Mineral Processing Equipment Market Size (2024 – 2030)

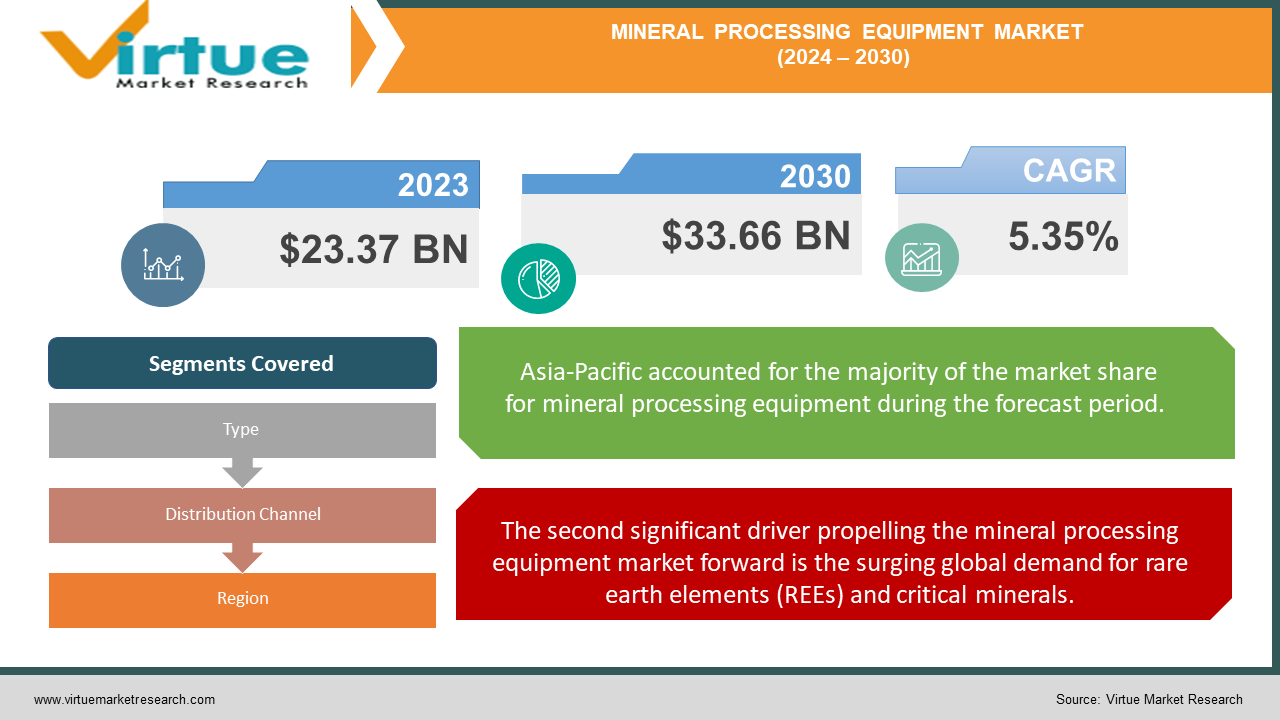

The Global Mineral Processing Equipment Market was valued at USD 23.37 Billion in 2023 and is projected to reach a market size of USD 33.66 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.35%.

The mineral processing equipment market stands as a cornerstone of the global mining and metallurgical industries, playing a pivotal role in the extraction and refinement of valuable minerals from raw ores. This market encompasses a diverse array of machinery and technologies designed to transform mined materials into marketable mineral products through various physical and chemical processes. At its core, the mineral processing equipment market is driven by the ever-growing global demand for metals, minerals, and other geological resources. As urbanization and industrialization continue to surge worldwide, the need for processed minerals in the construction, manufacturing, and technology sectors intensifies, propelling the market forward. The landscape of this market is characterized by its complexity and technological sophistication. Equipment ranges from massive crushers and grinders that reduce ore size to intricate flotation cells that separate minerals based on their surface properties, to advanced filtration and drying systems that prepare the final product for market. Each piece of equipment represents a crucial link in the mineral processing chain, contributing to the efficiency and effectiveness of the overall operation.

Key Market Insights:

- The demand for mineral processing equipment in North America constitutes around 15% of the global market.

- The adoption rate of automation in mineral processing equipment is over 40%.

- The average lifespan of mineral processing equipment is estimated to be between 10 to 15 years.

- Around 70% of mining companies have integrated digital technologies in their mineral processing operations.

- The market for refurbished mineral processing equipment is growing at a rate of 5% annually.

- The mineral processing equipment maintenance cost accounts for about 8% of the total operational costs in mining.

- The energy consumption of mineral processing equipment represents about 20% of the total energy use in mining operations.

- Over 25% of the new mineral processing equipment installations are aimed at improving environmental sustainability.

- More than 30% of the market is driven by the need for equipment upgrades and replacements.

- The usage of water in mineral processing has been reduced by 15% due to the adoption of new equipment technologies.

Mineral Processing Equipment Market Drivers:

The mineral processing equipment market is experiencing a profound transformation driven by rapid technological advancements and the integration of Industry 4.0 principles.

The idea of smart mining is at the forefront of this technological revolution. Equipment used in mineral processing is no longer seen as isolated pieces of machinery but rather as linked parts of a more sophisticated system. A new paradigm in equipment design and operation is being created by the combination of big data analytics, artificial intelligence, and Internet of Things (IoT) sensors. Data on several operational parameters is provided in real-time by IoT sensors that are integrated into mineral processing equipment. With these sensors, one may gain unparalleled insights into the minute-by-minute performance of processing circuits, ranging from the chemical composition of flotation cell froth to the wear and tear on crusher linings. Operators can quickly make well-informed choices and optimize procedures to enhance mineral recovery and minimize waste thanks to this continuous stream of data.

The second significant driver propelling the mineral processing equipment market forward is the surging global demand for rare earth elements (REEs) and critical minerals.

A set of seventeen metallic elements with similar chemical properties known as rare earth elements have become essential to contemporary technology. REEs are essential to many high-tech applications, ranging from wind turbines and military gear to cell phones and electric cars. Similarly, vital minerals like lithium, cobalt, and graphite are needed for the rapidly expanding renewable energy and electric car industries. The need for these components is rising as the world moves toward digital economies and greener technology. Exploration and development of new mining projects centered on REEs, and essential minerals are being driven by this expanding demand. These elements do, however, frequently exist in complicated mineralogies and low concentrations, creating particular difficulties for extraction and processing. The equipment and methods used in conventional mineral processing are frequently insufficient for effectively extracting these important minerals.

Mineral Processing Equipment Market Restraints and Challenges:

The mining industry's cyclical nature is one of the main obstacles facing the market for mineral processing equipment. Global commodity prices have a significant impact on mining activities overall, which is strongly linked to the need for mineral processing equipment. Mining businesses frequently reduce capital expenditures, including purchases of new processing equipment, when commodity prices decline. For equipment makers, this cyclicality breeds uncertainty, making it challenging to plan for long-term growth and investment in R&D. Significant obstacles for the market for mineral processing equipment come from sustainability issues and environmental restrictions. Governments are enacting stronger laws governing mining and mineral processing operations as environmental concerns gain traction on a worldwide scale. Equipment manufacturers must continually adapt their products to meet evolving environmental standards, which can increase development costs and complexity. Moreover, there's growing pressure to design equipment that minimizes water usage, reduces energy consumption, and limits the production of harmful waste products. While these challenges drive innovation, they also increase the complexity and cost of equipment design and manufacturing.

Mineral Processing Equipment Market Opportunities:

The integration of Industry 4.0 technology and the notion of "smart mining" provides a multitude of opportunities. Through the development of fully integrated, intelligent processing systems that make use of big data analytics, machine learning, and artificial intelligence, equipment makers may set themselves apart from competitors. These intelligent technologies provide mining firms with previously unheard-of levels of efficiency and cost-effectiveness by optimizing mineral recovery, lowering energy usage, and minimizing waste in real time. There are also a lot of chances for value addition in this field for developing remote monitoring systems, virtual reality training platforms, and predictive maintenance capabilities. The trend towards autonomous mining operations extends to mineral processing, offering opportunities for equipment manufacturers to develop fully automated processing plants. This includes not just automated control systems but also robotic maintenance solutions, autonomous sampling and analysis systems, and self-optimizing process circuits. The development of these technologies could significantly reduce operational costs and improve safety in processing operations.

MINERAL PROCESSING EQUIPMENT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.35% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Caterpillar Inc. (US), Komatsu Ltd. (Japan), Metso Outotec (Finland), FLSmidth A/S (Denmark), Sandvik AB (Sweden), Thyssenkrupp AG (Germany), Multotec Pty Ltd. (South Africa), McLanahan Corporation (US), TAKRAF GmbH (Germany), Braken Engineering (South Africa), SBM Minerals (France) |

Mineral Processing Equipment Market Segmentation: By Types

-

Crushing Equipment

-

Grinding Equipment

-

Flotation Equipment

-

Magnetic Separation Equipment

-

Screening Equipment

-

Gravity Separation Equipment

-

Dewatering Equipment

-

Others (such as cyclones and feeders)

Crushing equipment remains the most dominant type in the mineral processing equipment market due to its essential role in the initial stage of processing. The high demand for crushing equipment is driven by the need to prepare raw ore for subsequent processing steps, such as grinding and concentration. The efficiency and reliability of crushing equipment are critical factors that contribute to its dominance in the market. Innovations in crushing technology, such as automated control systems and advanced wear-resistant materials, have further solidified its position as the dominant type in the market.

Grinding equipment is the fastest-growing type in the mineral processing equipment market due to several factors. The increasing complexity of ores being mined requires more intensive grinding to achieve the desired particle size, driving the demand for advanced grinding equipment. Innovations in grinding technology, such as high-pressure grinding rolls (HPGR) and stirred mills, have improved the efficiency and throughput of grinding processes, making them more appealing to mining companies.

Mineral Processing Equipment Market Segmentation: By Distribution Channel

-

Direct Sales

-

Distributors and Dealers

-

Online Sales

-

Others

Equipment for processing minerals is sold directly from manufacturers to final consumers in a direct sales transaction. Because it can provide mining firms with direct support and specialized solutions, this distribution channel dominates the industry. Manufacturers frequently have specialized sales teams that collaborate closely with clients to comprehend their unique needs and offer customized solutions. The direct sales channel works especially well for large-scale mining companies that need continuous assistance and expensive equipment.

The market for mineral processing equipment is seeing a rise in online sales as e-commerce platforms and digitization become more widespread. This distribution channel has several advantages, such as ease of use, transparency, and simple pricing and product comparison. Smaller mining operations and areas with limited access to traditional distribution networks find online sales channels especially intriguing. Mining businesses may access a wider selection of equipment and make well-informed purchase decisions by utilizing Internet platforms, which include evaluations and specs.

Mineral Processing Equipment Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

With a dominating 35% share, the Asia-Pacific region is without a doubt the market leader for mineral processing equipment worldwide. This supremacy is the result of several variables coming together to put the area at the forefront of mineral extraction and processing. China, the greatest producer and consumer of several minerals worldwide, is at the center of Asia-Pacific's dominance. The country has been a major driver of growth in the mineral processing equipment market due to its insatiable desire for raw resources to power its vast industrial sector and infrastructural development. The "Belt and Road Initiative" by China has increased the demand for mineral resources since it is necessary for large-scale infrastructure projects in Asia and other regions.

Although the Middle East and Africa area now has the lowest market share (10%), it is developing at the quickest rate in the worldwide market for mineral processing equipment. Several variables that are changing the mining environment in the area and opening up new opportunities for equipment makers are responsible for this rapid rise. Large, frequently unexplored mineral deposits may be found throughout the Middle East and Africa area. The potential of their mineral richness to diversify their economies and lessen reliance on oil and gas earnings is being recognized by nations around the area. This change in emphasis is fueling expenditures for resource extraction and exploration, which in turn is increasing demand for processing machinery.

COVID-19 Impact Analysis on the Mineral Processing Equipment Market:

Global lockdowns and travel restrictions severely disrupted the movement of goods and materials. This created logjams in the supply chain for critical equipment components, spare parts, and even finished machinery. Imagine a crucial crusher sitting idle at a port due to logistical bottlenecks, delaying mining operations. The economic slowdown triggered by the pandemic led to a decrease in demand for mined minerals and metals. This, in turn, reduced the need for new processing equipment or upgrades to existing facilities. Think of a copper mine postponing the installation of a new concentrator plant due to a slump in global copper prices. The pandemic accelerated the trend towards automation in mineral processing plants. This included the deployment of autonomous haul trucks, automated crushing and screening operations, and the use of digital twins for process optimization.

Latest Trends/ Developments:

Equipment manufacturers are focusing on energy-saving designs. Imagine crushers with variable-speed drives that optimize energy consumption based on material size and throughput. This not only reduces operational costs but also lowers the environmental footprint of mineral processing. Water scarcity is a growing concern. New technologies like dry processing techniques or advanced water recycling systems are minimizing water usage in mineral processing operations. Think of crushers that utilize air pressure instead of water for dust suppression, or filtration systems that treat used processing water for reuse, minimizing reliance on freshwater sources. Advanced monitoring systems with AI-powered analytics are allowing for predictive maintenance. This means equipment can identify potential issues before they escalate into major breakdowns, minimizing downtime and optimizing maintenance schedules.

Key Players:

-

Caterpillar Inc. (US)

-

Komatsu Ltd. (Japan)

-

Metso Outotec (Finland)

-

FLSmidth A/S (Denmark)

-

Sandvik AB (Sweden)

-

Thyssenkrupp AG (Germany)

-

Multotec Pty Ltd. (South Africa)

-

McLanahan Corporation (US)

-

TAKRAF GmbH (Germany)

-

Braken Engineering (South Africa)

-

SBM Minerals (France)

Chapter 1. Mineral Processing Equipment Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Mineral Processing Equipment Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Mineral Processing Equipment Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Mineral Processing Equipment Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Mineral Processing Equipment Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Mineral Processing Equipment Market – By Types

6.1 Introduction/Key Findings

6.2 Crushing Equipment

6.3 Grinding Equipment

6.4 Flotation Equipment

6.5 Magnetic Separation Equipment

6.6 Screening Equipment

6.7 Gravity Separation Equipment

6.8 Dewatering Equipment

6.9 Others (such as cyclones and feeders)

6.10 Y-O-Y Growth trend Analysis By Types

6.11 Absolute $ Opportunity Analysis By Types, 2024-2030

Chapter 7. Mineral Processing Equipment Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Direct Sales

7.3 Distributors and Dealers

7.4 Online Sales

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Distribution Channel

7.7 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Mineral Processing Equipment Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Types

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Types

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Types

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Types

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Types

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Mineral Processing Equipment Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Caterpillar Inc. (US)

9.2 Komatsu Ltd. (Japan)

9.3 Metso Outotec (Finland)

9.4 FLSmidth A/S (Denmark)

9.5 Sandvik AB (Sweden)

9.6 Thyssenkrupp AG (Germany)

9.7 Multotec Pty Ltd. (South Africa)

9.8 McLanahan Corporation (US)

9.9 TAKRAF GmbH (Germany)

9.10 Braken Engineering (South Africa)

9.11 SBM Minerals (France)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Rapid urbanization across the globe is driving demand for construction materials like steel, cement, and aggregates. This necessitates increased production of minerals like iron ore, limestone, and copper, which in turn fuels the demand for efficient processing equipment.

Fluctuations in the prices of key raw materials like steel and copper can significantly impact the cost of mineral processing equipment. This can lead to hesitation from mining companies when it comes to investing in new equipment, hindering market growth.

Caterpillar Inc. (US), Komatsu Ltd. (Japan), Metso Outotec (Finland), FLSmidth A/S (Denmark), Sandvik AB (Sweden), Thyssenkrupp AG (Germany), Multotec Pty Ltd. (South Africa), McLanahan Corporation (US), TAKRAF GmbH (Germany), Braken Engineering (South Africa), SBM Minerals (France).

The market is dominated by Asia-Pacific, which commands a market share of around 35%.

With a market share of about 10%, the Middle East is expanding the quickest.