Mixed Signal IC Market Size (2025 – 2030)

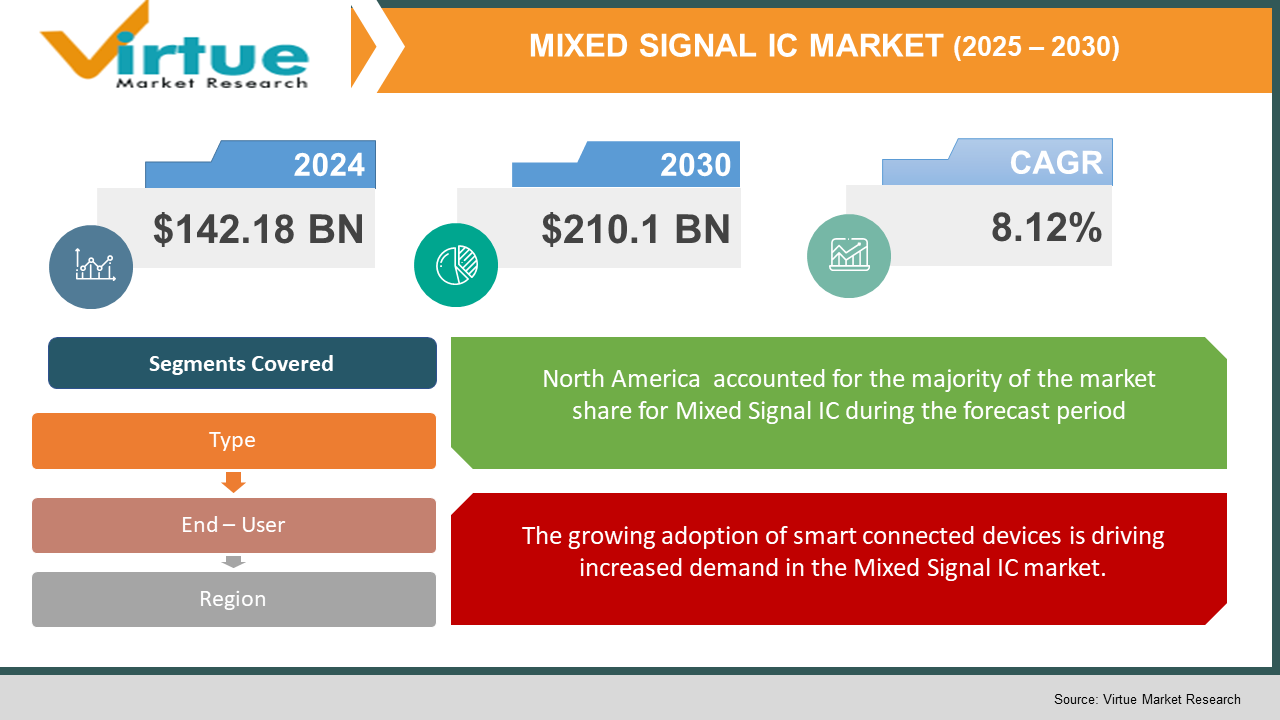

The Mixed Signal IC Market was valued at USD 142.18 billion and is projected to reach a market size of USD 210.1 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 8.12%.

For the highly integrated, complex operation of digital devices, mixed-signal integrated circuits (ICs) incorporate analog and digital circuitry on a single semiconductor die. To transform analog data streams into electronic signals, it uses data converters. It is regarded as an essential part of the frequency modulation (FM) tuners found in media players that have digital amplifiers integrated into them. Currently, some of the widely accessible mixed-signal integrated circuits (ICs) worldwide are digital radio chips, signal converters, delta-sigma modulation converters, and error detection and correction chips. The need for power-efficient and high-performance solutions in consumer electronics is pushing manufacturers to adopt mixed-signal ICs, thereby driving market expansion.

Key Market Insights:

- According to a 2023 survey by Deloitte, over 60% of semiconductor companies are investing in mixed-signal ICs to enable 5G, IoT, and AI-driven applications, accelerating industry adoption.

- Asia-Pacific dominates the market, with over 40% share in 2023, led by China, Taiwan, and South Korea, due to strong semiconductor manufacturing capabilities and high demand for consumer electronics.

- Over 75% of next-gen automotive electronics now integrate mixed-signal ICs, particularly in ADAS, infotainment, and EV battery management systems, driving significant demand growth.

- Medical electronics and remote healthcare applications have driven a 25% rise in mixed-signal IC adoption, particularly in AI-powered diagnostic tools and wearable health monitors.

- Startups and semiconductor giants are investing in chiplet-based mixed-signal IC designs, allowing for scalable and modular architectures to meet the diverse requirements of modern applications.

Mixed Signal IC Market Drivers:

The growing adoption of smart connected devices is driving increased demand in the Mixed Signal IC market.

The demand for mixed-signal ICs is surging as industries transition towards smart, connected devices powered by advanced semiconductor technologies. 5G deployment and IoT expansion are significantly boosting demand for mixed-signal ICs, which are essential for handling both analog and digital signals efficiently. Smart home devices, wearables, and industrial automation solutions rely on mixed-signal ICs to optimize power consumption, improve signal processing, and enhance device performance. Additionally, the growing automotive electronics sector, particularly electric vehicles (EVs) and autonomous driving, is driving innovation in power management ICs and sensor interface solutions. Tesla, Rivian, and traditional automakers are heavily investing in semiconductor technologies to develop advanced driver-assistance and infotainment systems. Governments worldwide are also funding semiconductor manufacturing projects to reduce dependency on imports and ensure a stable chip supply chain, further fuelling market expansion.

With Advancements in the AI sector, there is an increasing demand for AI-powered computing devices that rely on mixed-signal ICs. The latest gaming technology also involves Mixed-Signal ICs.

The increasing adoption of AI-powered edge computing devices is another major driver of the mixed-signal IC market. These chips enable low-latency processing and real-time decision-making, making them essential for smart factories, 6G communication, and medical wearables. Additionally, next-generation gaming consoles and augmented reality (AR) applications require advanced mixed-signal ICs for high-speed data transmission and enhanced user experiences. As industries push towards miniaturization and energy efficiency, mixed-signal ICs are evolving to offer higher integration, lower power consumption, and improved thermal management, making them a key enabler of future technological advancements. In addition, the healthcare and medical technology sector is leveraging mixed-signal ICs for next-gen imaging systems, portable diagnostic devices, and AI-powered patient monitoring solutions. Wearable health devices now incorporate bio-sensing mixed-signal chips to track vital signs, detect anomalies in real-time, and enable remote healthcare delivery. The integration of wireless communication and edge AI in medical applications is further driving demand for power-efficient, compact mixed-signal IC solutions. As industries increasingly focus on miniaturization, low power consumption, and high-speed connectivity, mixed-signal ICs are evolving to support multi-functional integration, advanced process nodes, and AI-driven optimizations, making them an essential component in the future of the smart technology ecosystem.

Mixed Signal IC Market Restraints and Challenges

R&D in this market is expensive, and as the technology becomes more complex, it is difficult to integrate with devices, moreover, geopolitical tensions threaten Supply chains.

Despite strong growth, the mixed-signal IC market faces challenges such as high design complexity, integration issues, and rising fabrication costs. Developing mixed-signal ICs requires advanced manufacturing processes, increasing R&D expenses and time-to-market delays. Additionally, supply chain disruptions in semiconductor raw materials, exacerbated by geopolitical tensions and chip shortages, impact production capabilities. The industry also faces competition from digital and RF-based signal processing solutions, which are gaining traction in high-speed communication applications. Counterfeit and low-quality ICs flooding the market pose another significant challenge, affecting brand reputation and product reliability. Furthermore, regulatory restrictions on semiconductor exports in countries like the U.S. and China are disrupting global trade dynamics, limiting the growth potential of certain players.

Mixed Signal IC Market Opportunities:

The expanding demand for AI-driven devices, automotive automation, and high-speed networking presents immense opportunities for mixed-signal IC manufacturers. The 5G and 6G revolution will require high-performance analog-digital converters (ADCs) and digital-to-analog converters (DACs), creating new avenues for growth. In the healthcare sector, the rise of remote patient monitoring devices and AI-powered diagnostic tools is increasing the need for low-power, high-accuracy mixed-signal ICs. Additionally, the shift towards autonomous robots and smart factories is opening up new opportunities in industrial automation and precision control systems. Emerging technologies like quantum computing and neuromorphic processors also present untapped potential for specialized mixed-signal IC solutions.

MIXED SIGNAL IC MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

8.12% |

|

Segments Covered |

By Type, end user, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Texas Instruments, Analog Devices, NXP Semiconductors, Infineon Technologies, STMicroelectronics, Broadcom Inc., ON Semiconductor, Renesas Electronics, Maxim Integrated, Qualcomm |

Mixed Signal IC Market Segmentation:

Mixed Signal IC Market Segmentation: By Type

- Mixed Signal SOC

- Microcontroller

- Data Converter

The Mixed-Signal System-on-Chip (SoC) segment dominates the market due to its high integration capabilities, combining analog and digital components into a single chip. These SoCs are widely used in consumer electronics, automotive applications, and IoT devices, enabling efficient power management, wireless connectivity, and signal processing. With industries moving towards AI-driven automation and edge computing, demand for mixed-signal SoCs is growing rapidly, particularly in 5G infrastructure, medical devices, and autonomous vehicles.

The Microcontroller (MCU) and Data Converter segments are also experiencing strong growth. Microcontrollers, which integrate processors, memory, and input/output interfaces, are critical in applications such as industrial automation, smart home devices, and wearable technology. Meanwhile, data converters, including Analog-to-Digital Converters (ADCs) and Digital-to-Analog Converters (DACs), play a crucial role in telecommunications, sensor-based systems, and medical imaging. As demand for real-time data processing and AI-driven analytics rises, these segments are expected to see sustained market expansion.

Mixed Signal IC Market Segmentation: By End – User

- Healthcare

- Electronics

- Automotive

- Telecommunications

The healthcare sector is increasingly adopting mixed-signal ICs for advanced medical devices, including patient monitoring systems, imaging equipment, and wearable health trackers. These ICs enable real-time data processing and energy-efficient operation, making them essential for portable and implantable medical devices.

Consumer electronics, such as smartphones, AR/VR headsets, and home automation systems, rely on mixed-signal ICs for seamless analog and digital signal conversion. In the automotive sector, the shift towards electric vehicles (EVs) and advanced driver assistance systems (ADAS) is driving demand for high-performance mixed-signal chips. These ICs power critical functions such as battery management, radar systems, and infotainment controls, making them indispensable for next-generation vehicle technologies.

Mixed Signal IC Market Segmentation: By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

North America is a key player in the mixed-signal IC market, driven by high R&D investments and the presence of leading semiconductor companies. The demand for AI-driven edge computing, 5G infrastructure, and EV adoption is accelerating market growth. Similarly, Europe is experiencing increased adoption of mixed-signal ICs in automotive, industrial automation, and telecommunications. Government initiatives supporting green energy and smart manufacturing further contribute to market expansion.

Asia Pacific dominates the mixed-signal IC market due to its strong consumer electronics, automotive, and telecom industries. Countries like China, Japan, South Korea, and India are major manufacturing hubs, fueling demand for high-performance ICs. South America and the Middle East & Africa are witnessing gradual adoption, with increasing investments in 5G, IoT, and industrial automation, opening new market opportunities.

COVID-19 Impact Analysis on the Mixed Signal IC Market:

The COVID-19 pandemic had mixed effects on the mixed-signal IC market. The initial phase saw supply chain disruptions, factory shutdowns, and chip shortages, leading to delayed shipments and higher prices. However, the rapid digital transformation accelerated demand for consumer electronics, cloud computing, and remote working technologies, boosting mixed-signal IC sales. Telemedicine, smart wearables, and AI-driven diagnostic devices saw increased adoption, further driving demand. Post-pandemic, industries have ramped up semiconductor investments, focusing on resilient supply chains and localized manufacturing to prevent future disruptions. Government initiatives such as the CHIPS Act (USA) and Europe's semiconductor strategy are supporting local chip fabrication and R&D, ensuring a steady supply of high-performance mixed-signal ICs. The market has now entered a high-growth phase, fueled by 5G expansion, automotive electrification, and AI integration.

Trends/Developments:

Automotive OEMs are increasingly integrating high-performance mixed-signal ICs for autonomous driving, EV battery management, and in-car connectivity. Companies like NXP, STMicroelectronics, and Renesas are launching automotive-grade solutions to cater to this growing demand.

AI-powered mixed-signal ICs are emerging for real-time data processing in edge computing, smart sensors, and IoT applications. Startups and tech giants are investing in neuromorphic computing chips for ultra-low-power applications.

Semiconductor foundries like TSMC, GlobalFoundries, and Intel are expanding mixed-signal IC production to support 5G infrastructure, industrial automation, and next-gen communication systems.

Key Players:

- Texas Instruments

- Analog Devices

- NXP Semiconductors

- Infineon Technologies

- STMicroelectronics

- Broadcom Inc.

- ON Semiconductor

- Renesas Electronics

- Maxim Integrated

- Qualcomm

Chapter 1. MIXED SIGNAL IC MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. MIXED SIGNAL IC MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. MIXED SIGNAL IC MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. MIXED SIGNAL IC MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. MIXED SIGNAL IC MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. MIXED SIGNAL IC MARKET – By Type

6.1 Introduction/Key Findings

6.2 Mixed Signal SOC

6.3 Microcontroller

6.4 Data Converter

6.5 Y-O-Y Growth trend Analysis By Type

6.6 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. MIXED SIGNAL IC MARKET – By End – User

7.1 Introduction/Key Findings

7.2 Healthcare

7.3 Electronics

7.4 Automotive

7.5 Telecommunications

7.6 Y-O-Y Growth trend Analysis By End – User

7.7 Absolute $ Opportunity Analysis By End – User , 2025-2030

Chapter 8. MIXED SIGNAL IC MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By End – User

8.1.3. By Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Type

8.2.3. By End – User

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Type

8.3.3. By End – User

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Type

8.4.3. By End – User

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Type

8.5.3. By End – User

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. MIXED SIGNAL IC MARKET – Company Profiles – (Overview, Packaging Type Type Portfolio, Financials, Strategies & Developments)

9.1 Texas Instruments

9.2 Analog Devices

9.3 NXP Semiconductors

9.4 Infineon Technologies

9.5 STMicroelectronics

9.6 Broadcom Inc.

9.7 ON Semiconductor

9.8 Renesas Electronics

9.9 Maxim Integrated

9.10 Qualcomm

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market is expanding due to rising demand for AI-powered edge computing, 5G infrastructure, automotive electronics, and IoT devices. Increased miniaturization, power efficiency, and high-performance integration are also fueling adoption.

Major industries using mixed-signal ICs include consumer electronics, healthcare, automotive, telecommunications, and industrial automation. The rise of smart factories, EVs, and wearable medical devices is increasing demand

AI is driving demand for mixed-signal ICs in real-time processing applications, edge computing, and predictive analytics. AI-powered chips are enhancing efficiency in autonomous vehicles, robotics, and smart devices.

Asia Pacific leads due to its dominance in semiconductor manufacturing, automotive production, and consumer electronics. North America and Europe follow, driven by R&D investments and industrial automation

Key trends include 6G development, AI-driven chip design, energy-efficient processors, and increasing use in augmented reality (AR) and virtual reality (VR) applications.