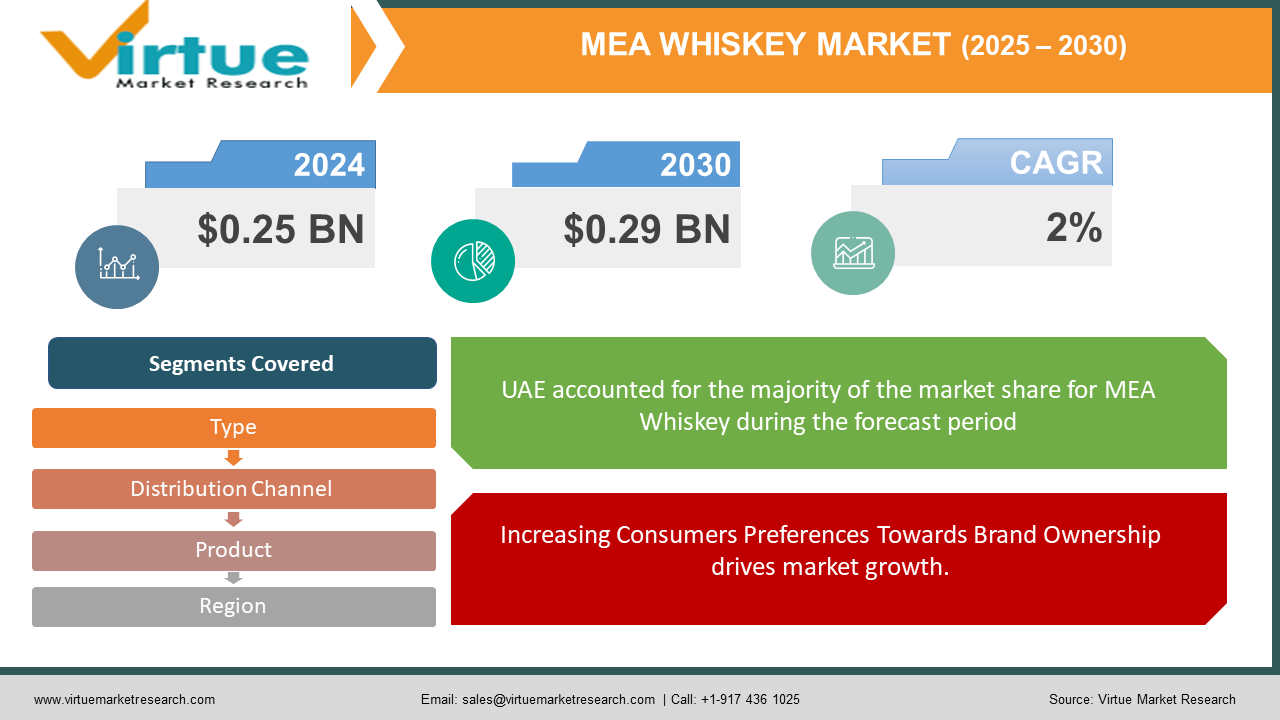

Middle East And Africa Whiskey Market Size (2024-2030)

The Middle East And Africa Whiskey Market was valued at USD 0.25 Billion in 2023. Over the forecast period of 2024-2030 it is projected to reach USD 0.29 billion by 2030, growing at a CAGR of 2%.

Whiskey, alternatively known as whisky, is a distilled alcoholic beverage derived from fermented grain mash. This spirit is commonly matured in wooden barrels, predominantly crafted from oak, imparting its distinct color and taste. The selection of grains and the duration of aging contribute to the creation of various types, including bourbon, Scotch, rye, and Irish whiskey.

Key Market Insights:

- Renowned for its varied cultural heritage and an increasing appreciation for premium spirits, the whiskey segment in the Middle East and Africa (MEA) exemplifies a unique blend of tradition and modernity.

- The region's market, with its refined taste for both local and international whiskey offerings, demonstrates a preference for rich and complex flavor profiles.

- From a regional analysis perspective, the MEA region shows a growing trend in whiskey consumption, driven by an expanding middle class and a heightened interest in luxury beverages. In conclusion, the MEA region stands out as a promising frontier in the whiskey market, representing a fusion of cultural heritage and evolving consumer preferences.

Middle East And Africa Whiskey Market Drivers:

Increasing Consumers Preferences Towards Brand Ownership drives market growth.

The demand for diverse scotch whiskey offerings from emerging markets, coupled with the growing request for lower alcohol varieties and organic whiskey among health-conscious consumers, is propelling the market forward. Additionally, with the emphasis on healthy living, there is a preference for leading brands. Top market players have also initiated a new trend towards organic whiskey.

Escalating Demand increases market growth.

There is an increasing demand for whiskey, particularly among individuals who value the craftsmanship and heritage of whiskey production. This trend is primarily driven by rising disposable incomes and a burgeoning social culture. A study indicates that the appreciation for premium and aged whiskeys has significantly grown, with consumers willing to invest in distinctive experiences.

Middle East And Africa Whiskey Market Restraints and Challenges:

Excess intake can lead to various diseases which can hinder the market.

Alcohol poisoning can result in elevated heart rates, nausea, and vomiting. It also impairs judgment, disrupts balance, and alters response patterns, leading individuals to make rash or negligent decisions even in critical situations. Excessive drinking causes liver cirrhosis, disrupting normal body metabolism, leading to fat deposition, liver hardening, and a complete breakdown of its functions. Additionally, excessive alcohol consumption can lead to addiction, prompting individuals to consume more, triggering a chain reaction of harmful effects on the body. This destructive cycle severely impairs body metabolism and increases the risk of stroke.

Middle East And Africa Whiskey Market Opportunities:

Extensive Promotional Activities creating opportunities.

Manufacturers are enhancing market visibility through advertising campaigns, event sponsorships, and digital marketing strategies. These efforts are vital in educating consumers and generating interest in diverse whiskey products. Additionally, the growth of online retail portals, which provide a wide selection of whiskeys and the convenience of doorstep delivery, has substantially contributed to market expansion.

MIDDLE EAST AND AFRICA WHISKEY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

2% |

|

Segments Covered |

By Product, Type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Saudi Arabia, Qatar, UAE, Israel, South Africa, Nigeria, Kenya, Egypt, Rest of the Middle East |

|

Key Companies Profiled |

Diageo, William Grant & Sons, Chivas Brothers, La Martiniquaise, Belvedere, Bacardi, The Edrington Group, Whyte & Mackay, Beam Suntory, Loch Lomond. |

Middle East And Africa Whiskey Market Segmentation:

Middle East And Africa Whiskey Market Segmentation By Type:

- Scotch whiskey

- American whiskey

- Canadian whiskey

- Irish whiskey

- Others

Scotch whiskey maintained a dominant market position, securing more than 35.2% of the market share. Known for its rich heritage and stringent production standards, Scotch whiskey boasts a loyal consumer base that appreciates its distinctive taste and quality. The market's robust growth is driven by an increasing appreciation for premium spirits and a strong demand for age-labeled single malts.

American whiskey followed closely as a substantial segment, benefiting from its versatility and wide range of flavors. The rise in craft distilleries and innovative aging techniques has boosted its popularity, particularly among younger consumers seeking unique and authentic experiences. The growth in exports and the rising trend of cocktail culture have further propelled its market expansion.

Irish whiskey, characterized by its triple-distilled smoothness, has been the fastest-growing segment. The revival of this category is fueled by an increase in distilleries, a booming tourism sector, and widespread distribution. Its approachable flavor profile continues to attract new enthusiasts, significantly enhancing its market presence.

Middle East And Africa Whiskey Market Segmentation By Product:

- Malt

- Wheat

- Rye

- Corn

- Blended

- Others

Wheat whiskey held a dominant market position. With a minimum of 51% wheat in its composition, wheat whiskey has a distinctive light and gently sweet profile. Its spice level varies depending on the secondary grains used, but it typically remains subtly flavored.

Blended whiskey, composed of a mix of different types of whiskeys and sometimes grain alcohol, offers a wide range of flavors and price points. The wide range of offerings makes it accessible and attractive to a diverse audience, thereby bolstering its consistent presence in the market. Innovations in blending techniques and the introduction of premium blends are enhancing its profile and market reach.

Middle East And Africa Whiskey Market Segmentation By Distribution Channel:

- On-Trade

- Off-Trade

In 2023, On-Trade distribution channels held a dominant position in the whiskey market, capturing over 55.2% of the market share. This channel, which includes restaurants, bars, and liquor stores, is a primary avenue for consumers to enjoy whiskey in engaging and social settings. These establishments offer a vast selection of whiskey brands and provide platforms for patrons to explore various whiskey expressions. The expertise of bartenders and the ambiance of these venues significantly enhance the drinking experience, attracting a steady flow of customers and driving sales within this segment.

Despite the prominence of On-Trade, Off-Trade distribution represents the largest channel. Off-Trade accounted for the most significant market share due to its widespread availability and convenience. Consumers prefer Off-Trade channels due to the convenience of purchasing whiskey for home consumption or as gifts. The ability to compare prices, read reviews, and enjoy doorstep delivery further boosts the attractiveness of this channel.

Supermarkets and hypermarkets, within the Off-Trade category, play a crucial role due to their extensive coverage and diverse selection of whiskey brands. These establishments cater to a broad spectrum of consumers, offering a range that spans from economical choices to premium selections. Discount stores, which attract price-sensitive consumers, further bolster this segment by providing accessible and affordable whiskey options, thereby contributing to its overall growth.

Online stores are revolutionizing how consumers buy whiskey, offering a hassle-free shopping experience with the added advantage of a broader selection. Consumers can easily browse and purchase from a variety of whiskey brands, benefiting from competitive pricing and detailed product information.

Liquor stores, an essential part of both On-Trade and Off-Trade channels, offer a curated selection of mainstream and niche whiskey brands. Knowledgeable staff in these stores are pivotal in assisting consumers, providing valuable guidance to help them make informed decisions tailored to their taste preferences and budget. This expertise enhances the overall customer experience, fostering satisfaction and contributing to market growth.

Middle East And Africa Whiskey Market Segmentation - by Region

- United Arab Emirates

- Saudi Arabia

- Qatar

- Israel

- South Africa

- Nigeria

- Kenya

- Egypt

- Rest of MEA

The UAE market represents nearly 72% of the whiskey market size in the Middle East and North Africa. Companies operating in the United Arab Emirates whiskey market are leveraging innovation to address gaps in product offerings. Continuous monitoring of market size and company performance is crucial for competitors aiming to capture and maximize profits.

Saudi Arabia is the fastest-growing segment in the market. Recently, Saudi Arabia has opened an off-license in the diplomatic quarter of Riyadh, marking the kingdom's first commercial outlet for alcohol sales since the public sale and consumption ban was enacted in 1952. As part of Vision 2030, Saudi Arabia is advancing plans to develop a tourism sector featuring major hotels, resorts, entertainment venues, sporting locations, and currently alcohol-free restaurants and bars.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic had a significant impact on the whiskey market. However, post-pandemic, the market is rebounding swiftly and is expected to regain its pre-COVID levels in the coming years. The increasing consumption of alcoholic beverages in numerous countries is driving market expansion. Factors such as high disposable incomes, evolving consumer lifestyles, and elevated standards of living are key trends influencing this growth.

Latest Trends/ Developments:

- In October 2022, William Grant & Sons unveiled their exclusive range of whiskies for travel retail under the Glenfiddich brand. The collection featured four distinct types: Vat 01 with 40% ABV, Vat 02 with 43% ABV, Vat 03 with 50.2% ABV, and Vat 04 with 47.8% ABV.

- In March 2022, Diageo India introduced Godawan Single Malt, an artisanal whisky produced locally. Initially launched in Rajasthan and Delhi, Diageo India has since expanded distribution plans to make Godawan available across the entire country, scaling up its presence in the Indian market.

Key Players:

These are top 10 players in the Middle East And Africa Whiskey Market: -

- Diageo

- William Grant & Sons

- Chivas Brothers

- La Martiniquaise

- Belvedere

- Bacardi

- The Edrington Group

- Whyte & Mackay

- Beam Suntory

- Loch Lomond

Chapter 1. Middle East And Africa Whiskey Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Middle East And Africa Whiskey Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Middle East And Africa Whiskey Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Middle East And Africa Whiskey Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Middle East And Africa Whiskey Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Middle East And Africa Whiskey Market– By Type

6.1. Introduction/Key Findings

6.2. Scotch whiskey

6.3. American whiskey

6.4. Canadian whiskey

6.5. Irish whiskey

6.6. Others

6.7. Y-O-Y Growth trend Analysis By Type

6.8. Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 7. Middle East And Africa Whiskey Market– By Product

7.1. Introduction/Key Findings

7.2 Malt

7.3. Wheat

7.4. Rye

7.5. Corn

7.6. Blended

7.7. Others

7.8. Y-O-Y Growth trend Analysis By Product

7.9. Absolute $ Opportunity Analysis By Product , 2024-2030

Chapter 8. Middle East And Africa Whiskey Market– By Distribution Channel

8.1. Introduction/Key Findings

8.2. On-Trade

8.3. Off-Trade

8.4. Y-O-Y Growth trend Analysis By Distribution Channel

8.5. Absolute $ Opportunity Analysis By Distribution Channel , 2024-2030

Chapter 9 . Middle East And Africa Whiskey Market, By Geography – Market Size, Forecast, Trends & Insights

9 .1. Middle East and Africa

9 .1.1. By Country

9 .1.1.1. Saudi Arabia

9 .1.1.2. Qatar

9 .1.1.3. UAE

9 .1.1.4. Israel

9 .1.1.5. South Africa

9 .1.1.6. Nigeria

9 .1.1.7. Kenya

9 .1.1.9 . Egypt

9 .1.1.9 . Rest of the Middle East

9.1.2. By Type

9.1.3. By product

9.1.4. Distribution Channel

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Middle East And Africa Whiskey Market– Company Profiles – (Overview, Type Type Portfolio, Financials, Strategies & Developments)

10.1. Diageo

10.2. William Grant & Sons

10.3. Chivas Brothers

10.4. La Martiniquaise

10.5. Belvedere

10.6. Bacardi

10.7. The Edrington Group

10.8. Whyte & Mackay

10.9. Beam Suntory

10.10. Loch Lomond

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The demand for diverse scotch whiskey offerings from emerging markets, coupled with the growing request for lower alcohol varieties and organic whiskey among health-conscious consumers, is propelling the market forward

The top players operating in the Middle East And Africa Whiskey Market are - Diageo, William Grant & Sons, Chivas Brothers, La Martiniquaise, Belvedere, Bacardi, The Edrington Group, Whyte & Mackay, Beam Suntory, Loch Lomond

The COVID-19 pandemic had a significant impact on the whiskey market. However, post-pandemic, the market is rebounding swiftly and is expected to regain its pre-COVID levels in the coming years.

. In October 2022, William Grant & Sons unveiled their exclusive range of whiskies for travel retail under the Glenfiddich brand. The collection featured four distinct types: Vat 01 with 40% ABV, Vat 02 with 43% ABV, Vat 03 with 50.2% ABV, and Vat 04 with 47.8% ABV.

Saudi Arabia is the fastest-growing segment in the market.