Milking Systems Market Size (2024 – 2030)

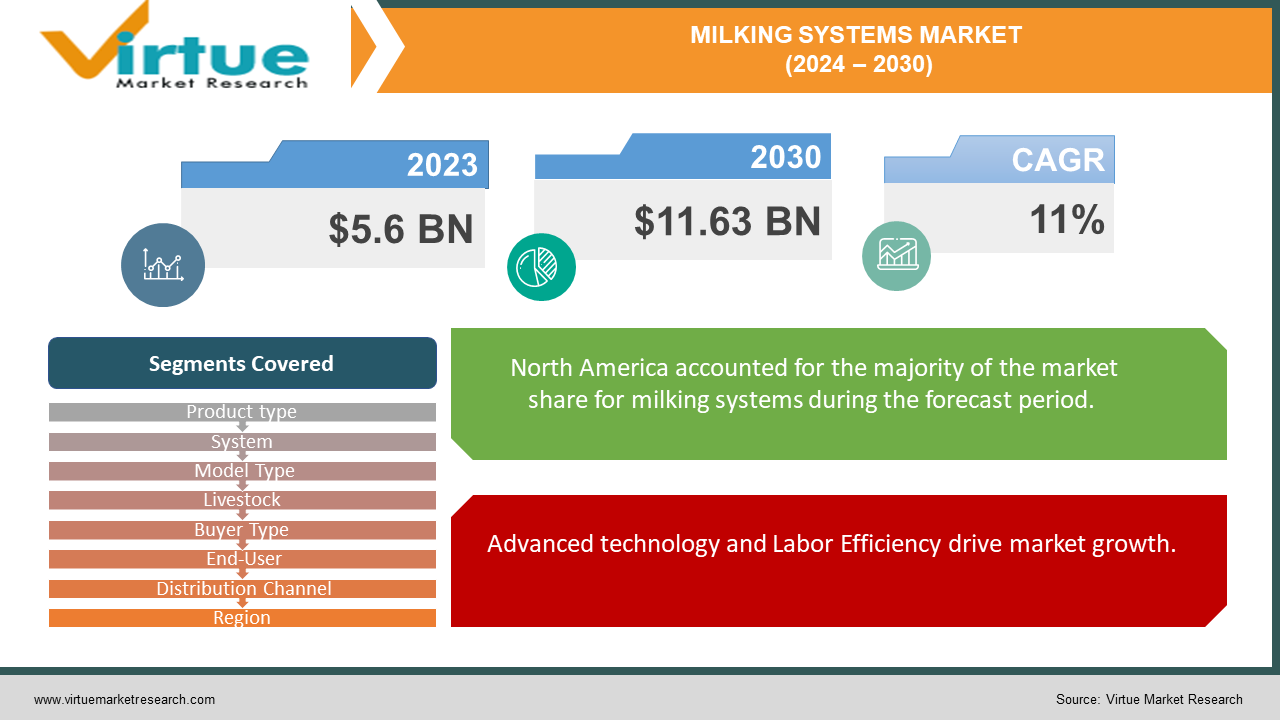

The Milking Systems Market was valued at USD 5.6 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 11.63 billion by 2030, growing at a CAGR of 11%.

Milking systems encompass a suite of apparatus, implements, and assorted components designed to automate the milk extraction process from diverse bovine species. This process, commonly known as milking, minimizes human intervention throughout its entirety. These systems are instrumental in enhancing productivity and streamlining the extraction process.

Key Market Insights:

Introducing the concept of machine milking should be approached gradually, with familiar personnel whom the cattle trust and feel at ease with, all under the careful supervision of an expert.

The training of milkers ought to be conducted by a representative from the milking machine company. This individual possesses comprehensive knowledge of milking biology, machine operations, and the design, functionality, and upkeep of milking equipment. Training sessions should encompass introduction procedures, milking protocols, machine handling, sanitation and maintenance practices, as well as essential aspects of daily machine servicing.

Before transitioning to machine milking, it is imperative to ensure the timely installation of the milking equipment and any requisite modifications on the dairy farm. This preparation should be meticulously executed well in advance.

Milking Systems Market Drivers:

Advanced technology and Labor Efficiency drive market growth.

The demand for efficient milk production is on the rise, propelled by factors such as increasing labor costs and a diminishing pool of skilled agricultural workers. Enhanced automation capabilities in automated milking routines now enable cows to freely access milking stalls, reducing the requirement for manual labor in routine milking tasks. This shift affords farmers additional time to focus on other aspects of farm management, thereby optimizing productivity and operational efficiency.

Milking Systems Market Restraints and Challenges:

High costs hinder market growth.

The high maintenance costs associated with milking equipment, comprising pricey vacuum pumps and other components, could potentially hinder the market growth. Additionally, the preference of certain individuals for traditional hand-squeezing methods of milk extraction may also pose a challenge to market expansion.

Milking Systems Market Opportunities:

The adoption of milking equipment is witnessing a steady rise, with an increasing number of dairy manufacturers opting to utilize such equipment for the production of high-quality milk, thereby meeting the growing demand for milk products. These manufacturers serve as the primary drivers of the milking equipment market.

MILKING SYSTEMS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

11% |

|

Segments Covered |

By Product type, System, Model Type, Livestock, Buyer Type, End-User, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

DeLaval Inc., Milkplan, Afimilk Ltd., Vansun Technologies Private Limited, Hokofarm Group B.V, Pearson International LLC, Caprine Supply, S. A. Christensen & Co., Impact Technologies, Bob-White Systems |

Milking Systems Market Segmentation: By Product Type

-

Fully Automatic

-

Semi-Automatic

The fully automatic product type segment currently holds dominance in the market. Buyers are showing a strong preference for fully automated machines for milking animals.

Furthermore, technological advancements, the widespread adoption of automation, and the escalating demand for organic milk are additional factors contributing to the growth of the milking equipment market over the forecast period.

Milking Systems Market Segmentation: By System

-

Portable Milking Machines

-

Barn Milking Systems

-

Robotics Milking Systems

-

Milking Parlors

A portable milking machine is a mobile, self-contained milking system mounted on wheels, offering the convenience of relocating it between different points. In contrast, a fixed system comprises stationary milking stations, necessitating the cows to be brought to the stations for milking.

Barn milking systems are installed within farms where cows are housed in individual cubicles. Milking occurs directly at the cow's location, facilitated by a portable milking unit that provides pulsation and vacuum to the teat end.

Robotic milking represents a voluntary milking system wherein cows autonomously decide when to be milked. This automated process grants farmers increased flexibility in managing their time, enabling them to allocate more time to farm management or other tasks. A milking parlor constitutes a section of a building dedicated to milking activities on a dairy farm. Cows are led to the milking parlor for milking and subsequently returned to feeding and resting areas.

Milking Systems Market Segmentation: By Model Type

-

Mobile

-

Stationary

-

Pipeline

The pipeline segment currently holds dominance in the market. Round-the-barn pipeline milking systems are specifically engineered to facilitate milking within the barn premises and direct the milk flow directly to the bulk tank. This setup significantly reduces working time in comparison to other tie-stall milking solutions, eliminating the need for separate emptying operations.

Milking Systems Market Segmentation: By Livestock

-

Cow

-

Sheep

-

Buffalo

-

Goat

-

Others

The cow and buffalo segment emerges as the dominant category in the market. Buffalo milk is noted for its higher cholesterol content compared to cow milk, which is a significant factor for individuals monitoring their cholesterol intake. Cow milk, on the other hand, enjoys widespread popularity and consumption due to its milder taste, lower fat content, and higher protein levels. On average, a cow yields approximately 15 to 20 liters of milk per day, whereas a buffalo typically produces anywhere between 7 to 11 liters of milk daily.

Milking Systems Market Segmentation: By Buyer Type

-

Individuals

-

Enterprise

The range of the machine encompasses both low and high-end options, catering to the diverse needs of individuals and enterprises alike. Fully equipped, these machines are capable of significantly reducing workload while ensuring the safety and well-being of the animals.

Milking Systems Market Segmentation: By End-User

-

Micro Dairy Farms

-

Macro Dairy Farms

-

Others

The MicroDairy system offers rapid installation, user-friendly operation, environmental sustainability, and thorough testing, certification, and commissioning before delivery. It is ideal for farmers aiming for a superior standard of pasteurized milk, complete with extended shelf life and associated benefits. With on-farm processing made easier and faster than ever, this system eliminates manual operations, ensuring that farmers do not need to enter the clean room environment at any stage during the process, thereby upholding product integrity and safety.

Milking Systems Market Segmentation: By Distribution Channel

-

Online

-

Offline

While both online and offline distribution segments are accessible, there is a prevailing preference for purchasing these machines offline. This preference stems from the novelty of the system and the lack of familiarity among users regarding its operation. Buying machines offline is seen as advantageous because it allows users to gain a better understanding of the equipment, and provides them with the reassurance that they can seek guidance from the vendor if they encounter any issues or difficulties in operation. In contrast, online distribution platforms may not offer the same level of support and guidance, leading to a lack of confidence among customers. Given that these machines are primarily used by farmers who are making a significant investment, they value the assurance and support provided by vendors in gaining their trust and confidence in the purchase.

Milking Systems Market Segmentation- By Region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

North America holds dominance in the milking systems market due to its robust development and widespread adoption of robotics technology, alongside the presence of prominent providers of robotic solutions within the region. The advancement of automated technologies is driving increased demand for milking equipment in North America, fueled further by the region's substantial demand for key dairy products. Dairy producers in North America prioritize the adoption of cutting-edge automated dairy technology to efficiently produce high-quality milk products. With the expanding demand for milk products and the widespread installation of state-of-the-art automated technology, the United States is anticipated to generate the highest revenue in this market. Meanwhile, the Asia-Pacific region is poised for growth during the forecast period.

COVID-19 Pandemic: Impact Analysis

The dairy industry has been significantly impacted by the pandemic, experiencing a range of challenges including reduced farmgate milk prices, disruptions in milk transportation within supply chains, labor shortages, heightened production costs, and limited operating capital. While these challenges are widespread, there are also notable differences in how they affect various aspects of the industry.

Government financial relief measures are essential in the short term to support many dairy farms and processors in weathering the effects of the pandemic. However, to ensure the long-term resilience and sustainability of the dairy sector, collaboration between industry stakeholders and governments is imperative. It is crucial to develop comprehensive strategies and policies that strike a balance between efficiency and flexibility, promote product specialization and diversification, integrate supply chains while supporting local food systems, and establish effective market mechanisms alongside policy regulations and interventions. Such concerted efforts will be vital in navigating the challenges posed by the pandemic and fostering a resilient dairy industry moving forward.

Latest Trends/ Developments:

The burgeoning size of dairy farm herds worldwide emerges as a significant catalyst propelling the expansion of the milking systems market. Technological advancements enabling the automation of various dairy operations such as milking, farm management, and herd management, coupled with the integration of robotics technology to reduce labor dependency and uphold product quality, drive market growth. The uptake of automation, coupled with the demand for organic milk and the availability of machinery and systems facilitating cattle mobility, further bolsters market dynamics. Moreover, the adoption by small and medium-sized enterprises, the proliferation of dairy manufacturers, and ongoing technological innovations contribute positively to the milking systems market. Additionally, the introduction of innovative automation technologies presents lucrative prospects for market players in the foreseeable future.

Key Players:

These are the top 10 players in the Milking Systems Market:-

-

DeLaval Inc.

-

Milkplan

-

Afimilk Ltd.

-

Vansun Technologies Private Limited

-

Hokofarm Group B.V

-

Pearson International LLC

-

Caprine Supply

-

S. A. Christensen & Co.

-

Impact Technologies

-

Bob-White Systems

Chapter 1. Milking Systems Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Milking Systems Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Milking Systems Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Milking Systems Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Milking Systems Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Milking Systems Market – By Product Type

6.1 Introduction/Key Findings

6.2 Fully Automatic

6.3 Semi-Automatic

6.4 Y-O-Y Growth trend Analysis By Product Type

6.5 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Milking Systems Market – By System

7.1 Introduction/Key Findings

7.2 Portable Milking Machines

7.3 Barn Milking Systems

7.4 Robotics Milking Systems

7.5 Milking Parlors

7.6 Y-O-Y Growth trend Analysis By System

7.7 Absolute $ Opportunity Analysis By System, 2024-2030

Chapter 8. Milking Systems Market – By End-Use Industry

8.1 Introduction/Key Findings

8.2 Micro Dairy Farms

8.3 Macro Dairy Farms

8.4 Others

8.5 Y-O-Y Growth trend Analysis End-Use Industry

8.6 Absolute $ Opportunity Analysis End-Use Industry, 2024-2030

Chapter 9. Milking Systems Market – By Buyer Type

9.1 Introduction/Key Findings

9.2 Individuals

9.3 Enterprise

9.4 Y-O-Y Growth trend Analysis By Buyer Type

9.5 Absolute $ Opportunity Analysis By Buyer Type, 2024-2030

Chapter 10. Milking Systems Market – By Model Type

10.1 Introduction/Key Findings

10.2 Mobile

10.3 Stationary

10.4 Pipeline

10.5 Y-O-Y Growth trend Analysis Model Type

10.6 Absolute $ Opportunity Analysis Model Type, 2024-2030

Chapter 11. Milking Systems Market – By Livestock

11.1 Introduction/Key Findings

11.2 Cow

11.3 Sheep

11.4 Buffalo

11.5 Goat

11.6 Others

11.7 Y-O-Y Growth trend Analysis Livestock

11.8 Absolute $ Opportunity Analysis Livestock, 2024-2030

Chapter 12. Milking Systems Market – By Distribution Channel

12.1 Introduction/Key Findings

12.2 Online

12.3 Offline

12.4 Y-O-Y Growth trend Analysis Distribution Channel

12.5 Absolute $ Opportunity Analysis Distribution Channel, 2024-2030

Chapter 13. Milking Systems Market , By Geography – Market Size, Forecast, Trends & Insights

13.1 North America

13.1.1 By Country

13.1.1.1 U.S.A.

13.1.1.2 Canada

13.1.1.3 Mexico

13.1.2 By Product Type

13.1.2.1 By System

13.1.3 By End-Use Industry

13.1.4 By Buyer Type

13.1.5 By Model Type

13.1.6 Countries & Segments - Market Attractiveness Analysis

13.2 Europe

13.2.1 By Country

13.2.1.1 U.K

13.2.1.2 Germany

13.2.1.3 France

13.2.1.4 Italy

13.2.1.5 Spain

13.2.1.6 Rest of Europe

13.2.2 By Product Type

13.2.3 By System

13.2.4 By End-Use Industry

13.2.5 By Buyer Type

13.2.6 By Model Type

13.2.7 Countries & Segments - Market Attractiveness Analysis

13.3 Asia Pacific

13.3.1 By Country

13.3.1.1 China

13.3.1.2 Japan

13.3.1.3 South Korea

13.3.1.4 India

13.3.1.5 Australia & New Zealand

13.3.1.6 Rest of Asia-Pacific

13.3.2 By Product Type

13.3.3 By System

13.3.4 By End-Use Industry

13.3.5 By Buyer Type

13.3.6 By Model Type

13.3.7 Countries & Segments - Market Attractiveness Analysis

13.4 South America

13.4.1 By Country

13.4.1.1 Brazil

13.4.1.2 Argentina

13.4.1.3 Colombia

13.4.1.4 Chile

13.4.1.5 Rest of South America

13.4.2 By Product Type

13.4.3 By System

13.4.4 By End-Use Industry

13.4.5 By Buyer Type

13.4.6 By Model Type

13.4.7 Countries & Segments - Market Attractiveness Analysis

13.5 Middle East & Africa

13.5.1 By Country

13.5.1.1 United Arab Emirates (UAE)

13.5.1.2 Saudi Arabia

13.5.1.3 Qatar

13.5.1.4 Israel

13.5.1.5 South Africa

13.5.1.6 Nigeria

13.5.1.7 Kenya

13.5.1.8 Egypt

13.5.1.9 Rest of MEA

13.5.2 By Product Type

13.5.3 By System

13.5.4 By End-Use Industry

13.5.5 By Buyer Type

13.5.6 By Model Type

13.5.7 Countries & Segments - Market Attractiveness Analysis

Chapter 14. Milking Systems Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

14.1 DeLaval Inc.

14.2 Milkplan

14.3 Afimilk Ltd.

14.4 Vansun Technologies Private Limited

14.5 Hokofarm Group B.V

14.6 Pearson International LLC

14.7 Caprine Supply

14.8 S. A. Christensen & Co.

14.9 Impact Technologies

14.10 Bob-White Systems

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The demand for efficient milk production is on the rise, propelled by factors such as increasing labor costs and a diminishing pool of skilled agricultural workers.

The top players operating in the Milking Systems Market are - DeLaval Inc., Milkplan, Afimilk Ltd., Vansun Technologies Private Limited, Hokofarm Group B.V, Pearson International LLC, Caprine Supply, S. A. Christensen & Co., Impact Technologies, Bob-White Systems.

The dairy industry has been significantly impacted by the pandemic, experiencing a range of challenges including reduced farmgate milk prices, disruptions in milk transportation within supply chains, labor shortages, heightened production costs, and limited operating capital.

The adoption of milking equipment is witnessing a steady rise, with an increasing number of dairy manufacturers opting to utilize such equipment for the production of high-quality milk, thereby meeting the growing demand for milk products.

The Asia-Pacific region is poised for growth during the forecast period.