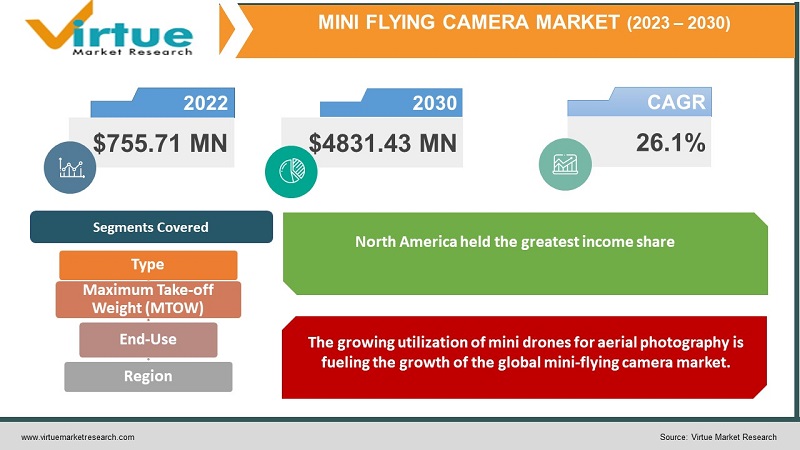

Global Mini Flying Camera Market Size (2023-2030)

In 2022, the Global Mini Flying Camera Market was valued at $755.71 Million and is projected to reach a market size of $4831.43 Million by 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 26.1%.

A mini flying camera, frequently known as a miniature drone, is an unmanned aerial vehicle (UAV) compact and small enough to be man-portable. They arrive in different sizes and shapes, resembling quadcopters and octocopters, and their characteristic of compactness allows them to effortlessly fit in the palm of a hand. Mini drones have limited features and are popular among beginners exploring drone technology. They are affordable contrasted to larger drones and are often used indoors. Mini drone regulations contrast from nation to nation, with weight constraints ranging from less than 2 kg in Canada to less than 25 kg in the United States and the European Union.

Mini drones have several advantages that make them a preferred choice for buyers. Their modest pricing of as little as USD 20 makes them accessible to a vast range of consumers. Mini drones are easy to control owing to their user-friendly design and simple controller pads, enabling even beginners to operate them effortlessly. They are suitable for indoor usage and require basic instructions. Additionally, mini drones are versatile and can be used for various purposes beyond recreation. They are durable and less prone to damage, providing beginners with a forgiving learning experience.

Global Mini Flying Camera Market Drivers:

The growing utilization of mini drones for aerial photography is fueling the growth of the global mini-flying camera market.

The utilization of drones in cinematography, real estate, sports photography, and journalism is driving the market forward. Drones have transformed several sectors by providing a low-cost alternative to pricey equipment such as helicopters and cranes. Their ability to capture footage in fast-paced action scenes, sci-fi sequences, and aerial perspectives simplifies the cinematography process. Additionally, the aerial capabilities of drones have found applications in real estate and sports photography, enabling unique and captivating shots. Journalists are also recognizing the value of drones for gathering footage and information during live broadcasts. Therefore, this factor propels the demand for mini-flying cameras.

The rising demand for mini drones for search and rescue operations is another factor contributing to the growth of the global mini-flying camera market.

The integration of thermal sensors in drones has emerged as a significant market driver. These sensors enable drones to possess night vision capabilities, making them highly efficient for surveillance applications. Their ability to locate missing individuals and distressed victims, especially in harsh terrains and adverse weather conditions, has created a growing demand. Additionally, drones equipped with thermal sensors can deliver essential supplies to inaccessible areas in war-torn or disaster-stricken regions. This involves providing stranded victims with supplies like walkie-talkies, GPS locators, medications, food, clothing, and water until rescue crews can safely evacuate them. The utilization of drones in search and rescue operations has proven to be a valuable asset, demonstrating their critical role in aiding emergency response efforts and addressing challenging scenarios.

Global Mini Flying Camera Market Challenges:

The global mini-flying camera market is encountering challenges, primarily in terms of stringent drone regulations. The increasing utilization of mini drones in civilian applications has led to the implementation of laws and regulations by governments in developed economies to protect important areas. However, the rapid advancement of drone technology has outpaced the ability of policymakers to keep up. Different countries have complex airspace regulations for mini drones, with some embracing drone usage for recreation and safety monitoring, while others have stricter rules. For instance, in the US, recreational drone pilots must pass the TRUST test, while commercial pilots need a Remote Pilot Certificate. In India, registration on the digital sky platform is required, and in Canada, pilots must follow the CARs and carry a valid certificate. Thus, these challenges inhibit the growth of the global mini-flying camera market.

Global Mini Flying Camera Market Opportunities:

Technological advancements present a lucrative opportunity in the global mini-flying camera market. Latest advancements in UAVs have led to quicker, longer-range, and more sophisticated surveillance capabilities. These improvements are attributed to the development of smaller and more versatile UAS through size, weight, and power optimization. The integration of autonomous flight, extended flight times, stabilization technology, and high-quality HDMI ports has sparked increased interest in drones. Defense manufacturers have even created mini-drones capable of autonomous and lethal operations. The ability to control these drones with smartphones further enhances their appeal. Consequently, the demand for miniature drones is anticipated to experience significant growth in the foreseeable period.

COVID-19 Impact on the Global Mini Flying Camera Market:

The outbreak of the COVID-19 pandemic substantially impacted the global mini-flying camera market. The pandemic caused disruptions in supply chains and distribution of goods and services, which highly affected the sales of miniature drones. These factors negatively impacted the growth of the global mini-flying camera market. However, to minimize transportation times and reduce the risk of infection, miniature drones were utilized for sample pick-up and delivery as well as transportation of medical supplies. Another application of mini drones was aerial spraying to disinfect potentially contaminated public areas. Additionally, drones were utilized for monitoring and guiding public spaces during lockdowns and quarantine periods. These measures aimed to enhance safety and prevent the spread of infections in various settings. These factors positively impacted the market's growth. Therefore, the global mini-flying camera market experienced both challenges and opportunities during the difficult time of the COVID-19 pandemic.

Global Mini Flying Camera Market Recent Developments:

- In December 2022, The UK Ministry of Defence (MOD) awarded Lockheed Martin UK, a subsidiary of the American aerospace and defense company Lockheed Martin, a GBP 129 million contract to replace its current mini uncrewed aerial systems (MUAS) with advanced devices. These avant-garde devices are specially designed for distant target detection and identification and are scheduled to be operational by the end of 2024.

- In December 2022, Shenzhen DJI Sciences and Technologies Ltd., frequently known as DJI, introduced the latest addition to its growing line-up of drones, the DJI Mini 3. This new model, which is the non-pro version of the Mini 3 Pro released earlier, aims to provide an even more accessible option for those interested in aerial photography.

- In October 2021, Autel Robotics introduced the EVO Nano and EVO Lite drone series, targeting pilots of varying skill levels. The EVO Nano, known for its lightweight design, is an excellent choice for beginners owing to its impressive capabilities. On the other hand, the EVO Lite is a bigger drone equipped with cutting-edge features, hardware, and a versatile array of applications, making it ideal for pilots at an intermediate level.

MINI FLYING CAMERS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

26.15% |

|

Segments Covered |

By Type, Maximum Take-off Weight (MTOW), End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Shenzhen Hubsan Technology Co., Ltd. (China), Autel Robotics (United States), Aarav Unmanned Systems Pvt. Ltd. (India), Dedrone Holdings (United States), Skylark Drones (India), DroneAcharya Aerial Innovations Ltd. (India), PrecisionHawk (United States), Flyability SA (Switzerland) |

Global Mini Flying Camera Market Segmentation:

Global Mini Flying Camera Market Segmentation: By Type

- Fixed-Wing

- Hybrid-Wing

- Rotary-Wing

Based on the type, the global mini-flying camera market is segmented into fixed-wing, hybrid-wing, and rotary-wing. In 2022, the fixed-wing segment held the highest market share. The growth can be attributed to rising demand for fixed-wing drones owing to their long endurance, mobility, and efficiency. Fixed-wing miniature drones primarily utilize vertical take-off and landing (VTOL) capabilities, making them energy-efficient, adaptable, and highly maneuverable. This is a key factor propelling the growth of the market. Furthermore, fixed-wing drones possess the capability to cover vast distances, operate over long ranges, and sustain prolonged hovering, all of which play a significant role in driving their market growth.

Global Mini Flying Camera Market Segmentation: By Maximum Take-off Weight (MTOW)

- Below 5 Kg

- 5-25 Kg

- Above 25 Kg

Based on the maximum take-off weight (MTOW), the global mini-flying camera market is segmented into below 5 Kg, 5-25 Kg, and above 25 Kg. In 2022, the below 5 Kg segment held the highest market share. The growth can be attributed to the extensive utilization of less than 5 Kg drones during the pandemic owing to their ability to sanitize and disinfect areas. Miniature drones proved useful in delivering fire control aids, emergency food supplies, and medical resources to different countries. In agriculture, miniature UAVs are utilized for precision farming tasks such as irrigation, pesticide spraying, and seeding. These various use cases of miniature drones have driven the global demand for mini-flying cameras.

Global Mini Flying Camera Market Segmentation: By End-Use

- Consumer

- Commercial & Civil

- Military & Defense

Based on the end-use, the global mini-flying camera market is segmented into consumer, commercial and civil, and military and defense. In 2022, the military and defense segment held the highest market share. The growth can be attributed to the augmented demand for military operations such as intelligence and surveillance operations in several nations. Mini drones are extensively utilized for military surveillance purposes owing to their compact size. These drones are purposely devised to be small so that they can easily navigate through narrow spaces without drawing significant attention. Their small wings enable them to enter rooms through windows with minimal noise. Consequently, they hold significant value for conducting surveillance and carrying out covert operations, particularly in military and intelligence contexts.

Global Mini Flying Camera Market Segmentation: By Region

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

The region of North America dominated the global mini-flying camera market in the year 2022. The growing utilization of miniature drones for military, logistic aid, and surveillance applications, the rising adoption of miniature drones for disaster management, search and rescue, and weather forecast applications, and the presence of strong research and development ecosystem, including universities, research institutions, and technology companies, in nations, such as the United States and Canada are some of the factors propelling the region's growth. Additionally, North America is home to several significant market players, including Autel Robotics, Dedrone Holdings, PrecisionHawk, Teledyne FLIR LLC, and 3D Robotics, Inc.

The region of Asia-Pacific is anticipated to expand at the quickest rate over the forecast period owing to the rising demand for precision farming, crop monitoring, and aerial photography, the increasing government initiatives and defense expenditure in response to terrorism in nations, such as India, China, and Japan, and the strong presence of major market players, including Shenzhen DJI Sciences and Technologies Ltd., Shenzhen Hubsan Technology Co., Ltd., and Aarav Unmanned Systems Pvt. Ltd.,

Global Mini Flying Camera Market Key Players:

- Shenzhen Hubsan Technology Co., Ltd. (China)

- Autel Robotics (United States)

- Aarav Unmanned Systems Pvt. Ltd. (India)

- Dedrone Holdings (United States)

- Skylark Drones (India)

- DroneAcharya Aerial Innovations Ltd. (India)

- PrecisionHawk (United States)

- Flyability SA (Switzerland)

Chapter 1. MINI FLYING CAMERA MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. MINI FLYING CAMERA MARKET – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 – 2030

2.3.2. Impact on Supply – Demand

Chapter 3. MINI FLYING CAMERA MARKET – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. MINI FLYING CAMERA MARKET - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. MINI FLYING CAMERA MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. MINI FLYING CAMERA MARKET - By Type

6.1. Fixed-Wing

6.2. Hybrid-Wing

6.3. Rotary-Wing

Chapter 7. MINI FLYING CAMERA MARKET - By Maximum Take-off Weight (MTOW)

7.1. Below 5 Kg

7.2. 5-25 Kg

7.3. Above 25 Kg

Chapter 8. MINI FLYING CAMERA MARKET - By End-User

8.1. Consumer

8.2. Commercial & Civil

8.3. Military & Defense

Chapter 9. MINI FLYING CAMERA MARKET – By Region

9.1. North America

9.2. Europe

9.3.The Asia Pacific

9.4.Latin America

9.5. Middle-East and Africa

Chapter 10. MINI FLYING CAMERA MARKET– Company Profiles – (Overview, Product Portfolio, Financials, Developments)

10.1. Shenzhen Hubsan Technology Co., Ltd. (China)

10.2. Autel Robotics (United States)

10.3. Aarav Unmanned Systems Pvt. Ltd. (India)

10.4. Dedrone Holdings (United States)

10.5. Skylark Drones (India)

10.6. DroneAcharya Aerial Innovations Ltd. (India)

10.7. PrecisionHawk (United States)

10.8. Flyability SA (Switzerland)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

In 2022, the Global Mini Flying Camera Market was valued at $755.71 Million and is projected to reach a market size of $4831.43 Million by 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 26.1%.

The Global Mini Flying Camera Market Drivers are the growing utilization of mini drones for aerial photography and the rising demand for mini drones for search and rescue operations.

Based on the Type, the Global Mini Flying Camera Market is segmented into Fixed-Wing, Hybrid-Wing, and Rotary-Wing.

The United States is the most dominating country in the region of North America for the Global Mini Flying Camera Market

Shenzhen DJI Sciences and Technologies Ltd., Shenzhen Hubsan Technology Co., Ltd., and Autel Robotics are the leading players in the Global Mini Flying Camera Market