Monoethylene Glycol (MEG) Market Size (2024 – 2030)

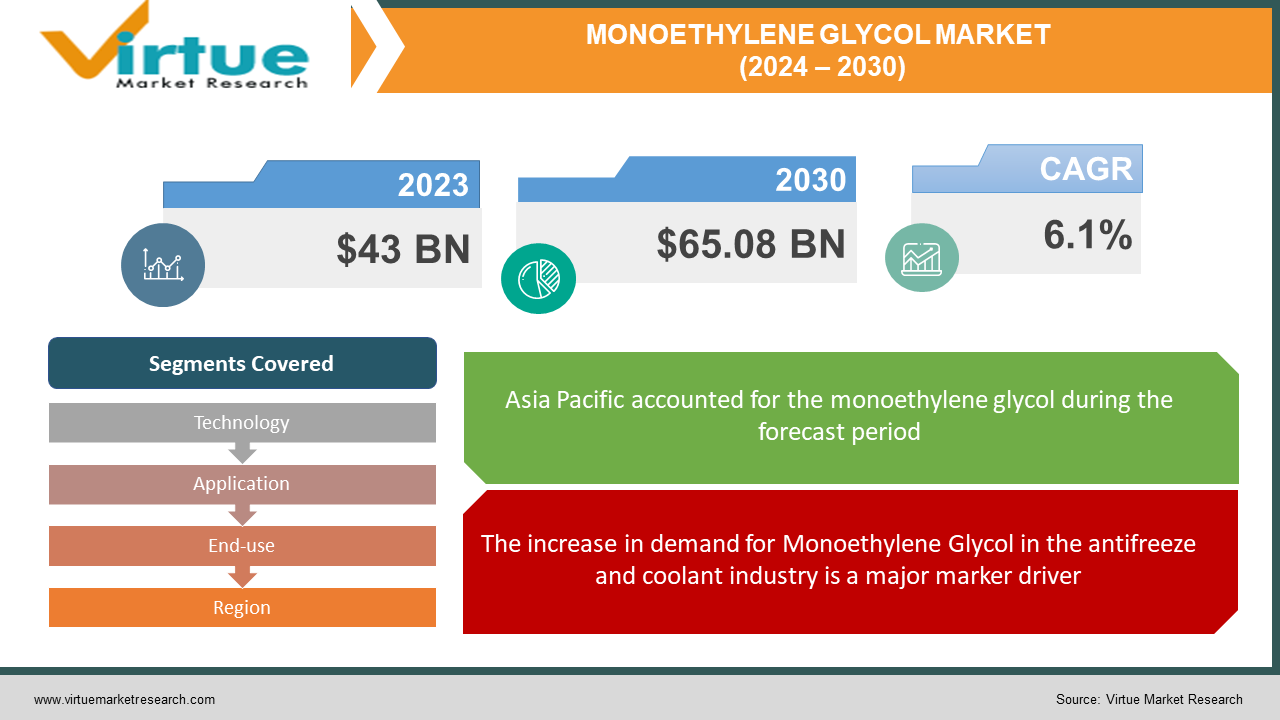

The global Monoethylene Glycol (MEG) market size was exhibited at USD 43 billion in 2023 and is projected to hit around USD 65.08 billion by 2030, growing at a CAGR of 6.1% during the forecast period from 2024 to 2030.

The global Monoethylene Glycol (MEG) market stands as a vital component within the chemical industry, serving as a key raw material in the production of various essential products. MEG, a versatile compound, finds extensive application in the manufacturing of polyester fibers, resins, and antifreeze solutions. The market's growth is intricately linked to the burgeoning demand for polyester products in the textiles, packaging, and automotive sectors. Also, MEG's pivotal role in producing PET bottles further propels its significance in the global market. A confluence of factors, including the expanding population, urbanization trends, and evolving consumer preferences, contribute to the steady rise in MEG consumption worldwide. Market dynamics, influenced by economic fluctuations, technological advancements, and sustainability initiatives, shape the trajectory of this sector. As the global economy continues to evolve, the Monoethylene Glycol market reflects the broader trends in industrial development, innovation, and environmental consciousness. Stakeholders in the industry closely monitor these dynamics to navigate challenges and capitalize on emerging opportunities in this dynamic and vital market.

Key Market Insights:

Prominent market entities are actively engaging in substantial research and development endeavors to broaden their array of products, facilitating the further advancement of the monoethylene glycol (MEG) market. These entities are executing diverse strategic initiatives to augment their presence, incorporating pivotal market advancements such as the introduction of new products, contractual collaborations, mergers and acquisitions, heightened investments, and partnerships with other entities. To flourish in an increasingly competitive and growing market environment, the monoethylene glycol (MEG) sector must deliver economically viable offerings. A prevalent business strategy adopted by manufacturers in the monoethylene glycol (MEG) industry involves localized manufacturing to mitigate operational costs, thereby enhancing client benefits and expanding market share. Notably, the monoethylene glycol (MEG) industry has, in recent years, proven to be instrumental in providing substantial advantages to the automotive sector.

Global Monoethylene Glycol (MEG) Market Drivers:

The increase in demand for Monoethylene Glycol in the antifreeze and coolant industry is a major marker driver.

Enhanced socioeconomic conditions, the emergence of new economies, upgraded infrastructure, a rising number of vehicles in circulation, and various other factors have contributed to the surge in demand for automobiles, consequently propelling the MEG market. The need for antifreeze and coolants is witnessing an uptick in HVAC systems and heat exchangers to facilitate efficient heat transfer processes, especially in challenging cold weather conditions. The utilization of antifreeze and coolants extends beyond automotive contexts, finding relevance in industrial and electronic applications. In industrial settings, these substances play a crucial role in winterizing potable water systems, sanitation facilities, non-operational engines, and air conditioning systems. Consequently, the expanding application possibilities within the automotive and electronic sectors are anticipated to further stimulate the demand for MEG.

The increased use of MEG in the packaging industry is another marker driver.

Monoethylene glycol (MEG), a transparent and odorless liquid, is integral in the production of polyethylene terephthalate (PET) packaging renowned for its durability, transparency, and recyclability. PET's widespread use in commercial and industrial applications has fueled an escalated demand for MEG. Its versatility extends to diverse sectors, including textiles, beverages, and pharmaceuticals. As industries prioritize sustainable and resilient packaging solutions, the role of MEG in meeting these demands becomes increasingly prominent. The global market anticipates sustained growth as MEG continues to be a cornerstone in enhancing the qualities and eco-friendliness of PET packaging across various end-use applications.

Global Monoethylene Glycol (MEG) Market Restraints and Challenges:

Toxicity associated with the use of MEG may impede its popularity and demand.

Monoethylene glycol (MEG) poses toxicity risks through inhalation, contact, and ingestion. Inhaling MEG may lead to respiratory irritation due to the concentration of aerosol. Contact with the eyes may result in mild irritation, manifesting as tears, pain, or blurred vision. Skin exposure may cause mild irritation. Ingesting MEG can induce inebriation, accompanied by nausea, vomiting, metabolic acidosis, and central nervous system depression. Cardiopulmonary effects may include tachycardia, hypertension, severe metabolic acidosis, hypoxia, congestive heart failure, adult respiratory distress syndrome, and renal failure. Digestive system irritation may lead to pain and bleeding. Prolonged exposure damages kidneys, and affects the central nervous system, causing symptoms like depression, headache, dizziness, euphoria, loss of equilibrium, drowsiness, visual disturbances, fatigue, unconsciousness, and respiratory arrest. These health risks impede the growth of the MEG market.

The fluctuating price of MEG raw materials may also be a concern for its growth.

An ongoing challenge faced by the global MEG market revolves around the persistent fluctuations in raw material prices, particularly those of ethylene, which are indirectly influenced by crude oil prices. The continual volatility in these prices poses a hindrance to the market's growth by diminishing demand and delaying end-user expenditures. Despite the challenges, producers are actively managing elevated and erratic raw material costs, intending to transmit the price escalations to end-users. The combination of cost pressures and heightened raw material expenses is anticipated to compress product margins for market players. In response, industry participants are compelled to augment the efficiency and productivity of their operations to sustain market growth.

Global Monoethylene Glycol (MEG) Market Opportunities:

China, despite being a major producer of Monoethylene Glycol (MEG), exhibits the highest demand for the compound and continues to import it. Recent investments in coal-based production plants signal a strategic move for the country. The adoption of coal-based processes, among various technologies employed in MEG production, presents growth prospects within China. The surge in domestic MEG production may impact ethane-based MEG exports from the Middle East. The proliferation of large-scale production plants in China is anticipated to influence MEG prices, with operational rates expected to remain fluctuating and low. While the technology's MEG is less utilized in polyester markets compared to other processes, the long-term effect may introduce competitiveness to the polyester industry. The integration of biomass platforms into the production process could offer opportunities for the MEG market, thereby increasing investment potential in the Middle East and Africa. Consequently, the utilization of coal-based production technology holds the potential to reduce MEG prices in China.

MONOETHYLENE GLYCOL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.1% |

|

Segments Covered |

By Technology, Application, End-use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

MEGlobal, Ishtar Company, LLC, Raha Group, India Glycols Ltd., Kimia Pars Co., LyondellBasell N.V., Arham Petrochem Pvt. Ltd., Indian Oil Corporation Ltd., Pon Pure Chemicals Group, Acuro Organics Ltd. |

Global Monoethylene Glycol (MEG) Market Segmentation: By Technology

-

Gas-Based

-

Naphtha-Based

-

Coal-Based

-

Bio-Based

The segmentation of the Mono Ethylene Glycol (MEG) market is based on product technology, encompassing four categories: gas-based, naphtha-based, coal-based, and bio-based. The naphtha-based sub-segment emerges as the leading revenue contributor. This dominance is attributed to its superior chemical stability, ease of recyclability, high barrier characteristics, and dimensional stability. The naphtha-based technology stands out for its versatility and reliability, making it a preferred choice in various applications, ultimately resulting in substantial revenue generation within the MEG market. The consistent demand for these advantageous properties continues to position the naphtha-based sub-segment as a significant driver in the market's overall growth.

Global Monoethylene Glycol (MEG) Market Segmentation: By Application

-

Polyethylene Terephthalate (PET)

-

Polyester Fibers

-

Antifreeze Coolants

-

Others

The Polyethylene Terephthalate (PET) segment emerged as the market leader, commanding a substantial revenue share exceeding 80%. This dominance is ascribed to Monoethylene Glycol's (MEG) superior properties in PET production compared to alternative products. These distinctive attributes encompass thermal stability, reactivity, compatibility, clarity, transparency, and effective barrier properties. MEG assumes a pivotal role as a primary raw material in the synthesis of polyester fiber. Its chemical interaction with terephthalic acid results in the formation of Dimethyl Terephthalate (DMT), a precursor polymerized to create polyester resin.

Global Monoethylene Glycol (MEG) Market Segmentation: By End-use

-

Packaging

-

Textile

-

Automotive

-

Plastics

-

Others

In 2023, the textile segment emerged as the market leader, capturing a significant revenue share of 45%. This supremacy is attributed to the versatile application of monoethylene glycol in textile industry processes, including dyeing, polyester fiber production, textile printing, finishing, and overall textile processing. Within the plastic industry, MEG plays a pivotal role as a primary raw material in the synthesis of polyester resins. Moreover, it finds extensive use in various plastic processing applications such as injection molding, blow molding, and extrusion.

Conversely, the packaging industry is poised for the fastest Compound Annual Growth Rate (CAGR). Within this sector, monoethylene glycol assumes a crucial role in the production of polyester resins, contributing to the manufacturing of diverse packaging materials like bottles, food packaging, and films. Also, MEG serves as a solvent in producing adhesives and coatings employed in packaging processes.

Global Monoethylene Glycol (MEG) Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Asia Pacific region dominates the MEG market and is also projected to achieve the fastest CAGR throughout the forecasted period. This notable performance is credited to the escalating demand witnessed in the textile, packaging, and electronics sectors within the region. The textile industry emerges as a significant end-user in Asia Pacific, utilizing polyester fibers extensively in diverse textile products like clothing, carpets, and furniture. The anticipated surge in demand for polyester fibers from the textile industry is poised to be a key driver of regional market growth. Additionally, substantial investments by prominent manufacturing companies in North America contribute significantly to the regional market's growth dynamics.

COVID-19 Impact Analysis on the Global Monoethylene Glycol (MEG) Market:

The global monoethylene glycol market experienced adverse effects due to the impact of COVID-19. Within Asia-Pacific, China, being the largest supplier and consumer of monoethylene glycol, faced challenges attributed to the country's population growth and urbanization, particularly in the textile sector. However, the COVID-19-induced lockdown disrupted the supply chain, significantly impeding the growth of the global monoethylene glycol market. Furthermore, the pandemic's widespread impact has negatively influenced the overall economic conditions for most individuals. A decline in consumer demand has been observed, with consumers prioritizing the reduction of non-essential spending in their budgets.

Recent Trends and Developments in the Global Monoethylene Glycol (MEG) Market:

In 2022, Backtrace Holdings Ltd, a prominent figure in Productizing Science, unveiled Particle Works, a venture stemming from the realm of Monoethylene Glycol Microfluidics. The official introduction of this new brand occurred during the LNP Formulation and Process Development Summit in Boston, MA, spanning from the 12th to the 14th of April 2022.

Key Players:

-

MEGlobal

-

Ishtar Company, LLC

-

Raha Group

-

India Glycols Ltd.

-

Kimia Pars Co.

-

LyondellBasell N.V.

-

Arham Petrochem Pvt. Ltd.

-

Indian Oil Corporation Ltd.

-

Pon Pure Chemicals Group

-

Acuro Organics Ltd.

Chapter 1. Monoethylene Glycol (MEG) Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Monoethylene Glycol (MEG) Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Monoethylene Glycol (MEG) Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Monoethylene Glycol (MEG) Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Monoethylene Glycol (MEG) Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Monoethylene Glycol (MEG) Market – By Technology

6.1 Introduction/Key Findings

6.2 Gas-Based

6.3 Naphtha-Based

6.4 Coal-Based

6.5 Bio-Based

6.6 Y-O-Y Growth trend Analysis By Technology

6.7 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 7. Monoethylene Glycol (MEG) Market – By Application

7.1 Introduction/Key Findings

7.2 Polyethylene Terephthalate (PET)

7.3 Polyester Fibers

7.4 Antifreeze Coolants

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Monoethylene Glycol (MEG) Market – By End-use

8.1 Introduction/Key Findings

8.2 Packaging

8.3 Textile

8.4 Automotive

8.5 Plastics

8.6 Others

8.7 Y-O-Y Growth trend Analysis By End-use

8.8 Absolute $ Opportunity Analysis By End-use, 2024-2030

Chapter 9. Monoethylene Glycol (MEG) Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Technology

9.1.3 By Application

9.1.4 By End-use

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Technology

9.2.3 By Application

9.2.4 By End-use

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Technology

9.3.3 By Application

9.3.4 By End-use

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Technology

9.4.3 By Application

9.4.4 By End-use

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Technology

9.5.3 By Application

9.5.4 By End-use

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Monoethylene Glycol (MEG) Market – Company Profiles – (Overview, By Technology Portfolio, Financials, Strategies & Developments)

10.1 MEGlobal

10.2 Ishtar Company, LLC

10.3 Raha Group

10.4 India Glycols Ltd.

10.5 Kimia Pars Co.

10.6 LyondellBasell N.V.

10.7 Arham Petrochem Pvt. Ltd.

10.8 Indian Oil Corporation Ltd.

10.9 Pon Pure Chemicals Group

10.10 Acuro Organics Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Monoethylene Glycol (MEG) Market size will be valued at USD 43 billion in 2023.

The worldwide Global Monoethylene Glycol (MEG) Market growth is estimated to be 6.1% from 2024 to 2030.

The Global Monoethylene Glycol (MEG) Market is segmented By Technology (Gas-Based, Naphtha-Based, Coal-Based, Bio-Based); By Application (Polyethylene Terephthalate (PET), Polyester Fibers, Antifreeze Coolant, Others); By End-use (Packaging, Textile, Automotive, Plastics, Others).

The future of the Global Monoethylene Glycol (MEG) Market holds promising trends and opportunities. Anticipated growth is driven by the rising demand in diverse industries, technological advancements, and increased focus on sustainable practices, offering a fertile ground for innovation and market expansion.

The global monoethylene glycol market, especially in China, faced COVID-19 challenges due to disruptions in supply chains and economic downturns. Lockdowns hindered growth, impacting the textile sector, and consumer demand declined, leading to reduced non-essential spending.