Modular Fabrication Market Size (2024 – 2030)

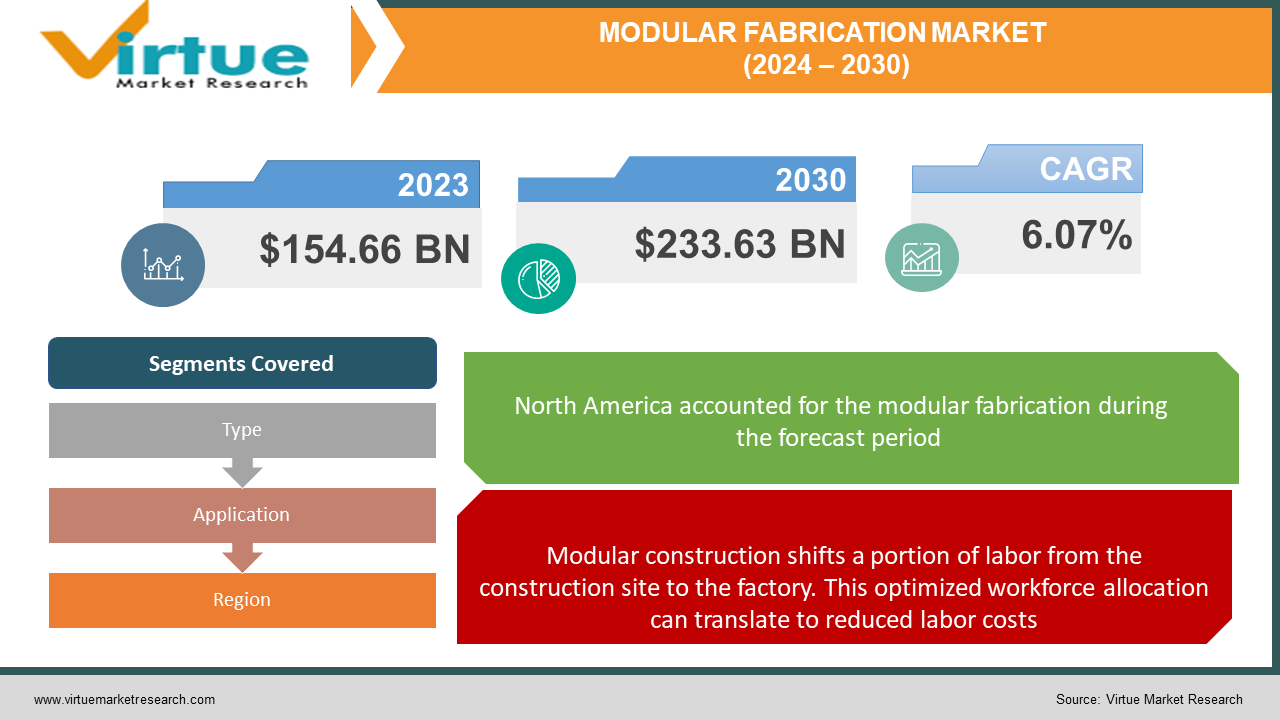

The Modular Fabrication Market was valued at USD 154.66 Billion in 2024 and is projected to reach a market size of USD 233.63 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.07%.

The Modular Fabrication Market is an innovative and rapidly evolving segment within the construction and manufacturing industries, offering a transformative approach to building and assembly processes. This market encompasses the design, production, and implementation of modular structures and components, which are pre-engineered, prefabricated, and assembled off-site before being transported and installed at their destination. At the heart of the Modular Fabrication Market lies the concept of efficiency, cost-effectiveness, and sustainability. Traditional construction methods often face challenges such as prolonged timelines, excessive waste generation, and inefficient resource utilization. Modular fabrication addresses these challenges by leveraging advanced manufacturing techniques, streamlined processes, and controlled environments to produce high-quality modules that can be seamlessly integrated into various projects. One of the key advantages of modular fabrication is its ability to reduce construction timelines significantly. By shifting a substantial portion of the building process to off-site facilities, modular components can be produced in parallel with site preparation activities, resulting in a shorter overall project duration. This accelerated timeline not only translates into cost savings but also allows for earlier occupancy or operational readiness, providing a competitive edge in industries where time-to-market is crucial.

Key Market Insights:

One of the most significant insights into the Modular Fabrication Market is its ability to significantly reduce construction timelines and associated costs. By shifting a substantial portion of the building process to off-site facilities, modular components can be produced in parallel with site preparation activities. This concurrent approach streamlines the overall project timeline, enabling earlier occupancy or operational readiness. Additionally, the controlled factory environment and streamlined processes inherent in modular fabrication contribute to cost savings through efficient material utilization, reduced waste, and optimized labour utilization. The market for modular fabrication is in line with the building sector's increasing focus on environmental responsibility and sustainability. Because modular building methods allow for precise material measurement and utilization, they naturally reduce waste formation and increase resource efficiency. To further lessen the negative effects of construction projects on the environment, a lot of modular fabrication facilities also use eco-friendly materials and recycling programmes. This observation underscores the market's capacity to foster a more ecologically sensitive and sustainable built environment. There is a lot of design freedom and customization available in the modular fabrication market. Modular components can be designed and built to fulfil the requirements of a variety of projects, including industrial plants, commercial structures, residential complexes, and healthcare facilities.

Modular Fabrication Market Drivers:

Perhaps the most prominent driver of modular construction is its acceleration of project delivery. By prefabricating elements off-site, builders can work on foundation preparation and other site work simultaneously.

In today's fast-paced world, time is often synonymous with money. Construction projects are no exception. From commercial ventures to critical infrastructure development, delays translate into lost revenue, missed opportunities, and even strained resources in crucial sectors like healthcare. Modular fabrication offers a compelling solution to this persistent challenge. The heart of modular construction's efficiency lies in its ability to streamline workflows. While modules are manufactured with precision in the controlled environment of a factory, on-site tasks like foundation laying, site preparation, and securing permits happen simultaneously. This eliminates the sequential dependencies of traditional construction, where one stage must be fully completed before the next begins. The modules themselves are designed and constructed with assembly in mind. With meticulous prefabrication, the on-site process becomes more akin to a well-orchestrated assembly rather than a construction project from scratch. This translates to projects being completed in a fraction of the time compared to their customarily constructed counterparts.

Modular construction shifts a portion of labor from the construction site to the factory. This optimized workforce allocation can translate to reduced labor costs.

Traditional construction projects are infamous for their budget volatility. Unforeseen expenses, material price fluctuations, delays, and change orders can push costs well beyond initial estimates. Modular fabrication seeks to bring a greater degree of predictability to construction spending with a multifaceted approach. In a factory environment, materials are meticulously tracked and utilized. Pre-engineering of modules minimizes the errors and overages common to on-site cutting and adjustments. This leads to significantly reduced material waste, translating into direct cost savings. Modular fabrication shifts a portion of labor from the unpredictable environment of the job site to the factory. This offers several cost advantages. When projects run behind schedule, costs escalate quickly. Equipment rentals, idle labor, and interest payments accrue with each passing day. Modular construction's faster timeline means fewer days on-site, minimizing the potential for these overruns to spiral. The transportation of modular components is planned and optimized well in advance. This helps avoid the costly rush shipments, last-minute sourcing, and delays that can plague traditional projects. The controlled manufacturing environment leads to higher-quality builds with fewer defects. This can translate into lower maintenance costs over the long run.

Modular Fabrication Market Restraints and Challenges:

The financial aspect plays a critical role in the excitation systems market and represents several layers of challenges.

Many people hold an outdated view of modular fabrication, associating it with the low-quality, boxy, "cookie-cutter" prefabricated homes of the past. There's often a lack of awareness of the technological advancements, design flexibility, and customization options now available in modern modular projects. Modular structures can be incorrectly perceived as inherently temporary or less durable than traditional builds. This misconception stems from their use in portable classrooms or disaster relief housing but ignores the vast applications of permanent modular buildings. Some believe that modular construction limits architectural creativity and results in monotonous buildings. This misperception doesn't account for the innovation that's taking place in modular design, with architects finding new ways to achieve aesthetically striking and unique structures. Outdated building codes or zoning regulations in some areas might not fully accommodate modular construction techniques. Navigating these can add complexity and create project delays. Negative perceptions can slow down the rate at which the industry progresses, as some players remain hesitant to embrace the new methodology fully. Highlighting high-quality, architecturally diverse, permanent modular buildings across various sectors (residential, hospitality, healthcare) showcases the capabilities of this construction approach. Targeted campaigns, workshops, and accessible resources informing developers, investors, and communities about the benefits, cost-savings, and design potential of modular construction will help dispel myths. Developing clear industry standards for modular construction and certifications reassures stakeholders of the quality, safety, and longevity of such buildings. Working with authorities to update building codes and streamline permitting processes for modular projects removes unnecessary obstacles to adoption.

Modular Fabrication Market Opportunities:

With urbanization increasing and a global need for affordable housing solutions, modular fabrication offers a compelling answer. Its streamlined processes and potential for cost reduction make it a viable option to address housing shortages. We can expect to see modular fabrication play a key role in both rapid-response housing after natural disasters and large-scale development projects for affordable housing communities. Hospitals, clinics, and senior care facilities often require quick deployment with strict quality standards. Modular fabrication meets these needs, offering prefabricated operating rooms, patient wards, or even entire medical outposts. Modular construction efficiency can be harnessed for projects like bridges, power substations, and water treatment facilities. This helps fast-track essential infrastructure development, particularly in remote or challenging locations. Increased automation in modular factories promises even greater efficiency gains in production and assembly. The potential integration of large-scale 3D printing could revolutionize modular fabrication, allowing for more complex geometries and on-demand production. Increasingly, governments recognize the value modular fabrication can bring in addressing housing shortages, infrastructure needs, and sustainability goals. Proactive policies that incentivize modular construction, streamline approvals, and provide funding for research and development can significantly accelerate the growth of this market. The modular fabrication industry is becoming increasingly globalized, potentially paving the way for greater standardization and cost competitiveness with the optimization of material sourcing and logistical chains.

MODULAR FABRICATION MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.07% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Laing O'Rourke, Red Sea Housing, Atco Ltd, Skanska AB, Kleusberg GmbH, Bouygues Construction, Vinci, Algeco Scotsman |

Modular Fabrication Market Segmentation: By Type

-

Steel

-

Concrete

-

Wood

-

Hybrid Systems

Steel holds 60-65% of the market share. Steel's dominance stems from multiple factors as the construction industry has long relied on steel, possessing deep knowledge of its engineering properties and behavior. Steel's superior ability to handle high-rise loads and create large open floor plans makes it indispensable in many commercial applications. Wood-framed modular construction is experiencing significant growth, Wood is a renewable resource, with the potential for lower embodied carbon in a structure. Innovations like cross-laminated timber (CLT) expand wood's capability in larger buildings and increase its appeal in modular applications.

Modular Fabrication Market Segmentation: By End User/Application

-

Residential

-

Commercial

-

Healthcare

-

Industrial

-

Hospitality

-

Others

Residential (Approx. 40-45%): The need for affordable and efficiently built housing continues to fuel significant demand for modular construction in single-family, multi-family, and student housing sectors. Commercial (Approx. 25-30%): From offices and retail spaces to mixed-use buildings, modular fabrication's speed and cost control benefits attract numerous commercial projects. Healthcare (Approx. 10-15%): Modular solutions are particularly appealing for hospitals, clinics, and assisted living facilities where speed, precision, and minimizing on-site disruption are critical. Industrial (Approx. 8-12%): Oil & gas facilities, power plants, mining infrastructure, and manufacturing plants benefit from the ability to prefabricate components in controlled environments and transport them to remote or challenging locations. Hospitality (Approx. 5-8%): The ability to rapidly construct hotels or resorts in response to tourism demand is a key driver in this segment. Others (Approx. 3-5%): Smaller market segments include data centers, educational facilities, and government projects.

The residential sector currently stands as the most dominant segment within the modular fabrication market. The healthcare sector is positioned as one of the fastest-growing applications for modular fabrication.

Modular Fabrication Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

With an estimated 40–45% of the market, North America currently holds the greatest share. The need for quick project delivery, a mature market, and labour scarcity in the construction industry are the main drivers pushing this. Asia Pacific: With a market share of roughly 30–35%, this region is expanding at the highest rate. Growth is being accelerated by government backing, infrastructure requirements, and rapid urbanisation. Europe: With a 20–25% market share, it commands a substantial portion. Its presence is a result of changing rules, innovation, and a strong focus on sustainability. Africa, the Middle East, and Latin America together make up emerging markets with lesser but growing percentages of 5–10%. With the growing usage of modular systems, there is significant potential for long-term growth.

Due to its early adoption of modular construction, which enabled the growth of a more established sector, North America leads the world in the modular fabrication market. In North America, problems like labour shortages and constrained building schedules can be effectively addressed via modular fabrication. Residential, commercial, healthcare, and industrial sectors are just a few of the industries that are served by the North American modular market. The need to build infrastructure and housing for rapidly expanding cities and megacities is driving the market expansion in the Asia Pacific area, where modular construction's efficiency is particularly appealing. Modular construction is actively promoted by certain regional governments as a means of achieving aspirational development objectives.

COVID-19 Impact Analysis on the Modular Fabrication Market:

The world's industries were rocked by the late 2019 COVID-19 outbreak, and the modular fabrication business was no exception. Although the epidemic brought with it many difficulties, it also brought with it unanticipated prospects for this novel approach to building. Travel restrictions and worldwide lockdowns hampered the supply of components and raw materials needed for modular construction. Project delays and higher expenses resulted from this. Construction activity was hindered by social distancing measures and worker health concerns, which affected the fabrication of modular units in factories as well as on-site assembly. The pandemic's economic uncertainty resulted in project cancellations or delays, which affected the market for modular solutions. The pandemic brought attention to the necessity of quickly deploying medical facilities. Temporary hospitals and isolation units found modular construction to be an appealing solution due to its speed and efficiency. Compared to traditional on-site construction, modular construction provides a higher opportunity to achieve social separation and execute safety standards because of its controlled factory setting. Modular building is an excellent option for prefabricated housing, which has seen a surge in popularity due to worries about safety and hygienic conditions in highly populated places. Digital fabrication tools and Building Information Modelling (BIM) are examples of how technology has advanced due to the necessity for remote collaboration and automation. The epidemic raised awareness of sanitation and cleanliness, which highlighted the possibilities of modular buildings for hygienic and controlled surroundings.

Latest Trends/ Developments:

The controlled factory environment leads to significant waste reduction compared to traditional construction. Precision engineering and material tracking minimize errors and overages. Modular construction offers the potential to reduce a building's embodied carbon (emissions associated with materials and construction processes). This gains importance as sustainability goals become more stringent. Designing modular buildings with end-of-life in mind is gaining traction. Components are engineered for easier disassembly, reuse, or recycling, contributing to a circular construction economy. Increasing automation in modular factories enhances precision, production speed, and safety. We're seeing the integration of advanced robotics in areas like assembly and welding. While still nascent in large-scale modular construction, 3D printing holds enormous potential. It could revolutionize the fabrication of complex modules and enable on-demand, customized production. BIM plays a crucial role in modular fabrication. It streamlines design, optimizes module coordination, and improves overall project efficiency, minimizing on-site surprises. The misconception that modular construction limits architectural expression is being shattered. Innovative architects are working with modular systems to create aesthetically striking and diverse structures. Advances in design software and fabrication processes are enabling greater customization of modular units while still maintaining efficiency gains. This caters to diverse client needs and site requirements.

Key Players:

-

Laing O'Rourke

-

Red Sea Housing

-

Atco Ltd

-

Skanska AB

-

Kleusberg GmbH

-

Bouygues Construction

-

Vinci

-

Algeco Scotsman

Chapter 1. Modular Fabrication Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Modular Fabrication Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Modular Fabrication Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Modular Fabrication Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Modular Fabrication Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Modular Fabrication Market – By Type

6.1 Introduction/Key Findings

6.2 Steel

6.3 Concrete

6.4 Wood

6.5 Hybrid Systems

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Modular Fabrication Market – By Application

7.1 Introduction/Key Findings

7.2 Residential

7.3 Commercial

7.4 Healthcare

7.5 Industrial

7.6 Hospitality

7.7 Others

7.8 Y-O-Y Growth trend Analysis By Application

7.9 Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. Modular Fabrication Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Modular Fabrication Market – Company Profiles – (Overview, Product Type Portfolio, Financials, Strategies & Developments)

9.1 Laing O'Rourke

9.2 Red Sea Housing

9.3 Atco Ltd

9.4 Skanska AB

9.5 Kleusberg GmbH

9.6 Bouygues Construction

9.7 Vinci

9.8 Algeco Scotsman

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Modular construction allows for simultaneous off-site fabrication and on-site preparation, slashing overall project timelines. Factory-controlled conditions minimize delays caused by weather, material shortages, or labor availability, issues that plague conventional construction.

Many potential clients and even some within the industry have limited knowledge of the advancements, customization possibilities, and full range of applications for modular fabrication. Setting up a modular fabrication facility requires significant initial investment, which can be a barrier to entry for smaller players.

Laing O'Rourke, Red Sea Housing, Atco Ltd, Skanska AB, Kleusberg GmbH, Bouygues Construction, Vinci, Algeco Scotsman.

North America currently holds the largest market share, estimated at around 40%.

The Asia Pacific exhibits the fastest growth, driven by its increasing population, and expanding economy.