Molecular Catalysts Market Size (2023 - 2030)

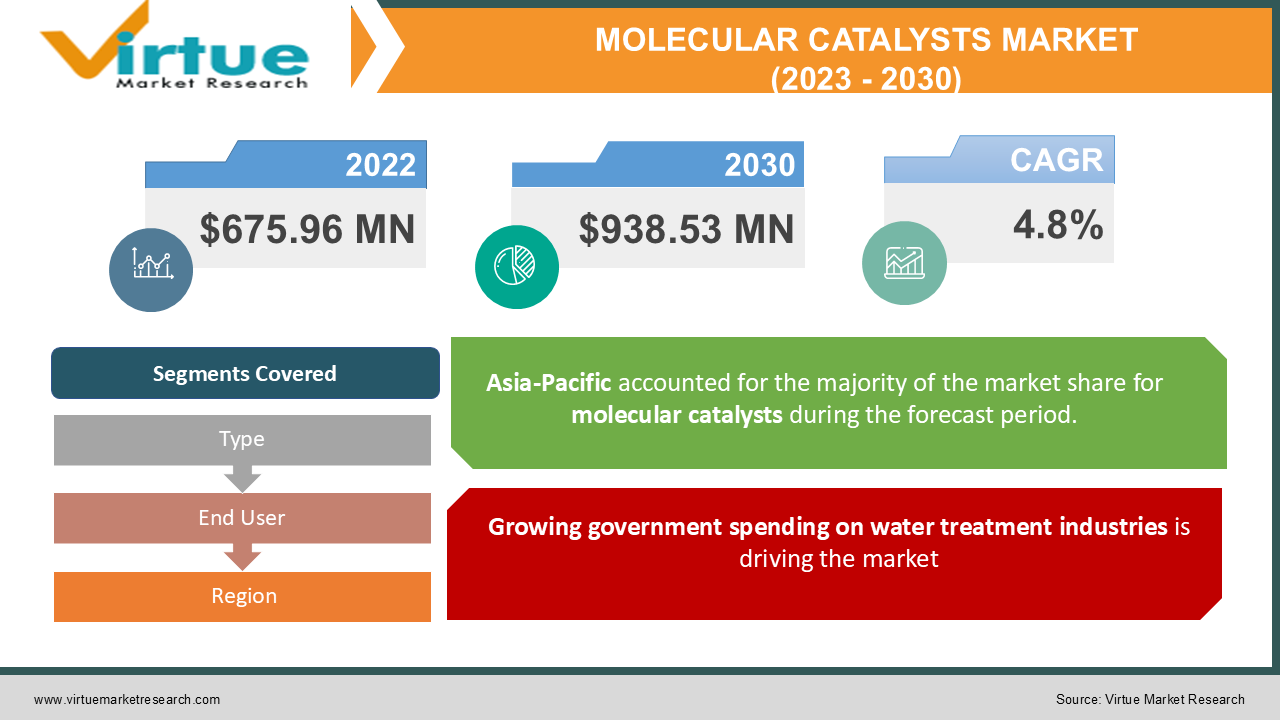

The Global Molecular Catalyst Market is valued at USD 675.96 Million in 2022 and is projected to reach a market size of USD 938.53 Million by 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 4.8%.

Industry Overview:

The term "molecular catalysts" refers to catalysts in which all reaction components are dissolved in the same liquid phase. These catalysts are frequently employed in electrochemical processes, mechanistic research, phthalocyanine synthesis, and oxygen reduction reactions. The growing demand for high-performance catalysts that generate more output, particularly in the oil and gas industry, is one of the main drivers of the growth of the molecular catalysts market. The global rise in refining applications has further fueled the market expansion for molecular catalysts. Small-molecule systems are suitable models for building a fundamental scientific understanding of catalytic processes because they can be studied in great detail using a variety of analytical techniques. By understanding how these catalysts to function, researchers may fine-tune them to more efficiently manufacture a wider variety of compounds. Numerous businesses where precise control over chemical reactivity is essential to use molecular catalysis extensively. Molecules can be highly customized in terms of their size, makeup, and reactivity. Molecular catalysts have an advantage over other types of catalysts, such as solid-state catalysts, in that their tunability, or ease of modifying catalyst properties, allows comparison studies that focus on the impact of particular structural or electrical modifications on the catalyst's reactivity. Many molecular catalysts are organometallic, consisting of a metal bound to organic molecules known as ligands. To speed up reactions, these ligands can be changed or chemically altered. The molecular catalysts market is predicted to expand quickly throughout the forecast period due to strong expansion and thriving applications across important industries such as transportation, oil & gas, and others.

COVID-19 pandemic impact on Molecular Catalysts Market

The COVID-19 pandemic has had a detrimental influence on the market for molecular catalysts due to the market's reliance on oil and gas, chemical production, polymer catalysis, automotive, and other industries. The oil and gas industry is among the most affected, with an average decrease of -2.8% in 2020, according to a report by Energy and Economic Growth Survey. Additionally, more than 100 nations restricted international travel and non-essential trade, which has decreased the demand for catalysts in the automotive industry. Demand-supply issues have also resulted from the oil refineries' temporary stoppage during the COVID-19 timeframe. Several chemical manufacturing enterprises that employ catalysts extensively for chemical synthesis, hydroprocessing, and other applications have also reduced or shut down their operations as a result of the danger of infection among the personnel. Because of this, the market for molecular catalysts has experienced a temporary decline in demand during the COVID-19 period. Additionally, the aerospace and aviation industries have temporarily suffered due to the travel restrictions put in place by several governments. Additionally, COVID-19 has temporarily halted several aircraft manufacturing projects, which has reduced demand for catalysts in the aerospace and aviation industries. However, despite the COVID-19 scenario, many significant firms, including BASF SE and others, are consistently expanding their reach and looking for new investment opportunities.

MARKET DRIVERS:

Growing government spending on water treatment industries is driving the market

Molecular catalyst demand is rising quickly as a result of increased government spending on water treatment. The best approach for treating water is with molecular catalysts. These include sophisticated oxidation techniques based on hydroxyl radicals, sulfate, electrochemistry, and photocatalysis. Molecular catalyst techniques have gained greater traction in the field of refractory pollutants abatement due to their utility and potential benefits in water purification, which is what is driving the market growth of molecular catalysts. The business for molecular catalysts will expand as a result of the wide range of molecular catalysts' properties and increased government spending on bettering water and wastewater treatment. For instance, the Office of Energy Efficiency and Renewable Energy (EERE) of the United States Department of Energy (DOE) announced in July 2020 a USD 20 million investment opportunity to develop technological innovations that strengthen America's water infrastructure and enable advanced water resource recovery systems that may be net energy positive. Additionally, on July 7, 2020, the US Department of Agriculture (USDA) announced that it would spend USD 307 million in 34 states and Puerto Rico to upgrade rural drinking water and wastewater infrastructure. Increased government spending on water treatment is therefore anticipated to raise the market share for molecular catalysts over the projected period.

The market is being driven by the oil and gas industry's robust growth

The increasing need for high-performance catalysts with higher output, notably in the oil and gas industry, is the main driver of the growth of the global market for molecular catalysts. The oil and gas industry frequently uses molecular catalyst because it has properties like electrochemical reactions, mechanistic analysis, phthalocyanine, and oxygen reduction reaction and is used in hydrocracking, which converts higher molecular weight petroleum fractions to lower molecular weight fuels. As a result, the market for molecular catalysts is expanding due to the increasing expansion in the oil and gas sector.

MARKET RESTRAINTS:

Renewable energy adoption could limit market expansion

The potential for expansion in numerous end-use sectors may be constrained by the increased awareness of renewable energy sources. The market for molecular catalysts will be hampered by the declining crude oil inventories and increased reliance on fossil fuels in the coming years. In addition, many organizations and governments are utilizing renewable energy to reduce their dependency on fossil fuels. Investments are being made by APAC oil producers in solar energy, electric vehicle initiatives, and other industries. The India Brand Equity Foundation (IBEF) forecasts that by 2028, investments in renewable energy will total USD 500 billion. The preference for electric vehicles over gasoline-powered vehicles and the fluctuation in crude oil prices would pose a serious challenge to the various sectors, leading to limited demand and slowing growth for the molecular catalysts sector.

Molecular catalysts have limitations related to their stability and need costly and labor-intensive purification

The scope of molecular catalysis must be constrained to systems that are entirely composed of molecules. When compared to solid-phase catalysts, these molecular systems pose difficulties. When everything is dissolved in the same solution, one significant challenge can be separating the catalyst from the rest of the reaction mixture. Purification is frequently expensive and time-consuming to separate the products from the catalyst. When the catalyst is expensive to produce, it is especially crucial to separate it from the reaction mixture. Numerous rare and expensive metals, including ruthenium, iridium, and platinum, are used in molecular catalysts that incorporate metals. Ruthenium, iridium, and platinum are only a few examples of rare and expensive metals used in many molecular catalysts. It might be difficult to develop well-tailored catalysts because doing so can take a lot of effort and knowledge. Because of their stability, molecular catalysts also have limitations. Molecular catalysts sometimes degrade at temperatures as low as 100 °C, whereas highly stable solid-phase catalysts frequently work at high temperatures.

MOLECULAR CATALYSTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

4.8% |

|

Segments Covered |

By Type, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Grace Catalysts AB, Albemarle Corp., BASF SE, Johnson Matthey Plc, JGC Catalysts & Chemicals Ltd., Inprocat Corporation, BASF SE, Luoyang Jalon Micro-Nano New Materials Co. Ltd., China National Petroleum Corp., Sinopec International Petroleum Exploration & Production Corporation, and Sumitomo Chemical Company Limited. |

Molecular Catalysts Market – By Type

-

Heterogeneous

-

Homogeneous

Based on Type, the Molecular Catalysts Market is bifurcated into Heterogenous and Homogenous. The heterogeneous segment held a sizable share in the global market for molecular catalysts in 2021 and is anticipated to expand at a CAGR of 4.9% from 2023 - 2030 due to the wide range of characteristics provided by heterogeneous, such as electrochemical reactions, mechanistic investigation, phthalocyanine and oxygen reduction reaction. In the plastic and chemical processing industries, heterogeneous catalysts, which are solids having more than one phase and can be added to solid or liquid reaction mixtures, have a wide range of applications. Heterogeneous catalysts can be easily separated from the reactants due to their nature, which reduces the complexity of the recovery procedure and the number of purification steps. The widespread use of heterogeneous catalysis in the chemical and oil and gas sectors fuels the market expansion for molecular catalysts. The demand for heterogeneous materials is therefore rising for use in important sectors due to their enormous advantages over other material types and availability, which will increase the molecular catalysts market share in the upcoming years.

Molecular Catalysts Market– By End User

-

Transportation

-

Oil & Gas

-

Agriculture

-

Packaging

-

Petrochemicals & Chemicals

-

Pharmaceuticals

-

Water Treatment

-

Others

Based on Type, the Molecular Catalysts Market is bifurcated into Transportation, Agriculture, Packaging, Oil & Gas, Pharmaceuticals, Petrochemicals & Chemicals, Pharmaceuticals, Water Treatment, and Others. The Petrochemical & Chemical segment, which accounted for a sizeable portion of the Molecular Catalysts Market in 2021, is anticipated to expand at a CAGR of 5.1% from 2023 - 2030. The need for molecular catalysts is booming in the chemical industry for a variety of applications including auxiliaries in chemical synthesis and fuel cells. Chemical manufacturing is safer, easier, and quicker thanks to molecular catalysts. The demand for novel and fuel-efficient chemical compounds is driving the rapid growth of the chemical sector. The growth of the petrochemical and chemical industries is accompanied by a sharp increase in the demand for molecular catalysts. Therefore, during the projection period, the molecular catalysts market share will grow as a result of the expanding chemical sector.

Molecular Catalysts Market– By Region:

-

North America

-

Europe

-

Asia-Pacific

-

Rest of the World

The Asia-Pacific region is anticipated to hold the majority of the global market share for molecular catalysts during the forecast period due to rising demand from end-use industries including the automotive and oil & gas sectors. Molecular catalysts are widely used in the oil and gas industry. This is likely to increase the demand for molecular catalysts over the anticipated time frame. The global molecular catalyst market has grown as a result of government initiatives and growing public awareness of the advantages of using them, including increased energy efficiency, reduced exhaust emissions from vehicles, and other environmental advantages. Due to a thriving base for chemical producers, increased demand for green chemical compounds, and increased production, the chemical industry in Asia-Pacific is expanding quickly. The need for molecular catalysts for a variety of applications, including fuel cells, chemical synthesis, and others, will increase due to the increase in chemical production and the thriving chemical processing base in APAC.

Major Key Players in the Market

-

Grace Catalysts AB

-

Albemarle Corp.

-

BASF SE

-

Johnson Matthey Plc

-

JGC Catalysts & Chemicals Ltd.

-

Inprocat Corporation

-

BASF SE

-

Luoyang Jalon Micro-Nano New Materials Co. Ltd.

-

China National Petroleum Corp.

-

Sinopec International Petroleum Exploration & Production Corporation

-

Sumitomo Chemical Company Limited.

Notable happenings in the Molecular Catalysts Market in the recent past:

-

Collaboration- In January 2022, Sinocompound Catalysts Co. Ltd. collaborated with InCatT to offer a customized Catalyst Screening Service for pharmaceutical and fine chemical companies looking to optimize customized reactions.

-

Product Launch- In March 2020, BASF SE produced a Tri-Metal Catalyst that can reduce the price of catalytic converters for cars while also partially rebalancing consumer demand for Platinum Group Metals (PGMs) to improve the sustainability of the market.

-

Acquisition- In November 2020, Evonik Industries AG has acquired The Porocel Group in Houston. With this acquisition, the company hopes to increase the global presence of Evonik's catalyst business by diversifying its knowledge of new products and technologies.

Chapter 1. Molecular Catalysts Market– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Molecular Catalysts Market – Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Molecular Catalysts Market– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Molecular Catalysts Market - Entry - Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Molecular Catalysts Market- Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Molecular Catalysts Market -BY TYPE

6.1 Introduction/Key Findings

6.2 Heterogeneous

6.3 Homogeneous

6.4 Y-O-Y Growth trend Analysis BY TYPE

6.5 Absolute $ Opportunity Analysis BY TYPE, 2023-2030

Chapter 7. Molecular Catalysts Market -BY END-USER

7.1 Introduction/Key Findings

7.2 Transportation

7.3 Oil & Gas

7.4 Agriculture

7.5 Packaging

7.6 Petrochemicals & Chemicals

7.7 Pharmaceuticals

7.8 Water Treatment

7.9 Others

7.10 Y-O-Y Growth trend Analysis BY END-USER

7.11 Absolute $ Opportunity Analysis BY END-USER, 2023-2030

Chapter 8. Molecular Catalysts Market, By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.2 BY TYPE

8.3 BY END-USER

8.4 Countries & Segments - Market Attractiveness Analysis

8.5 Europe

8.5.1 By Country

8.5.1.1 U.K.

8.5.1.2 Germany

8.5.1.3 France

8.5.1.4 Italy

8.5.1.5 Spain

8.5.1.6 Rest of Europe

8.6 BY TYPE

8.7 BY END-USER

8.8 Countries & Segments - Market Attractiveness Analysis

8.9 Asia Pacific

8.9.1 By Country

8.9.1.1 China

8.9.1.2 Japan

8.9.1.3 South Korea

8.9.1.4 India

8.9.1.5 Australia & New Zealand

8.9.1.6 Rest of Asia-Pacific

8.10 BY TYPE

8.11 BY END-USER

8.12 Countries & Segments - Market Attractiveness Analysis

8.13 South America

8.13.1 By Country

8.13.1.1 Brazil

8.13.1.2 Argentina

8.13.1.3 Colombia

8.13.1.4 Chile

8.13.1.5 Rest of South America

8.14 BY TYPE

8.15 BY END-USER

8.16 Countries & Segments - Market Attractiveness Analysis

8.17 Middle East & Africa

8.17.1 By Country

8.17.1.1 United Arab Emirates

8.17.1.2 Saudi Arabia

8.17.1.3 Qatar

8.17.1.4 Israel

8.17.1.5 South Africa

8.17.1.6 Nigeria

8.17.1.7 Kenya

8.17.1.8 Egypt

8.17.1.9 Rest of MEA

8.18 BY TYPE

8.19 BY END-USER

8.20 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Molecular Catalysts Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Grace Catalysts AB

9.2 Albemarle Corp.

9.3 BASF SE

9.4 Johnson Matthey Plc

9.5 JGC Catalysts & Chemicals Ltd.

9.6 Inprocat Corporation

9.7 BASF SE

9.8 Luoyang Jalon Micro-Nano New Materials Co. Ltd.

9.9 China National Petroleum Corp.

9.10 Sinopec International Petroleum Exploration & Production Corporation

9.11 Sumitomo Chemical Company Limited.

Download Sample

Choose License Type

2500

4250

5250

6900