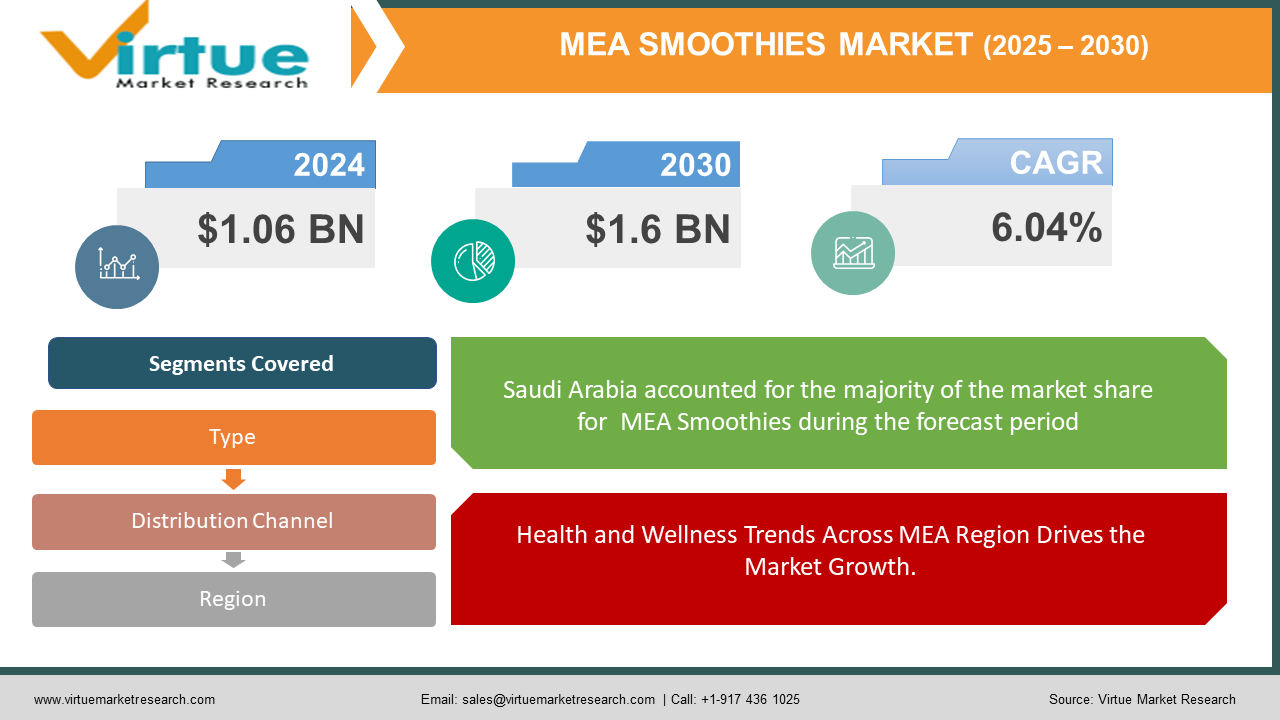

Middle East And Africa Smoothies Market Size (2024-2030)

The Middle East And Africa Smoothies Market was valued at USD 1.06 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 1.6 billion by 2030, growing at a CAGR of 6.04%.

Smoothies are blended drinks made by mixing fruits, vegetables, liquids (such as water, milk, or yogurt), sweeteners (like honey or agave syrup), and additional flavorings or supplements (such as protein powder or superfoods). Their main characteristics are a creamy texture and a wide range of ingredients and flavors. Currently, one of the key factors driving market expansion is the increasing public awareness of the advantages of consuming healthy foods. Additionally, the demand for convenient, on-the-go food options is rising due to people's busy lifestyles and extended working hours. This trend, along with the growing food and beverage (F&B) industry, is boosting market growth.

Key Market Insights:

- Leading manufacturers are providing gluten-free smoothies to manage the symptoms of celiac disease and other gluten-related health conditions. These manufacturers are also developing more innovative products to boost sales, which is contributing to market growth. Additionally, the rising demand for protein-rich snacks and meals over carbohydrate-heavy food products is supporting the positive trend in the smoothies market.

- The growth of the smoothies market is primarily driven by several key factors, including the increasing demand for tropical flavors in soft drinks, the introduction of innovative ingredients such as erythritol in soft drinks, and the growing preference for convenience among consumers.

Middle East And Africa Smoothies Market Drivers:

Health and Wellness Trends Across MEA Region Drives the Market Growth.

The focus on health and well-being is a major factor propelling the smoothies market. Consumers are increasingly mindful of their dietary choices, seeking healthful options. Smoothies, typically made with fresh fruits, vegetables, and other nutritious ingredients, offer a convenient and nutritious way to incorporate essential nutrients into the diet. Consumer surveys indicate a strong preference for healthier food and beverage options. For instance, a Nielsen survey revealed that 48% of respondents actively look for food and beverage products with health-related benefits, including those made from whole foods like smoothies.

Moreover, McKinsey & Company highlights that consumer spending on wellness is at an all-time high, with the wellness industry growing at a rate of 5 to 10% annually. The market has seen an increase in the use of functional ingredients in smoothies, known for their health benefits. Ingredients like turmeric, valued for its anti-inflammatory properties, and probiotics, beneficial for digestive health, are becoming common additions. This trend is expected to continue shaping the industry as consumers increasingly prioritize well-being and nutrition in their food and beverage choices.

Middle East And Africa Smoothies Market Restraints and Challenges:

Increasing Homemade Smoothies hinders market growth.

The growing popularity of homemade smoothies poses a challenge to the commercial smoothie sector. Many consumers prefer to prepare their smoothies at home, allowing them to customize the ingredients to their liking, which can impact the sales of pre-packaged commercial smoothies. This trend highlights the appeal of personalized recipes and the cost-effectiveness of making smoothies at home instead of buying premade options.

Ingredients commonly used in homemade smoothies, such as fresh fruits, vegetables, yogurt, and protein powders, are experiencing strong sales. This trend indicates consumers' willingness to invest in the necessary components for DIY smoothies. Additionally, there has been a surge in searches and activity on online platforms and social media for smoothie recipes and tips for making homemade smoothies. Consumers are actively seeking inspiration and guidance to create their personalized smoothie creations.

Middle East And Africa Smoothies Market Opportunities:

Sustainable Packaging Solutions creates opportunities for market growth.

Addressing environmental concerns can be achieved by adopting sustainable and eco-friendly packaging for smoothies. Investing in recyclable or biodegradable containers can help reduce plastic waste and cater to the preferences of environmentally conscious customers. With many regions and countries implementing regulations and bans on single-use plastics, there is both a regulatory requirement and a business opportunity for brands to transition to more sustainable packaging materials.

A poll conducted by Trivium Packaging revealed that 74% of consumers are willing to pay more for environmentally friendly packaging. Brands that adopt sustainable packaging can attract and retain eco-conscious customers. Furthermore, companies that prioritize sustainability are increasingly perceived as responsible corporate citizens. Consequently, brands that lead in sustainable packaging are likely to gain a competitive edge and meet the growing customer demand for environmentally responsible practices.

MIDDLE EAST AND AFRICA SMOOTHIES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.04% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Saudi Arabia, UAE, Qatar , Egypt , Israel, South Africa, Nigeria, Kenya, Rest of the Middle East and Africa |

|

Key Companies Profiled |

Barfresh Food Group, Inc., Ella’s Kitchen Ltd, Jamba Juice LLC, Bolthouse Farms, innocent ltd, Smoothie King, Maui Wowi Hawaiian Coffees & Smoothies, Tropical Smoothie Café, Suja Juice, The Smoothie Company |

Middle East And Africa Smoothies Market Segmentation:

Middle East And Africa Smoothies Market Segmentation By Type:

- Fruit-based

- Dairy-based

- Other product-based types

Fruit-based smoothies dominate the market share, characterized by fruit as the primary ingredient. These smoothies typically feature a blend of fruits such as berries, bananas, mangoes, and citrus fruits, offering natural sweetness and a refreshing taste. Additional ingredients like yogurt, ice, or fruit juice may also be included. The fruit-based segment accounted for over 55% of the market share. Anticipated increases in investment within the food and beverage industry, particularly in obtaining organic fruit-based smoothies, are expected to drive market demand in the coming years. The rising demand for vitamins and the desire to reduce sugar intake is projected to further boost sales of fruit-based products throughout the forecasted period.

On the other hand, dairy-based smoothies feature dairy products as a primary ingredient, typically yogurt or milk. These smoothies often combine dairy with fruits, vegetables, and other additives, imparting a creamy texture and a slightly tangy flavor.

Middle East And Africa Smoothies Market Segmentation By Distribution Channel:

- Supermarkets and hypermarkets

- Smoothie- elated bars

- Convenience stores

The market growth has been significantly influenced by supermarkets and hypermarkets, large retail establishments that offer a wide range of products, including pre-packaged smoothies. Bottled or canned smoothies are typically stocked in the chilled or beverage sections of these stores, making them easily accessible to customers during their routine shopping trips. Supermarkets and convenience stores collectively accounted for more than half of the revenue generated in the smoothies market. This expansion can be attributed to efficient cold chain management practices and the availability of a diverse selection of smoothie options at competitive prices. With their well-established presence and widespread availability, supermarkets and convenience stores hold a substantial market share.

In contrast, smoothie-related bars specialize in offering a variety of freshly made smoothies and similar items. These establishments provide customers with the opportunity to select from a range of ingredients and customize their orders according to their preferences, often presenting a menu of freshly prepared smoothies.

Middle East And Africa Smoothies Market Segmentation- by Region

- Saudi Arabia

- UAE

- Qatar

- Egypt

- Israel

- South Africa

- Nigeria

- Kenya

- Rest of the Middle East and Africa

In Saudi Arabia, the smoothies market is poised for increased demand during the forecast period as consumers increasingly opt for healthier alternatives over carbonated energy drinks. With a growing awareness of health-conscious choices, consumers are expected to become more concerned and discerning about the ingredients in their beverages.

Meanwhile, the African region is experiencing the most rapid growth in the market, largely fueled by a rise in tourism. Conversely, the Middle East market is progressing at a somewhat slower pace due to the limited availability of fruits and vegetables. Nonetheless, the burgeoning horticulture practices in the Middle East region are anticipated to drive growth in the smoothie market.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic has had widespread repercussions across various sectors and industries worldwide, with the food and beverage industry being notably impacted. Within this industry, the smoothie sector faced significant challenges due to the pandemic. However, an interesting trend emerged during this time as people began to increasingly embrace organic and natural food options, leading to a surge in the growth of the smoothie market. Smoothies, known for their organic and healthy ingredients, gained traction as individuals sought out healthier dietary choices amidst the pandemic. This period also saw a rise in the exploration of new and nutritious smoothie recipes as people became more health-conscious and sought to incorporate healthier options into their diets.

Latest Trends/ Developments:

- In October 2023, Smoothie King recognized as the world's largest smoothie company, unveiled two indulgent Smoothie Bowls: Açai Cocoa HazeTM and Coco Pitaya-YahTM.

- In September 2023, Sainsbury's made a further investment of £6 million annually in its dairy farmers, reaffirming its commitment to providing long-term support to the dairy industry.

- In November 2022, Barfresh Food Group launched a range of environmentally conscious 7.6oz Smoothie Cartons. Designed with both economic and ecological benefits in mind, this ready-to-drink packaging was engineered to deliver enhanced profit margins compared to the company's previous bottle format. Tailored specifically for schools, it caters to larger school districts and those seeking alternatives to single-use plastics.

Key Players:

These are the top 10 players in the Middle East And Africa Smoothies Market:-

- Barfresh Food Group, Inc.

- Ella’s Kitchen Ltd

- Jamba Juice LLC

- Bolthouse Farms

- innocent ltd

- Smoothie King

- Maui Wowi Hawaiian Coffees & Smoothies

- Tropical Smoothie Café

- Suja Juice

- The Smoothie Company

Chapter 1. Middle East And Africa Smoothies Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Middle East And Africa Smoothies Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Middle East And Africa Smoothies Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Middle East And Africa Smoothies Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Middle East And Africa Smoothies Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Middle East And Africa Smoothies Market– By Type

6.1. Introduction/Key Findings

6.2. Fruit-based

6.3. Dairy-based

6.4. Other product-based types

6.5. Y-O-Y Growth trend Analysis By Type

6.6. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Middle East And Africa Smoothies Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2. Supermarkets and hypermarkets

7.3. Smoothie- elated bars

7.4. Convenience stores

7.5. Y-O-Y Growth trend Analysis By Distribution Channel

7.6. Absolute $ Opportunity Analysis By Distribution Channel , 2024-2030

Chapter 8. Middle East And Africa Smoothies Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Middle East & Africa

8.1.1. By Country

8.1.1.1. United Arab Emirates (UAE)

8.1.1.2. Saudi Arabia

8.1.1.3. Qatar

8.1.1.4. Israel

8.1.1.5. South Africa

8.1.1.6. Nigeria

8.1.1.7. Kenya

8.1.1.8. Egypt

8.1.1.9. Rest of MEA

8.1.2. By Type

8.1.3. By Distribution Channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Middle East And Africa Smoothies Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Barfresh Food Group, Inc.

9.2. Ella’s Kitchen Ltd

9.3. Jamba Juice LLC

9.4. Bolthouse Farms

9.5. innocent ltd

9.6. Smoothie King

9.7. Maui Wowi Hawaiian Coffees & Smoothies

9.8. Tropical Smoothie Café

9.9. Suja Juice

9.10. The Smoothie Company

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The focus on health and well-being is a major factor propelling the smoothies market. Consumers are increasingly mindful of their dietary choices, seeking healthful options. Smoothies, typically made with fresh fruits, vegetables, and other nutritious ingredients, offer a convenient and nutritious way to incorporate essential nutrients into the diet. Consumer surveys indicate a strong preference for healthier food and beverage options.

The top players operating in the Middle East And African smoothies Market are - Barfresh, Food Group, Inc., Ella’s Kitchen Ltd, Jamba Juice LLC, Bolthouse Farms, Innocent Ltd, Smoothie King, Maui Wowi Hawaiian Coffees & Smoothies, Tropical Smoothie Café, Suja Juice, The Smoothie Company.

The COVID-19 pandemic has had widespread repercussions across various sectors and industries worldwide, with the food and beverage industry being notably impacted. Within this industry, the smoothie sector faced significant challenges due to the pandemic.

Companies that prioritize sustainability are increasingly perceived as responsible corporate citizens. Consequently, brands that lead in sustainable packaging are likely to gain a competitive edge and meet the growing customer demand for environmentally responsible practices.

The African region is experiencing the most rapid growth in the market, largely fueled by a rise in tourism. Conversely, the Middle East market is progressing at a somewhat slower pace due to the limited availability of fruits and vegetables.