Military satellites Market Size (2025 – 2030)

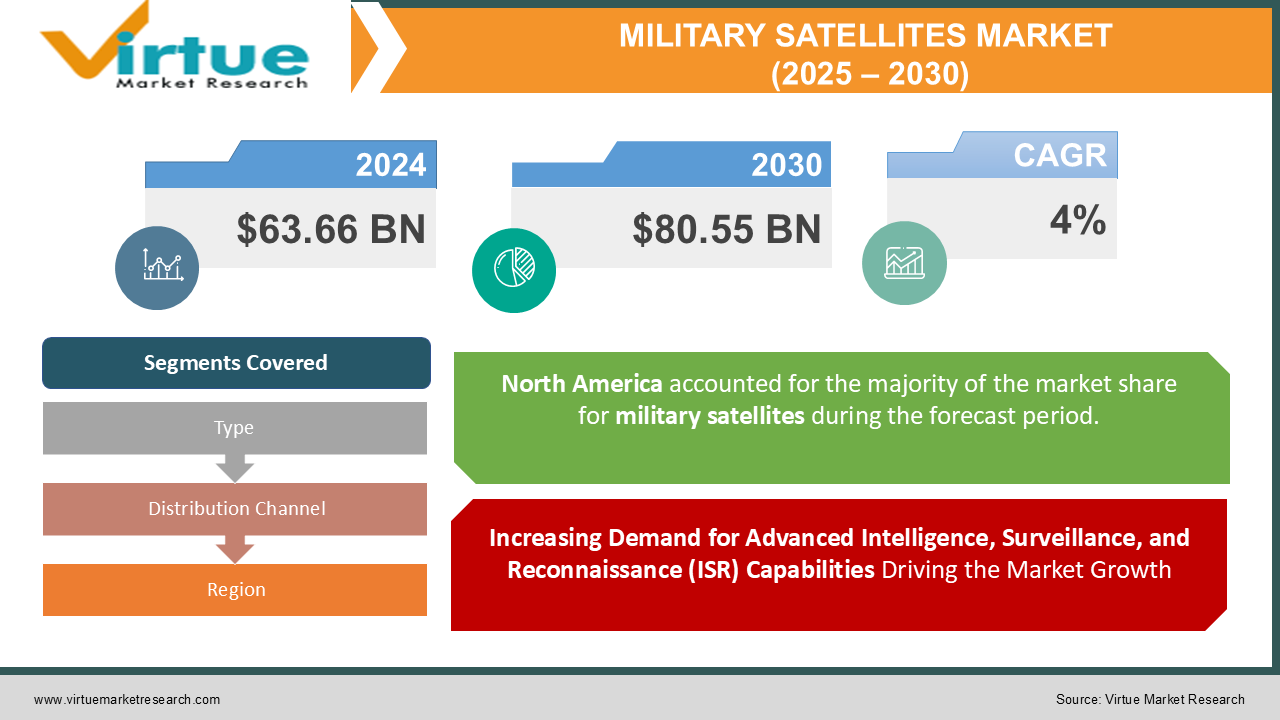

The Military satellites Market was valued at USD 63.66 Billion in 2024 and is projected to reach a market size of USD 80.55 Billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 4%.

The military satellite market has emerged as a cornerstone of modern defense and strategic operations, offering unparalleled advantages in communication, surveillance, navigation, and intelligence gathering. The increasing reliance of defense forces on advanced technology to enhance operational efficiency and respond effectively to emerging threats has made military satellites a vital component of national security strategies worldwide. The market encompasses a wide array of satellites, including reconnaissance, communication, navigation, and early warning systems, each designed to fulfill specific defense needs.

Key Market Insights:

-

Over 290 active military satellites were operational globally in 2023. The market saw the deployment of 45 new military satellites during the year. The global military satellite market accounted for approximately 18% of all satellite launches.

-

Communication satellites made up 42% of military satellite launches in 2023. Reconnaissance satellites represented 35% of the total market in terms of deployment.

-

Small military satellites accounted for 23% of launches, indicating a shift toward miniaturization. Low Earth Orbit (LEO) satellites comprised 62% of all military satellite deployments.

-

15 nations launched military satellites independently in 2023. Artificial intelligence was integrated into over 60% of newly launched military satellites.

Market Drivers:

Increasing Demand for Advanced Intelligence, Surveillance, and Reconnaissance (ISR) Capabilities Driving the Market Growth

In an era marked by rapid technological advancements and complex geopolitical tensions, the demand for ISR capabilities has grown exponentially. Military satellites equipped with cutting-edge reconnaissance technologies provide unmatched strategic advantages, enabling nations to monitor activities across borders, identify potential threats, and plan countermeasures effectively. High-resolution imaging and hyperspectral capabilities of reconnaissance satellites allow defense forces to gather detailed intelligence on enemy movements, infrastructure developments, and environmental conditions. These satellites are indispensable in counterterrorism, border security, and disaster response operations. Their ability to provide real-time data enhances decision-making and enables proactive responses to emerging threats. Moreover, the growing prevalence of hybrid warfare, cyber threats, and asymmetric conflicts has heightened the need for comprehensive situational awareness. ISR satellites play a crucial role in enabling defense agencies to gain a tactical edge in such scenarios. The advent of synthetic aperture radar (SAR) technology, capable of capturing high-resolution images even in adverse weather conditions or at night, has further amplified the effectiveness of military reconnaissance missions. Governments worldwide are allocating significant budgets to ISR satellite programs, recognizing their importance in maintaining national security. This trend, combined with technological advancements in satellite manufacturing and data analytics, continues to drive the adoption of ISR systems, cementing them as a cornerstone of the military satellite market.

Growing Reliance on Secure Communication Networks Fuelling the Market Growth

In modern warfare and defense planning, secure and uninterrupted communication is paramount. Military satellites serve as the backbone of defense communication networks, ensuring real-time data exchange, secure transmission, and seamless coordination across land, sea, and air operations. Satellites enable defense forces to maintain connectivity in remote or hostile regions where terrestrial networks are unreliable or non-existent. Communication satellites are equipped with encryption technologies to safeguard sensitive information against interception or cyberattacks. The increasing complexity of defense operations, coupled with the need for multi-domain connectivity, has accelerated the deployment of advanced satellite-based communication systems. The growing integration of artificial intelligence and machine learning in satellite communications further enhances their capabilities. AI-driven algorithms optimize bandwidth allocation, improve signal resilience, and detect anomalies in real-time, ensuring robust communication infrastructure. Additionally, the advent of next-generation satellite constellations in low-Earth orbit (LEO) has reduced latency and improved network coverage, making them ideal for dynamic and high-speed defense operations. The importance of secure communication networks is further emphasized in multinational defense alliances and peacekeeping missions, where seamless interoperability between forces is crucial. As nations invest in modernizing their defense communication systems, the demand for military communication satellites continues to soar, driving market growth.

Market Restraints and Challenges:

Despite the promising growth trajectory, the military satellite market faces several restraints and challenges that could impede its development. These include the high costs associated with satellite development and deployment, increasing concerns about space debris and satellite vulnerability, and regulatory complexities in the global space domain. Developing and launching military satellites is an expensive endeavour, requiring substantial investments in research and development, advanced manufacturing, and launch services. The costs associated with building satellites equipped with state-of-the-art technologies, such as hyperspectral imaging or advanced encryption, can exceed hundreds of millions of dollars. For smaller or developing nations, these expenses may be prohibitive, limiting their participation in the military satellite market. Additionally, the cost of maintaining and replacing satellites, particularly in cases of obsolescence or damage, adds to the financial burden. The growing demand for smaller and more agile satellites, while promising cost reductions, also necessitates investments in new manufacturing processes and technologies, further straining budgets. The proliferation of satellites, both military and commercial, has led to a significant increase in space debris. This debris poses a serious threat to operational satellites, with the potential to cause collisions and disrupt critical defense activities. Ensuring the safety and longevity of satellite assets requires continuous monitoring and mitigation efforts, adding to operational complexities. Military satellites are also vulnerable to adversarial activities, such as jamming, spoofing, and cyberattacks. As defense forces become increasingly reliant on satellite-enabled systems, the potential impact of such threats grows exponentially. Addressing these vulnerabilities requires robust cybersecurity measures, space situational awareness programs, and the development of counterspace capabilities, all of which entail additional costs and technical challenges.

Market Opportunities:

While the military satellite market faces challenges, it also presents numerous opportunities for growth and innovation. Key opportunities include the development of cost-effective small satellite solutions, advancements in quantum communication technologies, and expanding partnerships between governments and private players. The miniaturization of satellite technology has opened new avenues for the military satellite market. Small satellites, or small sats, offer cost-effective and scalable solutions for various defense applications, including reconnaissance, communication, and navigation. Their reduced size and weight enable cheaper launches and faster deployment cycles, making them an attractive option for nations with limited budgets. Small satellite constellations in low-Earth orbit (LEO) also provide enhanced coverage, low latency, and rapid response capabilities, addressing the growing demand for agile and responsive satellite systems. As manufacturing processes and launch technologies continue to evolve, the adoption of small satellites in the military sector is expected to rise significantly. Quantum communication is poised to revolutionize satellite-based secure communication systems, offering unparalleled encryption and data security. Military satellites equipped with quantum communication technologies can ensure tamper-proof transmission of sensitive information, addressing growing concerns about cyber threats. Ongoing research and development efforts in this domain present significant opportunities for innovation and market expansion. Governments and private players are investing heavily in quantum communication projects, recognizing their potential to redefine secure communication standards in defense and beyond.

MILITARY SATELLITES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

4% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

DJI, Precision Hawk, Trimble Inc., Parrot Drones, AgEagle Aerial Systems, AeroVironment, Inc., sense Fly, yamaha Motor Corporation, Drone Deploy, Skydio |

Military satellites Market Segmentation: by Type

-

Communication Satellites

-

Reconnaissance Satellites

-

Navigation Satellites

-

Early Warning Satellites

Communication satellites remain the most dominant type, accounting for a significant share of the market due to their widespread applications in secure defense communication and coordination.

Reconnaissance satellites are the fastest-growing segment, driven by increasing demand for advanced ISR capabilities and real-time intelligence gathering.

Military satellites Market Segmentation: by Distribution Channel

-

Government Agencies

-

Defense Contractors

-

Private Aerospace Companies

Government agencies represent the dominant channel, reflecting their direct involvement in satellite procurement and deployment for national defense.

Private aerospace companies are the fastest-growing channel, as partnerships and collaborations with governments gain momentum to foster innovation and reduce costs.

Military satellites Market Segmentation: by Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

Middle East and Africa

-

Latin America

North America holds the largest market share, primarily due to the robust satellite infrastructure, significant investments in defense technology, and the presence of key industry players like Lockheed Martin and Northrop Grumman. The U.S. Department of Defense leads in military satellite procurement, leveraging these assets for communication, navigation, reconnaissance, and missile defense systems. The integration of advanced technologies, such as AI and quantum computing, further solidifies North America's dominance.

Asia-Pacific is the fastest-growing region, driven by escalating geopolitical tensions, increasing defense budgets, and advancements in space technology. Nations like China and India are making significant strides in satellite development, aiming to enhance their defense and surveillance capabilities. China's BeiDou navigation system and India's RISAT and GSAT series exemplify the region's ambitious satellite programs, contributing to its rapid growth.

COVID-19 Impact Analysis:

The COVID-19 pandemic brought both challenges and opportunities for the military satellite market. Initially, the market faced disruptions in supply chains, manufacturing delays, and project postponements due to lockdowns and resource constraints. These setbacks affected satellite launches and delayed the deployment of planned systems. However, the pandemic underscored the critical importance of secure and reliable communication systems, particularly as global tensions and cyber threats heightened. Governments prioritized investments in satellite-based defence systems to bolster resilience against emerging threats. Remote operations and virtual defense coordination further emphasized the role of satellite technology in maintaining seamless connectivity. Additionally, the pandemic accelerated innovation, with defense agencies exploring automation, AI, and machine learning in satellite systems to enhance efficiency and reduce dependence on human intervention. The surge in cyber threats during this period also drove advancements in encryption and cybersecurity measures for military satellites. The long-term impact of COVID-19 on the military satellite market has been largely positive, with renewed focus on satellite resilience, innovation, and strategic partnerships.

Latest Trends and Developments:

The military satellite market is witnessing transformative trends that are reshaping its dynamics and broadening its scope. A significant trend is the shift toward low-Earth orbit (LEO) satellite constellations, which offer low latency, enhanced coverage, and rapid deployment capabilities. These constellations are particularly attractive for real-time intelligence and communication applications, aligning with the growing demand for agile defense systems. Another noteworthy trend is the integration of artificial intelligence (AI) and machine learning (ML) in satellite operations. These technologies optimize data processing, enhance decision-making, and enable predictive maintenance, reducing operational costs and improving efficiency. The deployment of AI-driven algorithms in satellite imaging and reconnaissance allows for more accurate threat detection and analysis, strengthening defense capabilities. Quantum communication is emerging as a game-changer, promising unprecedented levels of encryption and data security. Governments and defence agencies are investing heavily in quantum satellite projects, aiming to future-proof their communication networks against evolving cyber threats. The adoption of hybrid satellite systems, combining traditional geostationary satellites with smaller, agile satellites, is gaining traction. This approach enhances operational flexibility and ensures continuity of services in case of disruptions. The growing collaboration between public and private sectors further accelerates innovation, with companies like SpaceX and Blue Origin playing pivotal roles in advancing satellite technologies.

Key Players in the Military satellites Market:

-

DJI

-

Precision Hawk

-

Trimble Inc.

-

Parrot Drones

-

AgEagle Aerial Systems

-

AeroVironment, Inc.

-

sense Fly

-

Yamaha Motor Corporation

-

Drone Deploy

-

Skydio

Chapter 1. Military satellites Market– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Military satellites Market– Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Military satellites Market– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Military satellites Market- Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Military satellites Market– Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Military satellites Market– By Type

6.1 Introduction/Key Findings

6.2 Communication Satellites

6.3 Reconnaissance Satellites

6.4 Navigation Satellites

6.5 Early Warning Satellites

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Military satellites Market– By Distribution Channel

7.1 Introduction/Key Findings

7.2 Government Agencies

7.3 Defense Contractors

7.4 Private Aerospace Companies

7.5 Y-O-Y Growth trend Analysis By Distribution Channel

7.6 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Military satellites Market, By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Military satellites Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 DJI

9.2 Precision Hawk

9.3 Trimble Inc.

9.4 Parrot Drones

9.5 AgEagle Aerial Systems

9.6 AeroVironment, Inc.

9.7 sense Fly

9.8 Yamaha Motor Corporation

9.9 Drone Deploy

9.10 Skydio

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Key factors driving the growth of the military satellites market include increasing geopolitical tensions, rising defense budgets, demand for secure communication systems, advancements in satellite technology, integration of AI for intelligence and reconnaissance, and growing adoption of low-Earth orbit constellations.

Key concerns in the military satellites market include high development costs, vulnerability to cyberattacks, risks of space debris collisions, technological obsolescence, complex regulatory frameworks, limited skilled workforce, geopolitical tensions, and challenges in maintaining secure and uninterrupted communication networks globally.

DJI, Precision Hawk, Trimble Inc., Parrot Drones, AgEagle Aerial Systems, AeroVironment, Inc., sense Fly, Yamaha Motor Corporation.

North America currently holds the largest market share, estimated around 35%.

Asia Pacific has shown significant room for growth in specific segments.