mRNA Vaccines and Therapies Market Size (2024 – 2030)

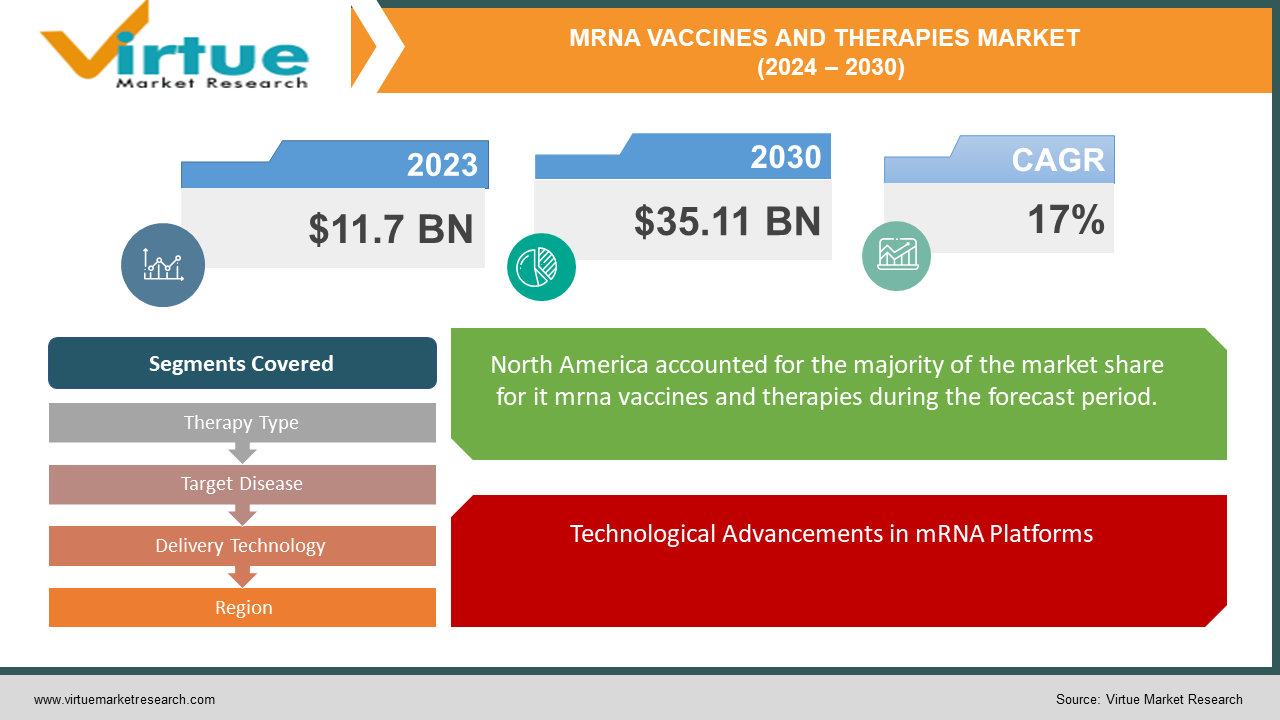

The Global mRNA Vaccines and Therapies Market was valued at USD 11.7 billion in 2023 and is projected to reach a market size of USD 35.11 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 17% between 2024 and 2030.

The global mRNA vaccines and therapies market has witnessed unprecedented growth and innovation in recent years, marking a significant milestone in the field of biotechnology and healthcare. mRNA (messenger RNA) technology has emerged as a groundbreaking platform with immense potential to revolutionize vaccine development, drug delivery, and therapeutic interventions. This transformative approach harnesses the body's cellular machinery to produce specific proteins, enabling the development of highly targeted vaccines and therapies for a wide range of diseases, including infectious diseases, cancer, and genetic disorders. With the successful deployment of mRNA-based COVID-19 vaccines amidst the global pandemic, the spotlight has intensified on the versatility and efficacy of this technology. As pharmaceutical companies continue to invest heavily in research and development, coupled with supportive regulatory frameworks and increasing public acceptance, the market for mRNA vaccines and therapies is poised for exponential growth. The convergence of scientific advancements, strategic partnerships, and rising healthcare needs underscores the immense potential of mRNA technology to reshape the landscape of preventive and therapeutic medicine on a global scale.

Key Market Insights:

In 2023, mRNA vaccines played a crucial role in preventing an estimated 30-40% of COVID-19 cases globally, according to a report by the World Health Organization (WHO).

The mRNA technology sector witnessed a surge in investment, receiving over USD 10 billion in funding in 2023 alone, indicating significant investor confidence, as reported by the Biotechnology Industry Organization.

As of June 2024, there are over 150 ongoing clinical trials worldwide evaluating mRNA vaccines and therapies for various diseases, according to data from ClinicalTrials.gov.

Vaccines currently dominate the market, holding around 65-70% of the market share, with a primary focus on combating infectious diseases, as outlined in an industry report.

The mRNA therapeutics segment is experiencing substantial growth, with clinical trials increasing by an estimated 40-50% year-over-year, according to industry reports.

While North America currently leads the global market, the Asia Pacific region is rapidly catching up, accounting for an estimated 35-40% of ongoing mRNA clinical trials, as noted in a biotechnology industry report.

The mRNA industry is also contributing to job creation, with North America experiencing a significant increase in job postings of about 20-25% year-over-year, according to the Biotechnology Industry Organization.

Global mRNA Vaccines and Therapies Market Drivers:

Technological Advancements in mRNA Platforms

One of the key drivers propelling the global mRNA vaccines and therapies market is the remarkable technological advancements in mRNA platforms. These innovations have significantly enhanced the stability, delivery, and efficacy of mRNA-based treatments. The development of lipid nanoparticles (LNPs) as delivery vehicles has been particularly transformative, protecting mRNA from degradation and facilitating its efficient uptake by cells. Additionally, advancements in synthetic mRNA production techniques have improved the scalability and cost-effectiveness of manufacturing processes. These technological strides enable rapid vaccine development, as demonstrated by the unprecedented speed at which COVID-19 mRNA vaccines were developed and authorized. Beyond vaccines, the enhanced precision and adaptability of mRNA technology are opening new avenues in therapeutic applications, such as cancer immunotherapy and the treatment of genetic disorders. Continuous improvements in mRNA synthesis, modification, and delivery systems are expected to further expand the capabilities and reach of mRNA-based solutions, solidifying their role as a cornerstone of modern medicine and driving sustained growth in the market.

Strong Regulatory and Government Support

Strong regulatory and government support is another significant driver of the global mRNA vaccines and therapies market. Governments and regulatory bodies worldwide have recognized the potential of mRNA technology to address critical public health challenges and have implemented policies to expedite its development and deployment. For instance, the rapid emergency use authorizations (EUAs) granted to COVID-19 mRNA vaccines by agencies like the FDA and EMA underscore the high level of institutional backing for this technology. Additionally, substantial public funding and grants have been allocated to mRNA research and development, fostering innovation and accelerating clinical trials. Governments are also establishing partnerships with pharmaceutical companies to ensure the swift production and distribution of mRNA vaccines and therapies, as seen during the global COVID-19 vaccination campaigns. This supportive regulatory environment not only facilitates quicker market entry for new mRNA products but also builds public confidence in their safety and efficacy. As a result, strong regulatory and governmental support continues to be a crucial catalyst for the expansion and maturation of the mRNA vaccines and therapies market.

Global mRNA Vaccines and Therapies Market Restraints and Challenges:

Despite the promising outlook, the global mRNA vaccines and therapies market faces several significant restraints and challenges. One of the primary challenges is the stability and storage requirements of mRNA vaccines, which often necessitate ultra-cold temperatures that complicate logistics and distribution, especially in low-resource settings. This cold chain requirement limits the widespread deployment of mRNA-based solutions in regions with inadequate infrastructure. Additionally, the high cost of mRNA vaccine development and production remains a barrier, potentially hindering access and affordability for lower-income countries. There are also scientific and technical hurdles to overcome, such as ensuring the long-term efficacy and safety of mRNA therapies, particularly for non-infectious diseases like cancer and genetic disorders. Regulatory hurdles and the need for extensive clinical trials to validate these therapies further prolong the time to market. Public perception and acceptance also pose challenges, as misinformation and vaccine hesitancy can affect uptake. Intellectual property issues and the need for robust patent protections can complicate collaboration and innovation within the industry. Addressing these challenges is crucial for the sustained growth and success of the mRNA vaccines and therapies market, requiring concerted efforts from industry stakeholders, governments, and the scientific community.

Global mRNA Vaccines and Therapies Market Opportunities:

The global mRNA vaccines and therapies market presents numerous opportunities for growth and innovation. One major opportunity lies in the expansion beyond infectious disease vaccines to therapeutic areas such as oncology, where mRNA technology can be used to develop personalized cancer vaccines that train the immune system to target specific tumor antigens. Additionally, mRNA therapies hold promise for treating genetic disorders by delivering modified mRNA to correct defective genes or produce therapeutic proteins. The versatility of mRNA technology also opens the door for rapid response to emerging infectious diseases, enabling the swift development of new vaccines. Another significant opportunity is the ongoing optimization of mRNA delivery systems, such as lipid nanoparticles, which can enhance the stability and cellular uptake of mRNA, making therapies more effective and accessible. The increasing investment from both private and public sectors into mRNA research and development further supports the growth of this market, fostering innovation and accelerating clinical trials. Moreover, the growing public and governmental support for sustainable and scalable vaccine production methods, highlighted by the global response to the COVID-19 pandemic, underscores the potential for mRNA technology to become a mainstay in modern medicine. These opportunities collectively position the mRNA vaccines and therapies market for substantial long-term growth and impact.

MRNA VACCINES AND THERAPIES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

17% |

|

Segments Covered |

By Therapy Type, Target Disease, Delivery Technology and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Pfizer-BioNTech, Moderna, CureVac, Translate Bio, BioNTech SE, Novartis AG, Sanofi, AstraZeneca, Gilead Sciences, Johnson & Johnson |

Global mRNA Vaccines and Therapies Market Segmentation: By Therapy Type

-

Vaccines

-

Therapeutics

The Global mRNA Vaccines and Therapies Market Segmented by Therapy Type, Vaccines had the largest market share last year and is poised to maintain its dominance throughout the forecast period. Vaccines currently dominate the global mRNA market, primarily fueled by the remarkable success of mRNA vaccines in combating COVID-19. Their proven efficacy, coupled with faster development timelines compared to traditional vaccines, has positioned mRNA vaccines as a cornerstone of infectious disease prevention strategies worldwide. However, the therapeutics segment holds immense potential for long-term growth. mRNA therapies offer a broader scope, targeting not only infectious diseases but also a wide array of ailments including cancer, chronic illnesses, and genetic disorders. With significant investment pouring into mRNA therapeutics research, fueled by its promising possibilities, the segment is poised for substantial expansion. While vaccines are expected to remain crucial in addressing immediate health needs and potential new infectious disease threats, the versatility and applicability of mRNA therapeutics suggest it could emerge as an equally significant or even larger segment in the long term. As research and development efforts continue to evolve, the global mRNA market stands at the forefront of revolutionizing preventive and therapeutic healthcare solutions.

Global mRNA Vaccines and Therapies Market Segmentation: By Target Disease

-

Infectious Diseases

-

Non-Infectious Diseases

The Global mRNA Vaccines and Therapies Market Segmented by Target Diseases, Infectious Diseases had the largest market share last year and is poised to maintain its dominance throughout the forecast period. The success of mRNA vaccines in combatting COVID-19 has propelled this segment to the forefront of the market, driven by its proven efficacy and rapid development capabilities. Ongoing threats from existing and emerging infectious diseases like influenza, HIV, and Zika sustain the momentum of vaccine development, bolstering the demand for mRNA vaccines. Established public health initiatives worldwide prioritize vaccination programs for infectious diseases, further solidifying the market for these vaccines. However, the long-term challenge lies in addressing non-infectious diseases, where mRNA therapeutics demonstrate significant potential. With the capacity to target a wide range of conditions such as cancer, autoimmune disorders, and genetic diseases, mRNA therapeutics attract substantial investments and research efforts. While infectious diseases are poised to maintain dominance shortly, the growing momentum of mRNA therapeutics presents a formidable challenge. As research progresses and successful treatments emerge, the market may witness a gradual shift towards mRNA therapeutics, ultimately reshaping the landscape of preventive and therapeutic healthcare solutions.

Global mRNA Vaccines and Therapies Market Segmentation: By Delivery Technology

-

Lipid Nanoparticle Delivery Systems

-

Non-Viral Delivery Systems

The Global mRNA Vaccines and Therapies Market Segmented by Delivery Technology, Lipid Nanoparticle Delivery Systems had the largest market share last year and is poised to maintain its dominance throughout the forecast period. Lipid nanoparticle delivery systems stand as the cornerstone technology for mRNA delivery in the current landscape, primarily due to their numerous advantages. These systems efficiently transport mRNA molecules into cells, ensuring effective therapeutic action, while also shielding the mRNA from degradation, thereby enhancing its stability and efficacy. With extensive research and development backing their reliability, lipid nanoparticles have established themselves as the go-to option for mRNA delivery. However, researchers are actively exploring alternative delivery methods, such as polymer-based nanoparticles, viral vectors, and microneedles, aiming to address potential limitations of lipid nanoparticles, including safety concerns and manufacturing costs. Despite these advancements, lipid nanoparticles are anticipated to maintain their dominance in the near to mid-term forecast period, given their proven effectiveness and safety profile. Nevertheless, as research progresses, non-viral delivery systems may evolve to overcome existing limitations, potentially leading to a shift in the market dynamics towards a combination of delivery technologies tailored to specific applications and desired characteristics. Thus, while lipid nanoparticles currently reign supreme, the future landscape of mRNA delivery systems holds promise for innovation and diversification, driven by ongoing research and technological advancements.

Global mRNA Vaccines and Therapies Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

The Global mRNA Vaccines and Therapies Market Segmented by Region, North America had the largest market share last year and is poised to maintain its dominance throughout the forecast period. North America stands as a powerhouse in the global mRNA market, leveraging its well-established research institutions, universities, and pharmaceutical companies to lead in mRNA research and development. Government funding initiatives in the US and Canada further bolster innovation, while a favorable regulatory environment facilitates the swift development and commercialization of mRNA vaccines and therapies. High private investment from venture capitalists and pharmaceutical firms provides crucial financial support. However, North America faces challenges from the rise of the Asia Pacific region, particularly China and India, which boast large patient populations and growing government support for biotechnology. Lower manufacturing costs in Asia Pacific may enhance global accessibility to mRNA therapies. Additionally, Europe's strong focus on innovation contributes to the market's dynamic landscape. While North America currently holds the lead, the Asia Pacific's rapid growth positions it as a strong contender for future dominance, with Europe maintaining significance through its emphasis on cutting-edge research. The global mRNA market is anticipated to evolve into a more balanced landscape, with North America, Europe, and Asia Pacific playing pivotal roles in shaping the industry's trajectory.

COVID-19 Impact Analysis on the Global mRNA Vaccines and Therapies Market.

The COVID-19 pandemic has profoundly impacted the global mRNA vaccines and therapies market, catalyzing both challenges and opportunities. On one hand, the urgent need for effective vaccines against the virus propelled unprecedented development and deployment of mRNA-based COVID-19 vaccines, showcasing the versatility and rapid response capabilities of this technology. mRNA vaccines from Pfizer-BioNTech and Moderna played pivotal roles in the global vaccination campaigns, demonstrating high efficacy rates and spurring widespread adoption. However, the pandemic also exposed vulnerabilities and limitations within the market. Supply chain disruptions, raw material shortages, and manufacturing bottlenecks initially hampered vaccine production, leading to uneven distribution and delays in global immunization efforts. Moreover, the focus on COVID-19 vaccines diverted resources and attention away from other mRNA therapeutic developments, potentially slowing progress in other disease areas. Nevertheless, the pandemic underscored the importance of mRNA technology in addressing public health crises and paved the way for future innovations and investments in the field. As the world transitions to a post-pandemic era, the global mRNA vaccines and therapies market is poised for continued growth, driven by ongoing research, technological advancements, and increased awareness of mRNA's potential in preventive and therapeutic healthcare solutions.

Latest trends / Developments:

The global mRNA vaccines and therapies market is experiencing dynamic trends and developments that are reshaping the landscape of preventive and therapeutic healthcare. One of the most notable trends is the continued expansion of mRNA technology beyond COVID-19 vaccines into a wide range of therapeutic applications. Research and clinical trials are underway to harness mRNA for treating various diseases, including cancer, infectious diseases, genetic disorders, and autoimmune conditions. This diversification reflects the versatility and potential of mRNA as a platform for personalized medicine and targeted therapies. Additionally, there is a growing focus on optimizing mRNA delivery systems to enhance efficacy, stability, and safety. Advancements in lipid nanoparticle technology and other delivery methods are improving the cellular uptake and tissue targeting of mRNA, unlocking new possibilities for precision medicine. Moreover, collaborations between pharmaceutical companies, biotech firms, and academic institutions are driving innovation and accelerating the development of next-generation mRNA vaccines and therapies. Regulatory agencies are also adapting to the rapid pace of mRNA advancements, streamlining approval processes and providing guidance to facilitate the translation of promising research into clinical applications. Overall, these trends underscore the transformative potential of mRNA technology in revolutionizing healthcare and addressing unmet medical needs on a global scale.

Key Players:

-

Pfizer-BioNTech

-

Moderna

-

CureVac

-

Translate Bio

-

BioNTech SE

-

Novartis AG

-

Sanofi

-

AstraZeneca

-

Gilead Sciences

-

Johnson & Johnson

Chapter 1. MRNA Vaccines and Therapies Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. MRNA Vaccines and Therapies Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. MRNA Vaccines and Therapies Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. MRNA Vaccines and Therapies Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. MRNA Vaccines and Therapies Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. MRNA Vaccines and Therapies Market – By Therapy Type

6.1 Introduction/Key Findings

6.2 Vaccines

6.3 Therapeutics

6.4 Y-O-Y Growth trend Analysis By Therapy Type

6.5 Absolute $ Opportunity Analysis By Therapy Type, 2024-2030

Chapter 7. MRNA Vaccines and Therapies Market – By Target Disease

7.1 Introduction/Key Findings

7.2 Infectious Diseases

7.3 Non-Infectious Diseases

7.4 Y-O-Y Growth trend Analysis By Target Disease

7.5 Absolute $ Opportunity Analysis By Target Disease, 2024-2030

Chapter 8. MRNA Vaccines and Therapies Market – By Delivery Technology

8.1 Introduction/Key Findings

8.2 Lipid Nanoparticle Delivery Systems

8.3 Non-Viral Delivery Systems

8.4 Y-O-Y Growth trend Analysis By Delivery Technology

8.5 Absolute $ Opportunity Analysis By Delivery Technology, 2024-2030

Chapter 9. MRNA Vaccines and Therapies Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Therapy Type

9.1.3 By Target Disease

9.1.4 By By Delivery Technology

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Therapy Type

9.2.3 By Target Disease

9.2.4 By Delivery Technology

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Therapy Type

9.3.3 By Target Disease

9.3.4 By Delivery Technology

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Therapy Type

9.4.3 By Target Disease

9.4.4 By Delivery Technology

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Therapy Type

9.5.3 By Target Disease

9.5.4 By Delivery Technology

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. MRNA Vaccines and Therapies Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Pfizer-BioNTech

10.2 Moderna

10.3 CureVac

10.4 Translate Bio

10.5 BioNTech SE

10.6 Novartis AG

10.7 Sanofi

10.8 AstraZeneca

10.9 Gilead Sciences

10.10 Johnson & Johnson

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

By 2023, the Global mRNA Vaccines and Therapies market is expected to be valued at US$ 11.7 billion.

Through 2030, the Global mRNA Vaccines and Therapies market is expected to grow at a CAGR of 17%.

By 2030, the Global mRNA Vaccines and Therapies Market is expected to grow to a value of US$ 35.11 billion.

North America is predicted to lead the Global mRNA Vaccines and Therapies market.

The Global mRNA Vaccines and Therapies Market has segments By Therapy Type, Delivery Technology, Target Disease, and Region.