Middle East and Africa shrink plastic film Market Size (2024-2030)

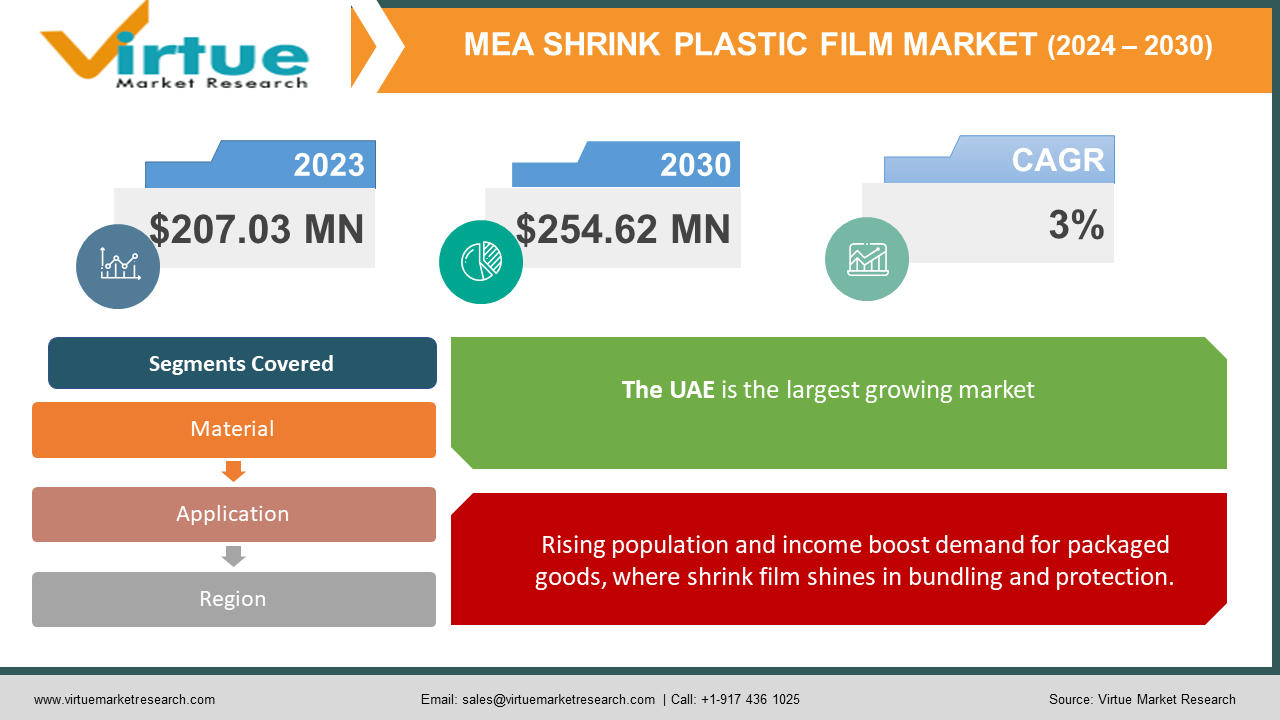

The Middle East and Africa shrink plastic film market was valued at USD 207.03 million in 2023 and is projected to reach a market size of USD 254.62 million by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 3%.

The Middle East and Africa shrink plastic film market is experiencing a promising upswing, driven by several key factors. A growing population with rising disposable incomes creates a surge in demand for packaged goods, fueling the need for shrink film for bundling and protection. Convenience reigns supreme, with consumers increasingly opting for grab-and-go food options, necessitating innovative packaging solutions where shrink film plays a leading role. This trend is further amplified by the thriving food and beverage industry, particularly packaged juices, drinks, and multipacks, all heavily reliant on shrink film for bundling and tamper-evident seals. The booming e-commerce sector adds another layer, emphasizing the need for secure and protective packaging, again propelling the demand for shrink film.

Key Market Insights:

- The Middle East and Africa shrink plastic film market is set for a bright future, fueled by several key trends. Rising population and income translate to higher demand for packaged goods, boosting the need for shrink film in bundling and protection. Busy consumers increasingly choose convenience food and e-commerce, demanding secure packaging where shrink film shines. Thriving food and beverage sectors, particularly packaged drinks and multipacks, heavily rely on shrink film for bundling and tamper-proofing.

- Material-wise, LLDPE films are gaining traction due to their superior performance and food safety, replacing PVC. Film properties are undergoing exciting innovations, focusing on enhanced strength, printability, and sustainability to attract wider appeal. However, stricter regulations on plastic waste urge the development of biodegradable and recyclable alternatives, pushing the industry towards eco-friendly solutions.

- Growth isn't evenly distributed. Established markets like the UAE and South Africa demonstrate strong growth, but emerging markets in North Africa and Sub-Saharan Africa hold exciting potential due to rising disposable incomes and increasing packaged food consumption.

The Middle East and Africa Shrink Plastic Film Market Drivers:

Rising population and income boost demand for packaged goods, where shrink film shines in bundling and protection.

A rapidly growing population across the region, coupled with climbing disposable incomes, creates a surge in demand for packaged goods. Consumers seek convenience and affordability, leading to a significant increase in processed and ready-to-eat food purchases. This, in turn, translates to a higher demand for secure and efficient packaging solutions, where shrink film excels in bundling and protecting individual items and multipacks.

Fast-paced life and online shopping fuel demand for secure packaging, making shrink film a perfect fit.

Fast-paced lifestyles and urbanization are driving the popularity of convenience food and online shopping. Consumers increasingly opt for grab-and-go options and rely on e-commerce platforms for their daily needs. Both of these trends necessitate secure and protective packaging that ensures product integrity during transit and storage. Shrink film, with its tamper-evident seals and flexible bundling capabilities, perfectly caters to these requirements.

Packaged drinks and multipacks rely heavily on shrink film for bundling, seals, and visual appeal.

The food and beverage sector in the Middle East and Africa is experiencing substantial growth, particularly in packaged juices, drinks, and multipacks. These products rely heavily on shrink film for bundling, tamper-evident seals, and visual appeal. The increasing consumption of packaged beverages and the rising popularity of multipacks further stimulate the demand for shrink film in this sector.

Hygiene and product safety concerns drive demand for shrink film's barrier properties and clear branding options.

Consumers are becoming increasingly aware of hygiene and product safety. Shrink film provides excellent barrier properties, protecting food and beverages from contamination and maintaining product freshness. Additionally, advancements in printing technology allow for visually appealing branding and product information on shrink film, enhancing consumer engagement and purchasing decisions.

Shrink film's temperature-resistant qualities make it ideal for transporting perishables in expanding cold chains.

With ongoing investments in infrastructure development and cold chain logistics across the region, the demand for efficient and temperature-resistant packaging solutions is rising. Shrink film's ability to maintain product integrity over long distances and varied temperatures makes it an ideal choice for transporting perishable goods, contributing to market growth.

The Middle East and Africa Shrink Plastic Film Market Restraints and Challenges:

While the plastic film market in the Middle East and Africa boasts exciting growth prospects, navigating its hurdles is crucial for sustainable development. Volatile raw material prices due to fluctuating crude oil costs can disrupt production and create pricing instability. Stringent environmental regulations, including plastic waste management and bans, necessitate adaptation and innovation for film manufacturers. Moreover, competition from eco-friendly alternatives like paper and bio-based films poses a significant challenge, requiring investment in sustainable solutions like biodegradable or recyclable options. Limited adoption of technological advancements like improved film properties can hinder progress in areas like cost-efficiency and sustainability. Additionally, inadequate waste collection and recycling infrastructure, along with underdeveloped logistics networks, create obstacles to responsible plastic waste management and hinder circular economy initiatives. Addressing these restraints requires proactive measures. Investing in sustainable materials like biodegradable or recyclable films is essential. Advocating for supportive policies that promote responsible plastic use and encourage recycling infrastructure development is crucial. Embracing technological advancements in film properties can enhance efficiency and environmental impact. Finally, collaboration among stakeholders to improve waste management infrastructure is vital for long-term market sustainability.

The Middle East and Africa Shrink Plastic Film Market Opportunities:

While the plastic film market in the Middle East and Africa faces challenges, it also teems with opportunities for those who adapt and innovate. Consumers' growing environmental awareness creates a demand for sustainable solutions like biodegradable or recyclable films, opening a vast market segment for forward-thinking companies. Emerging markets in North Africa and Sub-Saharan Africa, with their rising packaged food consumption, offer significant growth potential, requiring tailored solutions and local understanding. The booming e-commerce sector demands secure and innovative shrink film solutions, attracting companies investing in film strength, printability, and temperature resistance. Embracing advancements in film properties like barrier performance and down-gauging presents opportunities for efficiency, cost reduction, and improved product appeal. Finally, collaboration with research institutions, waste management companies, and government agencies can accelerate sustainable solutions, improve infrastructure, and advocate for supportive policies, benefiting the entire market.

MIDDLE EAST AND AFRICA SHRINK PLASTIC FILM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3% |

|

Segments Covered |

By Material, application, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Iran, UAE, Qatar, Oman, Iraq, Bahrain, Kuwait, Rest of Middle East |

|

Key Companies Profiled |

Amcor Limited, Berry Global Inc., AEP Industries, Inc., Bemis Company, Coveris Holdings, Ceisa Packaging SAS, Sarkina, Baroda Packaging, Dow Chemical, Intertape Polymer |

The Middle East and Africa Shrink Plastic Film Market Segmentation:

Middle East and Africa Shrink Plastic Film Market Segmentation: By Material:

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyolefin (POF)

- Others

The most dominant segment by material in the Middle East and Africa's shrink plastic film market is polyethylene-based films, particularly LLDPE. This dominance is driven by its superior performance, food safety, and cost-effectiveness compared to alternatives like PVC. However, the fastest-growing segment is polyolefin. This is because POF is more versatile and of higher quality than PVC. Furthermore, food goods can be wrapped in polyolefin shrink wrap that has FDA approval. POF shrink wrap is frequently used for printed and paper goods, baked goods, and frozen food items like pizza, tiny toys, sweets, and other items.

Middle East and Africa Shrink Plastic Film Market Segmentation: By Application:

- Food and Beverage

- Healthcare

- Pharmaceuticals

- Consumer Electronics

- Others

In the Middle East and Africa's shrink plastic film market, the dominant segment by application is food and beverage, encompassing packaged juices, drinks, multipacks, and more. This segment heavily relies on shrink film for bundling, tamper-evident seals, and product protection. However, the fastest-growing segment is the healthcare application. The need for specialized packaging solutions in the pharmaceutical, medical device, and healthcare supply industries is rising due to aging demographics, population expansion, and technological breakthroughs in these fields.

Middle East and Africa Shrink Plastic Film Market Segmentation: Regional Analysis:

- United Arab Emirates

- Saudi Arabia

- Qatar

- Israel

- South Africa

- Nigeria

- Kenya

- Egypt

- The rest of MEA

The United Arab Emirates (UAE) is the largest market with strong economic growth, robust infrastructure, and high per capita income, driving demand for premium and innovative shrink film solutions.

South Africa is the fastest-growing region. This is one of the most developed markets in Sub-Saharan Africa, with established infrastructure and a growing demand for packaged goods, presenting the potential for both local and international players.

Saudi Arabia, like the UAE, enjoys strong economic performance and a large population, making it a major market for both basic and advanced shrink film applications.

Although smaller than the UAE and Saudi Arabia, Qatar still boasts significant demand for shrink film due to its high purchasing power and focus on developing its food and beverage sector.

Israel is a technologically advanced market with a strong focus on sustainability, creating unique opportunities for innovative and eco-friendly shrink film solutions.

Boasting the largest population in Africa, Nigeria offers immense potential for growth in the shrink film market, driven by rising disposable incomes and increasing urbanization. However, infrastructure and logistical challenges need to be addressed.

Kenya, with a rapidly growing economy and a young population, presents an attractive market for affordable and versatile shrink film solutions.

A populous country with established industries and a developing packaged food sector, Egypt holds promise for the shrink film market, albeit with some infrastructural and economic hurdles.

The rest of the MEA encompasses diverse countries with varying economic profiles and levels of shrinking film demand. While individual markets might not rival the established players, collectively they represent a significant opportunity for customized solutions and regional partnerships.

COVID-19 Impact Analysis on the Middle East and Africa Shrink Plastic Film Market:

The COVID-19 pandemic presented both challenges and opportunities for the Middle East and Africa's shrinking plastic film market. While global disruptions impacted raw material supplies and caused demand fluctuations, the region displayed surprising resilience. Increased demand for packaged food and beverages due to lockdowns and hygiene concerns, coupled with the e-commerce boom, fueled demand for shrink film for bundling and tamper-evident sealing. Even though non-essential industries faced setbacks, essential sectors like pharmaceuticals maintained stable packaging needs. Supply chain disruptions and the economic slowdown posed challenges, but market players adapted by diversifying customers, focusing on essential goods, and strengthening local supply chains. Looking forward, sustainability will be crucial, with opportunities for biodegradable and recyclable alternatives. The booming e-commerce sector demands innovative and secure packaging solutions. While the overall outlook is positive, regional variations in recovery and consumer behavior necessitate tailored strategies for different markets.

Latest Trends/ Developments:

The Middle East and Africa shrink plastic film market is buzzing with activity, driven by a focus on sustainability. Biodegradable and recyclable films are flourishing, fueled by demand for eco-friendly solutions. The market is embracing circular economy initiatives and down-gauging techniques to minimize material use. Emerging markets like North Africa and Sub-Saharan Africa offer exciting growth, but affordability remains crucial. E-commerce demands innovative and secure packaging, leading to advances in film strength, printability, and personalization. Smart films with enhanced barrier performance and increased production automation are exciting tech trends. Building robust regional supply chains and fostering research collaborations are gaining traction. By staying abreast of these trends and adapting their strategies, companies can thrive in this dynamic and evolving market.

Key Players:

- Amcor Limited

- Berry Global Inc.

- AEP Industries, Inc.

- Bemis Company

- Coveris Holdings

- Ceisa Packaging SAS

- Sarkina

- Baroda Packaging

- Dow Chemical

- Intertape Polymer

Chapter 1. Middle East and Africa shrink plastic film Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Middle East and Africa shrink plastic film Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Middle East and Africa shrink plastic film Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Middle East and Africa shrink plastic film Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Middle East and Africa shrink plastic film Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Middle East and Africa shrink plastic film Market– By Material

6.1. Introduction/Key Findings

6.2. Polyethylene (PE)

6.3. Polyvinyl Chloride (PVC)

6.4. Polyolefin (POF)

6.5. Others

6.6. Y-O-Y Growth trend Analysis By Material

6.7. Absolute $ Opportunity Analysis By Material , 2024-2030

Chapter 7. Middle East and Africa shrink plastic film Market– By Application

7.1. Introduction/Key Findings

7.2. Food and Beverage

7.3. Healthcare

7.4. Pharmaceuticals

7.5. Consumer Electronics

7.6. Others

7.7. Y-O-Y Growth trend Analysis By Application

7.8. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. Middle East and Africa shrink plastic film Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Middle East & Africa

8.1.1. By Country

8.1.1.1. United Arab Emirates (UAE)

8.1.1.2. Saudi Arabia

8.1.1.3. Qatar

8.1.1.4. Israel

8.1.1.5. South Africa

8.1.1.6. Nigeria

8.1.1.7. Kenya

8.1.1.8. Egypt

8.1.1.9. Rest of MEA

8.1.2. By Material

8.1.3. By Application

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Middle East and Africa shrink plastic film Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Amcor Limited

9.2. Berry Global Inc.

9.3. AEP Industries, Inc.

9.4. Bemis Company

9.5. Coveris Holdings

9.6. Ceisa Packaging SAS

9.7. Sarkina

9.8. Baroda Packaging

9.9. Dow Chemical

9.10. Intertape Polymer

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The Middle East and Africa shrink plastic film market was valued at USD 207.03 million in 2023 and is projected to reach a market size of USD 254.62 million by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 3%.

Rising population and income boost demand for packaged goods; fast-paced life and online shopping; dependence of packaged drinks and multipacks on shrink film; hygiene and product safety concerns; and shrink film's temperature-resistant qualities are the main drivers in this market

Based on the material, the market is divided into polyethylene (PE), polyvinyl chloride (PVC), polyolefin (POF), and others

The most dominant region within the Middle East and Africa's shrink plastic film market is currently the United Arab Emirates (UAE).

Amcor Limited, Berry Global Inc., AEP Industries Inc., Bemis Company, Coveris Holdings, Ceisa Packaging SAS, Sarkina, Baroda Packaging, Dow Chemical, and Intertape Polymer are the major players.