Monomethylamine Market Size (2024 – 2030)

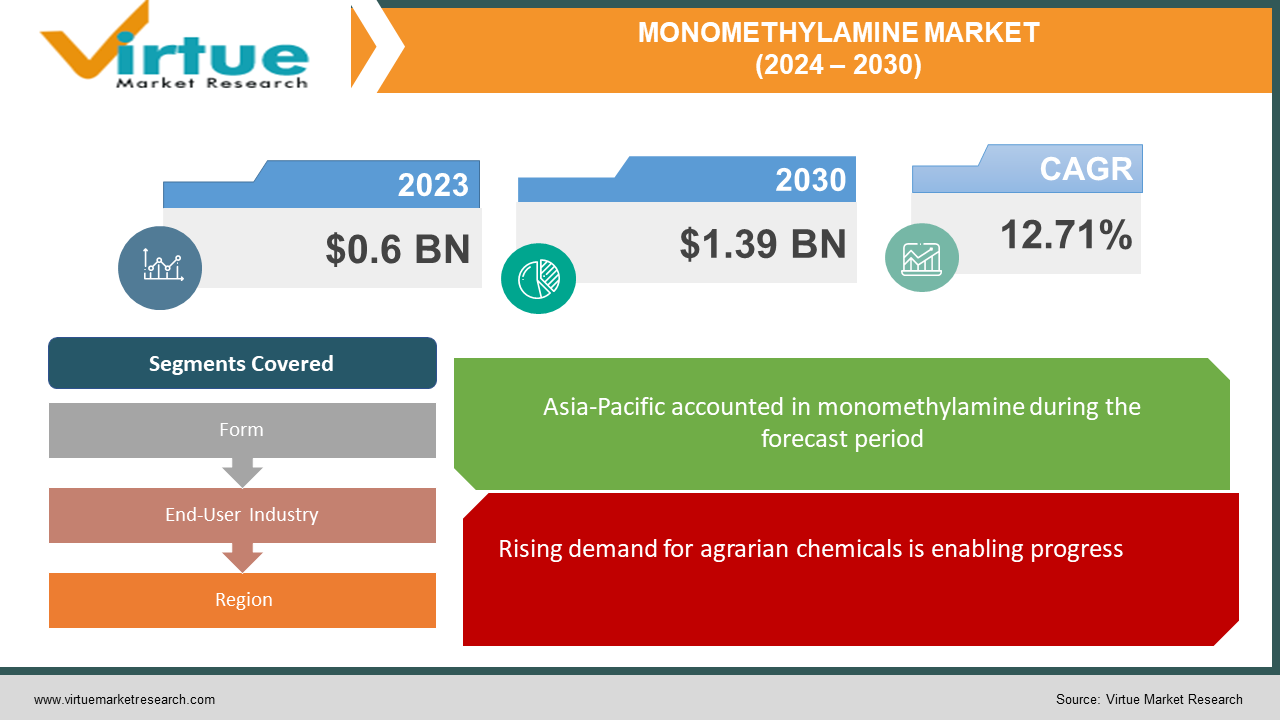

The market for monomethylamine at the global level was estimated to be worth 0.6 USD billion in 2023 and is expected to increase to 1.39 USD billion by 2030, with a projected compound annual growth rate (CAGR) of 12.71% from 2024 to 2030.

Monomethylamine (MMA) is a basic alkylamine gas that is colorless and has a distinct fishy smell. It is 31.06 in molecular weight. Trimethylamine (TMA) and dimethylamine (DMA) are co-produced with monomethylamine. Monomethylamine serves as a fundamental component in the production of several other commercial chemicals. Additionally, it is employed in the production of dyestuff intermediates.

Key Market Insights:

Applications in the chemical and pharmaceutical sectors, the expanding emphasis on renewable energy sources, and the rising need for agricultural chemicals are the main factors driving the MMA market. The market for monomethylamine is dominated by liquid form since it is easier to handle and use in a variety of sectors, including chemicals and medicines. Driven by industrialization, pharmaceutical advancements, and agricultural endeavors in nations like China, India, and Japan, the Asia-Pacific region dominates the worldwide monomethylamine market, while North America and Europe continue to hold sizable market shares as well.

Global Monomethylamine Market Drivers:

Rising demand for agrarian chemicals is enabling progress.

The rising worldwide demand for agrarian chemicals, including herbicides, pesticides, and fungicides, may be an essential driver driving the development of the monomethylamine (MMA) market. MMA serves as a key fixing within the union of these fundamental agrochemicals, contributing to improved edit assurance and expanded rural efficiency. As ranchers look for imaginative arrangements to address advancing bother and weed challenges while guaranteeing feasible agrarian hones, the request for MMA-based agrarian chemicals proceeds to surge, fueling showcase extension.

The developing pharmaceutical industry is aiding growth.

The pharmaceutical industry's ceaseless development is driving the expanded utilization of monomethylamine (MMA) in sedate union forms. MMA serves as a basic intermediary in the generation of different pharmaceutical compounds, contributing to the advancement of fundamental medicines over restorative regions. With rising healthcare consumptions, maturing populations, and an expanding predominance of incessant illnesses around the world, the request for pharmaceutical items proceeds to rise, in this manner driving the request for MMA as a key crude fabric in pharmaceutical fabrication.

Growing applications in chemical industries are boosting the market.

The extending applications of monomethylamine (MMA) in chemical generation divisions, counting surfactants, solvents, and strength chemicals, are cultivating advertising development. MMA's flexible properties make it an important component within the definition of surfactants for cleansers, solvents for various industrial forms, and forte chemicals for assorted applications. As businesses across divisions such as fabricating, development, and cars proceed to advance and enhance, the request for MMA-based chemicals remains vigorous, driving showcase development all-inclusive.

Global Monomethylamine Market Restraints and Challenges:

Administrative compliance is a major challenge.

The monomethyl amine (MMA) advertisement faces critical challenges related to administrative compliance as rigid directions administer its generation, dealing with, and transfer. Compliance with natural, well-being, and security directions poses an impressive jump for producers, leading to expanded operational costs and potential disturbances in supply chains. Besides, advancing administrative systems pointed at diminishing chemical outflows and advancing feasible hones require steady adjustment by industry players, assist in complicating showcase elements, and ruin development prospects.

Instability in crude fabric costs can create losses.

The monomethylamine (MMA) showcase is vulnerable to instability in crude fabric costs, especially those of methanol and smelling salts, which are essential forerunners for the MMA generation. Vacillations in crude fabric costs can altogether affect generation costs and benefit edges for producers, posing challenges in keeping up cost soundness and competitiveness within the industry. Moreover, geopolitical pressures, supply chain disturbances, and shifts in worldwide vitality markets can worsen crude fabric cost instability, making it a vulnerability and hazard for advertiser members.

The constrained accessibility of a talented workforce is another barrier.

The monomethylamine (MMA) showcase faces challenges related to the accessibility of a gifted workforce, especially in districts encountering quick industrialization and financial development. The specialized nature of chemical fabrication forms requires a capable workforce with the ability to deal with perilous materials, work complex gear, and follow rigid quality and security measures. Be that as it may, deficiencies of gifted faculty, coupled with competition from other businesses and posture limitations on advertise development endeavors, drive enrollment challenges and ability maintenance issues for companies working within the MMA segment.

Global Monomethylamine Market Opportunities:

The extension of the renewable vitality segment offers development openings for the monomethylamine market.

The expanding emphasis on renewable vitality sources, such as wind and sun-based control, presents profitable openings for the monomethylamine (MMA) industry. MMA is utilized within the generation of methylamines, which serve as key components within the fabrication of methylamine-based salts utilized as electrolytes in vitality capacity frameworks, including lithium-ion batteries. As the worldwide move towards renewable vitality quickens, driven by natural concerns and government activities to decrease carbon outflows, the request for MMA-based electrolytes is anticipated to rise, making critical development prospects for showcase players.

Rising applications for individual care items drive requests for monomethylamine.

The monomethylamine (MMA) advertisement is seeing expanding openings within the individual care industry, driven by the developing buyer request for inventive and high-performance restorative and skincare items. MMA and its subsidiaries discover applications within the detailing of surfactants, emulsifiers, and conditioning operators utilized in different individual care items, including shampoos, conditioners, and skin creams. With rising expendable salaries, changing buyer inclinations towards common and sustainable fixings, and the expansion of excellence and wellness patterns, the request for MMA-based fixings within the individual care segment is balanced for strong development, advertising profitable openings for showcase extension.

Headways in chemical blend innovations are improving market prospects.

Innovative headways in chemical blend techniques and preparation optimization methods display promising openings for the monomethylamine (MMA) showcase. Developments in catalyst plan, response design, and green chemistry hones are empowering more productive and feasible generation forms for MMA and its subordinates, driving fetched reserve funds, making strides in item quality, and diminishing natural impressions. Besides, advancements in biotechnology and microbial maturation procedures offer elective pathways for MMA generation from renewable feedstocks, decreasing reliance on fossil fuels and improving supportability accreditations. These progressions clear the way for expanded showcase infiltration, development into modern application zones, and competitiveness within the worldwide MMA showcase.

MONOMETHYLAMINE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

12.71% |

|

Segments Covered |

By Form, End-User Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF SE, Dow Chemical Company, Celanese Corporation, Eastman Chemical Company, Daicel Corporation, Alkyl Amines Chemicals Limited, Tokyo Chemical Industry Co., Ltd., Balaji Amines Limited, Zhejiang Jiangshan Chemical Co., Ltd., Luxi Chemical Group Co., Ltd., Anhui Huaxing Chemical Industry Co., Ltd., Tangshan Hengtong Chem Co., Ltd. |

Monomethylamine Market Segmentation: By Form

-

Liquid

-

Gas

The liquid category is the largest and fastest-growing form. Fluid MMA offers a few focal points over its vaporous partner, essentially in terms of taking care of, transportation, and ease of application. Being in a fluid state at surrounding temperatures, fluid MMA can be put away and transported more conveniently and securely compared to vaporous MMA, which needs specialized control and taking care of strategies due to its instability. Fluid MMA also permits more exact dosing and blending in different mechanical forms, encouraging precise definition and mixing in applications such as agrochemicals, pharmaceuticals, and chemical unions. Also, the fluid shape offers superior dissolvability characteristics, upgrading its compatibility with other fluid components in definitions and guaranteeing homogeneity of the ultimate items.

Monomethylamine Market Segmentation: By End-User Industry

-

Agriculture

-

Pharmaceuticals

-

Chemicals

-

Personal Care

-

Others

The pharmaceutical sector is the largest growing end-user. The pharmaceutical industry depends intensely on MMA for its flexible applications in medicating blends and detailing. As a crucial intermediate compound, MMA plays a part in the generation of different pharmaceutical compounds, including dynamic pharmaceutical fixings (APIs) and intermediates fundamental for sedate fabrication. Its utilization ranges over a wide range of restorative drugs, from anti-microbials to cardiovascular drugs, illustrating its significance in tending to assorted restorative needs. Moreover, the pharmaceutical sector's rigid quality and administrative measures require high-purity MMA, driving requests for pharmaceutical-grade MMA items. With the worldwide populace developing more seasoned and the predominance of inveterate illnesses expanding, the demand for pharmaceuticals is anticipated to rise, subsequently driving supported development within the advertising for MMA inside the pharmaceutical industry. The end-user sector with the fastest growth is the chemicals industry. With its broad range of uses in the synthesis of different molecules, such as specialty chemicals, agrochemicals, and pharmaceutical intermediates, monomethylamine is essential for fostering innovation and satisfying the changing needs of various production processes. The need for monomethylamine is growing as companies depend more and more on chemical solutions for a variety of purposes, and the chemicals industry is one of the main factors propelling the monomethylamine market's expansion.

Monomethylamine Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

With countries like China, India, Japan, and South Korea spearheading industrialization, rural development, and pharmaceutical research, Asia-Pacific is the largest and fastest-growing market. Asia-Pacific acts as a hub for manufacturing, and consumers promote MMA and its affiliates. North America is closely behind, accounting for 25% of the showcase share, buoyed by vigorous requests from different businesses, including farming, pharmaceuticals, and chemicals. Europe keeps up a critical nearness with a 20% showcase share, driven by its well-established chemical and pharmaceutical segments and exacting administrative benchmarks. South America, the Middle East, and African locales contribute little but outstanding offers of 6% and 4%, respectively, with developing agrarian exercises and continuous industrialization driving requests for MMA items.

COVID-19 Impact Analysis on the Global Monomethylamine Market:

The widespread COVID-19 has had a noteworthy effect on the worldwide monomethylamine (MMA) showcase, disturbing supply chains, diminishing requests from key end-user businesses, and affecting showcase elements. Amid the introductory stages of the widespread, far-reaching lockdowns, travel limitations, and operational disturbances driven by a lull in mechanical exercises, influencing the generation and utilization of MMA and its subsidiaries, businesses such as farming, pharmaceuticals, and chemicals, which are major buyers of MMA, experienced disturbances in generation and conveyance, driving to diminished demand for MMA-based items. Furthermore, the vulnerability and its financial repercussions brought about cautious investing behavior among buyers and businesses, advancing housing advertising development. In any case, as economies continuously revived and immunization endeavors advanced, the MMA showcase saw a continuous recuperation, backed by jolt measures, pent-up requests, and the resumption of mechanical exercises. Moving forward, whereas the long-term effect of the widespread phenomenon remains questionable, the MMA showcase is anticipated to bounce back, driven by recuperation in key end-user businesses, innovative progressions, and advancing customer inclinations. Adjustment to changing showcase flow and flexibility in supply chain administration will be basic for advertising players to explore the post-pandemic scene viably.

Latest Trends/ Developments:

The most recent patterns and improvements within monomethylamine (MMA) advertising reflect a developing emphasis on supportability, advancement, and expansion. One outstanding slant is the expanding selection of eco-friendly generation forms and renewable feedstocks to decrease natural effects and upgrade supportability qualifications. Producers are contributing to inquiries about and improvements to investigate elective generation strategies, such as microbial aging and bio-based courses, to create MMA from renewable assets, in this manner lessening dependence on fossil fuels and minimizing carbon emanations. Also, there's a rising request for high-purity MMA items to meet rigid quality guidelines in key end-user businesses, including pharmaceuticals and hardware.

Mechanical headways, such as progressed catalysts and preparation optimization procedures, are empowering a more effective and cost-effective generation of MMA, driving advertiser competitiveness and development. Moreover, the broadening of applications beyond conventional divisions, such as horticulture and chemicals, is opening up unused development opportunities in developing businesses like vitality capacity and advanced materials. By and large, these patterns emphasize the energetic nature of the MMA showcase and the requirement for persistent adjustment and advancement to meet advancing showcase requests and maintainability objectives.

Key Players:

-

BASF SE

-

Dow Chemical Company

-

Celanese Corporation

-

Eastman Chemical Company

-

Daicel Corporation

-

Alkyl Amines Chemicals Limited

-

Tokyo Chemical Industry Co., Ltd.

-

Balaji Amines Limited

-

Zhejiang Jiangshan Chemical Co., Ltd.

-

Luxi Chemical Group Co., Ltd.

-

Anhui Huaxing Chemical Industry Co., Ltd.

-

Tangshan Hengtong Chem Co., Ltd.

Chapter 1. Monomethylamine Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Monomethylamine Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Monomethylamine Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Monomethylamine Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Monomethylamine Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Monomethylamine Market – By Form

6.1 Introduction/Key Findings

6.2 Liquid

6.3 Gas

6.4 Y-O-Y Growth trend Analysis By Form

6.5 Absolute $ Opportunity Analysis By Form, 2024-2030

Chapter 7. Monomethylamine Market – By End-User Industry

7.1 Introduction/Key Findings

7.2 Agriculture

7.3 Pharmaceuticals

7.4 Chemicals

7.5 Personal Care

7.6 Others

7.7 Y-O-Y Growth trend Analysis By End-User Industry

7.8 Absolute $ Opportunity Analysis By End-User Industry, 2024-2030

Chapter 8. Monomethylamine Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Form

8.1.3 By End-User Industry

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Form

8.2.3 By End-User Industry

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Form

8.3.3 By End-User Industry

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Form

8.4.3 By End-User Industry

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Form

8.5.3 By End-User Industry

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Monomethylamine Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 BASF SE

9.2 Dow Chemical Company

9.3 Celanese Corporation

9.4 Eastman Chemical Company

9.5 Daicel Corporation

9.6 Alkyl Amines Chemicals Limited

9.7 Tokyo Chemical Industry Co., Ltd.

9.8 Balaji Amines Limited

9.9 Zhejiang Jiangshan Chemical Co., Ltd.

9.10 Luxi Chemical Group Co., Ltd.

9.11 Anhui Huaxing Chemical Industry Co., Ltd.

9.12 Tangshan Hengtong Chem Co., Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market for monomethylamine at the global level was estimated to be worth 0.6 USD billion in 2023 and is expected to increase to 1.39 USD billion by 2030, with a projected compound annual growth rate (CAGR) of 12.71% from 2024 to 2030.

The essential drivers of the global monomethyl amine market are broad applications in horticulture, pharmaceuticals, chemicals, and individual care businesses, nearby expanding requests for high-quality items, and mechanical progressions in generation forms.

Key challenges in the global monomethyl amine market include administrative compliance issues, instability in crude fabric costs, and restricted accessibility of a talented workforce.

In 2023, Asia-Pacific held the largest share of the global monomethylamine market.

BASF SE, Dow Chemical Company, Celanese Enterprise, Eastman Chemical Company, Daicel Organization, Alkyl Amines Chemicals Constrained, Tokyo Chemical Industry Co., Ltd., Balaji Amines Restricted, Zhejiang Jiangshan Chemical Co., Ltd., Luxi Chemical Gather Co., Ltd., Anhui Huaxing Chemical Industry Co., Ltd., and Tangshan Hengtong Chem Co., Ltd., are the major players in the global monomethylamine market.