Mine Hunting Sonar Market Size (2023 – 2030)

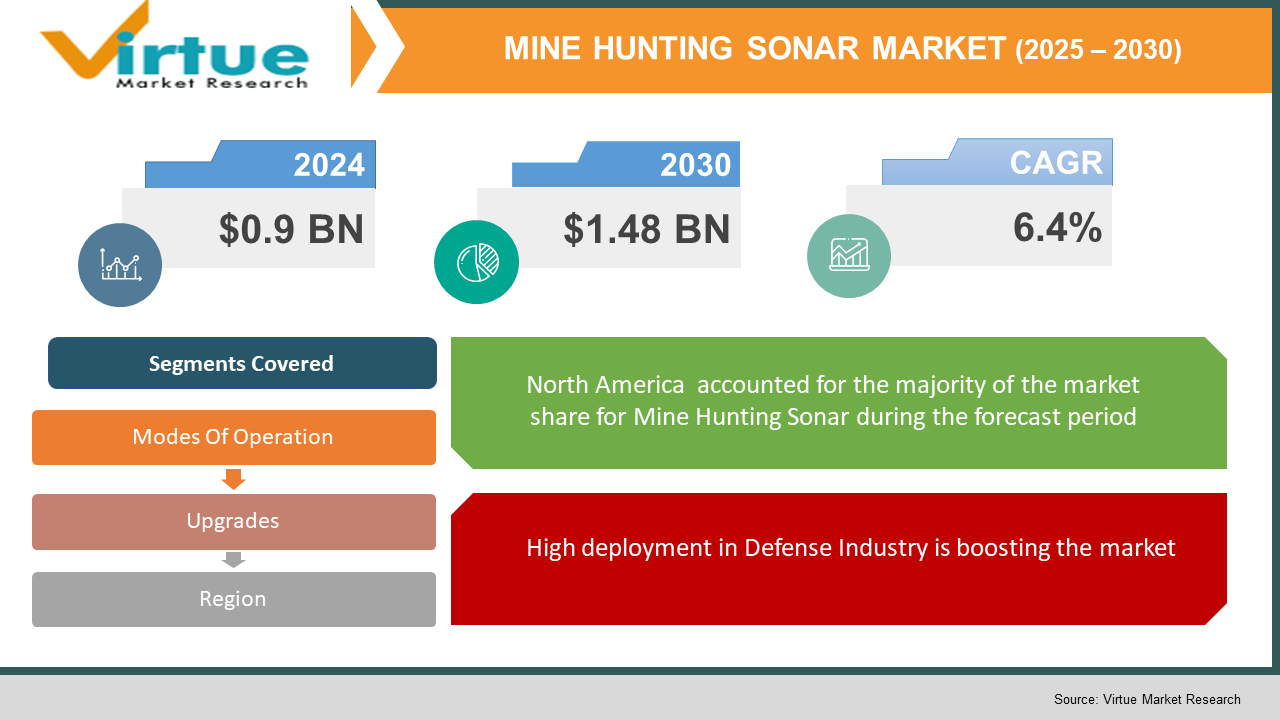

In 2022, the Global Mine Hunting Sonar Market was valued at USD 0.9 billion and is projected to reach a market size of USD 1.48 billion by 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 6.4%.

INDUSTRY OVERVIEW

Sonar stands for Sound Navigation And Ranging. The fundamental idea behind sonar is the transmission of sound waves to locate things. Acoustic waves are mechanical vibrations caused by longitudinal waves moving through an elastic material at a specific speed. Based on the time between the transmission of the echo and its return, a target distance can be calculated based on their velocity. However, acoustic waves propagate more quickly in water than they do in the air. When sound is in water as opposed to air, the sound velocity associated with this speed changes. Depth, temperature, pH, and salinity are the variables that influence this change in the speed of sound. Mines pose a serious hazard to both commercial and military marine traffic. Governments and authorities are becoming increasingly concerned about the use of these gadgets. Mines can be planted by intruders who can employ a mix of onboard bombs and targeted attacks to put them either externally on the ship's side and/or hull or within. For these attacks, mine detecting systems must be installed on all naval platforms.

Ships and submarines are in grave danger from underwater mines. Therefore, mine countermeasure (MCM) devices are used by fleets all over the world to protect themselves against them. Mine hunting is one of the tactics employed by MCM troops, which entails looking for all the mines in a questionable area. Detection, categorization, identification, and disposal are the four general steps. Typically, a ship's hull or an underwater vehicle equipped with sonar is used for the detection and classification processes. Military personnel check the seabed photos after receiving the sonar data to identify targets and categories them as mine-like objects (MLOs) or innocuous items. The introduction of computer-aided detection (CAD), computer-aided classification (CAC), and automatic target recognition (ATR) algorithms have reduced the burden of the technical operator and decreased the time required for post-mission analysis which is significantly influencing market development.

COVID-19 IMPACT ON THE MINE HUNTING SONAR MARKET

The global crisis caused by the COVID-19 pandemic caused significant disruptions in most industries and the manufacturing industry was severely hit. The lockdown imposed due to the pandemics caused the major manufacturing sectors to suspend their operations. The lockdown imposed by the government of several countries has slowed the production and the import and export of raw materials and finished products. The restriction created a supply chain crisis during the pandemic as there was a shortage of labour, and raw materials and the localized shutdown of a few production plants decelerated the overall market growth. The research and commercial activities were halted which negatively affected the growth of the market. However, in the upcoming years, the market is estimated to bounce back and gain momentum due to the relaxation of restrictions and restarting of the R&D and manufacturing activities. All these factors are working as proponents for the growth of the market rise during the forecast period. The naval, defence, aerospace, aviation, and other allied businesses have all suffered greatly as a result of the COVID-19 pandemic. The global spread of the COVID-19 virus has decreased the maritime industry's earnings. Due to the fact that very few nations have cut their defence spending, it has little effect on the naval defence industry. Since the defence industry had little influence, the demand for mine-hunting sonar was consistent over the COVID-19 era. The market has, however, seen some interruption in the supply chain, but after the lockdown and relaxation of travel restrictions, it has begun to restore its momentum.

MARKET DRIVERS:

High deployment in Defense Industry is boosting the market

With rising conflicts between countries and increase terrorism the USVs are highly used by military organizations for security and surveillance purposes. Sonars are deployed for submarine hunting, minesweeping and patrolling and are resulting to be more efficient operations. The growing tensions between nations and the modernization of the naval defence system is the major reason propelling the market growth.

MARKET RESTRAINTS:

Regulatory constraints in the transfer of technology is hampering the market growth

State-owned defense organizations across the world are required to abide by several federal and legislative laws and regulations, including exchange restrictions, import-export control regimes, the Foreign Corrupt Practices Act, and the Export Administration Act. Manufacturers of military equipment are unable to export their goods to countries like Japan, Germany, Canada, and South Korea, which reduces their ability to reach global markets. This makes it difficult for producers of mine detecting systems to enter the global market. During the forecast period, the rigorous laws and regulations governing the transfer of relevant technologies are anticipated to hinder the growth of the mine detecting system market by preventing terrorist groups from gaining access to cutting-edge technology.

High cost of development is acting as a restraint for this market

Modern combat situations increasingly depend on unmanned systems to perform tactical and strategic tasks, which has fueled the demand for innovative, cost-efficient warfare technologies that minimize human mistakes and casualties. To enable safe data transfer, these systems take advantage of electromagnetic radiation. These systems must carry out a variety of crucial tasks in distinct threat scenarios. To characterize all of the emitters' signals, locate the mine using thermal imaging, and establish their geogaphic positions or ranges of mobility, they must first identify all of the emitters in the region of interest using SIGINT techniques. The complexity of these systems makes it difficult to achieve the performance levels anticipated for the next unmanned electronic warfare weapons. For these systems to function in high-magnitude signal settings, complicated designs are necessary. Modifying and programming these systems is one of the main difficulties faced by makers of unmanned systems. To function in a congested electromagnetic (EM) environment, advanced technologies are needed, and a practical open system approach will assist realize difficult design objectives. Because large R&D expenditures are necessary, it is anticipated that the integration of AI in the market for unmanned systems would be cost-dependent, which presents a problem for manufacturers.

MINE HUNTING SONAR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

6.4% |

|

Segments Covered |

By Operation, By Upgrades and By Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ARMELSAN, ATLAS ELEKTRONIK GMBH, CIRRUS, KONGSBERG MARITIME, KRAKEN ROBOTICS, NORTHROP GRUMMAN., RAYTHEON TECHNOLOGIES, SONARDYNE, THALES GROUP, BAE SYSTEMS |

This research report on the Mine Hunting Sonar Market has been segmented and sub-segmented based on Modes of Operation, By Upgrades and By Region.

MINE HUNTING SONAR MARKET– BY MODES OF OPERATION

- Single Pass Shallow Mode

- Single Pass Deep Mode

- Volume Mine Mode

- Identification Mode

Based on the modes of operation, the mine hunting sonar market is segmented into, Single Pass Shallow Mode, Single Pass Deep Mode, Volume Mine Mode and Identification Mode. The speed and agility of a search are greatly increased while a search area is less time-consuming thanks to computer processing power, improved signal processing, and mobility. The mine-hunting sonars can identify and categories mine-like objects from the bottom to the near-surface in a single pass thanks to the combination of sides can, forward-looking, and gap filler sonars. Additionally, the device is equipped with an electro-optics identification feature that uses streak tube imaging laser technology to produce high-definition pictures of bottom mines. For post-mission analysis to help in mine detection, this gives the operator information on both range and contrast. To support the neutralization of mines by systems like the Airborne Mine Neutralization System, these modes allow the mine hunting sonar to provide fast and precise information on the location and position of mines.

MINE HUNTING SONAR MARKET- BY UPGRADES

- OEMs

- MROs

Based on the modes of operation, the mine hunting sonar market is segmented into OEMs and MROs. The OEMs category is anticipated to grow at the greatest CAGR throughout the forecast period based on upgrading. The work of modernizing the current mine detecting systems is underway, particularly in nations with platforms that already have well-established mine detection systems. One of the key reasons propelling the mine detection system market's expansion is a rise in vehicle-mounted mine detecting systems on a global scale. Additionally, one of the technical developments anticipated to accelerate the market expansion for mine detecting systems shortly is the expansion of dual-band radar. Mine detecting systems are provided to the armed services by the defence industry and deployed on ships, cars, and planes. Mine detecting systems are installed by OEMs. The OEM component suppliers also give the line-fit option, which reduces the amount of time needed for mine detection system installation after delivery.

MINE HUNTING SONAR MARKET- BY REGION

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East

- Africa

By region, the Mine Hunting Sonar Market is grouped into North America, Europe, Asia Pacific, Latin America, The Middle East and Africa. The Mine Detection Systems market is anticipated to be led by the North American region during the projected period. With the biggest market share, the US is acknowledged as one of the major producers, exporters, and consumers of mine detecting systems globally. L3Harris Technologies, Inc., Raytheon Technologies Corporation, Northrop Grumman Corporation, and Lockheed Martin Corporation are some of the major producers of mine detecting systems in the US. According to the US's new defence policy, more money will be spent on unmanned systems so that the US Army may integrate cutting-edge capabilities into its current defensive systems to find mines that have been laid.

MINE HUNTING SONAR MARKET- BY COMPANIES

Some of the major players operating in the Mine Hunting Sonar Market include:

- ARMELSAN

- ATLAS ELEKTRONIK GMBH

- CIRRUS

- KONGSBERG MARITIME

- KRAKEN ROBOTICS

- NORTHROP GRUMMAN.

- RAYTHEON TECHNOLOGIES

- SONARDYNE

- THALES GROUP

- BAE SYSTEMS

NOTABLE HAPPENING IN THE ENHANCED WATER MARKET

EXPANSION- The U.S. Navy received Raytheon's 10th AN/AQS-20C mine hunting sonar system in January 2020. The Panama City Division of the Naval Surface Warfare Center received the sonar-towed corpse in a formal transfer. The program of record for the Navy's mine countermeasure mission package for the Littoral Combat Shithe system is now completely certified and will proceed to initial operating capability.

AGREEMENT- - In May 2021, the US Navy granted a contract to General Dynamics Mission Systems Inc. of Quincy, Massachusetts, for the upgrade of five Surface Mine Countermeasure Unmanned Undersea Vehicle systems to the Block I configuration and engineering support services.

AGREEMENT- The US Navy has awarded Raytheon Technologies a contract in April 2021 to upgrade certain AQS-20A towed sonars to the AQS-20C model. The Naval Sea Systems Command awarded Raytheon a firm-fixed-price contract to engineer, design, develop, manufacture, integrate, and test the conversion of 10 vintage AQS-20A mine hunting sonars to the AN/AQS-20C form.

Chapter 1. MINE HUNTING SONAR MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. MINE HUNTING SONAR MARKET – Executive Summary

2.1. Market Size & Forecast – (2022 – 2026) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-16 Impact Analysis

2.3.1. Impact during 2022 - 2026

2.3.2. Impact on Supply – Demand

Chapter 3. MINE HUNTING SONAR MARKET – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. MINE HUNTING SONAR MARKET - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. MINE HUNTING SONAR MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. MINE HUNTING SONAR MARKET – By Modes Of Operation

6.1 Single Pass Shallow Mode

6.2. Single Pass Deep Mode

6.3. Volume Mine Mode

6.4. Identification Mode

Chapter 7. MINE HUNTING SONAR MARKET – By Upgrades

7.1 . OEMs

7.2. MROs

Chapter 8. MINE HUNTING SONAR MARKET – By Region

8.1. North America

8.2. Europe

8.3. The Asia Pacific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9. MINE HUNTING SONAR MARKET- – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

9.1. ARMELSAN

9.2. ATLAS ELEKTRONIK GMBH

9.3. CIRRUS

9.4. KONGSBERG MARITIME

9.5. KRAKEN ROBOTICS

9.6. NORTHROP GRUMMAN.

9.7. RAYTHEON TECHNOLOGIES

9.8. SONARDYNE

9.9. THALES GROUP

9.10. BAE SYSTEMS

Download Sample

Choose License Type

2500

4250

5250

6900