Molecular Diagnostics Genetic Testing Market Size (2023 – 2030)

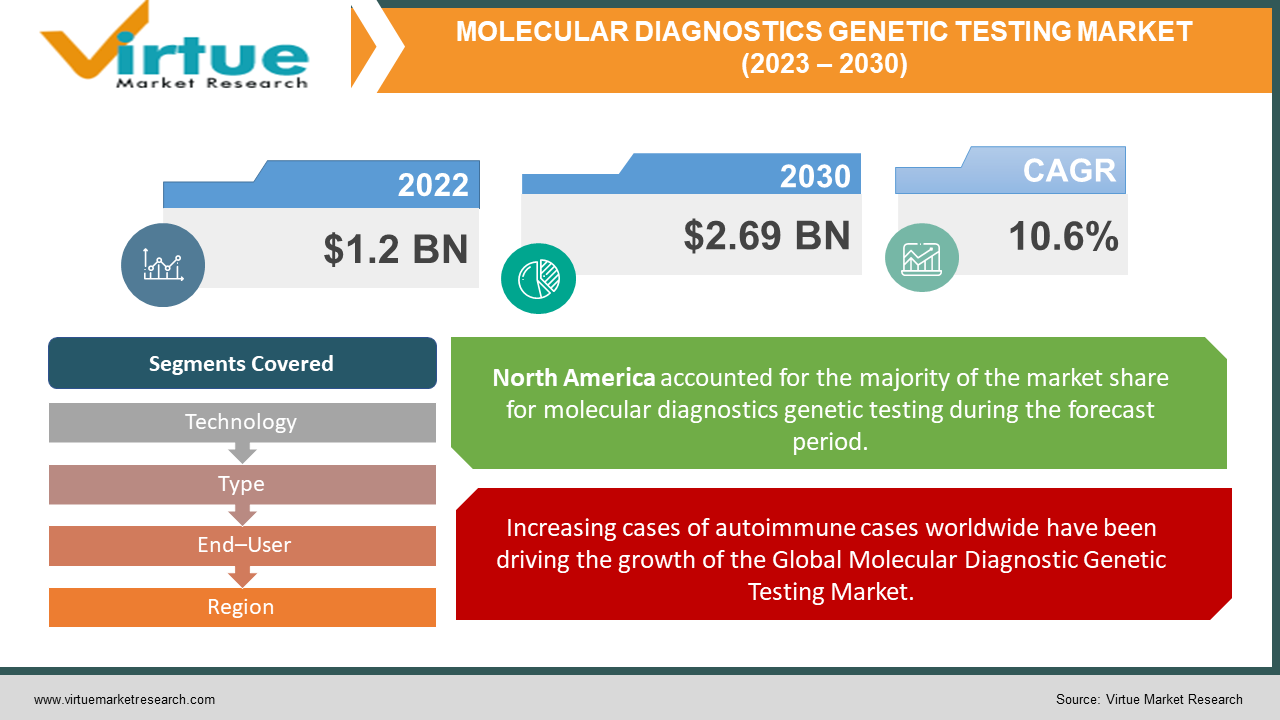

The Global Molecular Diagnostics Genetic Testing Market was valued at USD 1.2 billion and is projected to reach a market size of USD 2.69 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 10.6%.

The significance of molecular diagnostics plays an important role in evaluating disease prognosis, monitoring therapy effectiveness, and detecting even trace amounts of lingering disease (minimal residual disease). Over the last ten years, this field has expanded substantially, driven by advancements in chemistry and instrumentation. These progressions include automation, integration, high throughput capabilities, and the versatility to employ instrumentation in a mode where access is not bound by a fixed sequence.

The global market for molecular diagnostics genetic testing is being primarily propelled by several factors. One key driver is the increasing prevalence of chronic and genetic diseases, coupled with the emergence of advanced testing kits resulting from technological advancements. This trend is further supported by a heightened awareness among consumers about the availability of more sophisticated molecular diagnostic tests, driving the demand for genetic testing services. Additionally, the expanding elderly population demographic is anticipated to contribute significantly to the market's growth shortly. Governments across the globe are also taking proactive measures to promote awareness about the benefits of genetic testing, further fostering the adoption of molecular diagnostics genetic testing on a global scale. Furthermore, the presence of numerous prominent market players, along with substantial investments in research and development endeavors, has led to innovations in product design, improved distribution methods, and enhanced product quality. A notable trend is the increasing popularity of direct-to-consumer genetic testing kits, which are affordable and accessible. This trend is projected to further stimulate the adoption of molecular diagnostics and genetic testing kits worldwide, consequently boosting the overall growth of the global genetic testing market.

Key Market Insights:

The use of pharmacogenomics testing is becoming increasingly vital in aiding healthcare professionals to choose appropriate medications and determine the most suitable dosage for individual patients. Numerous research studies, endorsed by the Association for Molecular Pathology (AMP) Pharmacogenomics (PGx), have been disseminated, advocating for the integration of clinical pharmacogenomics assays. This recommendation aims to establish a uniform approach among laboratories, ensuring standardization in the field of pharmacogenomics.

On a global scale, the frequency of infectious diseases like HIV is on the rise. A case in point is the data provided by the UNAIDS update in August 2022, which indicated that around 38.4 million individuals worldwide were living with HIV in 2021. Among these cases, 36.7 million were adults, while 1.7 million were children. This heightened prevalence of infectious diseases, including HIV, is expected to drive market expansion as there is an increased adoption of molecular diagnostics genetic testing for HIV.

As showcased in the India TB report for 2022, there was a notable rise in the count of newly reported and relapse TB patients in India, with a total of 1,933,381 cases documented in 2021 compared to 1,628,161 cases in 2020. This surge in prevalence and the expanding patient cohort is projected to stimulate higher demand for molecular diagnostics genetic testing, consequently propelling market growth in this field.

As per the data from the American Cancer Society, the year 2020 witnessed the diagnosis of nearly 1.8 million new cancer cases, resulting in approximately 606,520 cancer-related fatalities in the United States. Globally, cancer stands as the second leading cause of death. A multitude of cancer types have a hereditary component, being passed down from one generation to the next due to genetic factors.

Global Molecular Diagnostic Genetic Testing Market Drivers:

Increasing cases of autoimmune cases worldwide have been driving the growth of the Global Molecular Diagnostic Genetic Testing Market.

The increasing incidence of autoimmune diseases is driving the need for molecular diagnostics and genetic testing services. These services find extensive applications across various domains, including oncology, obstetrics, and ancestry analysis. They serve as valuable tools for clinicians and individuals to uncover genetic factors responsible for the onset of the mentioned medical conditions. Anticipated to fuel market expansion in the forthcoming years, these trends align with broader factors such as population growth and the prevalence of both communicable and non-communicable diseases. Collectively, these factors are poised to contribute to the growth of the genetic testing services market.

Increasing demand for Molecular Diagnostic Genetic Testing kits in the point-of-care setting has been augmenting the growth of the market.

Over the past few years, molecular diagnostic platforms have gained significant traction within Point-of-Care (PoC) environments. Many companies are actively creating molecular diagnostic platforms and assays specifically tailored for PoC or near-patient testing. Furthermore, the ongoing innovation of new assays capable of swiftly delivering PoC results is projected to have a positive impact on market expansion. For example, Abbott introduced the ID NOW COVID-19 test in 2020, a molecular-based point-of-care test designed to diagnose COVID-19 in under 5 minutes. This innovation has effectively contributed to advancing market growth in this sector.

Technological advancement in this field has also been contributing to the growth of the Molecular Diagnostic Genetic Testing Market.

The field of genetic testing has experienced significant technological progress, highlighted by the emergence of next-generation sequencing and chromosomal microarray analysis. These advancements have revolutionized the approach to identifying both structural and numerical abnormalities in chromosomes, consequently enabling the detection of a wide range of rare genomic and genetic disorders. These technologies have played a pivotal role in the development of non-invasive methods such as cell-free fetal DNA (cffDNA) analysis. This innovative approach facilitates the identification of sub-chromosomal abnormalities, single-gene disorders, and chromosomal aneuploidy, particularly in prenatal diagnostics. Additionally, these technological strides have contributed to the creation of carrier screening techniques. These screenings allow for the simultaneous identification of multiple genetic disorders, further enhancing the capabilities and scope of genetic testing.

Global Molecular Diagnostic Genetic Testing Market Restraints and Challenges:

In developing nations, the expansion of the genetic testing market might face constraints due to cost considerations. The price of genetic testing spans a range from less than USD 100 to exceeding USD 2,000, contingent upon the intricacy and type of test being conducted. The expense increases when multiple tests are necessary, or when samples from multiple family members are required to generate a substantial test outcome. Additionally, the turnaround time for receiving results could extend to several weeks. In certain instances, the cost of genetic testing might be covered by health insurance plans, particularly when it is advised by medical professionals. Nevertheless, there is considerable variation among health insurance providers in their policies and extent of coverage.

Global Molecular Diagnostic Genetic Testing Market Opportunities:

Healthcare systems in developing nations like Brazil, India, and China have witnessed substantial increments in investments directed towards healthcare and infrastructure enhancements. Moreover, emerging economies are confronted with the imperative of achieving cost efficiency and scalability to meet the increasing demands of their growing patient populace. The demand for genetic testing has surged in scientific circles across the globe, driven by an increasing awareness of genetic disorders in developing economies. The user-friendliness and practicality of genetic testing methodologies have progressively bolstered research and development endeavors in regions such as Asia and other developing parts of the world. Concurrently, diverse genome-oriented initiatives like China Genome in these regions have acted as catalysts for market growth. The Asia-Pacific region, with its substantial population, decreasing costs of genetic testing techniques, and heightened awareness regarding genetic disorders, is poised to present an array of growth prospects for market participants throughout the forecast period.

MOLECULAR DIAGNOSTICS GENETIC TESTING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

10.6% |

|

Segments Covered |

By Technology, Type, End–User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Abbot Laboratories, Danaher Corporation, Bio-Rad Laboratories Inc. Myriad Genetics, AmGen Inc, Eurofins Genoma, Color Genomics, AncestryDNA, F. Hoffman La-Roche Ltd., Seimens AG |

Global Molecular Diagnostic Genetic Testing Market Segmentation: By Technology

-

Massively Parallel Sequencing

-

Polymer Chain Reaction

-

Array

-

Fluorescent In-situ Hybridization

-

Isothermal Nucleic Amplification Techniques

-

Others

The Massively Parallel Sequencing was the most dominant segment as it held the highest market share in 2022 and it demonstrated a CAGR of 23.03% during the period from 2023 to 2030. This growth is primarily attributed to a surge in genome mapping initiatives, an upswing in healthcare expenditure, continuous technological advancements, and a heightened scope of applications for next-generation sequencing.

DNA sequencing technologies are increasingly being harnessed for the identification and characterization of various cancer types and numerous genetic disorders. Genetic testing or profiling, facilitated by the implementation of tumor DNA sequencing, facilitates the identification of distinct DNA alterations. This understanding of genetic mutations subsequently aids in the formulation of targeted treatment strategies tailored to the specific genetic makeup of the individual. Consequently, the uptick in the prevalence of cancer and genetic disorders stands as a driving force behind the escalating demand for molecular diagnostics genetic testing, both within clinical environments and research settings.

Array Technology is the largest growing segment and is projected to hold significant revenue in the market share. Owing to the increased prevalence of cancer and other diseases which has given rise to DNA-based array technology in molecular diagnosis genetic testing.

Global Molecular Diagnostic Genetic Testing Market Segmentation: By Type

-

Prenatal & Newborn Testing

-

Health & Wellness Predisposition

-

Carrier Testing

-

Pharmacogenomic Testing

-

Others

The segment focused on prenatal and newborn testing secured the leading position in terms of revenue in 2022, and it is projected to continue its dominant stance throughout the forecast period. This trend can be attributed to the rising awareness among individuals about healthcare and the escalating incidence of mortality rates due to genetic diseases worldwide. Conversely, the pharmacogenomic testing segment is predicted to experience the highest compound annual growth rate (CAGR) during the forecast period. This growth is primarily expected due to the increasing adoption of personalized medicine on a global scale.

Global Molecular Diagnostic Genetic Testing Market Segmentation: By End–User

-

Diagnostic Laboratories

-

Hospitals & Clinics

-

Others

In 2022, the segment encompassing hospitals and clinics emerged as the leader in market revenue, claiming the largest share at 46.06%. This prominence is primarily attributed to mandatory newborn screenings for genetic disorders and the growing prevalence of cancer across different regions. Also, nearly 98% of childbirths in the U.S. occur within hospital settings, which is expected to contribute to heightened testing demand. The expansion of hospital and clinic capacities is projected to further drive this demand, with the added support of modern trends like telehealth and on-site hospital services, fostering market growth.

The Diagnostic Laboratories is poised to be the fastest growing market This trajectory is owed to the increasing partnerships and collaborations between diagnostic laboratories and genetic testing companies, enhancing their collective ability to offer comprehensive testing services.

Global Molecular Diagnostic Genetic Testing Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

In 2022, North America emerged as the dominant force in the global market with a market share of more than 35%. This achievement can be credited to the heightened demand for diagnostics, driven by a surge in chronic illnesses and the availability of cutting-edge diagnostic methodologies. The region also experiences an upswing in infectious diseases, including COVID-19, tuberculosis, HIV, and influenza, which is projected to amplify the need for detection and treatment services. The well-established healthcare infrastructure and government funding for research further contribute to market expansion in North America.

Meanwhile, the Asia Pacific region stands out as the fastest-growing market. This is primarily due to the sizable target population present in countries like China, India, South Korea, and Japan. Moreover, the adoption of innovative laboratory techniques, notably DNA sequencing, for swift investigation and diagnosis of both chronic and infectious disorders, serves as a pivotal factor driving market growth in this region.

COVID-19 Impact on Global Molecular Diagnostic Genetic Testing Market:

The emergence of the COVID-19 pandemic had a profound impact on the molecular diagnostic genetic testing market. The pandemic showcased the importance of rapid and accurate disease detection, leading to an increased focus on molecular diagnostic genetic testing as a crucial tool in managing and containing the spread of the virus, accelerated the adoption of molecular testing technologies, such as PCR and massively parallel sequencing, for detecting the presence of the SARS-CoV-2 virus which in turn bolstered the growth of the molecular diagnostic genetic testing market. The pandemic also highlighted the importance of robust healthcare infrastructure and streamlined supply chains to ensure the availability of testing kits and equipment. The overall impact of the COVID-19 pandemic on the molecular diagnostic genetic testing market has been positive as it emphasized the critical role of molecular testing in disease detection and management. The rapid adoption of advanced testing technologies and the integration of genetic insights into remote healthcare practices are likely to leave a lasting impact on the trajectory of this market beyond the pandemic.

Latest Trends/ Developments:

The molecular diagnostics genetic testing sector on a global scale is characterized by intense competition, featuring a multitude of participants actively engaged in genetic testing activities. These enterprises exhibit robust market presence, diverse arrays of products, expansive global coverage, and well-established distribution channels. Moreover, a substantial proportion of these entities have made significant investments in research and development endeavors, aiming to maintain a competitive edge by introducing cutting-edge and progressive testing solutions to their clients.

The Molecular diagnostic genetic testing industry has been achieving remarkable progress in the research and innovation field such as the CRISPR-Cas9 technology that revolutionized gene editing, allowing scientists to modify DNA with precision. It has immense potential in treating genetic disorders by correcting or modifying defective genes. Pharmacogenomics is a field that focuses on how an individual's genetics affects their response to drugs. Pharmacogenomic testing helps doctors prescribe medications that are likely to be effective and have fewer side effects for specific patients. The Association for Molecular Pathology (AMP) Pharmacogenomics (PGx) has released multiple studies advocating for the incorporation of clinical pharmacogenomics assays to establish uniformity among laboratories. In August 2022, the association issued guidelines encompassing the design and validation of clinical genotyping assays for NUDT15 and TPMT. These recommendations outline the essential genotyping procedures to be adopted by labs, ensuring the identification of patients at risk of thiopurine toxicity through the minimum set of alleles for TPMT and NUDT15 genotyping.

Key Players:

-

Abbot Laboratories

-

Danaher Corporation

-

Bio-Rad Laboratories Inc.

-

Myriad Genetics

-

AmGen Inc

-

Eurofins Genoma

-

Color Genomics

-

AncestryDNA

-

F. Hoffman La-Roche Ltd.

-

Seimens AG

In March 2023, Invitae, a company specializing in medical genetics testing, revealed a collaboration with Epic, a prominent healthcare software company, aimed at utilizing Epic's diagnostic suite called Aura. Through this partnership, Invitae intends to seamlessly integrate its genetic test outcomes into Aura's regular workflows for healthcare providers within the Epic network.

In September 2022, Eurofins Genoma, which is affiliated with the Eurofins group of firms and recognized for its expertise in genetic, cytogenetic, and molecular analyses, particularly as one of Europe's cutting-edge molecular diagnostics laboratories, introduced niPGT-A. This represents a non-invasive preimplantation genetic aneuploidy screening test, marking a notable addition to their portfolio of services.

Chapter 1. Molecular Diagnostics Genetic Testing Market– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Molecular Diagnostics Genetic Testing Market– Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Molecular Diagnostics Genetic Testing Market– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Molecular Diagnostics Genetic Testing Market- Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Molecular Diagnostics Genetic Testing Market- Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Molecular Diagnostics Genetic Testing Market- BY TECHNOLOGY

6.1 Introduction/Key Findings

6.2 Massively Parallel Sequencing

6.3 Polymer Chain Reaction

6.4 Array

6.5 Fluorescent In-situ Hybridization

6.6 Isothermal Nucleic Amplification Techniques

6.7 Others

6.8 Y-O-Y Growth trend Analysis BY TECHNOLOGY

6.9 Absolute $ Opportunity Analysis BY TECHNOLOGY, 2023-2030

Chapter 7. Molecular Diagnostics Genetic Testing Market- By Type

7.1 Introduction/Key Findings

7.2 Prenatal & Newborn Testing

7.3 Health & Wellness Predisposition

7.4 Carrier Testing

7.5 Pharmacogenomic Testing

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Type

7.8 Absolute $ Opportunity Analysis By Type, 2023-2030

Chapter 8. Molecular Diagnostics Genetic Testing Market - By End–User

8.1 Introduction/Key Findings

8.2 Diagnostic Laboratories

8.3 Hospitals & Clinics

8.4 Others

8.5 Y-O-Y Growth trend Analysis By End–User

8.6 Absolute $ Opportunity Analysis By End–User, 2023-2030

Chapter 9. Molecular Diagnostics Genetic Testing Market, By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.2 BY TECHNOLOGY

9.3 By Type

9.4 By End–User

9.5 Countries & Segments - Market Attractiveness Analysis

9.6 Europe

9.6.1 By Country

9.6.1.1 U.K.

9.6.1.2 Germany

9.6.1.3 France

9.6.1.4 Italy

9.6.1.5 Spain

9.6.1.6 Rest of Europe

9.7 BY TECHNOLOGY

9.8 By Type

9.9 By End–User

9.10 Countries & Segments - Market Attractiveness Analysis

9.11 Asia Pacific

9.11.1 By Country

9.11.1.1 China

9.11.1.2 Japan

9.11.1.3 South Korea

9.11.1.4 India

9.11.1.5 Australia & New Zealand

9.11.1.6 Rest of Asia-Pacific

9.12 BY TECHNOLOGY

9.13 By Type

9.14 By End–User

9.15 Countries & Segments - Market Attractiveness Analysis

9.16 South America

9.16.1 By Country

9.16.1.1 Brazil

9.16.1.2 Argentina

9.16.1.3 Colombia

9.16.1.4 Chile

9.16.1.5 Rest of South America

9.17 BY TECHNOLOGY

9.18 By Type

9.19 By End–User

9.20 Countries & Segments - Market Attractiveness Analysis

9.21 Middle East & Africa

9.21.1 By Country

9.21.1.1 United Arab Emirates

9.21.1.2 Saudi Arabia

9.21.1.3 Qatar

9.21.1.4 Israel

9.21.1.5 South Africa

9.21.1.6 Nigeria

9.21.1.7 Kenya

9.21.1.8 Egypt

9.21.1.9 Rest of MEA

9.22 BY TECHNOLOGY

9.23 By Type

9.24 By End–User

9.25 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Molecular Diagnostics Genetic Testing Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Abbot Laboratories

10.2 Danaher Corporation

10.3 Bio-Rad Laboratories Inc.

10.4 Myriad Genetics

10.5 AmGen Inc

10.6 Eurofins Genoma

10.7 Color Genomics

10.8 AncestryDNA

10.9 F. Hoffman La-Roche Ltd.

10.10 Seimens AG

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Molecular Diagnostics Genetic Testing Market was valued at USD 1.2 billion and is projected to reach a market size of USD 2.69 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 10.6%.

Increasing cases of autoimmune disease and development in technological advancements and innovations are the drivers.

Based on type, the Global Molecular Diagnostic Genetic Testing is segmented into Prenatal and newborn Testing, Health and wellness Predisposition, Carrier Testing, Pharmacogenomic Testing, and Others.

The United States of America is the most dominant country in the region of North America for the Global Molecular Diagnostic Genetic Testing Market.

Abbot Laboratories, Danaher Corporation, Bio-Rad Laboratories Inc., Myriad Genetics, AmGen Inc., Eurofins Genoma, Color Genomics, AncestryDNA, F. Hoffman La-Roche Ltd., Seimens AG.