Middle East and Africa Sports Food Market Size (2024-2030)

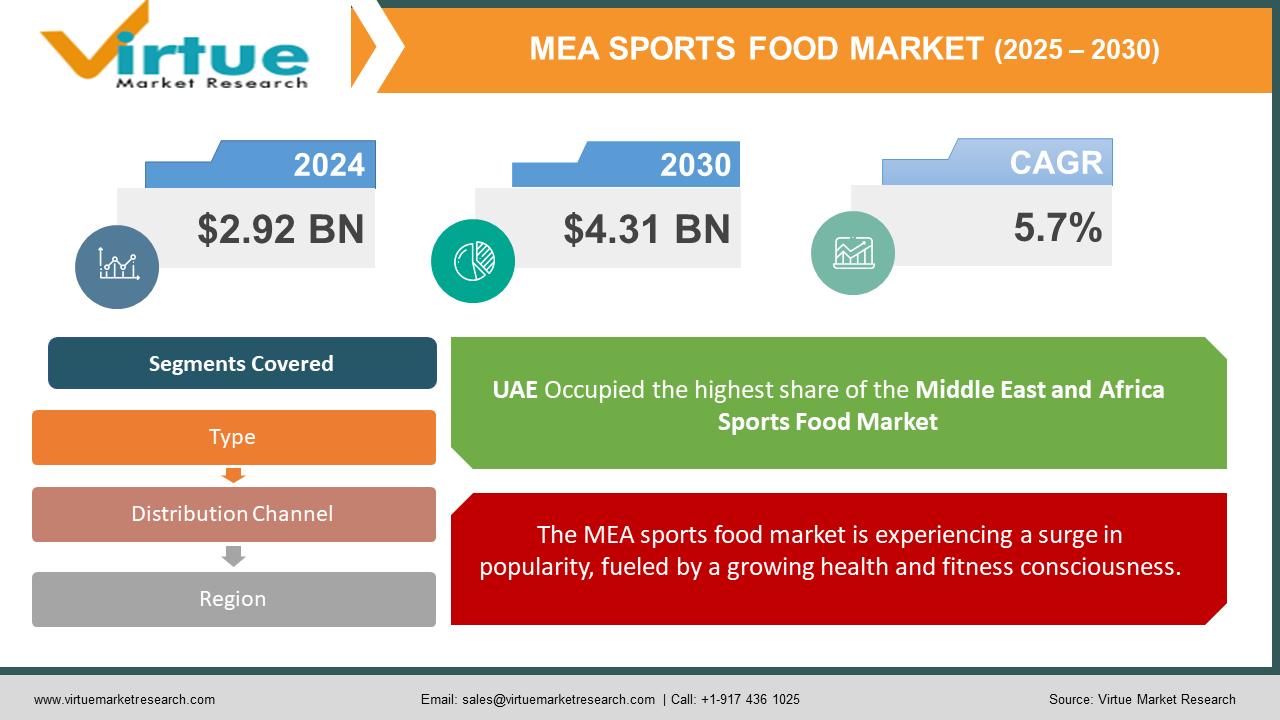

The Middle East and Africa Sports Food Market was valued at USD 2.92 Billion in 2023 and is projected to reach a market size of USD 4.31 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.7%.

The MEA sports food market is characterized by a mix of established international brands and emerging regional players. Major players include global giants like Nestlé (Optimum Nutrition), PepsiCo (Gatorade), and Glanbia (Optimum Nutrition) alongside regional brands like Dubai-based Sporter and Egypt's Biotech International. Market dominance can vary across the region, with international brands having a stronger presence in developed markets and regional players gaining traction in growing economies. The popularity of fitness activities like gym memberships, marathons, and endurance races is creating a wider customer base for sports food products. The rise of personalized fitness plans is leading to a demand for customized sports nutrition products tailored to individual needs and goals. Products combining protein, carbohydrates, healthy fats, and other functional ingredients like vitamins and probiotics are gaining popularity. Consumers are demanding transparency in product labeling, with a preference for clear information about ingredients and their benefits.

Key Market Insights:

- The growing number of gym memberships (estimated 25 million in 2023) and participation in fitness activities create a strong consumer base.

- Busy lifestyles fuel demand for ready-to-consume options like protein bars and energy drinks (estimated market share of 15-20%).

- Protein powders and supplements account for the largest market share (estimated 35-40%), with whey protein being a dominant choice.

- The energy drinks and gels segment is witnessing significant growth (estimated CAGR of 7%), driven by rising demand for performance enhancement.

- Recovery drinks and bars (estimated market share of 10-15%) are gaining traction as athletes prioritize post-workout muscle repair.

- Consumers are increasingly seeking sports food products made with natural and organic ingredients (estimated market segment growth of 10% annually).

- The presence of counterfeit sports nutrition products (estimated to account for 5-10% of the market) can pose a health risk. Strengthening regulations and consumer education are crucial.

Middle East and Africa Sports Food Market Drivers:

The MEA sports food market is experiencing a surge in popularity, fueled by a growing health and fitness consciousness.

Consumers in the MEA region have more money to spend on their health and wellness as disposable incomes rise, especially among young professionals and urban populations. This means that money will be spent more on gym memberships, fitness gear, and—most importantly—sports nutrition supplies. A busy lifestyle frequently leaves little time for cooking extravagant meals. This trend is well suited to the convenience aspect provided by ready-to-eat sports food options like protein bars, energy drinks, and pre-measured protein powders. Time-pressed people are especially drawn to portable products that require no preparation. The rise in disposable income creates an opportunity for the introduction of premium sports nutrition products with high-quality ingredients, targeted formulations, and innovative formats. Developing a variety of convenient, ready-to-consume options caters to busy lifestyles and expands the consumer base beyond dedicated athletes.

The rise of social media fitness influencers and athletes promoting sports nutrition products has significantly boosted consumer awareness.

The burgeoning fitness industry, with a growing number of gyms, fitness centers, and sports facilities, creates fertile ground for the sports food market. Partnerships with gyms and fitness professionals can provide valuable reach and establish brand trust. Increased media coverage of sporting events and endorsements by popular athletes can further elevate the perception of sports nutrition products and their importance in athletic performance and overall fitness. Transparency and clear labeling are crucial. Providing detailed information about ingredients, benefits, and scientific backing can build trust with consumers. Developing educational content that addresses common fitness and nutrition questions can establish brands as thought leaders in the space.

Middle East and Africa Sports Food Market Restraints and Challenges:

In some parts of the MEA region, particularly in less developed areas, awareness about sports nutrition and its benefits remains relatively low. Consumers might not understand the role these products can play in optimizing their workouts and recovery. The abundance of online information, not all of it credible, can lead to confusion and misconceptions about sports nutrition products. Consumers might be hesitant to embrace these products due to unfounded concerns about side effects or unnecessary ingredients. Counterfeit sports nutrition products can pose a significant health risk. These products may contain harmful ingredients, be ineffective, or even have dangerous side effects. The presence of such products erodes consumer trust in the market as a whole. Uneven or lax regulations across the MEA region can create loopholes for counterfeiters and make it difficult to enforce quality standards. This can discourage legitimate manufacturers from entering certain markets. Disposable income levels vary considerably across the MEA region. While some consumers have the means to invest in premium sports nutrition products, others might find them prohibitively expensive. This limits market penetration in some areas. Navigating the complex web of regulations and import/export restrictions across different countries in the MEA region can be challenging for manufacturers. This can hinder market entry and limit product availability.

Middle East and Africa Sports Food Market Opportunities:

A growing segment of consumers in the MEA region prioritizes natural and organic ingredients. This presents an opportunity for the development and marketing of sports nutrition products free from artificial additives, preservatives, and synthetic ingredients. A growing segment of consumers in the MEA region prioritizes natural and organic ingredients. This presents an opportunity for the development and marketing of sports nutrition products free from artificial additives, preservatives, and synthetic ingredients. The one-size-fits-all approach to fitness is waning. Consumers are increasingly interested in personalized fitness plans and nutrition strategies tailored to their specific goals and needs. Emerging technologies like wearable fitness trackers and smartphone apps can be leveraged to collect user data and suggest personalized sports nutrition solutions. Products combining protein, carbohydrates, healthy fats, vitamins, probiotics, and other functional ingredients are gaining popularity. These offer a convenient and comprehensive approach to sports nutrition. A growing understanding of the gut microbiome's role in overall health creates a space for sports nutrition products promoting gut health and improved digestion for athletes.

MIDDLE EAST AND AFRICA SPORTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.7% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Saudi Arabia, Qatar, UAE, Israel, South Africa, Nigeria, Kenya, Egypt, Rest of the Middle East |

|

Key Companies Profiled |

PepsiCo Inc., The Coca-Cola Company, Abbott Nutrition, Tiger Brands, Enduren Nutrition, Desert Muscle, Nutrocelle, Shape Nutrition |

Middle East and Africa Sports Food Market Segmentation:

Middle East and Africa Sports Food Market Segmentation: By Type

- Protein Powders and Supplements

- Sports Drinks and Gels

- Recovery Drinks and Bars

- Energy Bars and Snacks

- Dietary Supplements

Due to the emphasis on optimizing protein consumption for total muscle growth, recuperation, and developing muscle, protein powders and supplements are the industry leaders. Owing to its comprehensive amino acid profile and quick rate of absorption, whey protein continues to be the most preferred option. Muscle tissue's primary building component is protein. Protein powders are used by fitness enthusiasts and athletes to boost muscle growth, increase daily protein intake, and aid in post-workout repair. Protein powders are easily included in shakes, smoothies, and baking dishes because they are available in a variety of flavors and formulations. They are perfect for consuming before or after a workout because of their mobility.

The MEA sports food market is seeing a sharp increase in the use of functional food mixes. More and more customers are looking for goods that are customized to meet their unique wants and objectives. Protein, carbs, healthy fats, vitamins, minerals, and even probiotics can all be included in functional blends to provide individualized nutritional support. The focus has shifted beyond just performance enhancement to include overall health and well-being. Functional blends can address specific concerns like immune function, gut health, or recovery optimization. These blends offer a convenient one-stop solution for athletes, eliminating the need to mix multiple products. Continuous innovation in formulations and ingredients keeps this segment exciting and dynamic.

Middle East and Africa Sports Food Segmentation: By Distribution Channel:

- Supermarkets & Hypermarkets

- Convenience Stores

- Online Platforms

- Specialty Stores

The highest market share is held by supermarkets and hypermarkets. A large range of sports nutrition items are available at supermarkets and hypermarkets, making them easily accessible to a large number of customers. They frequently carry well-known brands and well-liked product categories. These shops are ideally situated in towns and cities, making them accessible to a big consumer base. They are a one-stop shop for food and sports nutrition needs because of their extensive presence. Supermarkets and hypermarkets generally carry well-known brands with a high level of brand awareness, enabling customers to select well-known products with assurance.

E-commerce is emerging as one of the fastest-growing distribution channels in the MEA sports food market. The rising number of internet users in the MEA region, coupled with increasing smartphone adoption, is creating a fertile ground for online shopping. E-commerce platforms offer a convenient and time-saving way to shop. Consumers can browse products, compare prices, and make purchases from the comfort of their homes. Online retailers often have a wider selection of products compared to traditional stores, including niche brands and specialty formulations.

Middle East and Africa Sports Food Market Segmentation: Regional Analysis:

- United Arab Emirates

- Saudi Arabia

- Qatar

- Israel

- South Africa

- Nigeria

- Kenya

- Egypt

- Rest of MEA

With an astounding 18% of the market, the United Arab Emirates (UAE) has solidly established itself as the most powerful nation in the Middle East and Africa's sports food sector. Numerous elements contribute to this supremacy, such as the nation's growing fitness and sports culture, its emphasis on healthy living, and its extensive retail and distribution network. The population of the United Arab Emirates is both wealthy and diversified, and a sizable percentage of its citizens lead active lifestyles by engaging in a variety of sports and fitness pursuits. Sports nutrition items are highly recommended for this group in order to aid in their recuperation and performance.

Saudi Arabia has become the nation with the fastest rate of growth. Saudi Arabia's youthful population has contributed greatly to the growth of the sports food business. A significant section of the population in the country is young, and they are showing an increasing amount of interest in sports and fitness. This tendency has been further fostered by government attempts to promote sports and physical fitness, such as the establishment of state-of-the-art sports facilities and the establishment of the Saudi Arabian Olympic Committee.

COVID-19 Impact Analysis on the Middle East and Africa Sports Food Market:

Lockdowns and border restrictions disrupted global supply chains, leading to temporary shortages of certain ingredients and finished products. This impacted both imported and locally produced sports nutrition items. The closure of gyms, fitness centers, and sporting events significantly reduced a key sales channel for sports nutrition products. This resulted in lost revenue and forced manufacturers to adapt their strategies. Pandemic-induced anxieties led some consumers to prioritize essential goods over sports nutrition products, impacting overall demand in the short term. Concerns about hygiene and in-person shopping also influenced purchasing habits. With gyms closed, many turned to home workouts, increasing demand for convenient and home-based sports nutrition solutions like protein powders, energy bars, and workout supplements.

Latest Trends/ Developments:

The growing number of vegans and flexitarians in the MEA region is driving the demand for plant-based sports nutrition products. Consumers are seeking protein alternatives derived from sources like pea protein, brown rice protein, and soy protein. Environmentally conscious consumers are increasingly interested in plant-based options due to their lower environmental footprint compared to animal-derived protein sources. Ethical concerns regarding animal welfare also contribute to the rise of plant-based sports nutrition. Exploring and utilizing new plant-based protein sources like hemp seed protein and chickpea protein can offer additional options for consumers. Consumers are moving beyond traditional protein powders and sports drinks. Functional food blends combine protein, carbohydrates, healthy fats, vitamins, minerals, and other functional ingredients in convenient formats like pre-portioned packets or ready-to-drink shakes. These blends cater to specific needs like muscle building, recovery optimization, or immune support. Emerging technologies like wearable fitness trackers and smartphone apps are providing valuable data on individual needs. Sports nutrition companies are leveraging this data to develop functional food blends tailored to specific activity levels and performance goals. In the MEA region, the proportion of women engaging in fitness-related activities is rising quickly. The sports food industry now has a great chance to meet the unique requirements and tastes of female athletes.

Key Players:

- PepsiCo Inc.

- The Coca-Cola Company

- Abbott Nutrition

- Tiger Brands

- Enduren Nutrition

- Desert Muscle

- Nutrocelle

- Shape Nutrition

Chapter 1. Middle East and Africa Sports Food Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Middle East and Africa Sports Food Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Middle East and Africa Sports Food Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Middle East and Africa Sports Food Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitute

Chapter 5. Middle East and Africa Sports Food Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Middle East and Africa Sports Food Market– By Type

6.1. Introduction/Key Findings

6.2. Protein Powders and Supplements

6.3. Sports Drinks and Gels

6.4. Recovery Drinks and Bars

6.5. Energy Bars and Snacks

6.6. Dietary Supplements

6.7. Y-O-Y Growth trend Analysis By Type

6.8. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Middle East and Africa Sports Food Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2. Supermarkets & Hypermarkets

7.3. Convenience Stores

7.4. Online Platforms

7.5. Specialty Stores

7.6. Y-O-Y Growth trend Analysis By Distribution Channel

7.7. Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Middle East and Africa Sports Food Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Middle East & Africa

8.1.1. By Country

8.1.1.1. United Arab Emirates (UAE)

8.1.1.2. Saudi Arabia

8.1.1.3. Qatar

8.1.1.4. Israel

8.1.1.5. South Africa

8.1.1.6. Nigeria

8.1.1.7. Kenya

8.1.1.8. Egypt

8.1.1.9. Rest of MEA

8.1.2. By Type

8.1.3. By Distribution Channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Middle East and Africa Sports Food Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 PepsiCo Inc.

9.2. The Coca-Cola Company

9.3. Abbott Nutrition

9.4. Tiger Brands

9.5. Enduren Nutrition

9.6. Desert Muscle

9.7. Nutrocelle

9.8. Shape Nutrition

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

A growing awareness of health issues like obesity, diabetes, and heart disease is motivating people in the MEA region to prioritize their well-being. This translates to increased interest in preventive healthcare and adopting healthy lifestyle practices, including a focus on proper nutrition

While awareness of sports nutrition products is increasing, there's still a significant knowledge gap among some consumers, particularly recreational exercisers, regarding the specific benefits these products offer. This can lead to confusion and hesitation in purchasing them

PepsiCo Inc., The Coca-Cola Company, Abbott Nutrition, Tiger Brands,

Enduren Nutrition, Desert Muscle, Nutrocelle, Shape Nutrition

The United Arab Emirates (UAE) has firmly established itself as the most dominant country in the Middle East and Africa's sports food market, commanding an impressive 18% market share

Saudi Arabia has emerged as the fastest-growing country, driven by a rapidly expanding youth population, rising disposable incomes, and government initiatives to promote sports and physical activity