GLOBAL MULTI-CURRENCY PAYMENTS PROCESSING MARKET (2024 - 2030)

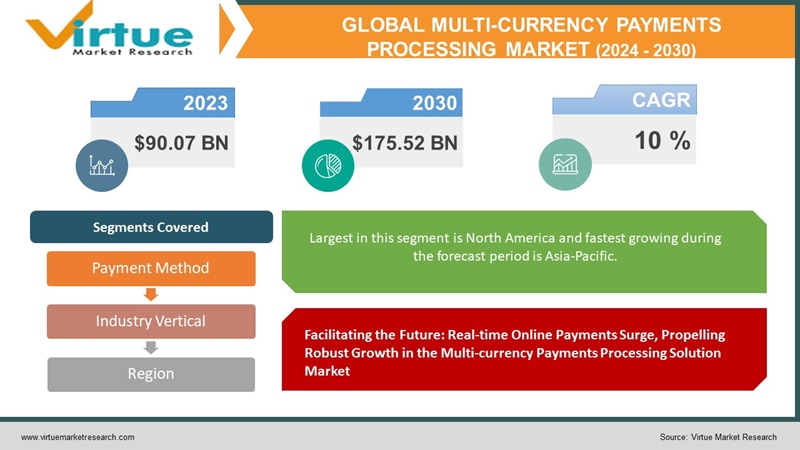

The Multi-currency Payments Processing Solution Market was valued at USD 90.07 billion in 2023 and is projected to reach a market size of USD 175.52 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 10%.

The Multi-currency Payments Processing Solution market has evolved from past challenges in cross-border transactions to the present dominance of digital platforms like PayPal and Stripe. Currently facilitating seamless multi-currency transactions, the future promises further innovation, potentially influenced by technologies like blockchain and decentralized finance. This has empowered businesses to expand globally and cater to diverse customer bases. Anticipated developments include heightened security measures and improved interoperability, reflecting the ongoing digital transformation in the financial sector, as the market continues to play a crucial role in facilitating global commerce.

Key Market Insights:

The payment processing solutions sector is experiencing significant upheaval, propelled by the increasing prevalence of Voice over LTE (VoLTE) and the widespread adoption of affordable smartphones.

In 2022, NFC-based payment processing solutions held a market share exceeding 40% in the U.S., fueled by the growing preference for digital payment channels. NFC-enabled payment modes like Apple Pay, Google Pay, and Samsung Pay are gaining traction.

In the UK market, the credit card segment is expected to achieve a CAGR of nearly 10% by 2028. Credit cards are extensively used for online purchases.

The in-store segment took a commanding share of 60% in the payment processing solutions market in Mexico in 2022.

Multi-currency Payments Processing Solution Market Drivers:

Facilitating the Future: Real-time Online Payments Surge, Propelling Robust Growth in the Multi-currency Payments Processing Solution Market

Amidst technological advancements and dynamic business landscapes, real-time payment solutions are undergoing a transformative journey within the banking industry. Financial institutions are proactively embracing digital channels such as wallets, e-channels, and third-party API providers, exemplified by the collaborative efforts under New Payments Platform Australia (NPP Australia). This collective initiative aims to streamline and simplify real-time money transfers, responding to the growing ubiquity of smart devices and the flourishing retail sector. Governments, albeit at a slower pace, are recognizing the potential of real-time payments for enhanced tax collection and fraud prevention, contributing to the market's accelerated growth.

Shaping Tomorrow's Transactions: Global E-commerce Boom Drives Unprecedented Adoption of Multi-currency Payment Solutions

The global retail market is undergoing a paradigm shift with the relentless evolution of payment technology, the proliferation of mobile purchases, and the surge in online card payments. Merchants are strategically realigning their sales approaches, prioritizing inventive mobile payment options, robust risk management, and customer-centric services both in the digital and physical realms. As the competitive landscape intensifies, technology emerges as a pivotal differentiator, prompting substantial investments by major retailers in technical development programs. The accessibility of the payment market to non-bank players further empowers online traders to offer customers a versatile range of multi-channel payment solutions, contributing to the widespread adoption of payment technologies.

Digital Horizon Unleashed: Technological Advances Propel Exponential Growth in the Multi-currency Payments Processing Solution Market

In an era where businesses and financial institutions champion digital and innovative payment methodologies, the payment processing solutions market is experiencing a seismic transformation. The embrace of cutting-edge technologies is particularly evident in the widespread adoption of real-time payment solutions, encompassing wallets, e-channels, and third-party API providers. Collaborative endeavors, exemplified by initiatives like New Payments Platform Australia (NPP Australia), underscore the industry's commitment to simplifying and expediting real-time money transfers. The pervasive use of smart devices, coupled with the thriving retail sector, amplifies the momentum toward adopting real-time payments, with consumers increasingly relying on smartphones for a diverse array of transactions.

Revolutionizing Retail Dynamics: Investment in Payment Technology Surges as Merchants Adapt Strategies to Global E-commerce Trends

Merchants are strategically reconfiguring their sales approaches, placing heightened emphasis on innovative mobile payment options, robust risk management practices, and elevated customer service standards in both digital and physical realms. Fueled by intensified competitive pressures, technology emerges as a pivotal factor for differentiation, prompting substantial investments by major retailers in comprehensive technical development programs. The entry of non-bank players into the payment market further empowers online traders, enabling them to provide customers with a versatile array of multi-channel payment options and solidifying the pervasive adoption of payment

Multi-currency Payments Processing Solution Market Restraints and Challenges:

Data Security and Identity Theft Concerns Pose Significant Hurdles for Multi-currency Payments Processing Solution Market Growth

While online payment systems strive to ensure safe and stable transactions, vulnerabilities persist, with fraudsters employing tactics like phishing attacks to illicitly obtain login details and access personal and financial information. The absence of robust authentication methods, such as biometrics and face recognition, leaves payment processes susceptible to unauthorized use of cards and e-wallets, undermining user trust. Citizens, wary of these security issues, may hesitate to embrace e-payment services. Companies offering in-house e-payment solutions grapple with additional costs to acquire, implement, and maintain advanced payment security measures to counter unauthorized access to confidential financial data. Privacy and security concerns associated with consumer data further compound challenges in the Multi-currency Payments Processing Solution Market. The risks of online transactions, including identity theft and bank account hacking, contribute to heightened apprehensions among consumers. The utilization of customer information by Internet retailers for purposes such as price adjustments and marketing raise privacy concerns, with customers objecting to the use of their data for advertising purposes within payment solutions. Geolocation data requirements for service provision add another layer of privacy concerns. Payment gateways, crucial for real-time financial transactions in e-commerce and mobile commerce, expose consumers to potential financial losses in the event of data theft. Despite advancements, security risks persist in payment gateways, dissuading the adoption of payment processing solutions due to the potential for unauthorized access, presenting a significant challenge expected to impede market growth throughout the forecast period.

Multi-currency Payments Processing Solution Market Opportunities:

As businesses worldwide establish and strengthen their online presence and consumers increasingly turn to online shopping, there is a growing demand for secure, seamless, and dependable payment processing solutions. This encompasses the facilitation of diverse payment methods, including credit/debit cards, digital wallets, and alternative payment options, to accommodate the varied preferences of customers. Furthermore, the rising adoption of mobile payment methods within the e-commerce sector presents a substantial opportunity for payment processing solutions. Given the widespread use of smartphones and the convenience offered by mobile apps, consumers are increasingly embracing mobile payment solutions. Payment processors equipped with robust mobile payment capabilities, encompassing in-app payments and mobile point-of-sale (mPOS) solutions, are well-positioned to capitalize on this expanding market segment.

GLOBAL MULTI-CURRENCY PAYMENTS PROCESSING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10 % |

|

Segments Covered |

By Payment Method, Industry Vertical and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ACI Worldwide Inc, Adyen N.V, Authorize Net, Due Inc, Dwolla Inc, Fidelity National Information Services Inc (FIS), First Data Corporation, Fiserv Inc, Flagship Merchant Services, Global Payments Inc |

Multi-currency Payments Processing Solution Market Segmentation:

Market Segmentation: By Payment Method:

- Debit Card

- Credit Card

- e-Wallet

- Automated Clearing House (ACH)

- Others

Largest in this segment is Debit Card and fastest growing during the forecast period is e-Wallet. The well-established debit card infrastructure in areas with a substantial percentage of banked consumers, along with a recent upsurge in debit cardholders observed in nations like India, China, and Germany, played a pivotal role in this predominant status. The e-wallet segment is adapting to the upswing in digital payments. As outlined in the World Payments Report by Capgemini, the global estimate for non-cash transactions with e-wallets reached 42.8 billion in 2021, driven by the increasing prevalence of mobile payments, widespread smartphone adoption, and evolving customer preferences. Remarkably, governments worldwide are actively championing initiatives to propel the adoption of online payment solutions, fostering the anticipated expansion of bank transfers and prepaid debit cards in the forecast period. The market's dynamism is further accentuated by diverse preferences and evolving trends within segments like credit cards, Automated Clearing House (ACH), and other methods, encompassing bank transfers, prepaid debit cards, and cheques.

Market Segmentation: By Industry Vertical:

- Banking, Financial Services and Insurance (BFSI)

- Manufacturing

- IT and Telecommunications

- Travel and Hospitality

- Retail and Consumer Goods

- Healthcare

- Transportation and Logistics

- Others

Largest in this segment is BFSI and fastest growing during the forecast period is Retail and Consumer Goods. BFSI’s substantial growth is primarily driven by the heightened adoption of advanced payment processing solutions among banks and Fintech firms. With the rapid expansion of the internet, banks are undertaking initiatives to establish stable and cost-effective payment mechanisms, facilitating the increasing volume of network trade activities. The fastest growing retail sector growth is fueled by vendors' focus on providing personalized payment solutions that empower retailers to offer versatile processing methods at the point of sale. This strategic approach enhances the customer experience through secure, convenient, and reliable check-out processes. Concurrently, other industry verticals such as manufacturing, IT and telecommunications, travel and hospitality, healthcare, transportation and logistics, and others are also integral components of the market, each with its unique considerations and contributions to the overall growth of the Multi-currency Payments Processing Solution Market.

Market Segmentation: Regional Analysis:

- North America

- South America

- Europe

- Asia-Pacific

- Middle East and Africa

Largest in this segment is North America and fastest growing during the forecast period is Asia-Pacific. North America benefits from a robust interstate economic structure, witnessing a steady annual increase in net interest margins on current account balances. The dominance of digital payments, particularly through credit cards, is a key driver, with the market standing at USD 24.98 billion in 2023 and poised to maintain its leadership during the forecast period. The Asia-Pacific region emerges as the fastest-growing segment, driven by a thriving retail and consumer goods industry, substantial growth in technology adoption for transactions, and government initiatives supporting digital payments. The region's dynamic e-commerce industry, coupled with supportive government measures, contributes significantly to the heightened demand for Multi-currency Payments Processing Solutions during the forecast period. Meanwhile, Europe exhibits moderate growth, attributed to major players' presence and the escalating adoption of online channels by retail customers. The transition from cash to advanced payment solutions, propelled by increased card transactions and regulatory frameworks like PSD2 and open banking, fuels demand in the region. Conversely, the Middle East & Africa, currently fragmented, experiences a demand surge for digital payment solutions amidst a largely unbanked population, with governments and fintech firms implementing initiatives to accelerate the shift from cash transactions.

COVID-19 Impact Analysis on the Multi-currency Payments Processing Solution Market:

In 2020, the regional Multi-currency Payments Processing Solution Market experienced diverse effects from the COVID-19 pandemic. While certain sectors, such as online grocery stores, pharmacies, gaming, and utility payments, saw a surge in digital transactions during lockdowns, the overall impact varied. The subsequent large-scale vaccination efforts in 2021 and 2022 contributed to suppressing the pandemic and fostering market growth. Looking ahead, the forecast for the Multi-currency Payments Processing Solution Market in the region anticipates continued growth during the forecast period.

Latest Trends/ Developments:

The Multi-currency Payments Processing Solution Market is evolving with a focus on global financial inclusion. The increased accessibility of financial services worldwide has led to a surge in digital transactions, highlighting the need for reliable multi-currency payment solutions. These platforms play a vital role in supporting micro and small enterprises, aligning with broader financial inclusion goals. By facilitating secure and convenient online/offline payments and offering specialized tools for transaction control and data analytics, these solutions contribute to entrepreneurship and economic growth in the formal economy. Global financial inclusion is a key trend shaping the landscape of the Multi-currency Payments Processing Solution Market.

Key Players:

- ACI Worldwide Inc

- Adyen N.V

- Authorize Net

- Due Inc

- Dwolla Inc

- Fidelity National Information Services Inc (FIS)

- First Data Corporation

- Fiserv Inc

- Flagship Merchant Services

- Global Payments Inc

- Jan 2022: PayPal and Salesforce collaborated to offer merchants direct access to the PayPal Commerce Platform in conjunction with Salesforce payments. This collaboration is part of several strategic alliances between key players to launch new and innovative solutions with added functionalities, aimed at maintaining revenue share and profitability in the market.

- June 2023: Visa acquired Pismo to provide core banking and issuer processing capabilities across debit, prepaid, credit, and commercial cards for clients via cloud-native APIs. The goal is to also offer support and connectivity for emerging payment rails, like Pix in Brazil, to serve financial institution clients.

Chapter 1. GLOBAL MULTI-CURRENCY PAYMENTS PROCESSING MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL MULTI-CURRENCY PAYMENTS PROCESSING MARKET – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. GLOBAL MULTI-CURRENCY PAYMENTS PROCESSING MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL MULTI-CURRENCY PAYMENTS PROCESSING MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL MULTI-CURRENCY PAYMENTS PROCESSING MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL MULTI-CURRENCY PAYMENTS PROCESSING MARKET – By Payment Method

6.1. Debit Card

6.2. Credit Card

6.3. e-Wallet

6.4. Automated Clearing House (ACH)

6.5. Others

Chapter 7. GLOBAL MULTI-CURRENCY PAYMENTS PROCESSING MARKET – By Industry Vertical

7.1. Banking, Financial Services and Insurance (BFSI)

7.2. Manufacturing

7.3. IT and Telecommunications

7.4. Travel and Hospitality

7.5. Retail and Consumer Goods

7.6. Healthcare

7.7. Transportation and Logistics

7.8. Others

Chapter 8. GLOBAL MULTI-CURRENCY PAYMENTS PROCESSING MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Payment Method

8.1.3. By Industry Vertical

8.1.5. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Payment Method

8.2.3. By Industry Vertical

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Payment Method

8.3.3. By Industry Vertical

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Payment Method

8.4.3. By Industry Vertical

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Payment Method

8.5.3. By Industry Vertical

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. GLOBAL MULTI-CURRENCY PAYMENTS PROCESSING MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. ACI Worldwide Inc

9.2. Adyen N.V

9.3. Authorize Net

9.4. Due Inc

9.5. Dwolla Inc

9.6. Fidelity National Information Services Inc (FIS)

9.7. First Data Corporation

9.8. Fiserv Inc

9.9. Flagship Merchant Services

9.10. Global Payments Inc

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market was valued at USD 90.07 billion in 2023 and is expected to reach USD 175.52 billion by 2030, with a projected CAGR of 10% from 2024-2030.

Significant drivers include the surge in real-time online payments, global e-commerce growth, and technological advances in payment processing solutions.

Segments include payment methods (Debit Card, Credit Card, e-Wallet, ACH, Others), industry verticals (BFSI, Manufacturing, IT, Travel, Retail, Healthcare, Transportation, Others), and regions.

Opportunities lie in the global e-commerce growth, increasing adoption of mobile payments, and the demand for secure, seamless, and dependable payment processing solutions.

North America dominates, while Asia-Pacific is projected to experience the fastest growth, driven by a thriving retail industry and government initiatives supporting digital payments.