Global Monocrystalline Silicon Market Size (2023 – 2030)

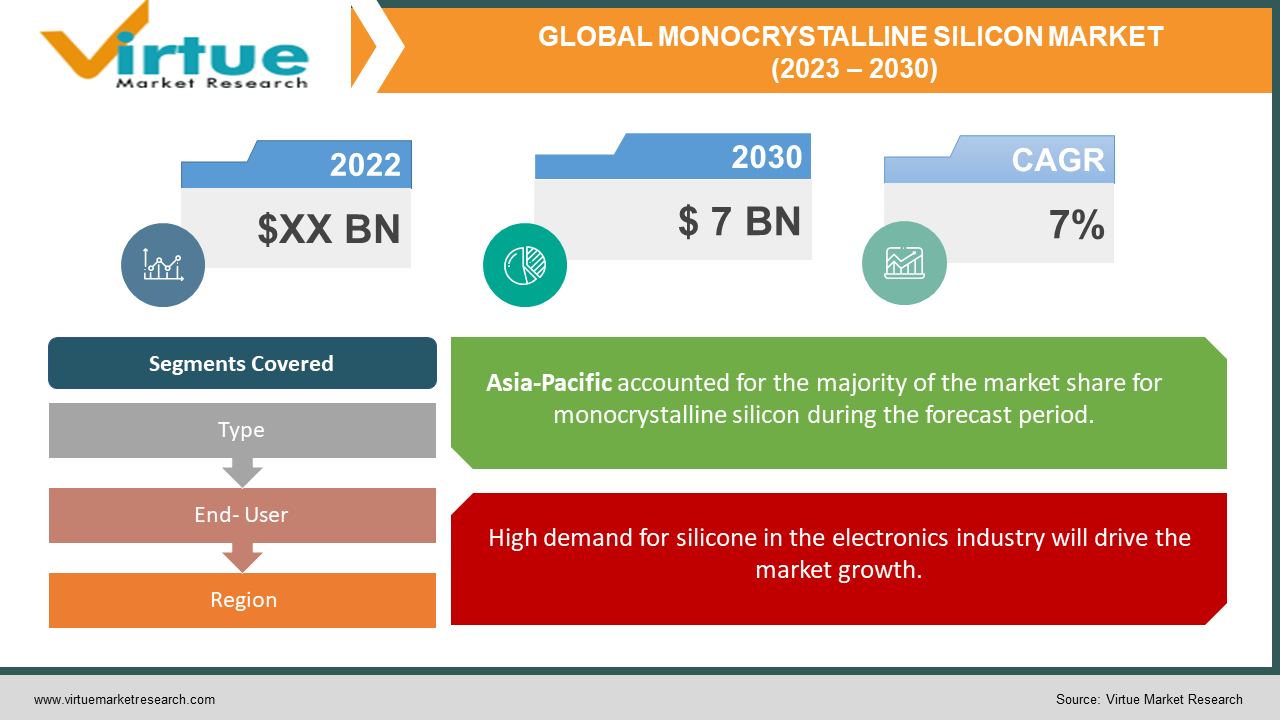

According to our research report, the global monocrystalline silicon market is estimated to reach a total market valuation of USD 7 billion by 2030. The market is projected to grow with a CAGR of 7% per annum during the period of analysis (2023 - 2030).

Industry Overview

One continuous silicone lattice cell makes up monocrystalline silicone, also referred to as single-crystal silicone. It plays a significant role in the production of solar cells, which turn solar energy into electricity. Using the Czochralski process, it is produced. Compared to other technologies, such as amorphous technology, monocrystalline silicon has several advantages. Compared to other technologies, it is robust and has the highest efficiency rate of about 15%. The market for monocrystalline silicone is anticipated to experience profitable growth over the course of the projected period as a result of the rising demand for solar cells around the world. Government mandates for energy conservation have also helped the worldwide monocrystalline silicone industry. Approximately 32% of the world's solar cell market is made up of monocrystalline silicone. The global monocrystalline silicone market is expanding as a result of rising urbanization, rising demand for solar cells, and the expansion of the electrical and electronics industries. Global demand for monocrystalline silicon has increased as a result of shifting consumer preferences about the usage of solar panels, supportive government policies on energy saving, and a rise in the world's capacity to produce the material.

Future attractive chances for the global monocrystalline silicon market will result from an increased focus on R&D operations to increase solar cell and production technology efficiency. Monocrystalline silicon is being actively developed by manufacturers like Panasonic and SolarCity to create extremely effective solar panels. As an illustration, Panasonic unveiled the HIT® N330 hetero-junction solar module made of monocrystalline silicon in 2016. Because monocrystalline silicone is so expensive, producers have focused primarily on the high-end of the market. The demand for monocrystalline silicone is, however, dwindling as a result of the increased manufacturing rate, high cost of installation, and falling cost of polycrystalline silicone.

Impact of Covid-19 on the industry

Due to the COVID-19 pandemic, numerous governments ordered a lockdown to stop the virus from spreading, which caused some manufacturers to halt production. In addition to government restrictions, the manufacturer reportedly shut down the business due to decreased demand, a broken supply chain, and worker safety concerns. The manufacturing of silicone was halted during the COVID-19 pandemic by several Tier I and II suppliers, including the Dow Chemical Company (US), Shin-Etsu Chemical Co. Ltd. (Japan), Wacker Chemie AG (Germany), Elkem ASA (Norway), KCC Corporation (South Korea), and Momentive (US), among others. Furthermore, the price of raw materials increased as a result of the supply chain disruption, which in turn raised the price of silicones.

Market Drivers

High demand for silicone in the electronics industry will drive the market growth

Due to its excellent electrical insulation, thermal conductivity, resistance to both high and low temperatures, and flame retardance, silicone is becoming more popular in a variety of industrial applications. Silicone is a material utilized in a variety of electronic products, including ignition wire, refrigerator wire, heater wire, and highly sensitive circuits. These materials offer good insulating qualities that aid in shielding electrical circuits from heat, dust, and other elements in a variety of electronic components, including computers, televisions, and aviation video displays. Silicone demand is therefore anticipated to rise significantly throughout the projection period because of the surge in demand for electronics, semiconductors, and consumer goods globally.

High market potential in structural silicone glazing will drive the market growth

The US adopted structural glazing for the first time in the early 1960s. In the commercial façade industry, structural silicone glazing (SSG) is one of the most effective methods for building curtain walls. In commercial and institutional structures, architects and designers use SSG to impart an aesthetic appeal or to create dramatic facades. The demand for SSG is anticipated to rise significantly in the next years as a result of changing consumer behaviour and rising consumer spending, which will promote the expansion of the silicone industry. Additionally, the SSG is frequently utilized in the construction of green buildings in European and North American nations, which presents another potential opportunity for the silicone market.

Market Restraints

Stringent regulatory policies for silicone will challenge the market growth

There are no restrictions on silicone materials in industrial applications. However, some silicone products used in the personal care and healthcare industries are governed by governmental organizations like the European Chemicals Agency (ECHA) and UK Competent Authorities, among others. In that document, the usage of two silicone products—cyclosiloxanes D4 and D5—was limited to the personal care sector. In personal care products, the concentration of these chemicals is limited to 0.1% by weight. Similar restrictions have been put in place in Canada and the US. As a result, silicone growth will be constrained.

Fluctuating raw material prices will challenge the market growth

The main obstacle for the producer of silicone is the variation in the cost of electricity and raw materials. Costs for raw materials like silicon metal and methyl chloride increased dramatically between 2016 and 2018, which had an impact on silicone prices. Many manufacturers had cut the profit margin to keep their market share. The COVID-19 outbreak also caused a major spike in raw material prices. The cost of feedstock is a constant challenge for the silicone industry, and producers are likely to raise prices for consumers.

GLOBAL MONOCRYSTALLINE SILICON MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

7% |

|

Segments Covered |

By Type, End- User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Amels, Azimut Benetti, Feadship, ISA Yachts, OVERMARINE GROUP, LONGI Silicone Materials Corp, SUMCO CORPORATION, Shin-Etsusu, Wacker, MEMC, Komatsu, Jinglong Group |

This research report on the global monocrystalline silicon market has been segmented and sub-segmented based on type, end-user and Geography & region.

Global Monocrystalline Silicon Market- By Type

-

Monocrystalline Silicone Wafer

-

Monocrystalline Silicone Rod

Based on type, the global monocrystalline market is segmented into silicon wafers and silicon rods. The silicon wafer market is projected to grow with the highest CAGR during the period of analysis. It is made of silicon, and the solid's whole crystal lattice is uninterrupted, unbroken to its borders, and devoid of any grain boundaries. Extremely pure silicon can be used to create mono-Si as an intrinsic semiconductor, or it can be doped with additional substances like boron or phosphorus to create p-type or n-type silicon.

Global Monocrystalline Silicon Market- By End- User

-

Industrial Process

-

Building & Construction

-

Transportation

-

Personal Care & Consumer Products

-

Medical & Healthcare

-

Electronics

-

Energy

-

Others (agriculture, packaging, textile, sporting goods, and aquaculture)

The silicone market is dominated by the industrial process segment in terms of demand. The key reason for this is the rising demand for silicone in a variety of industrial applications, including industrial coatings, paper production, offshore drilling, additives, and adhesives & sealants, among others. Silicone anti-foams in the oil and gas industry give better extraction rates and use less water. Similar to this, silicone increases pulp quality and increases yields in the paper and pulp sectors. Additionally, silicone-based sealants are gaining popularity in several industrial applications due to their great resilience to temperature, pressure, and corrosion. Silicone is frequently used in industrial coatings because of its great resilience. Additionally, it aids in enhancing the performance of lubricants.

Global Monocrystalline Silicon Market- By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

The Middle East and Africa

East Asia holds the greatest market share in the global monocrystalline silicon market among the aforementioned regions, thanks to the region's expanding electrical and electronics sector and increased production capacity. Japan and China are the top two net exporters of monocrystalline silicone. The main drivers of the expansion of the monocrystalline silicone market in the area are rising urbanization and an increase in solar installation.

Due to favourable government policies surrounding energy saving, the monocrystalline silicon market in North America is anticipated to have profitable growth shortly. Due to Europe's declining economy, it is anticipated that the market for monocrystalline silicone will continue to grow steadily in the next years. Due to increased urbanization and rising per capita spending, the monocrystalline silicon market in South Asia and Oceania is predicted to grow exponentially. However, the monocrystalline silicon industry has seen a modest dip due to a lack of supply in the area. In the upcoming projected period, Latin America and the Middle East & Africa will both have single-digit growth.

Global Monocrystalline Silicon Market- By Companies

-

Amels

-

Azimut Benetti

-

Feadship

-

ISA Yachts

-

OVERMARINE GROUP

-

LONGI Silicone Materials Corp

-

SUMCO CORPORATION

-

Shin-Etsusu

-

Wacker

-

MEMC

-

Komatsu

-

Jinglong Group

NOTABLE HAPPENINGS IN THE GLOBAL MONOCRYSTALLINE SILICONE MARKET IN THE RECENT PAST:

-

Business Agreement: - In 2019, A long-term supply agreement was inked by Vina Solar Technology Co., Ltd, a Vietnamese PV manufacturer, and LONGI Silicone Materials Corp.

-

Business Agreement: - In 2019, A contract for product development and R&D activities was signed by BeyondPV Co. Ltd., a developer of photovoltaic technology, and ClearVue Technologies Ltd.

Chapter 1. Global Monocrystalline Silicone Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Monocrystalline Silicone Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Global Monocrystalline Silicone Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Global Monocrystalline Silicone Market Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Global Monocrystalline Silicone Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Monocrystalline Silicone Market – By Type

6.1. Monocrystalline Silicone Wafer

6.2. Monocrystalline Silicone Rod

Chapter 7. Global Monocrystalline Silicone Market – By End- User

7.1. Industrial Process

7.2. Building & Construction

7.3. Transportation

7.4. Personal Care & Consumer Products

7.5. Medical & Healthcare

7.6. Electronics

7.7. Energy

7.8. Others (agriculture, packaging, textile, sporting goods, and aquaculture)

Chapter 8. Global Monocrystalline Silicone Market- By Region

8.1. North America

8.2. Europe

8.3. Asia-Pacific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9. Global Monocrystalline Silicone Market – key players

9.1 Amels

9.2 Azimut Benetti

9.3 Feadship

9.4 ISA Yachts

9.5 OVERMARINE GROUP

9.6 LONGI Silicone Materials Corp

9.7 SUMCO CORPORATION

9.8 Shin-Etsusu

9.9 Wacker

9.10 MEMC

9.11 Komatsu

9.12 Jinglong Group

Download Sample

Choose License Type

2500

4250

5250

6900