Millets Market Size (2024 – 2030)

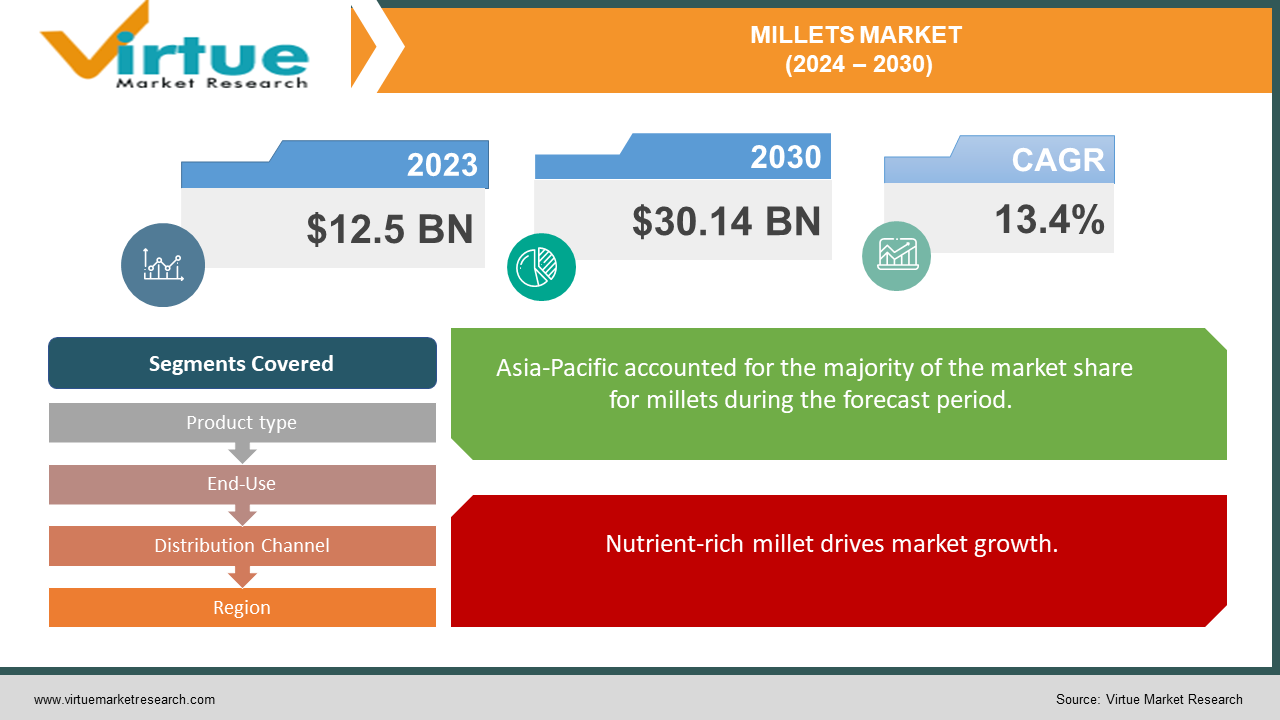

The Millets Market was valued at USD 12.5 Billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 30.14 Billion by 2030, growing at a CAGR of 13.4%.

Millets, coarse grains predominantly cultivated in Asia and Africa, form a significant component of the staple diet in these regions. These grains require considerably less water for growth compared to cereals like rice and wheat, and they remain resilient under severe climatic conditions. Consequently, millets serve as a crucial nutritional source in regions with challenging climates, particularly in western and southwestern African countries.

Millets, known for their small seeds, are highly esteemed for their rich nutritional profile. They are available in various colors, including red, white, grey, and pale yellow. Nutritionally, millets surpass many common cereals such as wheat and rice.

While millets boast high protein and mineral content, including calcium and iron, which can aid in preventing diseases, concerns have been raised regarding their association with ailments such as diabetes, obesity, and cardiovascular issues like heart attack and coronary artery disease. However, future industry growth is expected to be propelled by increasing public awareness of the health benefits associated with millet consumption.

Key Market Insights:

With nearly 6,000 varieties, millets are small-seeded cereals known for their extensive nutritional benefits. A significant portion of the global millet production is consumed directly, while the remainder is utilized in the production of beer, infant food, and breakfast items. Millets are particularly popular as a breakfast choice. These grains are available in various colors, including pale yellow, white, gray, and red, and they offer superior nutritional value compared to other cereals. Despite this, millets have traditionally received less attention than competitors such as cornflakes and other cereals. However, the gluten-free and hypoglycemic properties of millet are increasingly gaining recognition worldwide.

Millets Market Drivers:

Nutrient-rich millet drives market growth.

The unsustainable production of rice and wheat has driven an increased interest in cultivating millet. Millets are rich in fiber, proteins, vitamins, and essential fats, providing the precise amount of fat needed by the body, which helps prevent unnecessary fat accumulation and associated health issues such as high cholesterol, obesity, and heart ailments. Thus, millets are considered a healthy dietary option.

Globally, there is a growing trend towards weight loss, with significant spending on healthy eating. This trend, combined with the availability of nutritious options like millet, has created a promising market opportunity. Millets are nutrient-dense, offering more nutritional benefits than wheat and rice. They are a rich source of dietary fiber, calcium, iron, magnesium, potassium, zinc, and vitamins such as thiamine, riboflavin, folic acid, and niacin. The protein, fat, and carbohydrate content in millets ranges from 7 to 12%, 2 to 5%, 65 to 75%, and 15 to 20%, respectively. Additionally, being gluten-free, millets cater to the rising demand associated with celiac disease, highlighting the untapped potential in the millet market.

Millets Market Restraints and Challenges:

High costs hinder the market growth.

The limited shelf life of millets necessitates expedited preservation and processing, leading to increased costs. Consequently, these elevated costs serve as a barrier, preventing the market from reaching mass consumers.

Millets Market Opportunities:

The growing awareness of the benefits of consuming organic, nutrient-rich foods in the Western world is driving increased adoption of millet, particularly in Europe. Furthermore, these countries are recognizing millet as a power food, further enhancing its popularity. Major Western countries such as the UK, the U.S., and Denmark are witnessing significant demand for millet as a result of these trends.

Millet-based products such as flour, flakes, biscuits, etc., are gaining unprecedented visibility in the consumer market. These grains are particularly well-suited for vegetarian and vegan populations owing to their high protein content. Granules and regional recipes for breakfast cereal have witnessed a surge in popularity among consumers. With increasing trends in the consumption of fibrous and gluten-free foods, millet-based breakfast items have not only generated revenue but are also projected to experience significant growth in the future.

The potential to produce gluten-free and low glycemic index (GI) food presents promising opportunities for profitability. Millet, buckwheat, and quinoa are increasingly utilized in various common foods such as waffles, pasta, pizza, and sandwiches. With growing awareness of healthy diets and a shift in consumer preferences towards low-cholesterol and fat-free options, the demand for gluten-free food is anticipated to rise.

MILLETS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

13.4% |

|

Segments Covered |

By Product type, End-Use, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Mayoora Foods, Sydler India Pvt. Ltd, Navan Foods, LLC , Nestle S.A., Sresta Natural Bioproducts Pvt. Ltd, Nature’s Logic, Dharani FaMCooP Ltd, Janadhanya, Dharmapuri District Minor Millet Farmer Producer Company Ltd, Pramoda Exim Corporation |

Millets Market Segmentation: By Product Type

-

Pearl Millet

-

Foxtail Millet

-

Sorghum

-

Finger Millet

-

Others

Pearl millets hold the highest market share globally, primarily attributed to their significant consumption and production rates. In India, Pearl Millet stands as the primary variant cultivated, contributing to the country's position as the world's top millet producer. While regular millets are also cultivated, they necessitate insecticides and fertilizers for optimal growth. However, the demand for healthy foods incorporating millet predominantly revolves around organic varieties. With an increasing number of health-conscious consumers, the market for organic millet production is proving to be lucrative.

Millets Market Segmentation: By End-Use

-

Ready-to-eat food

-

Bakery

-

Beverages

-

Breakfast

-

Others

The millets-based ready-to-eat segment boasts the highest market share, largely due to the high protein content of these products, which appeals to consumers seeking nutritious options. Conversely, the breakfast segment is experiencing the most rapid growth among all segments.

Consumers' increasing preference for healthy bakery preparations is encouraging manufacturers to utilize naturally occurring and gluten-free ingredients. Gluten-free food products offer similar flavor and consistency to traditional options while avoiding excessive amounts of saturated and trans fats. As people increasingly opt for low-calorie options and adopt healthier eating habits, the market share of millets is anticipated to rise.

Millets Market Segmentation: By Distribution Channel

-

Trade Associations

-

Supermarkets

-

Grocery Stores

-

Online Platforms

-

Others

Distribution in the millet market typically involves middlemen playing a crucial role in the agricultural process. Processors engage with farmers to procure crops for subsequent processing into final products. These processed goods, such as bakery products and cereals, are then distributed through grocery stores. In the modern age of advanced technology, online platforms have emerged as a lucrative and cost-efficient distribution channel for producers. As a result, online platforms serve as a major distribution platform for the millet market.

Millets Market Segmentation- by region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

The Asia-Pacific region takes the lead in both millet production and export, with Africa following closely behind. Within the Asia-Pacific, India stands out as the top producer and consumer of millet globally, benefitting from conducive conditions for cultivation. In African nations like Nigeria, Mali, and Niger, millet production has thrived for an extended period, thanks to the favorable dry climate in these regions.

During the forecast period, the dominance of the Asia-Pacific region in the millets market is expected to persist. India and China are emerging as significant contributors, driven by factors such as rising personal disposable incomes, urbanization, and supportive governmental policies. Increasing awareness of the health benefits and nutritional value of millet is projected to fuel demand further. Additionally, the rising preference for fiber-rich and gluten-free food products among health-conscious consumers will contribute to the market's growth in this region.

COVID-19 Pandemic: Impact Analysis

The millet seeds industry experienced a slight positive impact during the pandemic period, primarily due to heightened demand for healthy food options. While the COVID-19 pandemic disrupted millet exports to Western countries, it concurrently spurred increased local demand within the Asia-Pacific and African regions, resulting in boosted sales. The rise in demand for natural and organic foods is anticipated to drive significant growth in the organic millet market.

Latest Development:

-

In March 2023, in Dehradun, Ivar Agro unveiled plans to launch a cutting-edge millet-based food products project with an initial investment of Rs 200 crore. The initiative aims to create significant employment opportunities for the local community.

-

In April 2022, the Orissa Government approved the second phase of the 'Odisha Millet Mission,' allocating over US$ 340 million for six years to rejuvenate millet production within the state. The mission aims to enhance millet output across 19 districts.

-

In November 2022, the Indian government launched a five-year strategic plan to promote millet on the global market. The strategy involves the participation of Indian embassies abroad and collaboration with international supermarket chains such as Carrefour, Walmart, Al Ruya, and Lulu Group to boost millet exports worldwide.

-

In February 2022, Wholesome Food, an Indian firm headquartered in Gurugram, secured funding exceeding US$ 7.0 million to expand its millet-based services. The investment is directed towards enhancing product innovation, marketing efforts, and expanding its global presence.

Key Players:

These are the top 10 players in the Millets Market:-

-

Mayoora Foods

-

Sydler India Pvt. Ltd

-

Navan Foods, LLC

-

Nestle S.A.

-

Sresta Natural Bioproducts Pvt. Ltd

-

Nature’s Logic

-

Dharani FaMCooP Ltd

-

Janadhanya

-

Dharmapuri District Minor Millet Farmer Producer Company Ltd

-

Pramoda Exim Corporation

Chapter 1. Millets Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Deployment Models

1.5 Secondary Deployment Models

Chapter 2. Millets Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Millets Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Millets Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Millets Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Millets Market – By Product Type

6.1 Introduction/Key Findings

6.2 Pearl Millet

6.3 Foxtail Millet

6.4 Sorghum

6.5 Finger Millet

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Product Type

6.8 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Millets Market – By End-Use

7.1 Introduction/Key Findings

7.2 Ready-to-eat food

7.3 Bakery

7.4 Beverages

7.5 Breakfast

7.6 Others

7.7 Y-O-Y Growth trend Analysis By End-Use

7.8 Absolute $ Opportunity Analysis By End-Use, 2024-2030

Chapter 8. Millets Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Trade Associations

8.3 Supermarkets

8.4 Grocery Stores

8.5 Online Platforms

8.6 Others

8.7 Y-O-Y Growth trend Analysis By Distribution Channel

8.8 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Millets Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By End-Use

9.1.4 By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By End-Use

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By End-Use

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By End-Use

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By End-Use

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Millets Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Mayoora Foods

10.2 Sydler India Pvt. Ltd

10.3 Navan Foods, LLC

10.4 Nestle S.A.

10.5 Sresta Natural Bioproducts Pvt. Ltd

10.6 Nature’s Logic

10.7 Dharani FaMCooP Ltd

10.8 Janadhanya

10.9 Dharmapuri District Minor Millet Farmer Producer Company Ltd

10.10 Pramoda Exim Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The unsustainable production of rice and wheat has driven an increased interest in cultivating millet. Millets are rich in fiber, proteins, vitamins, and essential fats, providing the precise amount of fat needed by the body, which helps prevent unnecessary fat accumulation and associated health issues such as high cholesterol, obesity, and heart ailments. Thus, millets are considered a healthy dietary option.

The top players operating in the Millets Market are - Mayoora Foods, Sydler India Pvt. Ltd., Navan Foods, LLC., Nestle S.A., Sresta Natural Bioproducts Pvt. Ltd., Nature’s Logic., Dharani FaMCooP Ltd., Janadhanya, Dharmapuri District Minor Millet Farmer Producer Company Limited, Pramoda Exim Corporation.

The millet seeds industry experienced a slight positive impact during the pandemic period, primarily due to heightened demand for healthy food options. While the COVID-19 pandemic disrupted millet exports to Western countries, it concurrently spurred increased local demand within the Asia-Pacific and African regions, resulting in boosted sales. The rise in demand for natural and organic foods is anticipated to drive significant growth in the organic millet market.

In April 2022, the Orissa Government approved the second phase of the 'Odisha Millet Mission,' allocating over US$ 340 million for six years to rejuvenate millet production within the state. The mission aims to enhance millet output across 19 districts.

The Asia-Pacific region takes the lead in both millet production and export, with Africa following closely behind.