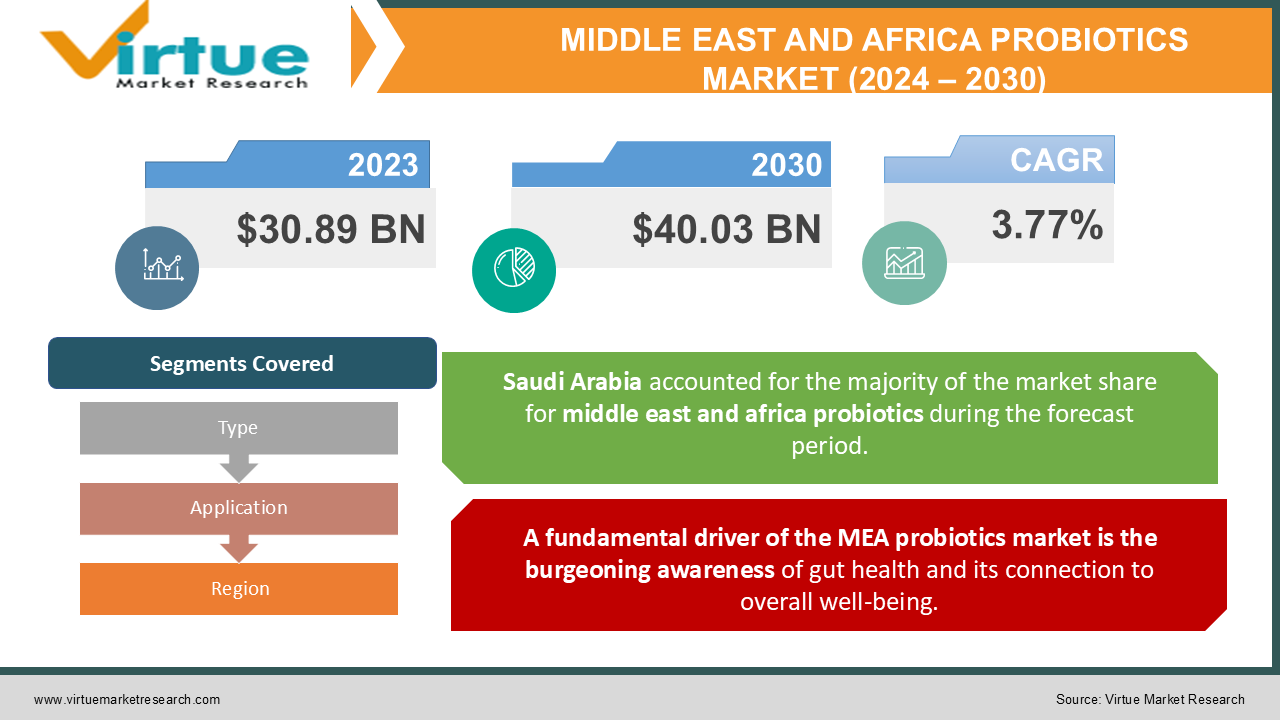

Middle East and Africa Probiotics Market Size (2024-2030)

The Middle East and Africa Probiotics Market was valued at USD 30.89 Billion and is projected to reach a market size of USD 40.03 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 3.77%.

The Middle East and Africa (MEA) probiotics market is experiencing a period of significant growth, fueled by a growing awareness of gut health and the potential benefits of probiotics. This market encompasses a diverse range of probiotic products, including supplements, yogurt drinks, and fortified foods. Doctors, dietitians, and other healthcare professionals are increasingly recommending probiotics to patients for various health concerns. Maintaining the viability of probiotic strains throughout the product shelf life and ensuring proper storage conditions can be a challenge in some regions with limited cold chain infrastructure. Targeted educational campaigns can bridge the knowledge gap about probiotics and empower consumers to make informed choices. Advancements in technology might pave the way for personalized probiotic solutions based on individual gut microbiome analysis. Probiotics could potentially find applications beyond gut health, such as in skin care products or for targeted immune support.

Key Market Insights:

- Probiotic products aimed at women's health had a $136 million market value, they are projected to expand at a CAGR of 12.2% to $242 million by 2028.

- Probiotic products aimed at newborn and child health had a market value of $68 million. Throughout the period, this market is expected to rise at a growth rate of 12.2% to reach $121 million by 2028.

- Probiotic products intended for skin health had a $34 million market value in 2023, they are projected to expand at a growth rate of 12.2% to reach $60 million by 2028.

- Probiotics intended for respiratory health had a $8.5 million market value in 2028, and at a compound annual growth rate of 12.2%, that market is predicted to reach $15 million.

- Probiotics aimed at cardiovascular health had a $4.25 million market value in 2028 and are expected to expand at a 12.2% growth rate to reach $7.5 million.

- Spore-forming probiotics had a $51 million market value in 2023, and at a growth rate of 12.2%, it is projected to reach $90 million by 2028.

- Probiotic products aimed at sports and active people had a $34 million market value and it is expected to expand at a growth rate of 12.2% to $60 million by that time.

Middle East and Africa Probiotics Market Drivers:

A fundamental driver of the MEA probiotics market is the burgeoning awareness of gut health and its connection to overall well-being.

Information about gut health is increasingly proliferating in the media. The complex functions of the gut microbiome and its possible effects on immunity, digestion, and even mental health are being made more widely known by educational documentaries, educational articles, and even social media influencers. Customers become more interested in finding ways to support their gut health as a result of this exposure. Probiotics may provide advantages that medical experts including doctors, dieticians, and others are starting to realize. They are being included in therapy regimens for several digestive disorders, including diarrhea brought on by antibiotics, inflammatory bowel disease (IBD), and irritable bowel syndrome (IBS). Customers' favorable opinions of probiotics are further enhanced by these recommendations from reliable sources. Consumer behavior is greatly influenced by personal experiences and anecdotal evidence that are posted on social media platforms. Probiotics can improve immunity, aid with digestion, and even treat mild skin disorders. As more people learn about these benefits, the industry is growing at an even faster pace.

The MEA probiotics market is not a one-size-fits-all scenario. Consumers have diverse needs and preferences, and the market is responding with a wider variety of probiotic products, making them more accessible and appealing.

Consumers are increasingly seeking convenient ways to incorporate probiotics into their daily lives. This has led to a surge in the popularity of probiotic-fortified foods. Yogurt drinks traditionally enjoyed in the MEA region are now often fortified with probiotic strains. Similarly, breakfast cereals, granola bars, and even some baked goods are incorporating probiotics, catering to busy individuals seeking a convenient gut health boost. Dietary supplements remain a significant segment of the MEA probiotics market. These concentrated doses of specific probiotic strains offer targeted solutions for various concerns. For instance, some supplements might focus on promoting digestive health with strains like Lactobacillus acidophilus and Bifidobacterium bifidum. Others might target immune support with formulations containing strains like Lactobacillus plantarum or Saccharomyces boulardii. This diversity empowers consumers to choose a probiotic supplement that aligns with their specific needs.

Middle East and Africa Probiotics Market Restraints and Challenges:

Many consumers might not grasp the importance of specific probiotic strains and their functionalities. They might perceive all probiotics as offering the same benefits, leading to a less targeted approach to gut health management. Understanding the appropriate dosage of probiotics for different needs can be challenging. Consumers might be unsure about whether a single serving of yogurt with probiotics is sufficient or if a daily supplement is necessary. The long-term potential of probiotics for gut health maintenance and immune support might not be fully understood. Consumers might be looking for quick fixes and become discouraged if they don't experience immediate results. Stringent regulations in some countries might involve lengthy and expensive approval processes for new probiotic strains. This can limit product diversity and innovation in the market. Regulations governing the types of health claims manufacturers can make about probiotics can vary. This can be confusing for both consumers and manufacturers, hindering effective communication about the potential benefits of probiotics.

Middle East and Africa Probiotics Market Opportunities:

Sub-Saharan Africa is rapidly becoming more urbanized, which is causing food and lifestyle changes. This may increase the market for quick-to-consume probiotic goods that appeal to busy urban populations, such as yogurt drinks and fortified foods. Sub-Saharan Africa is seeing a rise in the middle class, which is generating a customer base with more disposable income and a willingness to make investments in their health and well-being. This may result in a rise in the market for functional foods and high-quality probiotic supplements. In Sub-Saharan Africa, there is an increasing emphasis on enhancing the health outcomes for mothers and children. There is a big potential with probiotics that contain particular strains that are known to support the immune system and gastrointestinal development in infants. It's critical to create focused marketing efforts that speak to the local languages and cultures. To guarantee greater accessibility to probiotic goods, strong distribution channels that reach remote areas should be established. Next-generation probiotic solutions that target particular health issues can be developed through research on finding and isolating novel probiotic strains with specified capabilities.

MIDDLE EAST AND AFRICA PROBIOTICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

||

|

Market Size Available |

2023 - 2030 |

||

|

Base Year |

2023 |

||

|

Forecast Period |

2024 - 2030 |

||

|

CAGR |

3.77% |

||

|

Segments Covered |

By Type, Application, and Region |

||

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

||

|

Regional Scope |

|

||

|

Key Companies Profiled |

Nestlé S.A., Danone S.A., Chr. Hansen Holding AS, Yakult Honsha Co., Ltd, Bio Gaia AB, DuPont de Nemours, Inc. , Lallemand Inc, Mezoon, Desert Harvest |

Middle East and Africa Probiotics Market Segmentation:

Middle East and Africa Probiotics Market Segmentation: By Type

- Dietary Supplements

- Yogurt Drinks

- Fortified Foods

- Animal Feed Additives

- Cosmetics

The Probiotic Dietary Supplements (40-45%) segment currently holds the largest market share in the MEA region. Probiotic supplements offer concentrated doses of specific probiotic strains, targeted towards individuals with various health concerns. They come in various formats like capsules, tablets, powders, and even chewable options for children. Supplements allow consumers to address specific gut health issues by choosing formulations containing strains known to benefit digestion, immunity, or even mental well-being. Consumers have greater control over the dosage of probiotics they ingest compared to other product types. Doctors and dieticians often recommend probiotic supplements for specific health conditions, bolstering their credibility and driving sales.

The segment of fortified foods is witnessing the fastest growth in the MEA probiotics market. This burgeoning segment encompasses a wide range of food products infused with probiotics. Cereals, granola bars, bakery items, and even some dairy alternatives are increasingly incorporating probiotic strains. Fortified foods provide a convenient way to incorporate probiotics into daily meals and snacks, appealing to busy consumers. Manufacturers are constantly innovating, offering a diverse range of fortified food options to cater to different dietary preferences and taste buds. The presence of probiotics adds a perceived health halo to fortified foods, influencing purchasing decisions.

Middle East and Africa Probiotics Market Segmentation: By Application:

- Human Health

- Animal Health

Human Health (85-90%) is the dominant application segment that encompasses a wide range of health concerns addressed by probiotics. A significant portion of the human health segment focuses on digestive issues like irritable bowel syndrome (IBS), inflammatory bowel disease (IBD), and antibiotic-associated diarrhea. Probiotics can help restore gut balance and alleviate symptoms associated with these conditions. Probiotics are increasingly explored for their potential to bolster the immune system. They might help reduce the frequency and severity of common illnesses like coughs and colds. Emerging areas within human health include gut-brain health, with probiotics potentially influencing mood and cognitive function. Additionally, research is ongoing on the use of probiotics for skin health and even allergies.

The animal health segment is witnessing the fastest growth within the MEA probiotics market. Improved animal performance through better gut health translates to higher profits for farmers and food producers. This economic incentive drives the adoption of probiotics in animal feed. Growing concerns about antibiotic resistance are prompting stricter regulations on antibiotic use in animal agriculture. Probiotics offer a viable alternative for promoting animal health without relying on antibiotics. The environmental impact of animal agriculture is gaining attention. Probiotics can contribute to a more sustainable livestock breeding system by improving gut health and reducing waste production.

Middle East and Africa Probiotics Market Segmentation: Regional Analysis:

- United Arab Emirates

- Saudi Arabia

- Qatar

- Israel

- South Africa

- Nigeria

- Kenya

- Egypt

- Rest of MEA

With a significant 22% market share, Saudi Arabia emerged as the most powerful nation in the Middle East and Africa's probiotics industry. The dairy sector in Saudi Arabia is well-established and a significant market for probiotic products. Demand for probiotic yogurt and other dairy-based probiotic products is high due to their widespread usage throughout the nation. Saudi Arabia has a robust retail and e-commerce infrastructure, which facilitates the widespread distribution and availability of probiotic products. Major retailers and online platforms offer a wide range of probiotic products, catering to consumer demand.

While Saudi Arabia dominates the market, Kenya emerged as the fastest-growing country in the Middle East and Africa Probiotics Market, with a projected compound annual growth rate (CAGR) of 14.2%. Kenya has a thriving dairy industry, which is a key consumer of probiotic products. The demand for probiotic yogurt and other fermented dairy products has been on the rise, fuelling the growth of the probiotic market. Probiotic items are now much easier to find in Kenya thanks to the growth of contemporary retail channels like supermarkets and online shopping portals. Probiotic product accessibility and consumer reach have grown as a result.

COVID-19 Impact Analysis on the Middle East and Africa Probiotics Market:

Lockdowns and border restrictions disrupted global supply chains, leading to temporary shortages of raw materials and finished probiotic products in some parts of the MEA region. This created uncertainty for both manufacturers and consumers. In the initial stages of the pandemic, the primary focus shifted towards essential goods and hygiene products. Probiotics might have taken a backseat for some consumers as immediate health concerns dominated purchasing decisions. Lockdowns and social distancing measures encouraged a shift towards online shopping platforms. This might have benefited the probiotics market, as it offered consumers convenient access to a wider range of products. The pandemic shone a spotlight on the importance of a healthy immune system. This could lead to a lasting increase in consumer awareness of gut health and the potential benefits of probiotics. The experience of COVID-19 might encourage a shift towards preventive healthcare practices. Probiotics, perceived as a way to potentially bolster immunity and overall well-being, could benefit from this trend.

Latest Trends/ Developments:

The human gut microbiome is a complex and diverse ecosystem of microorganisms. While the concept of probiotics has traditionally focused on specific strains, the rise of microbiome analysis opens doors for personalization. Imagine a future where consumers can undergo gut microbiome testing and receive personalized probiotic formulations tailored to their unique microbial composition. This targeted approach has the potential to significantly enhance the efficacy and appeal of probiotic products. The gut-brain axis, a bidirectional communication pathway between the gut microbiome and the central nervous system, is garnering increasing attention. Research suggests that gut health can influence mood, cognitive function, and even mental well-being. Convenience remains a key driver in the MEA consumer market. Fortified food and beverage options are gaining traction, offering a seamless way to incorporate probiotics into daily diets.

Key Players:

- Nestlé S.A.

- Danone S.A.

- Chr. Hansen Holding AS

- Yakult Honsha Co., Ltd

- Bio Gaia AB

- DuPont de Nemours, Inc.

- Lallemand Inc

- Mezoon

- Desert Harvest

Chapter 1. Middle East and Africa Probiotics Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Middle East and Africa Probiotics Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Middle East and Africa Probiotics Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Middle East and Africa Probiotics Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Middle East and Africa Probiotics Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Middle East and Africa Probiotics Market– By Type

6.1. Introduction/Key Findings

6.2. Dietary Supplements

6.3. Yogurt Drinks

6.4. Fortified Foods

6.5. Animal Feed Additives

6.6. Cosmetics

6.5. Y-O-Y Growth trend Analysis By Type

6.6. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Middle East and Africa Probiotics Market– By Application

7.1. Introduction/Key Findings

7.2. Human Health

7.3. Animal Health

7.4. Y-O-Y Growth trend Analysis By Application

7.5. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. Middle East and Africa Probiotics Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Middle East & Africa

8.1.1. By Country

8.1.1.1. United Arab Emirates (UAE)

8.1.1.2. Saudi Arabia

8.1.1.3. Qatar

8.1.1.4. Israel

8.1.1.5. South Africa

8.1.1.6. Nigeria

8.1.1.7. Kenya

8.1.1.8. Egypt

8.1.1.9. Rest of MEA

8.1.2. By Type

8.1.3. By Application

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Middle East and Africa Industrial Lubricants Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Nestlé S.A.

9.2. Danone S.A.

9.3. Chr. Hansen Holding AS

9.4. Yakult Honsha Co., Ltd

9.5. Bio Gaia AB

9.6. DuPont de Nemours, Inc.

9.7. Lallemand Inc

9.8. Mezoon

9.9. Desert Harvest

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

Public perception is shifting. Consumers are increasingly recognizing the gut microbiome's significance for overall well-being. Media coverage, educational campaigns, and the accessibility of online information have all contributed to a heightened awareness of the gut's delicate ecosystem and its connection to digestion, immunity, and even mental health

While consumer interest is surging, there's a risk of getting lost in a maze of misinformation. Unrealistic claims about probiotics curing diseases or guaranteeing perfect gut health can erode consumer trust. Clear communication based on scientific evidence is crucial to setting realistic expectations and promoting responsible use.

Nestlé S.A., Danone S.A., Chr. Hansen Holding AS, Yakult Honsha Co., Ltd,

Bio Gaia AB, DuPont de Nemours, Inc., Lallemand Inc, Desert Harvest

With a significant 22% market share, Saudi Arabia emerged as the most powerful nation in the Middle East and Africa's probiotics industry.

While Saudi Arabia dominates the market, Kenya emerged as the fastest-growing country in the Middle East and Africa Probiotics Market, with a projected compound annual growth rate (CAGR) of 14.2%.