Mirrorless Camera Market Size (2024 –2030)

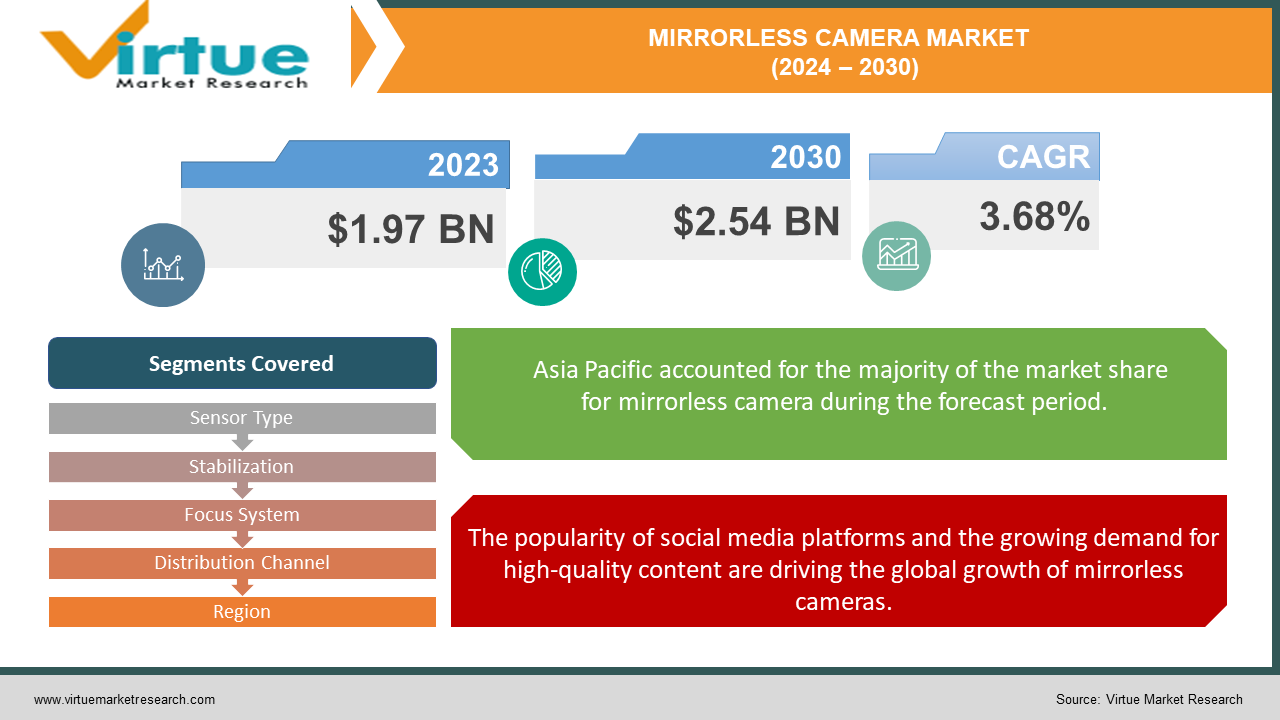

The Global Mirrorless Camera Market was estimated at USD 1.97 Billion in 2023 and is anticipated to have a value of USD 2.54 Billion by 2030, growing at a fast CAGR of 3.68% during the forecast period 2024-2030.

With innovative designs and cutting-edge technology, the camera industry has undergone significant change. Mirrorless cameras are rapidly gaining popularity because they are lighter, faster, and smaller than conventional DSLR cameras. They are a user favorite because of their unique design, which helps capture more detail. The market for mirrorless cameras is expanding rapidly due to changes in people's lifestyles and rising incomes. Professionals and amateurs alike can now easily acquire these cameras, simplifying the process of photography. To improve their product offerings, stay competitive in the market, and develop new and cutting-edge products, companies are also heavily investing in research and development.

Key Market Insights:

- Due to their affordability, small size, and appeal to hobbyists and amateur photographers, entry-level mirrorless cameras makeup approximately 55% of the market share of mirrorless cameras overall.

- Around 30% of the world's demand for mirrorless cameras comes from the Asia-Pacific area, where the growing popularity of photography as a hobby, rising disposable incomes, and a sizable population are to blame.

- APS-C (crop sensor) mirrorless cameras account for about 65% of the market share in terms of sensor size, offering a compromise between portability, affordability, and image quality when compared to full-frame mirrorless cameras.

- The need for professional-grade performance in a small form factor is driving the adoption of mirrorless cameras with advanced features like advanced autofocus systems, high-resolution electronic viewfinders (EVFs), and in-body image stabilization (IBIS), which is growing at a rate of about 15% annually.

Global Mirrorless Camera Market Drivers:

The popularity of social media platforms and the growing demand for high-quality content are driving the global growth of mirrorless cameras.

The increasing demand for superior content, particularly for social media platforms, is propelling the sales of mirrorless cameras. Because of their sophisticated features, which include rapid autofocus, fast frame rates, and superb video quality, these cameras are well-liked by content creators. Additionally, they feature interchangeable lenses that let users adjust to various circumstances and produce original images and videos. Mirrorless cameras are anticipated to become more and more in demand as the need for high-quality content increases.

Global sales of mirrorless cameras are being driven by the explosive growth in online retail sales.

Mirrorless camera sales are increasing due to the growing popularity of online retailers such as Amazon, Flipkart, and Alibaba, as well as increased internet access. The global mirrorless camera market is expanding because camera manufacturers are also establishing strategic alliances with online retailers.

The market for mirrorless cameras is growing thanks to developments in sensor technology.

The global market for mirrorless cameras is growing rapidly due to ongoing developments in sensor technology and the camera industry. Leading camera companies are spending money on R&D to expand their product line and include the newest technologies. In the upcoming years, mirrorless cameras should provide even better performance and image quality as the industry continues to develop.

Unlock Market Insights: Get A FREE Sample Report Today!

Mirrorless Camera Market Challenges and Restraints:

The high cost for consumers is one of the main problems facing the global mirrorless camera market. Because mirrorless cameras have more sophisticated features than DSLRs, they are typically more expensive. Despite the entry of new manufacturers and models, the high price may put off buyers, slowing the growth of the market. The subpar battery life of mirrorless cameras is another factor impeding their growth. Because mirrorless cameras' advanced features are electronic and wireless, they use more battery power. Consequently, their battery life is lower than that of other products on the market.

Mirrorless Camera Market Opportunities:

There are many opportunities for innovation and growth in the mirrorless camera market. By advancing the technology that powers cameras, such as the sensors and focusing mechanisms, manufacturers can produce better cameras. Companies can create customized features for various user groups, such as travelers and vloggers, who have varying needs for these cameras. Selling these cameras is a great idea in regions like Asia-Pacific and Latin America where people are starting to have more money and use the Internet more frequently.

Additionally, since more people are making purchases online, businesses can sell their cameras online as well. Companies are also able to produce the lenses and bags that people desire as accessories for their cameras. Environmentally friendly camera manufacturing is becoming more and more important, allowing manufacturers to use recyclable materials and create energy-efficient cameras. Camera manufacturers can improve cameras, reach a wider audience, and protect the environment by implementing all of these strategies.

MIRRORLESS CAMERA MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.68% |

|

Segments Covered |

By Sensor Type, Stabilization, Focus System, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Sony, Nikon, Panasonic, Canon, Fujifilm, Olympus Leica, Pentax, Samsung, Hasselblad |

CUSTOMIZE THIS FULL REPORT AS PER YOUR NEEDS

Segmentation Analysis

Global Mirrorless Camera Market - By Sensor Type:

-

CMOS sensor

-

Exor CMOS

-

Back-illuminated CMOS

-

X Trans CMOS

-

Dual Pixel CMOS

CMOS sensors were the most widely used type of sensor in mirrorless cameras in 2023, dominating the market. They have excellent video and picture-capturing features. Because Exor CMOS sensors have more pixels than traditional CMOS sensors, they stand out for producing images with higher resolution. In addition, because of their special qualities and abilities, other sensor types like X-Trans CMOS and back-illuminated CMOS are becoming more and more well-liked in various market niches.

Global Mirrorless Camera Market - By Stabilization:

-

Lens Based

-

Sensor Based

Lens-based cameras are predicted to rule the market in 2023 since manufacturers prefer them. It is common practice to reduce blurriness in photos and videos by using lens-based stabilization. This widely used technology is integrated into the lens of the camera. In contrast, sensor-based stabilization minimizes blur from camera shake by integrating into the camera body. Most mirrorless cameras use a combination of lens- and sensor-based stabilization systems; some models use both to produce higher-quality and more sophisticated images and videos.

Global Mirrorless Camera Market - By Focus System:

-

Phase Detection autofocus

-

Contrast detection autofocus

Phase detection autofocus (PDAF) uses particular pixels on the image sensor to adjust the focus based on how far away the subject is from the camera. Because most high-end mirrorless cameras use PDAF technology for fast and accurate autofocus performance, it held the largest market share in 2023. On the other hand, contrast detection autofocus, or CDAF, chooses the focus point by contrasting the contrast in various areas of the picture. Research and development in the field of autofocus technology is expected to continue to be crucial as the market for mirrorless cameras expands. Autofocus technology has a lot of unrealized potential.

Global Mirrorless Camera Market – By Distribution Channel:

-

Online

-

Offline

The offline market segment held the largest market share for mirrorless cameras in 2023 and is predicted to grow at a steady rate between 2024 and 2030. This is a result of the growing number of retail establishments across the globe. Nonetheless, the online market is anticipated to expand quickly as well, propelled by the surge in internet traffic and the acceptance of e-commerce websites. Consequently, it is anticipated that during the forecast period, the online segment will grow at the fastest rate.

What's Next for Your Market? Get a Snapshot with FREE Sample Report

Global Mirrorless Camera Market - By Region:

-

North America

-

Europe

-

Asia Pacific

-

Middle East and Africa

-

South America

The Asia Pacific region accounted for the largest share of the mirrorless camera market in 2023. Leading producers like Sony, Fujifilm, and Panasonic as well as a sizable community of photography enthusiasts are to blame for this. Because of the growing need for more compact, portable camera systems and the rising acceptance of mirrorless cameras among professional photographers in these areas, North America and Europe are also anticipated to be major markets for mirrorless cameras.

COVID-19 Impact on the Global Mirrorless Camera Market:

The COVID-19 pandemic caused a dramatic downturn in the camera industry. Travel bans and company closures altered consumer purchasing patterns, upsetting the supply chain and leading to a shortage of chips and raw materials. Due to the delays in launching new products, the market grew more slowly in the first part of 2020. But as regulations relaxed, the market rebounded thanks to the introduction of cutting-edge full-frame mirrorless cameras. Technology is always evolving, and this has altered the dynamics of the market. It is anticipated that the trend of vlogging and content creation for both educational and entertainment purposes will accelerate market growth. Because they produce excellent photos and are lightweight, portable, and travel-friendly, mirrorless cameras are in great demand. In the upcoming years, their popularity is probably going to keep rising.

Latest Trend/Development:

There are tons of innovations and trends in the mirrorless camera market right now. To produce sharper images and faster focusing, companies are improving the technology inside cameras, such as sensors and autofocus systems. Manufacturers are reducing the size and weight of cameras without sacrificing quality because consumers demand them to be light and portable.

Additionally, vloggers and travelers will benefit from new features like improved video recording and simple smartphone sharing. These days, cameras are becoming more intelligent and can connect to phones and other devices to facilitate sharing and control. Additionally, they are employing more environmentally friendly materials and are becoming more eco-friendly. Mirrorless cameras are becoming even more adaptable and user-friendly as a result of all these changes, meeting the various needs of photographers and videographers.

Key Players:

-

Sony

-

Nikon

-

Panasonic

-

Canon

-

Fujifilm

-

Olympus

-

Leica

-

Pentax

-

Samsung

-

Hasselblad

Market News:

-

Canon India unveiled the EOS R8 and EOS R50, two brand-new mirrorless cameras, in February 2023. The EOS R50, which has replaced the EOS M50 Mark II, is a lightweight, portable, and entry-level APS-C mirrorless camera with creative tools and automated features for vloggers that make creating high-quality content simple.

-

The flagship camera in Fujifilm India's X Series mirrorless camera lineup, the X-T5, was introduced in December 2022.

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Chapter 1. Mirrorless Camera Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Mirrorless Camera Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Mirrorless Camera Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Mirrorless Camera Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Mirrorless Camera Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Mirrorless Camera Market – By Sensor Type

6.1 Introduction/Key Findings

6.2 CMOS sensor

6.3 Exor CMOS

6.4 Back-illuminated CMOS

6.5 X Trans CMOS

6.6 Dual Pixel CMOS

6.7 Y-O-Y Growth trend Analysis By Sensor Type

6.8 Absolute $ Opportunity Analysis By Sensor Type, 2024-2030

Chapter 7. Mirrorless Camera Market – By Stabilization

7.1 Introduction/Key Findings

7.2 Lens Based

7.3 Sensor Based

7.4 Y-O-Y Growth trend Analysis By Stabilization

7.5 Absolute $ Opportunity Analysis By Stabilization, 2024-2030

Chapter 8. Mirrorless Camera Market – By Focus System

8.1 Introduction/Key Findings

8.2 Phase Detection autofocus

8.3 Contrast detection autofocus

8.4 Y-O-Y Growth trend Analysis End-Use Industry

8.5 Absolute $ Opportunity Analysis End-Use Industry, 2024-2030

Chapter 9. Mirrorless Camera Market – By Distribution Channel

9.1 Introduction/Key Findings

9.2 Online

9.3 Offline

9.4 Y-O-Y Growth trend Analysis End-User

9.5 Absolute $ Opportunity Analysis End-User, 2024-2030

Chapter 10. Mirrorless Camera Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Sensor Type

10.1.2.1 By Stabilization

10.1.3 By Focus System

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Sensor Type

10.2.3 By Stabilization

10.2.4 By Focus System

10.2.5 By Distribution Channel

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Sensor Type

10.3.3 By Stabilization

10.3.4 By Focus System

10.3.5 By Distribution Channel

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Sensor Type

10.4.3 By Stabilization

10.4.4 By Focus System

10.4.5 By Distribution Channel

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Sensor Type

10.5.3 By Stabilization

10.5.4 By Focus System

10.5.5 By Distribution Channel

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Mirrorless Camera Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Sony

11.2 Nikon

11.3 Panasonic

11.4 Canon

11.5 Fujifilm

11.6 Olympus

11.7 Leica

11.8 Pentax

11.9 Samsung

11.10 Hasselblad

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Mirrorless Camera Market was esteemed at USD 1.97 Billion in 2023 and is projected to USD 2.54 Billion by 2030, growing at a fast CAGR of 3.68% during the forecast period 2024-2030.

The Global Mirrorless Camera Market is majorly driven by the growing demand for High-Quality Content and the surge in social media usage.

The Segments under the Global Mirrorless Camera Market by the distribution channel are Online and Offline modes.

China, Japan, and South Korea are the most dominating countries in the Asia-Pacific region for the Global Mirrorless Camera Market.

Sony, Nikon, and Fujifilm are the three major leading players in the Global Mirrorless Camera Market.