Mixed Tocopherols Market Size (2025-2030)

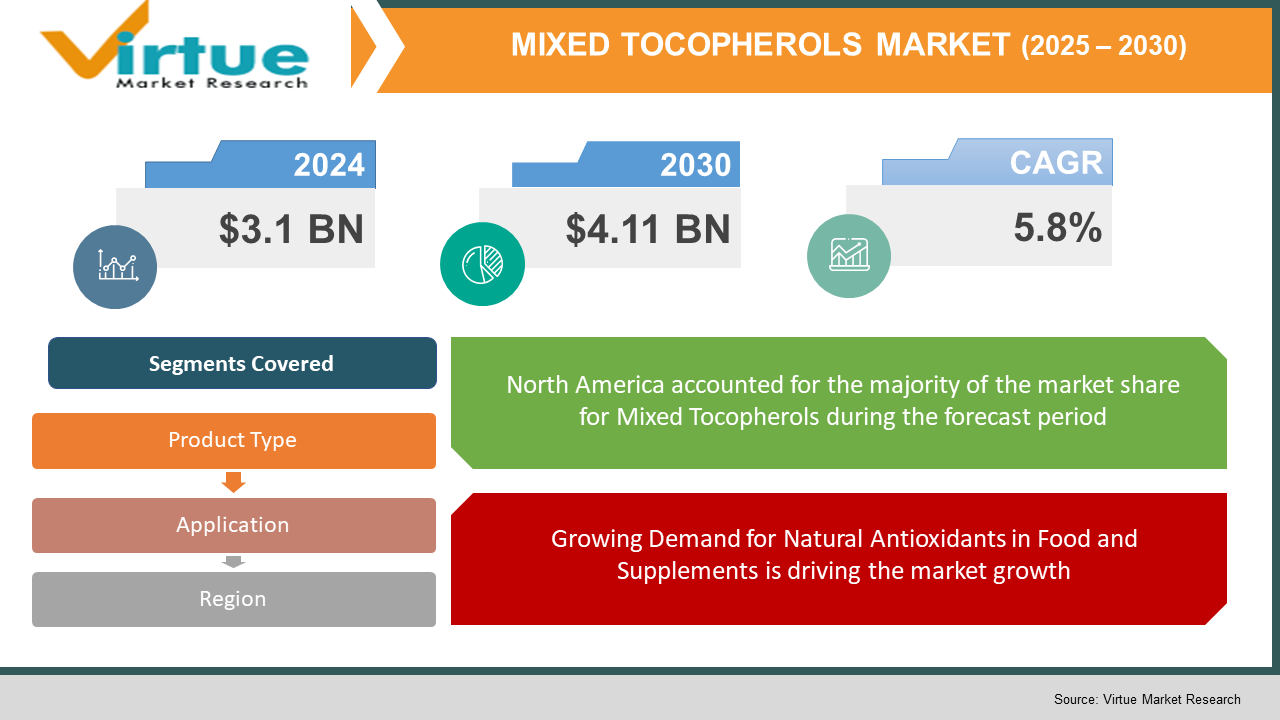

The Global Mixed Tocopherols Market was valued at USD 3.1 billion in 2024 and will grow at a CAGR of 5.8% from 2025 to 2030. The market is expected to reach USD 4.11 billion by 2030.

Mixed tocopherols are a combination of naturally occurring vitamin E compounds, including alpha, beta, gamma, and delta tocopherols, widely used as antioxidants in food, dietary supplements, pharmaceuticals, and cosmetics. Increasing consumer awareness about the health benefits of tocopherols, such as their role in preventing oxidative stress and supporting cardiovascular health, is driving market growth. The rising demand for natural antioxidants over synthetic alternatives, coupled with the growing preference for clean-label and organic products, is fueling the expansion of the mixed tocopherols market. The expanding nutraceuticals industry and the inclusion of tocopherols in functional foods and animal feed further contribute to market development.

Key Market Insights:

- The dietary supplements segment accounts for over 35% of the total mixed tocopherols demand, with growing consumer preference for natural vitamin E supplements.

- Gamma-tocopherol holds the largest market share due to its superior antioxidant properties, widely used in food preservation and health supplements.

- North America and Europe together contribute over 60% of the global mixed tocopherols consumption, driven by high awareness of health and wellness products.

- The cosmetics industry is incorporating mixed tocopherols in skincare and anti-aging formulations, with a 7% annual growth in demand from the personal care sector.

- The demand for plant-based tocopherols sourced from sunflower and soybean oil has increased by 20% due to rising concerns over synthetic antioxidants.

- The growing pet food industry is incorporating mixed tocopherols as natural preservatives, with a 15% increase in their use in premium pet food products.

Global Mixed Tocopherols Market Drivers

Growing Demand for Natural Antioxidants in Food and Supplements is driving the market growth

Consumers are increasingly preferring natural antioxidants over synthetic additives like butylated hydroxytoluene (BHT) and butylated hydroxyanisole (BHA). Mixed tocopherols, derived from plant-based sources such as soybean oil and sunflower oil, are widely used in food preservation and dietary supplements due to their safety and health benefits. They help extend the shelf life of food products by preventing oxidation and are commonly found in cereals, dairy products, and processed meats. The rising demand for functional foods and dietary supplements enriched with vitamin E is a major driver for the mixed tocopherols market. Additionally, regulatory bodies worldwide are pushing for clean-label ingredients, further boosting their adoption in food formulations.

Expanding Nutraceutical and Pharmaceutical Applications is driving the market growth

The increasing awareness of the health benefits associated with tocopherols is driving their demand in the nutraceutical and pharmaceutical industries. Mixed tocopherols are known for their role in reducing oxidative stress, improving cardiovascular health, and supporting immune function. With the rising incidence of chronic diseases such as heart disease, neurodegenerative disorders, and diabetes, the demand for tocopherol-enriched supplements has surged. Additionally, ongoing research on tocopherols’ anti-inflammatory and neuroprotective properties is opening new avenues in pharmaceutical applications. The shift toward preventive healthcare and dietary supplementation is further driving the growth of this segment.

Growth in the Cosmetics and Personal Care Industry is driving the market growth

The cosmetics industry is witnessing increasing incorporation of mixed tocopherols in skincare and haircare products due to their anti-aging and skin-protective properties. Tocopherols act as natural antioxidants that help protect the skin from oxidative damage caused by free radicals and UV exposure. They are commonly found in moisturizers, anti-aging creams, sunscreens, and hair serums. The growing consumer preference for organic and natural beauty products has further propelled the demand for tocopherol-based formulations. With rising disposable incomes and the expanding global beauty industry, the use of mixed tocopherols in personal care products is expected to grow significantly.

Global Mixed Tocopherols Market Challenges and Restraints

Fluctuations in Raw Material Availability and Pricing is restricting the market growth

Mixed tocopherols are primarily sourced from vegetable oils such as soybean and sunflower oil. The production and pricing of these oils are subject to fluctuations due to factors like climate change, agricultural yield, and geopolitical events. Any disruption in the supply of raw materials can impact tocopherol availability and pricing, affecting manufacturers' profit margins. Additionally, the increasing competition for plant-based raw materials in the biofuel and food industries can further strain the supply chain, posing a challenge for consistent production and pricing.

Regulatory Challenges and Labeling Restrictions is restricting the market growth

The mixed tocopherols market is subject to stringent regulations regarding food and pharmaceutical ingredients. Regulatory bodies such as the FDA, EFSA, and other global agencies impose strict guidelines on tocopherol content, labeling, and permissible usage limits in food and supplements. Compliance with these regulations requires significant investment in quality control and testing, making it challenging for small-scale manufacturers to enter the market. Additionally, variations in regulatory approvals across different regions can create hurdles in product commercialization and market expansion.

Market Opportunities

The increasing consumer shift toward clean-label and natural products presents a significant opportunity for the mixed tocopherols market. As regulatory bodies phase out synthetic antioxidants in food and cosmetics, manufacturers are actively seeking natural alternatives, positioning mixed tocopherols as an ideal solution. Additionally, the expansion of the vegan and plant-based food industry is creating new opportunities for tocopherol-enriched formulations. Growing R&D investments in the pharmaceutical sector are also unlocking potential applications in neurodegenerative disease treatments. With increasing awareness of the health benefits of tocopherols, innovative product launches, and strategic partnerships, the market is poised for significant growth in the coming years.

MIXED TOCOPHEROLS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.8% |

|

Segments Covered |

By Product Type, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF, DSM Nutritional Products, ADM, DuPont, Zhejiang Medicine Co., Ltd. |

Mixed Tocopherols Market Segmentation

Mixed Tocopherols Market Segmentation By Product Type:

- Alpha-Tocopherol

- Beta-Tocopherol

- Gamma-Tocopherol

- Delta-Tocopherol

The most dominant segment in the mixed tocopherols market is gamma-tocopherol, as it offers superior antioxidant properties compared to other forms. Gamma-tocopherol is widely used in food preservation, dietary supplements, and cosmetics due to its ability to neutralize free radicals and prevent oxidative damage. Its increasing adoption in functional foods and pharmaceuticals has further solidified its market dominance.

Mixed Tocopherols Market Segmentation By Application:

- Food & Beverages

- Dietary Supplements

- Pharmaceuticals

- Cosmetics

- Animal Feed

The most dominant application segment is dietary supplements, driven by the rising demand for vitamin E-enriched health supplements. Consumers are increasingly turning to tocopherol-based supplements to support heart health, boost immunity, and improve skin and hair health. The growing focus on preventive healthcare and the rise in chronic diseases have further fueled the demand for tocopherol-fortified supplements.

Mixed Tocopherols Market Regional Segmentation:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

North America is the dominant region in the mixed tocopherols market, accounting for the largest market share. The high consumer awareness regarding dietary supplements, functional foods, and natural cosmetics has driven demand in the region. The presence of leading nutraceutical and pharmaceutical companies, coupled with strong retail distribution networks, further supports market growth. Additionally, regulatory support for clean-label and natural ingredients has accelerated the adoption of tocopherol-based formulations in food and personal care industries.

COVID-19 Impact Analysis on the Mixed Tocopherols Market

The COVID-19 pandemic exerted a profound and multifaceted influence on the mixed tocopherols market, initiating with substantial disruptions to global supply chains and a consequential scarcity of raw material availability. These initial setbacks posed significant challenges for manufacturers and distributors, creating a period of instability within the market. However, this phase of disruption was swiftly followed by a notable surge in consumer awareness and concern regarding health and immunity, which directly translated into an amplified demand for vitamin E supplements and antioxidant-rich foods. This heightened focus on preventative healthcare solutions catalyzed a significant upswing in sales within the dietary supplements sector, as individuals sought to bolster their immune systems and overall well-being. Simultaneously, the pandemic accelerated the pre-existing trend of online shopping, resulting in a substantial increase in e-commerce sales of natural beauty products. This surge in online retail directly benefited the cosmetics industry, driving a corresponding rise in the demand for tocopherols, which are widely utilized for their antioxidant and skin-protecting properties. Consumers, confined to their homes and increasingly reliant on online platforms, discovered and embraced the benefits of tocopherol-enriched skincare and beauty products. Moreover, the long-term impact of the COVID-19 pandemic has solidified and reinforced consumer preferences for health-oriented and natural products, creating a lasting shift in market dynamics. This enduring focus on wellness and natural ingredients has provided a sustained impetus for the growth of the mixed tocopherols market, as consumers continue to prioritize products that support their health and well-being. The pandemic, while initially disruptive, ultimately acted as a catalyst, accelerating existing trends and reshaping the market landscape in favor of mixed tocopherols.

Latest Trends/Developments

The contemporary food and wellness industries are experiencing a notable surge in the utilization of tocopherols, primarily driven by their vital role in plant-based and vegan food formulations. Tocopherols, a family of vitamin E compounds, are increasingly being incorporated into these products due to their potent antioxidant properties, which help to extend shelf life and maintain product quality by preventing lipid oxidation. This is particularly crucial for plant-based alternatives, which often rely on unsaturated fats that are susceptible to degradation. Concurrently, there's a significant growth in sustainable and organic tocopherol production methods, reflecting a broader consumer and industry commitment to environmental responsibility. This shift involves employing eco-friendly extraction techniques and sourcing tocopherols from sustainable crops, minimizing the environmental footprint associated with their production. The focus on organic production further aligns with the rising demand for clean-label products, catering to consumers who prioritize natural and ethically sourced ingredients. Beyond food applications, the expansion of tocopherol applications in neuroprotective and anti-aging products is gaining considerable traction. Scientific research is increasingly highlighting the potential of tocopherols in mitigating oxidative stress and inflammation, key factors in neurodegenerative diseases and the aging process. This has led to the development of innovative formulations, including dietary supplements and topical skincare products, that leverage the neuroprotective and anti-aging benefits of tocopherols. The ability of tocopherols to combat free radicals and support cellular health makes them a valuable ingredient in these applications, addressing the growing consumer interest in proactive health and wellness solutions. The confluence of these trends—increased use in vegan foods, sustainable production, and applications in neuroprotective products—underscores the growing importance of tocopherols in both the food and wellness sectors. As consumers become increasingly aware of the health benefits and seek sustainable product options, the demand for tocopherols is expected to continue its upward trajectory.

Key Players:

- BASF

- DSM Nutritional Products

- Archer Daniels Midland (ADM)

- DuPont

- Zhejiang Medicine Co., Ltd.

- Wilmar International

- BTSA Biotechnologías Aplicadas

Chapter 1. MIXED TOCOPHEROLS MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. MIXED TOCOPHEROLS MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. MIXED TOCOPHEROLS MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. MIXED TOCOPHEROLS MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. MIXED TOCOPHEROLS MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. MIXED TOCOPHEROLS MARKET – By Product Type

6.1 Introduction/Key Findings

6.2 Alpha-Tocopherol

6.3 Beta-Tocopherol

6.4 Gamma-Tocopherol

6.5 Delta-Tocopherol

6.6 Y-O-Y Growth trend Analysis By Product Type

6.7 Absolute $ Opportunity Analysis By Product Type , 2025-2030

Chapter 7. MIXED TOCOPHEROLS MARKET – By Application

7.1 Introduction/Key Findings

7.2 Food & Beverages

7.3 Dietary Supplements

7.4 Pharmaceuticals

7.5 Cosmetics

7.6 Animal Feed

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. MIXED TOCOPHEROLS MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Product Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Product Type

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Product Type

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Product Type

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Product Type

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. MIXED TOCOPHEROLS MARKET – Company Profiles – (Overview, Packaging Product Type Portfolio, Financials, Strategies & Developments)

9.1 BASF

9.2 DSM Nutritional Products

9.3 Archer Daniels Midland (ADM)

9.4 DuPont

9.5 Zhejiang Medicine Co., Ltd.

9.6 Wilmar International

9.7 BTSA Biotechnologías Aplicadas

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Mixed Tocopherols Market was valued at USD 3.1 billion in 2024 and will grow at a CAGR of 5.8% from 2025 to 2030. The market is expected to reach USD 4.11 billion by 2030.

Rising demand for natural antioxidants, increasing dietary supplement consumption, and growth in the cosmetics industry.

By product type (alpha, beta, gamma, delta tocopherols) and by application (food, dietary supplements, pharmaceuticals, cosmetics, animal feed).

North America, due to high consumer awareness and strong demand for dietary supplements and functional foods

BASF, DSM Nutritional Products, ADM, DuPont, Zhejiang Medicine Co., Ltd.