Mobile Games Market Size (2025-2030)

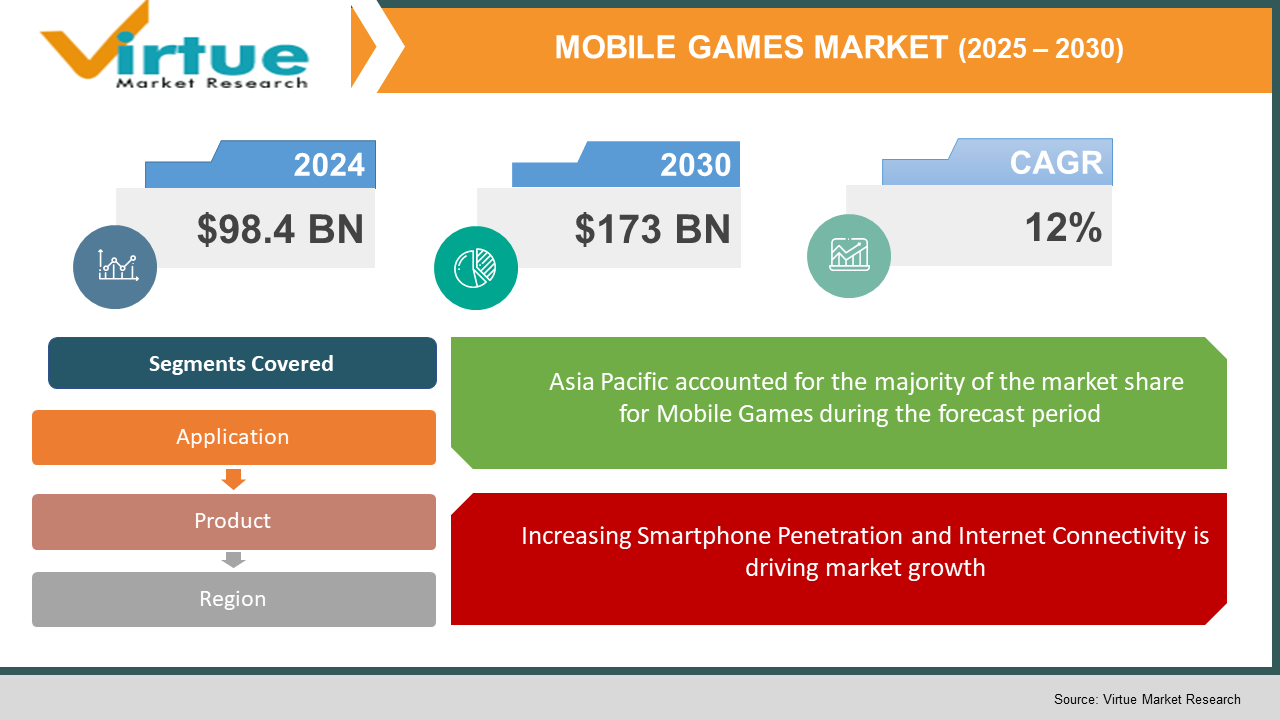

The Global Mobile Games Market was valued at USD 98.4 billion in 2024 and will grow at a CAGR of 12% from 2025 to 2030. The market is expected to reach USD 173 billion by 2030.

The mobile games market includes games played on smartphones, tablets, and other mobile devices. This sector has seen rapid growth due to the increasing penetration of smartphones, internet connectivity, and the growing popularity of mobile gaming across all age groups. Key factors driving this growth include the rise of freemium models, enhanced graphics, and immersive experiences. The mobile gaming market is expanding globally, with regions such as Asia-Pacific and North America leading the charge due to higher disposable incomes and advanced technological infrastructure.

Key Market Insights:

- The mobile games market is driven by the widespread adoption of smartphones and tablets, with over 6.8 billion mobile devices expected to be in use by 2025, contributing to higher game downloads and engagement.

- The freemium model is the most popular monetization strategy in the mobile gaming market, with over 70% of mobile games using in-app purchases as their primary revenue source.

- Cloud gaming is a growing trend, with services like Google Stadia, NVIDIA GeForce Now, and Apple Arcade enhancing the gaming experience on mobile devices through streaming and offering high-quality games without the need for powerful hardware.

- The mobile games market is increasingly attracting major gaming companies, with traditional console game developers like Sony and Microsoft investing heavily in mobile platforms.

Global Mobile Games Market Drivers:

Increasing Smartphone Penetration and Internet Connectivity is driving market growth:

The growth of the mobile games market is closely tied to the increasing penetration of smartphones and internet connectivity across the globe. As of 2024, there are over 6.8 billion smartphone users worldwide, with projections showing further growth in the coming years. More smartphones mean a larger potential user base for mobile games. The improvement in mobile networks, including the expansion of 4G and 5G infrastructure, also contributes to the accessibility and quality of mobile gaming experiences. High-speed internet access allows for smoother gameplay, quicker downloads, and the ability to play online multiplayer games without latency issues. This connectivity also facilitates in-app purchases and microtransactions, key components of mobile game monetization models. Additionally, mobile data plans have become more affordable, enabling a wider range of players from various income brackets to access games without worrying about expensive data costs.

Shift in Consumer Behavior and Increased Entertainment Consumption is driving market growth: The shift in consumer behavior has been a significant driver for the mobile games market. As more consumers choose entertainment options that are convenient, portable, and affordable, mobile games have become the go-to form of gaming for a large portion of the global population. The growth of the gaming industry is no longer limited to hardcore gamers; casual players, women, and older demographics are increasingly involved. Mobile games offer an easy entry point for these groups, as they don't require expensive hardware or long play sessions. This shift in entertainment consumption, combined with social media platforms’ influence and mobile advertising, has resulted in an explosion of free-to-play and easy-to-access mobile games. Mobile games are also becoming a significant part of the entertainment portfolio, with people preferring to play during commutes, breaks, or even at home for relaxation.

Freemium and In-App Purchase Models is driving market growth: The freemium model has been one of the most successful monetization strategies in the mobile games market, making it accessible to a broader audience. In this model, mobile games are offered for free to download, but players are encouraged to make in-game purchases for virtual goods, premium content, or extra lives. This business model is highly effective, as it encourages users to try the game without any upfront cost, with the possibility of making purchases down the line. Freemium games rely on compelling gameplay and engaging mechanics to keep players coming back. Over time, as players become more invested in a game, they are more likely to spend money on upgrades or additional content. This approach has proven to be highly lucrative, with top-grossing mobile games generating billions of dollars through in-app purchases. The continued success of freemium and microtransaction-based models ensures that mobile gaming remains financially viable for developers, fueling further innovation and expansion in the market.

Global Mobile Games Market Challenges and Restraints:

Increasing Competition in the Mobile Gaming Industry is restricting market growth: The mobile games market is highly competitive, with millions of games available across app stores like Google Play and Apple’s App Store. New entrants face significant challenges in gaining visibility among a plethora of existing games. As a result, user acquisition costs can be high, and developers may struggle to attract and retain players. Additionally, the growing number of indie game developers has intensified competition for limited attention in the market. While the barriers to entry are relatively low, standing out in a crowded marketplace requires considerable marketing investments and user retention strategies. Larger gaming companies with established fanbases can more easily dominate, while smaller developers may find it harder to compete unless they offer something truly unique. This oversaturation of the market can result in smaller players struggling to generate consistent revenue streams or sustain long-term profitability.

Regulatory Challenges and Data Privacy Concerns is restricting market growth: As the mobile games market expands globally, it faces increasing scrutiny from regulators concerning data privacy and consumer protection. Many mobile games collect large amounts of user data, including personal information, gameplay data, and payment details. While this data collection is crucial for personalizing user experiences and enabling in-app purchases, it raises privacy concerns, especially among younger players. In recent years, governments in regions like the European Union and the United States have introduced stringent data privacy regulations, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), requiring companies to protect consumer data. Additionally, mobile games that involve gambling-like mechanics, such as loot boxes, have faced regulatory pushback. The legal framework for mobile gaming is still evolving, and developers must navigate various local laws, which could lead to compliance costs and market access restrictions in certain regions.

Market Opportunities:

The global mobile games market continues to present vast opportunities for growth, innovation, and expansion. As internet connectivity improves and the penetration of mobile devices increases, new user bases are emerging in developing regions, including Africa, Southeast Asia, and parts of Latin America. The growing middle class and improved mobile internet infrastructure are driving mobile gaming adoption in these regions. Additionally, mobile game developers are increasingly targeting diverse demographics, including women and older age groups, which have traditionally been underserved by the gaming industry. This trend opens up opportunities to design and develop mobile games that cater to a broader range of preferences, including puzzle games, simulation games, and educational content. The integration of new technologies such as augmented reality (AR), virtual reality (VR), and artificial intelligence (AI) in mobile games offers exciting prospects for the industry. Games using AR and VR technologies are able to offer more immersive and interactive experiences, pushing the boundaries of traditional mobile gaming. For example, AR games like Pokémon Go have seen massive success, demonstrating the potential for integrating location-based gaming and real-world experiences into mobile platforms. As AI continues to evolve, it can be used to create more sophisticated, personalized gaming experiences, improving user engagement and retention. Additionally, cloud gaming services are rapidly emerging as a game-changing trend in the industry. With the growth of services like Google Stadia, Nvidia GeForce Now, and Xbox Cloud Gaming, mobile gamers can access high-quality games without needing powerful hardware. Cloud gaming allows mobile players to enjoy console-quality graphics and experiences directly on their devices, making it a compelling offering for gaming enthusiasts. As 5G technology expands, cloud gaming will benefit from faster speeds and reduced latency, further enhancing the mobile gaming experience. Overall, the mobile gaming market is set to continue its strong growth trajectory, fueled by technological advancements, expanding user bases, and the integration of new, engaging gaming experiences.

MOBILE GAMES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

20235- 2030 |

|

CAGR |

12% |

|

Segments Covered |

By Application, product,and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Tencent, Activision Blizzard, King, Niantic, Epic Games, and Supercell. |

Mobile Games Market Segmentation:

Mobile Games Market Segmentation By Product:

- Action Games

- Adventure Games

- Puzzle Games

- Sports Games

- Role-Playing Games (RPG)

- Simulation Games

- Strategy Games

- Other Games

The action games segment dominates the mobile gaming market, contributing to the highest share of total market revenue. This segment attracts a broad user base due to the excitement and fast-paced nature of action games, with popular titles like PUBG Mobile and Call of Duty Mobile continuing to perform well. These games are especially popular in regions like North America and Asia-Pacific, with their high player engagement and in-app purchases driving the market's overall growth.

Mobile Games Market Segmentation By Application:

- Smartphones

- Tablets

Smartphones dominate the mobile gaming market, accounting for a significant share of the revenue. The widespread use of smartphones and the constant technological advancements in mobile hardware have made smartphones the preferred device for mobile gaming. With a larger screen size, better performance, and improved battery life, smartphones offer an optimal gaming experience. Tablets also contribute significantly, but smartphones remain the primary device for mobile gamers due to their portability and functionality.

Mobile Games Market Regional Segmentation:

• North America

• Asia-Pacific

• Europe

• South America

• Middle East and Africa

The Asia-Pacific region is the dominant region in the global mobile games market, accounting for over 50% of the total market share. This region benefits from a large and growing population of mobile gamers, particularly in countries such as China, Japan, and South Korea, where gaming is a deeply ingrained part of the culture. The increasing adoption of smartphones and affordable mobile internet plans further accelerates the growth of mobile gaming in this region. Additionally, the presence of major mobile game developers and publishers, coupled with a strong gaming ecosystem, ensures that Asia-Pacific remains the largest and most lucrative region for mobile game sales and revenue generation. The growth of mobile e-sports in countries like China and South Korea is also contributing significantly to the market expansion in this region.

COVID-19 Impact Analysis on the Mobile Games Market:

The COVID-19 pandemic had a profound impact on the global mobile games market. As countries implemented lockdowns and people stayed at home, the demand for digital entertainment surged. Mobile gaming saw a significant increase in downloads, player engagement, and in-app purchases as people sought new forms of entertainment during the isolation period. With traditional entertainment venues closed, mobile games became a primary source of leisure for millions of people worldwide. Social distancing and work-from-home arrangements further fueled this trend, as players had more free time to spend on mobile games. The pandemic also led to an increase in the popularity of multiplayer games and mobile e-sports. Games like Fortnite and PUBG Mobile saw massive spikes in active users, and mobile e-sports tournaments became more prominent, drawing larger audiences. Many developers capitalized on the increased demand by launching new games and updating existing titles with fresh content to maintain player interest. Despite the initial surge, the long-term impact of COVID-19 on the mobile gaming market remains to be seen. As restrictions ease and people return to their pre-pandemic routines, it is expected that the growth rate of mobile games may normalize. However, the increased habit of mobile gaming during the pandemic has laid the foundation for continued growth in the sector, with many players likely to continue their gaming habits even after the pandemic ends.

Latest Trends/Developments:

The global mobile games market is experiencing several trends and developments that are reshaping the industry. One of the most significant trends is the integration of advanced technologies such as augmented reality (AR), virtual reality (VR), and artificial intelligence (AI) into mobile games. Games like Pokémon Go have shown the immense potential of AR technology in creating immersive experiences. This trend is expected to grow further as developers experiment with new ways to incorporate AR features into mobile gameplay, particularly with the advent of 5G technology, which enables faster speeds and enhanced AR experiences. Another trend gaining traction is cloud gaming, which allows players to stream high-quality games without the need for expensive hardware. This shift in gaming infrastructure is expected to revolutionize the mobile gaming experience, with players able to access console-quality games on their mobile devices. Major companies such as Google, Microsoft, and Nvidia are leading the way in cloud gaming services, offering seamless mobile gaming experiences. Moreover, mobile e-sports has emerged as a significant trend, with mobile gaming tournaments attracting large audiences and offering substantial cash prizes. This has led to a new wave of professional mobile gamers and has further legitimized mobile gaming as a competitive sport. The integration of social media and streaming platforms such as Twitch and YouTube also plays a key role in the growth of mobile e-sports. These developments show that the mobile games market is evolving rapidly, with technological innovations and new entertainment formats pushing the boundaries of what’s possible on mobile devices.

Key Players:

- Tencent

- Activision Blizzard

- Electronic Arts (EA)

- King

- Niantic

- Epic Games

- Supercell

- Zynga

- NetEase Games

- Gameloft

Chapter 1. MOBILE GAMES MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. MOBILE GAMES MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. MOBILE GAMES MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. MOBILE GAMES MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. MOBILE GAMES MARKET- LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. MOBILE GAMES MARKET – By Product

6.1 Introduction/Key Findings

6.2 Action Games

6.3 Adventure Games

6.4 Puzzle Games

6.5 Sports Games

6.6 Role-Playing Games (RPG)

6.7 Simulation Games

6.8 Strategy Games

6.9 Other Games

6.10 Y-O-Y Growth trend Analysis By Product

6.11 Absolute $ Opportunity Analysis By Product, 2025-2030

Chapter 7. MOBILE GAMES MARKET – By Application

7.1 Introduction/Key Findings

7.2 Smartphones

7.3 Tablets

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. MOBILE GAMES MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Product

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Product

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Product

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Product

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Product

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. MOBILE GAMES MARKET– Company Profiles – (Overview, Type Portfolio, Financials, Strategies & Developments)

9.1 Tencent

9.2 Activision Blizzard

9.3 Electronic Arts (EA)

9.4 King

9.5 Niantic

9.6 Epic Games

9.7 Supercell

9.8 Zynga

9.9 NetEase Games

9.10 Gameloft

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global mobile games market was valued at USD 98.4 billion in 2024 and is expected to reach USD 173 billion by 2030.

Key drivers include increasing smartphone penetration, enhanced internet connectivity, freemium models, and technological advancements like AR and cloud gaming.

The market is segmented by product (action games, adventure games, RPG, etc.) and application (smartphones, tablets).