Mobile Payments Market Size (2024 – 2030)

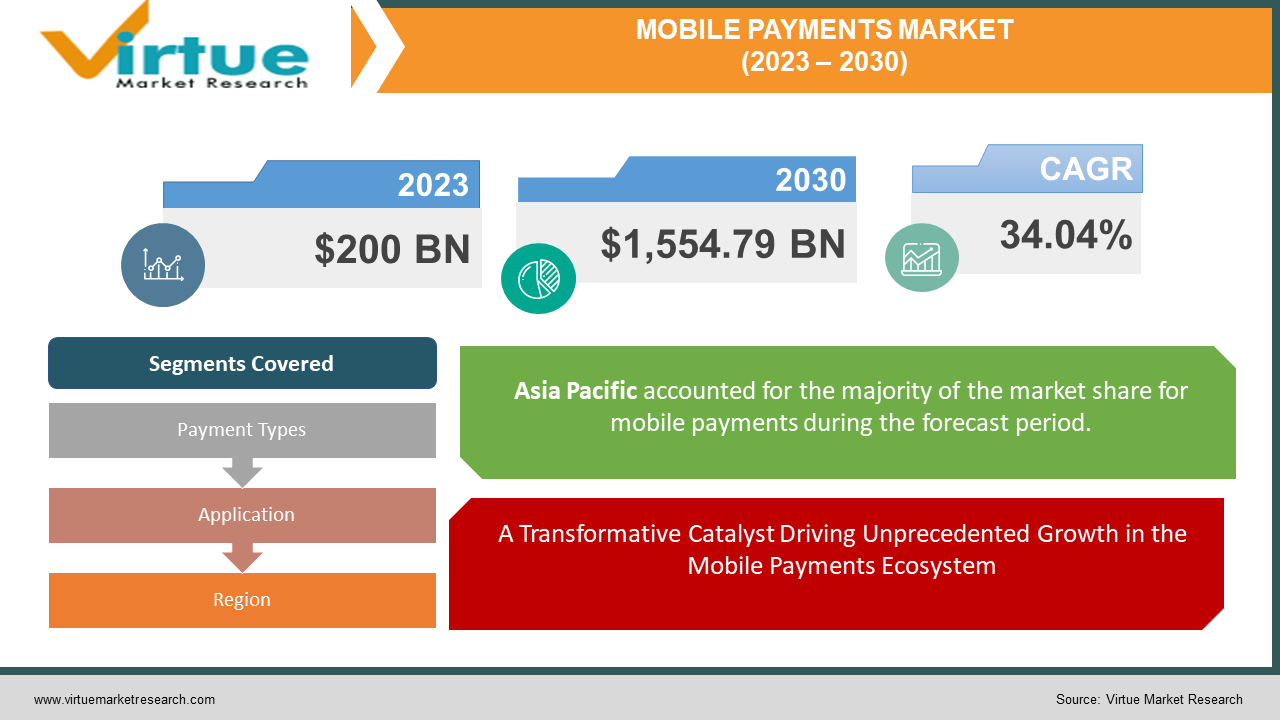

The Global Mobile Payments Market was valued at USD 200 Billion in 2023 and is projected to reach a market size of USD 1,554.79 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 34.04%.

The global mobile payments market is poised for substantial growth, driven by several key factors that reflect the evolving landscape of digital transactions. With the projected number of smartphone users worldwide expected to soar to 8.9 billion by 2025, the market is presented with an expansive user base, offering unprecedented potential for mobile payment solutions. This surge in smartphone penetration not only signifies an increase in accessibility but also establishes a foundation for the widespread adoption of digital payment methods. One of the pivotal catalysts propelling the mobile payments market forward is the flourishing e-commerce sector. Contactless payments are rapidly gaining popularity due to their inherent convenience and heightened security features. This shift in consumer behavior is fueling an increased appetite for mobile payment solutions that not only accommodate but also enhance the experience of contactless transactions. As the world embraces the efficiency and safety offered by contactless payments, the global mobile payments market is positioned to capitalize on this burgeoning trend, offering a dynamic and evolving landscape for both businesses and consumers alike.

Key Market Insights:

The global mobile payments market is on a trajectory of significant expansion, driven by the projected surge in worldwide smartphone users, estimated to reach 8.9 billion by 2025. This burgeoning user base not only signifies increased accessibility but also lays the groundwork for the widespread adoption of mobile payment solutions. In tandem, the dynamic growth of the e-commerce sector has positioned mobile wallets as pivotal players, accounting for nearly half of global e-commerce payment transactions in 2022. This symbiotic relationship between mobile payments and e-commerce underlines the integral role of digital payment solutions in the evolving retail landscape. Furthermore, the escalating demand for contactless payments, fueled by the inherent convenience and security they offer, is reshaping consumer behaviour. This shift underscores a growing appetite for mobile payment solutions that seamlessly support contactless transactions.

Three major players dominate the mobile payments landscape, each contributing significantly to the market's growth. Apple Pay, a leading mobile payment service, commands over 40% market share, offering seamless transactions through iPhones, iPads, and Apple Watches. Renowned for its convenience and security features, Apple Pay has played a pivotal role in shaping consumer preferences. Google Pay, with a substantial 25% market share, extends its reach to Android devices, fostering widespread accessibility and contributing to the overall expansion of the mobile payments market. Samsung Pay, available exclusively on Samsung Galaxy devices, holds a 15% market share, enhancing convenience for users of Samsung smartphones. Together, these three giants—Apple Pay, Google Pay, and Samsung Pay—have not only established themselves as integral players in the mobile payments arena but have also collectively fueled the industry's evolution by prioritizing user-friendly and secure payment solutions.

Mobile Payments Market Drivers:

Smartphone Penetration: A Transformative Catalyst Driving Unprecedented Growth in the Mobile Payments Ecosystem

The pervasive adoption of smartphones stands as a foundational driver for the robust growth of the mobile payments market. Projections indicate that the global number of smartphone users will soar to an unprecedented 8.9 billion by 2025. This surge, fueled by factors such as more affordable smartphone options, expanded network coverage, and heightened consumer demand for mobile devices, presents a vast and lucrative market for mobile payment solutions. As smartphones become ubiquitous, the potential applications of mobile payments for a myriad of transactions, spanning from online purchases to in-store transactions, expand exponentially.

E-commerce Boom: A Pervasive Phenomenon Redefining and Reshaping the Dynamic Landscape of the Mobile Payments Ecosystem.

The rapid evolution of e-commerce represents a formidable force propelling the mobile payments market forward. E-commerce has redefined consumer purchasing behaviors, and mobile payments have emerged as the payment method of choice for online transactions. The inherent advantages of mobile wallets, including convenience, security, and user-friendly interfaces, make them particularly appealing to the growing community of online shoppers. Notably, mobile wallets claimed a substantial 50% share of global e-commerce payment transactions in 2022, underscoring their dominance in this dynamic and evolving domain.

Contactless Payment Craze: Catalyzing a Revolution and Driving Innovative Paradigms within the Mobile Payments Ecosystem.

The surging demand for contactless payments, characterized by transactions without physical contact between payment devices, has become a pivotal driver reshaping the mobile payments landscape. Technologies like near-field communication (NFC) and radio frequency identification (RFID) have gained prominence as consumers increasingly appreciate the ease and security offered by contactless transactions. In fast-paced environments such as retail stores and public transportation, the speed and convenience of contactless payments are paramount. Mobile payments, leveraging innovations in contactless payment solutions, are at the forefront of providing consumers with a seamless and secure means of conducting transactions without the need for physical cards.

Mobile Payments Market Restraints and Challenges:

Security Concerns: Safeguarding Trust in Mobile Payments through Robust and Dynamic Security Measures.

Security emerges as a paramount concern for both discerning consumers and businesses venturing into the realm of mobile payments. The omnipresent threat of fraud, data breaches, and unauthorized access to sensitive financial information casts a looming shadow, presenting a significant challenge to the widespread adoption of mobile payment solutions. To assuage these concerns and foster trust among users, mobile payment providers find themselves compelled to make continuous investments in robust security measures. This entails the implementation of cutting-edge technologies such as encryption, multi-factor authentication, and device fingerprinting. By prioritizing the fortification of their security infrastructure, providers aim not only to address immediate apprehensions but also to establish a resilient foundation for the enduring trust of users in the mobile payment landscape.

Regulatory Compliance: Navigating the Complex Regulatory Tapestry in the Evolving Landscape of Mobile Payments.

The labyrinthine landscape of regulatory compliance poses a multifaceted challenge for mobile payment providers. Compliance with diverse data privacy, consumer protection, and financial regulations becomes imperative, with the added complexity of varying mandates across jurisdictions. Operating seamlessly across borders demands a delicate dance through this regulatory tapestry. The harmonization and streamlining of regulatory frameworks stand out as crucial imperatives, offering the potential to create an environment more conducive to the growth of mobile payments. Mobile payment providers, in their pursuit of a global presence, must navigate this intricate landscape with finesse, ensuring adherence to regulations while advocating for a more standardized and unified approach to regulatory compliance.

Interoperability Issues: Paving the Way for Seamless Experiences and a Unified Mobile Payment Ecosystem.

Interoperability, or the lack thereof, emerges as a critical hurdle in the journey towards widespread mobile payment adoption. The absence of standardized communication between different mobile payment platforms and systems introduces friction for consumers, limiting their ability to use preferred payment methods universally across merchants and service providers. Addressing this challenge requires a concerted effort from the industry to promote interoperability. By fostering collaboration and standardization among diverse players, mobile payment providers can pave the way for seamless experiences, unlocking the full potential of mobile payments on a global scale.

Mobile Payments Market Opportunities:

Expanding Presence in Emerging Markets: Capitalizing on the Mobile Payments Revolution.

The relentless expansion of mobile payments finds fertile ground in emerging markets characterized by large and burgeoning smartphone penetration. This presents a golden opportunity for mobile payment providers to extend their reach, offering individuals in these markets not just a mode of financial transaction but a gateway to comprehensive financial services. By leveraging the ubiquity of smartphones, mobile payments become a catalyst for financial inclusion, empowering individuals to actively participate in the digital economy. This strategic foray into emerging markets not only positions mobile payment providers as key players in the global financial landscape but also contributes to socioeconomic development by bridging the digital divide and fostering economic empowerment.

Unveiling Omnichannel Payment Solutions: Revolutionizing the Consumer Payment Experience.

Consumer expectations are evolving, demanding not just convenience but a seamless payment experience across a spectrum of channels – from online platforms to brick-and-mortar establishments. In response to this paradigm shift, the unveiling of omnichannel payment solutions emerges as a strategic imperative. By seamlessly integrating mobile payments into diverse channels, providers can offer consumers a unified, consistent, and hassle-free payment experience. This not only caters to the evolving preferences of the modern consumer but also positions mobile payments as the linchpin in the larger ecosystem of contemporary retail and commerce. The strategic implementation of omnichannel solutions not only meets consumer demands but also fosters customer loyalty and elevates the overall payment experience to unprecedented heights.

Harnessing Biometric Authentication: Fortifying Security in the Mobile Payments Landscape.

In the pursuit of enhancing security and reducing fraud risks, mobile payment providers are increasingly turning to the realm of biometric authentication. Technologies such as fingerprints and facial recognition are gaining traction as secure and convenient methods to verify identity in the mobile payments sphere. The strategic integration of biometric authentication into mobile payment platforms not only fortifies security measures but also aligns with the contemporary consumer preference for seamless and user-friendly authentication processes. This innovative approach not only positions mobile payments as a technologically advanced solution but also addresses critical concerns related to security, paving the way for a future where transactions are not only efficient but also impenetrably secure.

MOBILE PAYMENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

34.04% |

|

Segments Covered |

By Payment Types, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Apple Pay, Google Pay, Samsung Pay, PayPal AliPay, Amazon Pay, WeChat Pay, Stripe, Square, Adyen |

Mobile Payments Market Segmentation: By Payment Types

-

Mobile Wallets

-

Mobile Banking

-

Peer-to-Peer (P2P) Payments

Within the expansive realm of digital payments, distinct payment types carve out their significance, revealing intriguing trends in user preferences. Mobile wallets assert their dominance as the largest payment type, representing a ubiquitous and versatile tool for users to store, manage, and transact funds through their smartphones. The widespread adoption of mobile wallets is fueled by their convenience, security features, and seamless integration into everyday transactions.

Meanwhile, the fastest-growing payment type is exemplified by the meteoric rise of Peer-to-Peer (P2P) payments. This category showcases a surge in popularity, reflecting a fundamental shift in how users prefer to transfer funds directly to peers, friends, or family members. The agility and immediacy of P2P payments resonate with contemporary consumer expectations, driving its rapid growth. Together, these payment types underscore the dynamic nature of the digital payments landscape, where user behavior and technological innovations continually shape the evolution of financial transactions.

Mobile Payments Market Segmentation: By Application

-

E-commerce

-

In-store Payments

In the expansive realm of mobile applications, their diverse applications manifest in various domains, with notable distinctions in usage patterns. E-commerce stands tall as the largest domain, where mobile applications play a pivotal role in facilitating seamless online transactions. The convenience, accessibility, and user-friendly interfaces embedded in e-commerce applications contribute significantly to their widespread adoption.

On the other end of the spectrum, in-store payments emerge as the fastest-growing segment within the mobile application landscape. The surge in in-store payment applications reflects a shifting consumer preference toward leveraging mobile devices for real-time, contactless transactions at brick-and-mortar establishments. The speed of adoption in this category underscores the evolving nature of consumer behaviors, as mobile applications redefine and expedite the traditional in-store payment experience.

Mobile Payments Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia Pacific emerges as the dominant force in the global mobile payments market, commanding a substantial market share of 55% in 2023. Not only is it the largest segment, but it also claims the position of the fastest-growing segment during the forecast period, projecting an impressive Compound Annual Growth Rate (CAGR) of 22%. This robust growth underscores the region's pivotal role in shaping the trajectory of the mobile payments landscape, driven by factors such as increasing smartphone penetration, a burgeoning digital economy, and the rapid adoption of innovative payment technologies across diverse markets in the Asia Pacific region.

COVID-19 Impact Analysis on the Global Mobile Payments Market:

The COVID-19 pandemic has exerted a profound influence on the global mobile payments market, acting as a catalyst for transformative shifts and accelerating the adoption of contactless payment methods. On the positive front, the heightened emphasis on hygiene and reduced physical contact have driven increased demand for contactless payments, with mobile wallets and near-field communication (NFC) transactions experiencing a surge in popularity. The pivot towards remote work and online shopping has further propelled the growth of the mobile payments industry, as consumers increasingly turn to digital transactions. Governments worldwide actively promoted mobile payments as part of broader initiatives to reduce the handling of cash and encourage social distancing measures.

Despite these positive impacts, challenges arose as non-essential businesses temporarily shuttered, resulting in a decline in in-store mobile payment transactions. Supply chain disruptions also impacted the manufacturing and distribution of mobile payment devices. Additionally, the surge in online activity during the pandemic created opportunities for cybercriminals to target mobile payment systems, posing cybersecurity threats. However, the mobile payments market demonstrated resilience, adapting to the changing landscape. Merchants embraced mobile payment solutions, and the industry witnessed a robust expansion of acceptance. Looking ahead, key trends such as the accelerated adoption of contactless payments, the rise of omnichannel payments, increased use of mobile wallets, growing demand for P2P payments, and integration with emerging technologies are poised to shape the future of the mobile payments landscape.

Latest Trends/ Developments:

The ascent of biometric authentication marks a paradigm shift in the realm of mobile payments, introducing an innovative and secure method to verify identity. Fingerprints and facial recognition technologies are rapidly gaining traction, providing users with a seamless and convenient way to authenticate transactions. The integration of biometric authentication into mobile payment platforms not only bolsters security measures but also serves as a formidable deterrent against fraud risks. This transformative approach not only aligns with the contemporary emphasis on user convenience but also positions biometric authentication as a cornerstone in fortifying the security infrastructure of mobile payments, ensuring a robust and trustworthy ecosystem for users worldwide.

In the era of digital payments, the strategic integration of AI and ML technologies takes center stage, revolutionizing the landscape of mobile transactions. These advanced technologies serve as powerful tools to personalize mobile payment experiences, tailoring them to individual preferences and transaction patterns. AI-driven algorithms optimize payment routes, suggest relevant and preferred payment methods, and play a crucial role in fraud detection and prevention. By harnessing the power of AI and ML, mobile payment platforms evolve beyond mere transaction facilitators, becoming intuitive and adaptive systems that cater to the unique needs of users. This not only enhances the overall user experience but also positions mobile payments as a dynamic and evolving facet of the digital era, leveraging cutting-edge technologies to stay at the forefront of innovation.

Key Players:

-

Apple Pay

-

Google Pay

-

Samsung Pay

-

PayPal

-

AliPay

-

Amazon Pay

-

WeChat Pay

-

Stripe

-

Square

-

Adyen

In the dynamic landscape of mobile payments, a myriad of key players shapes the industry's trajectory, each contributing to its growth and innovation. Apple Pay, with over 40% market share, has redefined convenience and security in mobile payments for iPhone, iPad, and Apple Watch users. Google Pay, boasting a 25% market share, extends accessibility to Android users globally. Samsung Pay, capturing a 15% market share, enhances convenience for Samsung Galaxy device owners. PayPal, holding a 10% market share, facilitates seamless online and offline transactions. In China, Alipay commands a 5% market share, dominating the e-commerce payment scene. Amazon Pay gained ground, particularly in e-commerce, while WeChat Pay dominates the Chinese market integrated into the popular messaging app.

Chapter 1. Mobile Payments Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Mobile Payments Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Mobile Payments Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Mobile Payments Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Mobile Payments Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Mobile Payments Market – By Payment Types

6.1 Introduction/Key Findings

6.2 Mobile Wallets

6.3 Mobile Banking

6.4 Peer-to-Peer (P2P) Payments

6.5 Y-O-Y Growth trend Analysis By Payment Types

6.6 Absolute $ Opportunity Analysis By Payment Types, 2024-2030

Chapter 7. Mobile Payments Market – By Application

7.1 Introduction/Key Findings

7.2 E-commerce

7.3 In-store Payments

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Mobile Payments Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Payment Types

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Payment Types

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Payment Types

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Payment Types

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Payment Types

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Mobile Payments Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Apple Pay

9.2 Google Pay

9.3 Samsung Pay

9.4 PayPal

9.5 AliPay

9.6 Amazon Pay

9.7 WeChat Pay

9.8 Stripe

9.9 Square

9.10 Adyen

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Mobile Payments Market was valued at USD 200 Billion and is projected to reach a market size of USD 1,554.79 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 34.04%.

The global mobile payments market is applied in diverse applications, including e-commerce transactions, in-store payments, peer-to-peer transfers, transportation ticketing, utility bill payments, access control, digital wallets, international remittances, charitable donations, mobile banking, and point-of-sale systems.

The COVID-19 pandemic has significantly accelerated the adoption of contactless payment methods, driving growth in the global mobile payments market by fostering increased demand for secure and hygienic transactions.

Key market players include Apple Pay, Google Pay, Samsung Pay, PayPal, AliPay, Amazon Pay, WeChat Pay, Stripe, Square, Adyen, Worldpay, Visa, and Mastercard.

The primary drivers for the growth of the Global Mobile Payments Market include increasing smartphone penetration, propelled by the expected reach of 8.9 billion users by 2025, and the rising demand for contactless payments, driven by convenience and security preferences.