50 per month for monitoring services, according to a report released by HomeGuide in 2022. However, the upfront expenditures for alarm system equipment range from $199 to $399, plus $0 to $199 for activation and installation costs. The market for Multi-dimensional Perception Security Systems is also constrained by the necessity for trained specialists for installation, high maintenance costs, and potential cyber security issues, to name a few.

MULTI DIMENSIONAL PERCEPTION SECURITY SYSTEM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10% |

|

Segments Covered |

By system, industry vertical, and Geography & region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Honeywell International Inc., Fiber Sensys Inc., Axis Communications, Rbtec perimeter security Systems, FLIR Systems Inc., Hikvision, Schneider Electric SE, Advanced Perimeter Systems Ltd., Heras Mobile Fencing & Security, Resideo Technologies Inc. |

This research report on the global multi-dimensional perception security system market has been segmented and sub-segmented based on, system, industry vertical, and Geography & region.

Global Multi-Dimensional Perception Security System Market- By System

-

Access Control Systems

-

Security Alarms & Notification Systems

-

Intrusion Detection Systems

-

Video Surveillance Systems

-

Barrier Systems

-

Active Barriers

-

Passive Barriers

-

-

Others

During the forecast period of 2022–2030, the global market for multidimensional perception security systems is estimated to develop at the quickest rate of 11.1% for video surveillance systems. Government initiatives to put cameras in public places, a rise in the use of video surveillance equipment in the defence sector to track and monitor public activity, and other factors. The prevalence of thefts, unusual ATM withdrawals, and fraudulent transactions has led to the widespread deployment of video management software. Additionally, analytical services are provided by technical breakthroughs like the fusion of deep learning, the Internet of Things (IoT), and artificial intelligence (AI). They make capabilities like license plate recognition, vehicle detection, and face recognition possible (LPR).

To safeguard the integrity of surveillance footage, Axis Communications introduced an open-source video authentication project in December 2021. The framework will be used by businesses to develop integrated video management software. It will offer a free technique for video authentication and verification to the surveillance market. The expansion of video surveillance systems in the Multi-dimensional Perception Security System market has been considerably impacted by these advances over time.

Global Multi-Dimensional Perception Security System Market- By Industry Vertical

-

Commercial & Service buildings

-

Government

-

Military & Defence

-

Transportation

-

Education

-

Others

In the Military & Defence sector, Multi-dimensional Perception Security System is predicted to see the highest CAGR of 12.4% from 2023 - 2030. The market has been growing as a result of factors including increased defence spending to increase the security of troops and residents, increasing usage of contemporary security technologies like drones, unmanned aerial vehicles (UAVs), & robots in the defence industries, and others. Because military and defence establishments are important targets for terrorists and organized crime, they need modern technologies to thwart terrorist attacks. High-quality detection, tracking, and categorization of intruder risks are provided by advanced security alarms and systems, thermal imaging cameras, and video management software. In such situations, UAV infiltration is also becoming a major worry, which in turn promotes the usage of air surveillance radars for air traffic monitoring.

To maintain continuous surveillance of military bases, this aids in intrusion detection, automatic multiple threat detection from a distance, and quick deployment capabilities. Global military spending climbed by 2.6 % from 2019 to 2020, according to the Stockholm International Peace Research Institute (SPIRI) research. In 2020, the United States (USD 778 billion), China (USD 252 billion), India (72.9 billion), Russia (61.7 billion), and the United Kingdom were the top five nations with the highest military budgets (59.2 billion). The demand for multi-dimensional perception security systems is rising as a result of rising investments in advanced security systems and the purchase of drones and robots for defence purposes. These variables are examined to see how they will affect the future Military & Defence sector market size for Multi-dimensional Perception Security Systems.

Global Multi-Dimensional Perception Security System Market- By Geography & Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

The Middle East and Africa

In 2021, North America held a 36% share of the global market for multi-dimensional perception security systems. This dominance was attributed to rising Internet of Things (IoT) and AI usage, government initiatives to ensure national security, rising crime rates, including personal crime and data theft, and other factors. The demand for multi-dimensional perception security systems is also expanding due to the increased installation of advanced security systems in residences, businesses, and other public spaces, as well as the rising investment in personal & public security technologies in the region.

To increase the penetration of home automation and home security devices in both new and existing multifamily and student housing developments in the United States, ADT and HHHunt, Inc. cooperated in February 2020. Smart locks, hubs, and thermostats will be included in the collaboration's smart home security systems. Customers in the US are very interested in its specialized smart security systems. The prognosis for the Multi-dimensional Perception Security System market in North American markets is estimated to change as a result of these reasons.

Global Multi-Dimensional Perception Security System Market- By Companies

-

Honeywell International Inc.

-

Fiber Sensys Inc.

-

Axis Communications

-

Rbtec perimeter security Systems

-

FLIR Systems Inc.

-

Hikvision

-

Schneider Electric SE

-

Advanced Perimeter Systems Ltd.

-

Heras Mobile Fencing & Security

-

Resideo Technologies Inc.

NOTABLE HAPPENINGS IN THE GLOBAL MULTI-DIMENSIONAL PERCEPTION SECURITY SYSTEM MARKET IN THE RECENT PAST:

-

Merger & Acquisition: - In 2022, First Alert Inc. was acquired by Resideo Technologies, Inc. to expand its selection of detection and suppression tools. It includes fire extinguishers, combination alarms, connected fire devices, smoke alarms, carbon monoxide (CO) alarms, and other suppression techniques.

-

Product Launch: - In 2021, The FLIR VS290-32, a video scope system with thermal imaging and crew safety for inspecting difficult-to-reach underground utility vaults, was introduced by FLIR Systems. With an IP67 camera and IP54 dust- and water-resistant base unit, this multi-dimensional security system has an electrical inspection system with a CAT IV 600 V safety rating.

-

Product Development: - In 2021, The next-generation multi-dimensional perception security system from Heras has been updated. This system aims to increase perception security in a range of commercial settings, including distribution centers and warehouses.

Chapter 1. Global Multi-dimensional Perception Security System Market– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Global Multi-dimensional Perception Security System Market– Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Global Multi-dimensional Perception Security System Market– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Global Multi-dimensional Perception Security System Market- Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Global Multi-dimensional Perception Security System Market– Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Global Multi-dimensional Perception Security System Market– By System

6.1 Introduction/Key Findings

6.2 Access Control Systems

6.3 Security Alarms & Notification Systems

6.4 Intrusion Detection Systems

6.5 Video Surveillance Systems

6.6 Barrier Systems

6.7 Active Barriers

6.8 Passive Barriers

6.9 Others

6.10 Y-O-Y Growth trend Analysis By System

6.11 Absolute $ Opportunity Analysis By System, 2024-2030

Chapter 7. Global Multi-dimensional Perception Security System Market– By Industry Vertical

7.1 Introduction/Key Findings

7.2 Commercial & Service buildings

7.3 Government

7.4 Military & Defence

7.5 Transportation

7.6 Education

7.7 Others

7.8 Y-O-Y Growth trend Analysis By Industry Vertical

7.9 Absolute $ Opportunity Analysis By Industry Vertical, 2024-2030

Chapter 8. Global Multi-dimensional Perception Security System Market, By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By System

8.1.3 By Industry Vertical

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By System

8.2.3 By Industry Vertical

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By System

8.3.3 By Industry Vertical

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By System

8.4.3 By Industry Vertical

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By System

8.5.3 By Industry Vertical

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Global Multi-dimensional Perception Security System Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Honeywell International Inc.

9.2 Fiber Sensys Inc.

9.3 Axis Communications

9.4 Rbtec perimeter security Systems

9.5 FLIR Systems Inc.

9.6 Hikvision

9.7 Schneider Electric SE

9.8 Advanced Perimeter Systems Ltd.

9.9 Heras Mobile Fencing & Security

9.10 Resideo Technologies Inc.

Download Sample

Choose License Type

2500

4250

5250

6900