Military Drone Navigation System Market Size (2023 - 2030)

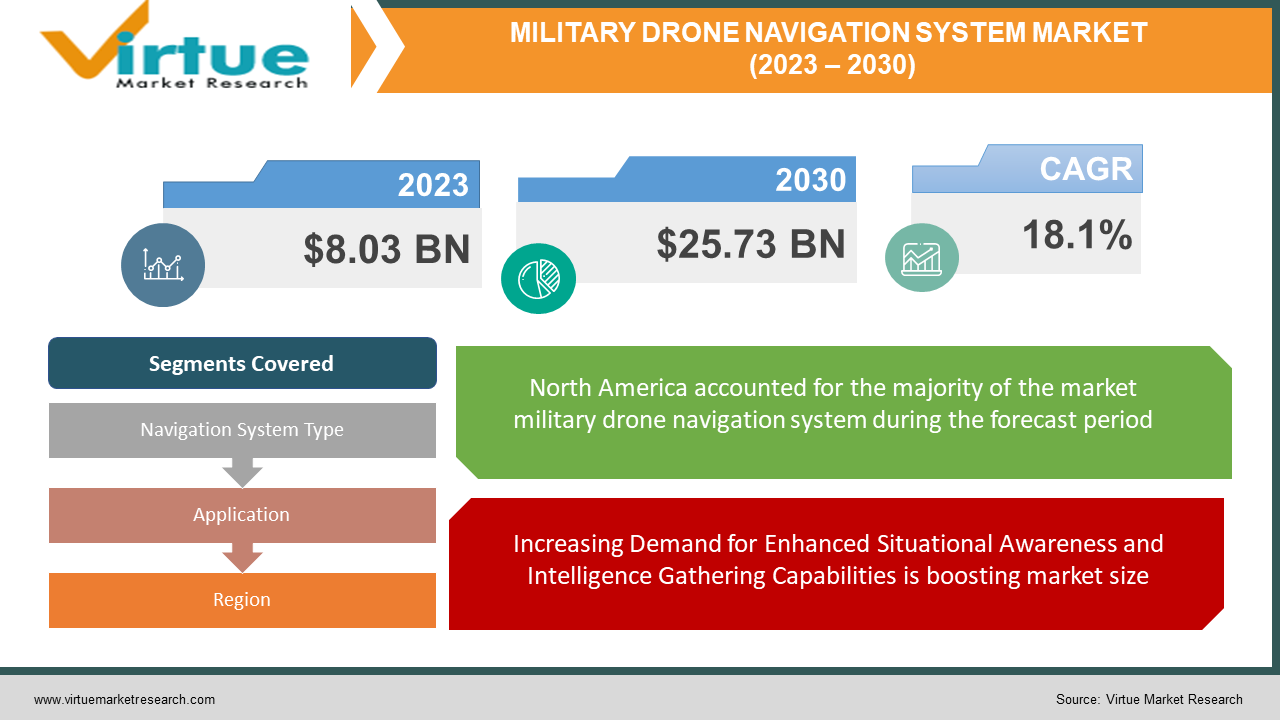

The Global Military Drone Navigation System Market was valued at USD 8.03 Billion and is projected to reach a market size of USD 25.73 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 18.1%.

Due to the growing use of unmanned aerial vehicles (UAVs) in defense operations, the market for military drone navigation systems has experienced significant expansion in recent years. A military drone navigation system is an essential part that permits precise and autonomous drone navigation, assuring the efficacy of drones in numerous military applications. This article gives a general overview of the military drone navigation system market, outlining its key drivers, difficulties, and opportunities going forward. Numerous reasons are contributing to the robust expansion of the global market for military drone navigation systems. First off, the expanding use of military drones is a result of the growing demand for sophisticated surveillance and reconnaissance capabilities in contemporary combat. In comparison to human systems, these unmanned ones have advantages like improved situational awareness, long-endurance operations, and cost-effectiveness. Additionally, the development of drone navigation systems has been fundamental to the market's growth. Military drones now have far better autonomy and navigational capabilities thanks to advancements in sensor technology, machine learning, and artificial intelligence (AI). These developments make it possible for drones to operate with extreme accuracy and dependability in complicated contexts, such as cities and hazardous regions. Due to the rising use of unmanned aerial vehicles in defense-related applications, the market for military drone navigation systems is increasing significantly. Technology advancements, the arising defense budget, and the need for greater surveillance and reconnaissance capabilities are all contributing to the market's growth. The market must be fully developed to overcome obstacles like regulatory constraints and cybersecurity dangers. The market for military drone navigation systems is anticipated to have a promising future as continuing discoveries and developments are anticipated to further enhance the autonomy and effectiveness of military drones in the years to come.

Global Military Drone Navigation System Market Drivers:

Increasing Demand for Enhanced Situational Awareness and Intelligence Gathering Capabilities is boosting market size.

The arising desire for better situational awareness and intelligence-collecting capabilities in contemporary warfare is one of the key factors propelling the global market for military drone navigation systems. Advanced navigation systems on military drones enable real-time surveillance and reconnaissance activities, giving military forces useful information and insights. These systems provide advanced image, video, and sensor technologies that can monitor and analyze ground activity, spot potential dangers, and acquire vital knowledge. Defense forces can gather vital data without putting personnel in danger thanks to military drones’ capacity to operate in hazardous conditions, such as hostile or distant areas. Drones can automatically travel through challenging terrain, adjust to shifting conditions, and maintain accurate positions by integrating sophisticated navigation systems. This skill improves military operations efficacy and efficiency, enabling quick decision-making and mission success. The need for sophisticated military drone navigation systems is anticipated to increase dramatically over the next few years as defense organizations throughout the world become more aware of the benefits of unmanned aerial systems in the intelligence-collecting process.

Technological Advancements in Drone Navigation Systems are fuelling market expansion.

Another significant factor propelling the global military drone navigation system market is technological developments in drone navigation systems. The capabilities of military drones have been transformed by the quick development of technologies like artificial intelligence (AI), machine learning, and sensor technologies, enabling more autonomous and precise navigation. Drones can now process enormous volumes of data in real-time thanks to AI and machine learning algorithms, enabling them to make wise judgments and adapt to changing settings. To ensure secure and effective operations, these algorithms may examine sensor data, spot impediments, improve fly trajectories, and modify navigational parameters. These developments have drastically reduced the need for human operators, enabling drones to operate autonomously and carry out complex tasks with little assistance. The navigational skills of drones have been greatly enhanced by the development of advanced sensor technologies, including inertial sensors, computer vision cameras, and GPS systems. These sensors track speed and orientation, provide accurate location data, and record visual data for precise mapping and object detection. These developments make it possible for military drones to fly steadier, prevent collisions, and navigate more precisely.

Global Military Drone Navigation System Market Challenges:

The growing danger of cybersecurity breaches is one of the biggest problems the global market for military drone navigation systems is facing. Military drones are vulnerable to cyberattacks that could damage their control and navigational systems as they become increasingly autonomous and linked. There are huge hazards to military operations and crew safety from hackers who could try to eavesdrop on communication channels, change navigation data, or even seize control of drones. To reduce these risks and preserve the integrity and security of military drone operations, it is crucial to ensure strong cybersecurity measures, put encryption protocols into place, and regularly update and patch drone navigation systems.

COVID-19 Impact on Global Military Drone Navigation System Market:

The COVID-19 epidemic has had some favorable effects on the market for military drone navigation systems worldwide. The need for unmanned devices, especially military drones, for surveillance, reconnaissance, and monitoring reasons surged as countries imposed lockdowns and travel restrictions. Drones were used by military troops to maintain situational awareness and enforce laws in outlying locations. This increase in demand for military drones increased the requirement for sophisticated navigational systems, which fuelled market expansion. On the other hand, the pandemic hampered manufacturing, logistics, and supply chains, which slowed down the development and delivery of military drone navigation systems. The availability of essential components was adversely impacted by trade restrictions and difficulties in international transportation, which also hampered market expansion. Additionally, budget restraints and a reordering of defense expenditures because of the pandemic's effects on the economy's stability may have resulted in lower investments in military drone navigation systems.

MILITARY DRONE NAVIGATION SYSTEM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

18.1% |

|

Segments Covered |

By Navigation System Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

SZ DJI Technology Co., Ltd., AeroVironment, Inc., SBG Systems, Leica Geosystems AG, Hexagon AB, UAV Navigation, DJI, Collins Aerospace (United Technologies Corporation), AeroVironment Inc., Honeywell International Inc. |

Global Military Drone Navigation System Market Segmentation: By Navigation System Type

-

Global Positioning Systems (GPS)

-

Inertial Navigation Systems (INS)

-

Visual Odometry and Simultaneous Localization and Mapping (SLAM)

Global Positioning Systems (GPS), Inertial Navigation Systems (INS), Visual Odometry and Simultaneous Localization and Mapping (SLAM), and other navigation systems can be used to segment the market for military drone navigation systems. Satellite signals are used by GPS-based navigation systems to identify the position and trajectory of the drone. INS systems assess acceleration, rotation, and direction using internal sensors. Cameras and computer vision algorithms are used in visual odometry and SLAM technologies to map the drone's surroundings and determine its position. The industry is currently dominated by GPS-based navigation systems because of their extensive use and dependability. However, improvements in computer vision, machine learning, and artificial intelligence are promoting the use of SLAM and visual odometry systems. The market share of each segment differs, with GPS-based systems and INS systems having the two greatest market shares. However, because of their capacity to function in areas where GPS is not available and because they offer more accurate and reliable navigation capabilities, visual odometry and SLAM systems are expanding significantly.

Global Military Drone Navigation System Market Segmentation: By Application

-

Surveillance and Reconnaissance

-

Combat and Weaponization

Based on how these systems are used, the market for military drone navigation systems can be divided into two categories: combat and weaponization and surveillance and reconnaissance. Military drones are used in surveillance and reconnaissance applications for real-time intelligence gathering, activity monitoring, and aerial surveillance. Because drones with sophisticated navigation systems make it possible to collect accurate and thorough data during various military missions, this market sector commands a sizeable market share. The use of military drones for offensive objectives, such as target engagement and payload delivery, is covered under the Combat and Weaponization part. As armed drones with precise navigation systems are used in combat operations more frequently, this market is expanding quickly. While the majority of the market is taken up by surveillance and reconnaissance applications due to their wide range of uses, the combat and weaponization segment is rapidly expanding as a result of the growing integration of navigation systems with weapon systems, which increases the efficiency of military drones in combat situations.

Global Military Drone Navigation System Market Segmentation: By Region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

Regional divisions of the global market for military drone navigation systems include North America, Europe, Asia Pacific, South America, and the Middle East & Africa. In terms of market share, North America now dominates the market for military drone navigation systems. Key drone manufacturers and defense companies are well-represented in the area, and major expenditures in R&D have been made. Due to the arising use of military drones for defense and surveillance by many European nations, Europe is also a significant market. As a result of increased defense budgets in nations like China and India, which are investing in cutting-edge military drone capabilities, the Asia Pacific region is experiencing significant market expansion. The demand for improved military capabilities and an increase in defense modernization initiatives are likely to drive expansion in South America, the Middle East, and Africa. Despite the market's current dominance in North America, other areas are escalating quickly and offering lucrative prospects to market participants.

Global Military Drone Navigation System Market Key Players:

-

SZ DJI Technology Co., Ltd.

-

AeroVironment, Inc.

-

SBG Systems

-

Leica Geosystems AG

-

Hexagon AB

-

UAV Navigation

-

DJI

-

Collins Aerospace (United Technologies Corporation)

-

AeroVironment Inc.

-

Honeywell International Inc.

Chapter 1. Military Drone Navigation System Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Military Drone Navigation System Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Military Drone Navigation System Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Military Drone Navigation System Market - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Military Drone Navigation System Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Military Drone Navigation System Market - By Navigation System Type

6.1 Global Positioning Systems (GPS)

6.2 Inertial Navigation Systems (INS)

6.3 Visual Odometry and Simultaneous Localization and Mapping (SLAM)

Chapter 7. Military Drone Navigation System Market - By Application

7.1 Surveillance and Reconnaissance

7.2 Combat and Weaponization

Chapter 8. Military Drone Navigation System Market - By Region

8.1 North America

8.2 Europe

8.3 Asia-Pacific

8.4 Rest of the World

Chapter 9. Military Drone Navigation System Market - Key Players

9.1 SZ DJI Technology Co., Ltd.

9.2 AeroVironment, Inc.

9.3 SBG Systems

9.4 Leica Geosystems AG

9.5 Hexagon AB

9.6 UAV Navigation

9.7 DJI

9.8 Collins Aerospace (United Technologies Corporation)

9.9 AeroVironment Inc.

9.10 Honeywell International Inc

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Global Military Drone Navigation System Market is estimated to be worth USD 6.8 Billion in 2022 and is projected to reach a value of USD 25.73 Billion by 2030, growing at a CAGR of 18.1% during the forecast period 2023-2030

The Global Military Drone Navigation System Market is driven by the Increasing Demand for Enhanced Situational Awareness and Intelligence Gathering Capabilities.

The Segments under the Global Military Drone Navigation System Market by the Application are Surveillance and Reconnaissance, Combat, and Weaponization.

China, Japan, South Korea, Singapore, and India are the most dominating countries in the Asia Pacific region for the Global Military Drone Navigation System Market.

SZ DJI Technology Co., Ltd., AeroVironment, Inc., and SBG Systems are the three major leading players in the Global Military Drone Navigation System Market.