Military Optronics Surveillance and Sighting Systems Market Size (2023 - 2030)

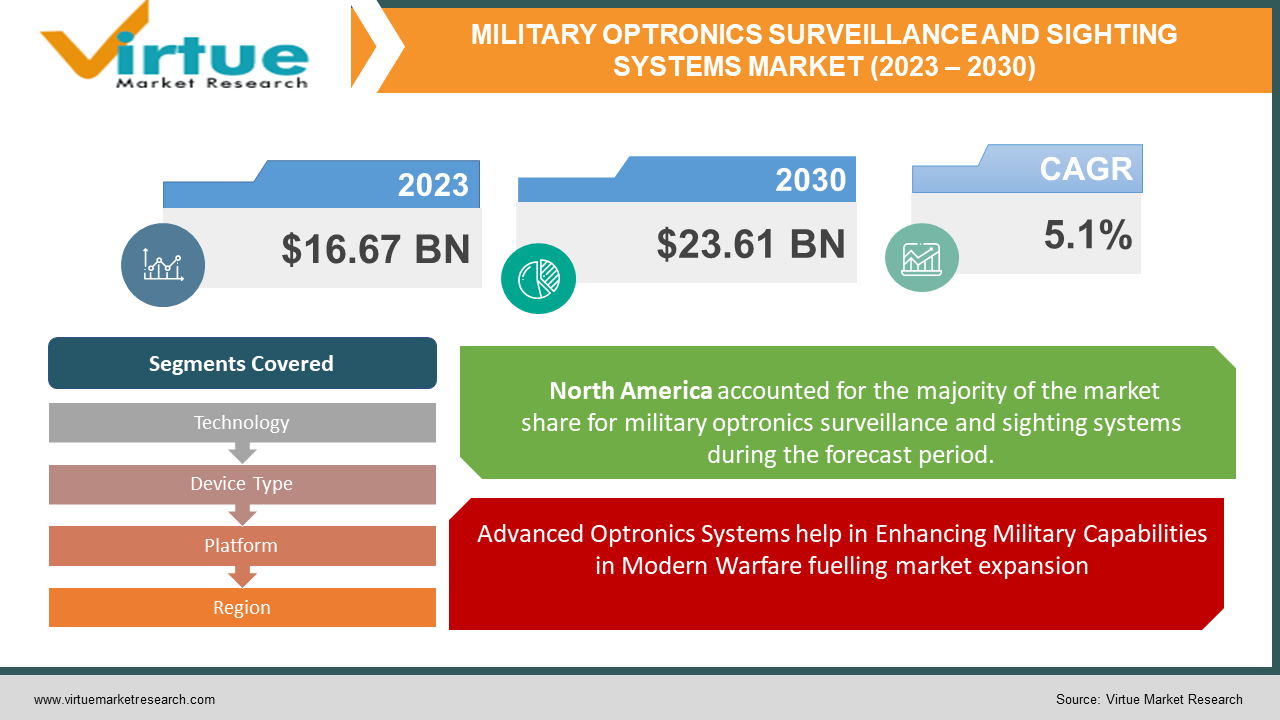

The Global Military Optronics Surveillance and Sighting Systems Market was valued at USD 16.67 Billion and is projected to reach a market size of USD 23.61 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.1%.

The rising demand for cutting-edge technology to improve defense capabilities has led to tremendous expansion in the military optronics surveillance and sighting systems market in recent years. Modern warfare relies heavily on optronics, a branch of optics and electronics that provides greater capabilities for target acquisition, surveillance, and aiming. This article gives a general overview of the military optronics surveillance and sighting systems industry, emphasizing its important factors, significant market participants, new developments, and prospects. More compact, lighter, and high-performance optronics systems have been created as a result of ongoing developments in sensor technology, image processing algorithms, and miniaturization. The efficiency of military operations has greatly increased as a result of these developments. Several nations are implementing defense modernization initiatives to replace their outdated military hardware. Through these efforts, armed forces are upgrading their combat effectiveness by replacing traditional sighting systems with cutting-edge optronic equipment. Over the anticipated years, there is projected to be a large rise in the need for military optronic surveillance and sighting equipment. Some of the major variables affecting this surge are arising defense spending, technical development, and escalating demand for sophisticated surveillance and targeting capabilities. The integration of optronics technology into unmanned platforms and the use of AI will open up new potential for industry expansion. Military optronic surveillance and sighting systems are experiencing tremendous growth in the market as a result of the need for cutting-edge defense technology in contemporary combat.

Global Military Optronics Surveillance and Sighting Systems Market Drivers:

Advanced Optronics Systems help in Enhancing Military Capabilities in Modern Warfare fuelling market expansion.

A key factor fuelling the expansion of the global market for military optronic surveillance and sighting systems is the changing nature of the threats faced in contemporary combat. Asymmetric warfare, urban battles, and non-state actors are just a few of the many complicated problems that traditional military operations must overcome. Armed forces need sophisticated optronics systems that offer better situational awareness, target recognition, and precision engagement capabilities to successfully fight these threats. Military personnel can quickly identify and address possible threats thanks to the real-time monitoring, intelligence collection, and target tracking capabilities provided by optronic surveillance and sighting systems. The operational efficacy of armed troops is considerably increased by these systems’ enhanced visual and sensor capabilities, which include electro-optical sensors, night vision equipment, thermal imagers, and laser rangefinders. The need for improved optronics systems will increase as the threat environment changes due to new technology and unconventional military strategies. To ensure that their armed forces are capable of successfully countering the difficulties posed by contemporary threats, governments, and defense organizations from all over the world are investing in the development and acquisition of these systems.

Technological Advancements Fuel the Growth of Military Optronics Surveillance Systems.

The global market for military optronic surveillance and sighting systems is expanding significantly as a result of technological improvements. Military forces now have access to cutting-edge optronics devices that are small, light, and highly effective because of ongoing advancements in sensor technology, image processing algorithms, and downsizing. Optronic systems now have greater range, resolution, and clarity because of advances in detector technology that have produced more precise and sensitive detectors. The rapid target recognition, identification, and tracking are made possible by image processing algorithms through real-time data analysis. Optronics systems are also more dependable, long-lasting, and power-efficient because of these technological developments, ensuring their performance in difficult operational settings. Optronics devices may now be integrated into a range of military assets, including ground vehicles, ships, and aerial platforms, thanks to downsizing. Because tiny and lightweight optronics systems offer better mobility and flexibility, military personnel can use these devices in a variety of tactical circumstances.

Global Military Optronics Surveillance and Sighting Systems Market Challenges:

Budget restrictions are one of the biggest issues the global industry for military optronic surveillance and sighting systems is facing. Governments must distribute cash among diverse defense initiatives and priorities since defense budgets are sometimes constrained. Budgetary restrictions may prevent the mainstream use of these cutting-edge technologies since optronics systems demand large investments in research, development, and procurement. Additionally, optronics systems' lifecycle maintenance and upgrade expenses may result in additional financial strains. The purchase and deployment of optronics systems may be constrained by the high cost of these devices, which includes acquisition, training, and maintenance costs, particularly for nations with constrained defense budgets or competing priorities. For market companies and defense agencies, finding affordable solutions without sacrificing quality and capabilities continues to be a major concern.

Global Military Optronics Surveillance and Sighting Systems Market Opportunities:

The growing emphasis on border protection represents a significant business opportunity for the global market for military optronic surveillance and sighting equipment. To address difficulties with illegal immigration, smuggling, and cross-border threats, many nations are giving priority to improving their border surveillance capabilities. Optronics devices are perfect for border surveillance applications because they provide sophisticated surveillance, target tracking, and situational awareness capabilities. The possibility for market participants to offer cutting-edge and efficient optronics systems specifically designed to meet border protection needs is enormous given the rising need for border security solutions.

COVID-19 Impact on Global Military Optronics Surveillance and Sighting Systems Market:

Due to the rising desire for remote operations and autonomous systems, the COVID-19 pandemic has created a sizable market potential for the global military optronics surveillance and sighting systems industry. The epidemic has made it more important than ever to limit human contact and lower the chance of transmission among military personnel. As a result, the use of unmanned systems, such as unmanned aerial vehicles (UAVs), unmanned ground vehicles (UGVs), and unmanned marine systems (UMS), is becoming more and more important. These unmanned platforms' integrated optics systems offer remote surveillance, reconnaissance, and targeting capabilities, allowing military operations to go successfully in circumstances when physical presence may be constrained. This possibility opens up new paths for optronics producers to create and offer cutting-edge systems designed for remote and mobile applications.

Global Military Optronics Surveillance and Sighting Systems Market Recent Developments:

In January 2021, Lockheed Martin has been awarded a $4.9 billion contract by the U.S. Space Force to build three new next-generation infrared spacecraft for space-based missile defense. Incoming ballistic missile launches from adversaries will be detected with the help of the Next Generation Geosynchronous (NGG) satellites. Along with building the satellites, Lockheed Martin will also develop software for analyzing data from ground sensors as part of the agreement. The project intends to enhance observational capacities while also modernizing the American missile defense system.

MILITARY OPTRONICS SURVEILLANCE AND SIGHTING SYSTEMS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

5.1% |

|

Segments Covered |

By Technology, Device Type, Platform and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Lockheed Martin Corporation, Raytheon Technologies Corporation, Thales Group, Safran Electronics & Defense, L3Harris Technologies, Inc., BAE Systems plc, Elbit Systems Ltd., Leonardo S.p.A., FLIR Systems, Inc. |

Global Military Optronics Surveillance and Sighting Systems Market Segmentation: By Technology

-

Image Intensification

-

Military Lasers System

-

Electric-Optics/Infrared

Image intensification, military laser systems, and electro-optics/infrared are the three technology segments that make up the global market for military optronic surveillance and sighting systems. Military troops can work productively at night thanks to image intensification technology, which improves sight in low-light situations. Including laser range finders and laser target designators, military laser systems provide precise targeting and engagement capabilities. A wide range of technologies, such as thermal imagers, night vision equipment, and infrared sensors, which improve situational awareness and target detection capabilities, are included in the electro-optics/infrared section. Due to the rising demand for sophisticated surveillance and target acquisition capabilities in numerous military applications, key market insights show that the electro-optics/infrared category now maintains a sizable market share. A sizeable portion of the industry is also accounted for by the image intensification market, which is primarily driven by the demand for better visibility in low light. Despite having a smaller market share, military laser systems are becoming more popular because of their accurate aiming skills. Overall, these technological areas support the many demands of the armed forces, boosting their operational efficiency under various conditions.

Global Military Optronics Surveillance and Sighting Systems Market Segmentation: By Device Type

-

Handheld Thermal Imaging Devices

-

Night Vision Devices

-

Standalone Infrared

-

Seismic and Acoustic Sensors

-

Others

For improved situational awareness in a variety of military missions, handheld thermal imaging systems provide portability and real-time thermal imaging capabilities. For night-time operations, night vision gadgets offer enhanced target recognition capability and low-light visibility. Various infrared imaging and detecting systems that are used for surveillance and target acquisition fall under the category of standalone infrared systems. To improve perimeter security and infiltration detection, seismic and acoustic sensors are used to find ground vibrations and auditory signatures. Laser rangefinders, laser target designators, and optical sensors are other products available on the market. Due to its widespread use in military activities, key industry insights show that the market share of night vision devices is large. The demand for portable and real-time thermal imaging capabilities has led to a significant market share for handheld thermal imaging equipment. The demand for sophisticated infrared systems for target acquisition and surveillance is driving growth in the standalone infrared market. Despite having a smaller market share, seismic and acoustic sensors are becoming more popular for perimeter security applications. In general, these device types meet various operational needs in the market for military optronic surveillance and sighting systems.

Global Military Optronics Surveillance and Sighting Systems Market Segmentation: By Platform

-

Airborne

-

Naval

-

Ground

The airborne, naval, and ground systems categories can be used to categorize the global market for military optronic surveillance and sighting systems. To improve surveillance, target acquisition, and precise engagement capabilities from the air, optronics technologies are integrated into military aircraft, helicopters, and unmanned aerial vehicles (UAVs). Optronics systems used on naval ships, submarines, and other maritime platforms that provide cutting-edge surveillance, tracking, and targeting capabilities for maritime operations make up the naval section. The optronics systems built into armored vehicles, infantry gear, and other ground-based platforms that are part of the ground segment improve situational awareness, target recognition, and engagement capabilities on the battlefield. A high market share is held by the ground platform sector, according to key market insights, as a result of the widespread use of optronics systems in ground-based military operations. Due to the growing use of optronics systems in military aircraft and unmanned aerial vehicles (UAVs), the airborne platform category also commands a sizeable market share. Despite having a lesser market share, the naval platform sector is anticipated to develop because of the increased demand for marine surveillance and targeting capabilities.

Global Military Optronics Surveillance and Sighting Systems Market Segmentation: By Region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

North America, Europe, Asia Pacific, South America, and the Middle East & Africa are the regions into which the global market for military optronics surveillance and sighting systems can be divided. Due to the existence of important defense manufacturers, technological breakthroughs, and high defense spending by nations like the United States, key market data show that North America holds a sizable market share. Due to defense modernization projects and the demand for advanced optronics systems in nations like the United Kingdom, Germany, and France, Europe also accounts for a sizeable portion of the market. Due to rising military spending, geopolitical unrest, and the modernization of armed forces in nations like China, India, and Japan, the Asia Pacific area is anticipated to experience significant expansion. Despite having lesser market shares, South America, the Middle East, and Africa provide prospects for market expansion since they require stronger monitoring systems and border security measures. Overall, the geographical segmentation highlights the disparities in defense spending, technological development, and military modernization initiatives across various geographic areas.

Global Military Optronics Surveillance and Sighting Systems Market Key Players:

-

Lockheed Martin Corporation

-

Raytheon Technologies Corporation

-

Thales Group

-

Safran Electronics & Defense

-

L3Harris Technologies, Inc.

-

BAE Systems plc

-

Elbit Systems Ltd.

-

Leonardo S.p.A.

-

FLIR Systems, Inc.

Chapter 1. Military Optronics Surveillance and Sighting Systems Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Military Optronics Surveillance and Sighting Systems Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Military Optronics Surveillance and Sighting Systems Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Military Optronics Surveillance and Sighting Systems Market - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Military Optronics Surveillance and Sighting Systems Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Military Optronics Surveillance and Sighting Systems Market - By Technology

6.1 Image Intensification

6.2 Military Lasers System

6.3 Electric-Optics/Infrared

Chapter 7. Military Optronics Surveillance and Sighting Systems Market - By Device Type

7.1 Handheld Thermal Imaging Devices

7.2 Night Vision Devices

7.3 Standalone Infrared

7.4 Seismic and Acoustic Sensors

7.5 Others

Chapter 8. Military Optronics Surveillance and Sighting Systems Market - By Platform

8.1 Airborne

8.2 Naval

8.3 Ground

Chapter 9. Military Optronics Surveillance and Sighting Systems Market - By Region

9.1 North America

9.2 Europe

9.3 Asia-Pacific

9.4 Rest of the World

Chapter 10. Military Optronics Surveillance and Sighting Systems Market - Key Players

10.1 Lockheed Martin Corporation

10.2 Raytheon Technologies Corporation

10.3 Thales Group

10.4 Safran Electronics & Defense

10.5 L3Harris Technologies, Inc.

10.6 BAE Systems plc

10.7 Elbit Systems Ltd.

10.8 Leonardo S.p.A.

10.9 FLIR Systems, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Military Optronics Surveillance and Sighting Systems Market was esteemed at USD 15.86 Billion in 2022.

The Global Military Optronics Surveillance and Sighting Systems Market is driven by Modern Warfare's Evolving Threats Drive Global Optronics Surveillance Market.

The Segments under the Global Military Optronics Surveillance and Sighting Systems Market by Device Type are Handheld Thermal Imaging Devices, Night Vision Devices, and Standalone Infrared.

China, Japan, South Korea, Singapore, and India are the most dominating countries in the Asia Pacific region for the Global Military Optronics Surveillance and Sighting Systems Market.

Lockheed Martin Corporation, Raytheon Technologies Corporation, and Thales Group are the three major leading players in the Global Military Optronics Surveillance and Sighting Systems Market.