Global Mulberry Silk Market Size (2024 – 2030)

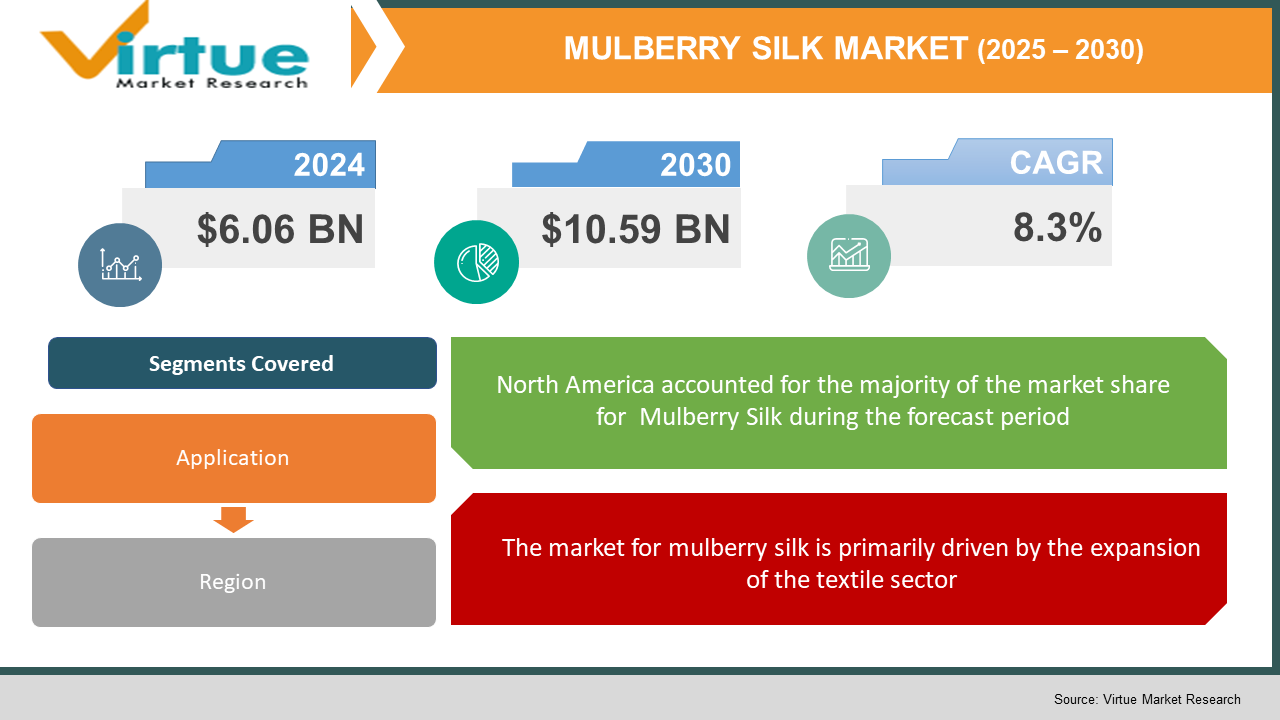

The Global Mulberry Silk Market was valued at USD 6.06 billion in 2023 and is projected to reach a market size of USD 10.59 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 8.3%.

Industry Overview:

Natural silk is manufactured and known commercially around the globe in four different varieties. The term "silk" often refers to the silk produced by mulberry silkworms because it is the most significant of these and accounts for up to 90% of global output. Non-mulberry silks include three further varieties that are commercially significant: Eri silk, Tasar silk, and Muga silk. There are additional non-mulberry silk varieties, such as Anaphe silk, Fagara silk, Coan silk, Mussel silk, and Spider silk, which are primarily harvested in Africa and Asia from wild animals. The Bombyx mori L silkworm, which only consumes the leaves of the mulberry plant, is the source of mulberry silk. This is the proteinaceous fiber made from fibroin, which is created by the larvae of small, delicate insects that are about to complete their metamorphosis. These silkworms are entirely domesticated and are raised indoors. The textile industry makes extensive use of mulberry silk. To improve the qualities of the basic fiber, mulberry silk is also incorporated into blends with other natural fibers like cotton. The demand for mulberry silk is anticipated to rise and fuel the silk market in the future due to improvements in silk quality. Mulberry silk is probably going to be in the lead in the global silk market due to its flexibility, remarkable strength, and durability. Silk is frequently used in clothing because it is supple, lustrous, flexible, and comfortable to wear. Silk clothing has the added benefit of being absorbent, which keeps the body comfortable in all weather conditions. Silk is used in industries other than the textile sector, including medicine and cosmetics. In the Asia-Pacific area, particularly in China, silk is in high demand. Being the region with the easiest access to raw materials, Asia-Pacific is where the majority of raw silk is produced. The textile sector uses silk most frequently. The utilization of silk was encouraged by rising textile industry demand. Market growth for silk is anticipated to be further fueled by technological advancements in the sericulture sector.

COVID-19 pandemic impact on the Mulberry Silk Market

The mulberry silk market suffered as a result of the most recent coronavirus outbreak. The silk industry experienced a variety of production-related challenges during the COVID-19 period, including fluctuating cocoon and raw silk prices, a labor shortage, transportation problems, a decline in the sale of raw silk and silk-related products, a decline in working capital and cash flow, fewer export/import orders, and other limitations. Numerous silk industries were shut and operations were halted. Changes in consumption habits and silk marketing methods have also been brought on by the pandemic. Businesses in the China, India, and France region have had significant issues with their supply chains. During the peak of COVID-19, orders and supply indicated a falling trend in silk production, which is currently noticeably improving. Several businesses have simultaneously worked to combine the Internet and new technology to innovate, develop, transform, and upgrade in response to market shifts, thereby fending off the pandemic-related economic catastrophe. The demand for silk is estimated to boost over the next few years, in the post-pandemic situation as the manufacturing of silk resumes.

MARKET DRIVERS:

The market for mulberry silk is primarily driven by the expansion of the textile sector

The increasing demand for mulberry silk due to its many benefits, including its superior natural, quality, pure white color, and odorlessness is driving the industry. The textile sector, which is increasing and undergoing continuous changes in terms of supply and demand, includes silk as a significant element. Due to its luster, plush feel, lightweight, durability, and strength, silk is utilized in textiles. As well as cushions, draperies, wall hangings, and upholstery, it is utilized in a wide range of apparel items, including dresses, neckties, scarves, and bridal gowns. Silk has a long history of use and popularity, unlike some other materials. India serves as a remarkable illustration of a country where demand exceeds supply (and hampers export growth). India has emerged as the main importer of raw silk while being the second-largest producer at the moment. As consumers become more able to buy lower-priced silk products, domestic demand for other silk producers, like those in China, is growing quickly.

The market for mulberry silk is being driven by factors including low capital requirements and advances in sericulture technology

The global mulberry silk market is expanding as a result of rising sericulture technical improvements and rising demand for silk-related goods globally. Modern technology has increased silk's ability to absorb moisture, making it more pleasant to wear in warm weather. Due to technological advancements, silk products have a low conductivity, which keeps the body's heat close to it during the cold. Since producing silk does not require sophisticated machinery or equipment, the silk market requires less capital. When compared to investment-intensive industries, it is more labor-intensive. These elements encourage market expansion. A rise in the textile industry's demand for silk, evolving fashion trends, and rising purchasing power in developing nations all point to a growth in silk consumption.

MARKET RESTRAINTS:

High Material Costs could impede the expansion of the mulberry silk market.

Mulberry silk tends to be more expensive than more widely available varieties of silk because of its premium status. The most difficult element for the size of the silk market is the high cost of the raw materials for making silk and the heavy dependence on the export of those materials, with China reportedly being the main producer of those materials. Silk clothing is also difficult to clean because it typically requires dry cleaning. Additionally, it might be harmed by prolonged sun and water exposure. Because of this, it costs extra to the final consumers. The overall high price of silk will limit the expansion of the silk market. Due to its dominance in silk production and exportation, China influences product pricing and standards. Customers' ability to swap vendors is reduced as a result, which restrains the demand-side market growth.

Some of the industry's limiting factors include the lack of supply of raw materials, the need for large amounts of energy during manufacturing, and the presence of substitutes due to ethical concerns with mulberry silk.

The treatment of the mulberry silkworm, an insect that is essential to the production of mulberry silk, is one of the key ethical concerns with this product. The biggest hindrance to the size of the silk market is also the lack of a sufficient supply of raw materials. The growth of the market is slowed down by the affordability of substitute raw resources. The largest issue with mulberry silk is energy consumption as well. Silk farms must be maintained at a specific humidity and temperature, even in the hot temperatures of Asia, necessitating a lot of air conditioning and humidity management. Significant amounts of energy are also needed for the drying and boiling stages. Another issue is the dying process. Both acid and reactive dyes are synthetic colors used in traditional silk production, and as such, they are both linked to excessive water usage, harm to marine life, and water pollution.

GLOBAL MULBERRY SILK MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.3% |

|

Segments Covered |

By Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Wujiang First Textile Co., Ltd., Anhui Silk Company, Wanshiyi silk Co., Ltd., and Zhejiang Jiaxin silk Corp., Ltd. |

This research report on the global Mulberry Silk Market has been segmented based on application and region.

Mulberry Silk Market – By Application

- Textile

- Cosmetics

- Medical

- Others

Based on Application, the mulberry silk market is segmented into Textile, Medical, Cosmetics, and others. Textiles are the fastest-growing application for silk. Silk plays a vital role in the production of textiles, which is constantly expanding and shifting in terms of supply and demand. Because of its gleaming appearance, plush feel, light weight, strength, and tenacity, silk is utilized in textiles. It's utilized in a wide range of products, including cushions, wall hangings, draperies, upholstery, dresses, blouses, scarves, and neckties. Additionally, silk is very comfortable to wear, particularly in warm weather, because of its absorbency. In cold conditions, its limited conductivity keeps warm air near to the skin. This expands the range of clothing items that can be made from silk, including shirts, ties, formal dresses, high-fashion clothing, lingerie, pajamas, robes, dress suits, sun dresses, and kimonos. Sarees, an Indian traditional garment, are also made from silk in India.

Another important application area for silk is in cosmetics and medicine. This silk application is still in its infancy and serves a very small portion of the market for silk. A natural protein called silk fibroin serves as the raw material for many cosmetic products. Silk is used in liquid soaps, cosmetic creams, lotions, foaming cleansers, shampoos, conditioners, and nail enamel. Due to its exceptional film-making ability, silk polypeptide is used in shampoo, skin lotion, cleaning cream, skin cream, and soap. Silk-based biomaterials (SBBs) have been utilized as sutures in clinical settings in the field of medicine for centuries.

Mulberry Silk Market - By Region:

-

North America

-

Europe

-

Asia-Pacific

-

Rest of the World

The North American mulberry silk market is anticipated to grow profitably throughout the projected period due to the region's rapidly growing textile sector.

Silk products are mostly imported, processed, and exported from Italy in Europe. Italy is renowned for having extremely advanced capabilities in processing silk (finishing, dyeing, and printing silk fabrics). France is another nation with a sizable silk processing industry. For years, Lyon has produced premium silk fabrics to meet domestic and worldwide demand. More than 70% of silk materials are normally utilized for clothing in the French market. Silk seems to be becoming more and more fashionable for use in interior design as upholstery, wall coverings, bedspreads, and curtains. Germany is the largest European market for textiles and apparel, including silk. German consumers favor natural fibers. Germany imports a vast selection of silk apparel, accessories (particularly silk pillowcases), and building supplies.

The Asia-Pacific region is anticipated to experience the quickest growth in the mulberry silk market in terms of volume and value. The majority of the supply and demand for silk are met by countries in the Asia-Pacific region. China and India are the top two manufacturers of silk worldwide, respectively. China has a more than 6,000-year history of sericulture. Additionally, silk is a significant export from China. In China, mulberry and tussar silk are the two main types of silk produced. The Asia-Pacific region's silk markets include China, India, Uzbekistan, and Thailand. The growing population of these nations and the export of the textile products they produce are the main factors driving the demand for silk. Additionally, domestic silk demand in China and India has a considerable impact on regional silk demand.

Major Key Players in the Market

The top companies in the global mulberry silk market are

- Wujiang First Textile Co., Ltd.,

- Anhui Silk Company

- Wanshiyi silk Co., Ltd.

- Zhejiang Jiaxin silk Corp., Ltd.

Chapter 1. Mulberry Silk Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Mulberry Silk Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2024 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Mulberry Silk Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Mulberry Silk Market Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Mulberry Silk Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Mulberry Silk Market – By Application

6.1. Textile

6.2. Cosmetics

6.3. Medical

6.4. Others

Chapter 7. Mulberry Silk Market- By Region

7.1. North America

7.2. Europe

7.3. Asia-Pacific

7.4. Latin America

7.5. The Middle East

7.6. Africa

Chapter8. Mulberry Silk Market – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

8.1. Wujiang First Textile Co., Ltd.,

8.2. Anhui Silk Company

8.3. Wanshiyi silk Co., Ltd.

8.4. Zhejiang Jiaxin silk Corp., Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900