Middle East and Africa Plastic Packaging Market Size (2024-2030)

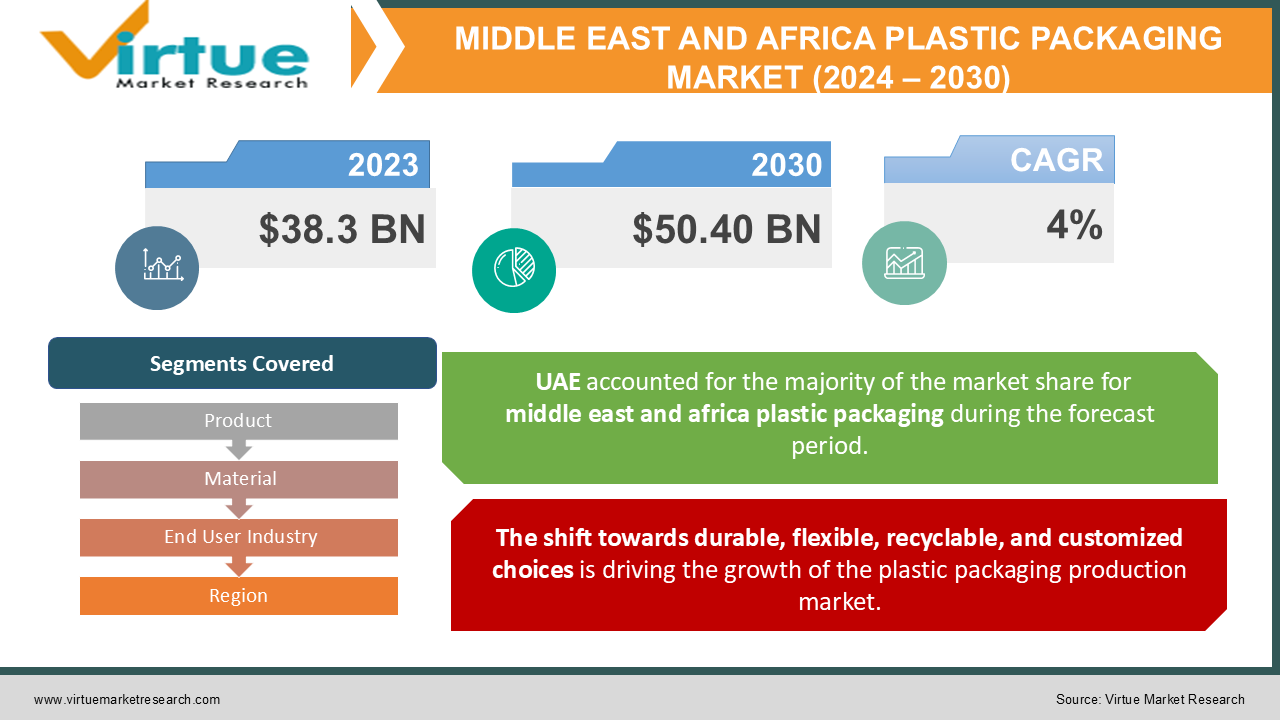

The Middle East and Africa plastic packaging market, valued at USD 38.3 billion in 2023, is projected to reach a market size of USD 50.40 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 4%.

One of the world's primary uses of plastic materials, accounting for an important proportion of the total output of plastic, is packaging. Plastics are indeed becoming essential in the world of packaging because of their low cost, high durability, and lightweight nature. The market for plastic packaging was estimated to have had consistent growth over the years. Major businesses are focusing on specific and customized plastic packaging to make an impression on customers and raise brand awareness. Packaging allows businesses to offer personalization and differentiate their brands. In addition to enhancing the product and giving data about its provenance, packaging can provide links to other product information. Plastic packaging allows international firms to strengthen their brand power and provides a practical way to take on private labels and emerging local competitors. The increasing trend of digitalization offers consumers vast and extensive knowledge. Effectively communicating brand values and facilitating product uniqueness are key elements propelling the plastic packaging industry's expansion. It is unlikely that many constraints will stifle demand in the global plastic packaging market. The high cost of raw materials derived from crude oil or petrochemicals, which are needed to make plastics, is one of the main obstacles. Moreover, the cost of exploration and shipping is increased by the rising crude oil prices, which are erratic on a worldwide scale. Additionally, this aspect is likely to limit the worldwide plastic packaging market's expansion. Throughout the forecast period, there will likely be a significant growth in demand for rigid packaging in the worldwide plastic packaging market. However, given the growing demand for flexible packaging, there's also a good probability that flexible packaging will dominate the industry. Global demand for flexible packaging is increasing because of its increased toughness and tensile strength and its capacity to store many items.

Key Market Insights:

From 2024 to 2030, the extrusion technology market in the global market is anticipated to grow at a strong rate. Because of their durability and excellent performance, extrusion-based plastic packaging goods, including bags, pouches, wraps, containers, films, etc., are extensively used in the majority of consumer and industrial applications. The substantial portion of the demand for plastic packaging globally has been largely attributed to the great penetration of organized shopping centers throughout. The e-commerce sector's strong growth is likely to generate new opportunities for businesses to expand. E-commerce businesses want lightweight, flexible packaging options to save money on shipping. The expansion of internet shopping for everyday fresh food, fast-moving consumer goods (FMCG), electronics, and apparel is anticipated to drive industry growth. In addition, newer opportunities for plastic packaging are anticipated in the upcoming years due to the growing introduction of cutting-edge packaging solutions, including bioplastic, edible, modified atmosphere, and active packaging. To reduce plastic pollution and raise sustainability awareness, strict regulations on single-use plastic are expected to be obstacles to the industry's expansion in the coming years.

Middle East and African Plastic Packaging Market Drivers:

The shift towards durable, flexible, recyclable, and customized choices is driving the growth of the plastic packaging production market.

The produce market packaged in plastic is growing substantially, driven by consumers' increasing preference for flexible, long-lasting, recyclable, and personalized packaging options. The need for packaging solutions that strike a balance between functionality, sustainability, and customization has increased as customer tastes change and awareness of the environment grows. The inherent strength of plastic packaging ensures that products are preserved and have a long shelf life. It can also easily fit a wide range of shapes and sizes. The focus on recyclability reflects a dedication to lessening environmental effects and is in line with global sustainability goals. Additionally, the trend toward customization helps firms stand out from the competition and improve customer interaction. This combination of qualities not only satisfies the changing demands of the market but also marks a turning point in the plastic packaging sector.

The increasing demand for customized plastic packaging products is facilitating the expansion.

The market for customized plastic packaging products is growing rapidly due to consumer demand for unique and personalized packaging options. Customization has become a top priority. Companies in a variety of sectors are realising how important it is to stick out on store shelves and in consumers' thoughts. Customization enables visually appealing trends, forms, and branding components that build brand loyalty while also drawing attention. Whether it's unique designs for consumer goods or bespoke packaging for luxury goods, the ability to customize plastic packaging products to meet individual needs is increasingly important for market strategy. The market for customized plastic packaging products is growing as a result of this trend, which not only improves products' aesthetic appeal but also makes shopping more memorable and engaging for customers.

Middle East and Africa Plastics Packaging Market Restraints and Challenges:

Regulatory impact is a significant hurdle.

The market for plastic packaging may expand more slowly due to increased laws meant to promote environmentally friendly options and reduce plastic waste since businesses will need to adjust to meet the new requirements.

Disruptions to the supply chain are another major barrier.

Plastic packaging materials might grow sparse or expensive due to supply chain disruptions caused by issues like transportation problems and shortages of raw materials. It is difficult for businesses and consumers to deal with these disruptions.

Middle East and Africa Plastics Packaging Market Opportunities:

New developments in plastic packaging technologies, like smart packaging and biodegradable polymer materials, present chances to improve product differentiation and achieve goals related to sustainability. Development of new technologies such as flexible plastic. Reusing and recycling plastics in line with the principles of the circular economy can not only lessen the impact on the environment but also make the supply chain more affordable, which presents a big opportunity for the plastic packaging business.

MIDDLE EAST AND AFRICA PLASTICS PACKAGING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4% |

|

Segments Covered |

By Product, Material. end user industry, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Kingdom of Saudi Arabia, UAE, Israel, Rest of GCC countries, South Africa, Ethiopia, Kenya, Egypt, Sudan, Rest of MEA |

|

Key Companies Profiled |

Saudi Basic Industries Corporation (SABIC), Bemis Company, Inc., Sealed Air Corporation, National Petrochemical Industrial Company , Nampak Limited, Alpla Group, RPC Group PLC, Berry Global Group, Inc., Gulf Plastic Industries Company (Gulf Plastics), Oman Plastics Industries, LLC |

Middle East and Africa Plastic Packaging Market Segmentation:

Middle East and Africa Plastic Packaging Market Segmentation: By Material:

- Polyethylene (PE)

- Polyethylene terephthalate (PET)

- Polypropylene (PP)

- Polystyrene (PS)

- Expanded polystyrene (EPS)

- Polyvinyl chloride (PVC)

Polyethylene (PE) is the largest and fastest-growing segment. By minimizing carbon footprint during distribution, PE's intrinsic lightweight nature not only lowers transportation costs but also matches perfectly with the growing emphasis on sustainability. PE is also a more affordable option than other materials, which attracts producers looking to minimize production costs. Its toughness and resistance to moisture further increase its usefulness for extending the shelf life of perishable foods when packaged. Consequently, the recyclability of PE corresponds with increasing environmental concerns, allowing for the creation of closed-loop recycling systems that aid in waste minimization. PE's versatility, affordability, sustainability, and functional qualities further make it a desirable material and contribute to its ongoing dominance in the ever-changing plastic packaging market.

Middle East and Africa Plastic Packaging Market Segmentation: By Products:

- Bottles

- Jars

- Trays

- Containers

Bottles are the largest and fastest-growing segment. The ability to adapt to different shapes and sizes makes plastic a popular option for packaging products. Bottles are used in a variety of industries, including beverages, cosmetics, medicines, and sauces. Particularly for products that are prone to breaking or spoiling, the natural stiffness and resilience of bottles and jars offer product protection and lifetime. Furthermore, their transparency makes the packaged product easily visible, boosting customer confidence and influencing purchase decisions. Additionally, bottles and jars provide easy dispensing and effective storage, which is in line with customer desires for packaging that is user-friendly. The use of bottles is encouraged by their capacity to reseal and provide portion control, which eliminates waste and improves shelf life. Bottle manufacturers take advantage of the customizable design options available to them, integrating ergonomic features and branding components to improve the user experience. The industry is seeing a transition in the production of bottles towards eco-friendly materials as environmental concerns grow, which will increase their appeal to consumers who care about the environment.

Middle East and Africa Plastic Packaging Market Segmentation: By End-User Industry:

- Food & Beverage

- Healthcare

- Cosmetics

- Personal Care

- Others

The food & beverage industry is the largest growing end-user. Plastic packaging ensures the integrity and freshness of food and beverage goods by providing superior barrier characteristics against moisture, oxygen, and pathogens. Reusable packets, single-serving portions, and ready-to-eat (RTE) options are examples of convenient package designs. These designs are especially important in light of the evolving consumer lifestyle, which is characterized by hectic schedules and a propensity for on-the-go consumption. In addition, marketing and branding are important; plastic packaging makes products visible and allows for vibrant images and designs, improving shelf appeal and customer interaction. Also, a variety of items might have cost-effective packaging options thanks to the affordability and adaptability of plastic materials. In addition, the packaging of perishable commodities is further maximized by innovations in technology, including vacuum sealing and modified atmosphere packaging. The healthcare industry is the fastest-growing. For a variety of pharmaceutical and medical goods, the healthcare sector significantly depends on plastic packaging solutions. Throughout their entire existence, medical supplies, medications, and healthcare goods must be kept secure, sterile, and intact. Plastic packaging is essential for this. Medical supplies, including syringes, vials, IV bags, catheters, and surgical tools, are frequently packaged in plastic. To guarantee medical device safety and effectiveness, these packaging materials need to fulfill strict specifications for sterility, durability, and contamination resistance.

Middle East and Africa Plastic Packaging Market Segmentation: By Regional Analysis:

- UAE

- Saudi Arabia

- Qatar

- Israel

- South Africa

- Nigeria

- Kenya

- Egypt

- Rest of MEA

The UAE is the largest growing market. The UAE is a major trade hub for plastic packaging items in the area due to its advantageous location at the intersection of Asia, Africa, and Europe. The effective import and export of commodities to neighboring nations and beyond is made possible by its well-connected ports and airports. The UAE's diverse economy, which includes large investments in industries including retail, healthcare, hospitality, and building, fuels the need for plastic packaging items for a range of uses. In particular, the nation's construction boom is driving up demand for packaging materials for building supplies, fixtures, and other items involved in construction. South Arabia is the fastest-growing market. Aside from the oil and gas industry, the region has a sizable consumer base and engages in a variety of industrial operations, which largely contributes to the nation's yearly growth in the need for plastic packaging. The need for a more robust non-oil sector has become apparent as a result of the world market's declining crude oil prices. Saudi Arabia has been strengthening its non-oil economy through several programs and regulatory reforms, including Vision 2030 and the National Industrial Development and Logistics Program (NIDLP), which might boost industrial production in the area. Furthermore, Saudi Arabia is one of the biggest users of plastic items in the GCC. The nation is the biggest user of plastic items in the GCC, consuming over 95 kg of plastic per person, according to current figures from the GPCA. Furthermore, it is projected that the industry will develop as a result of the growing embrace of Western culture brought about by travel and educational activities. It is anticipated that the present surge in food courts and malls will fuel market expansion.

COVID-19 Impact Analysis on the Middle East and Africa Plastic Packaging Market:

During the COVID-19 epidemic, there has been a significant decrease in the demand for plastic packaging products from the cosmetics and personal care sectors. This fall was linked to global lockdown limitations and a decline in manufacturing activity in these industries. Additionally, the market's expansion was inhibited by the sharp dip in crude oil prices brought on by a drop in demand and a reduction in storage capacity for excess supplies. Conversely, the market will be driven by the medical industry's need for Personal Protective Equipment (PPE), which includes masks, goggles, shields, gloves, respirators, gowns, and coveralls. Not only in the medical sector but also in the food and beverage sector, we could see an increase in the plastic packaging market.

Latest Trends/ Developments:

The need for plastic packaging is increasing since it is more resilient and long-lasting than ordinary traditional packaging methods. They are lightweight, affordable, and offer superior mechanical and thermal qualities. The market is expected to grow because of the growing demand for more polymer solutions across several end-use sectors. Furthermore, a wider range of sectors are using flexible packaging plastic polymers due to the growing need to replace non-recyclable substances in packaging. The market for customized plastic packaging products is growing rapidly due to consumer demand for unique and personalized packaging options. The capacity to customize plastic packaging is being seen as a critical competitive advantage in this industry. The produce market packaged in plastic is growing substantially, driven by consumers' increasing preference for flexible, long-lasting, recyclable, and personalized packaging options, which is making this industry grow rapidly.

Key Players:

- Saudi Basic Industries Corporation (SABIC)

- Bemis Company, Inc.

- Sealed Air Corporation

- National Petrochemical Industrial Company

- Nampak Limited

- Alpla Group

- RPC Group PLC

- Berry Global Group, Inc.

- Gulf Plastic Industries Company (Gulf Plastics)

- Oman Plastics Industries, LLC

Chapter 1. Middle East and Africa Plastic Packaging Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Middle East and Africa Plastic Packaging Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Middle East and Africa Plastic Packaging Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Middle East and Africa Plastic Packaging Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Middle East and Africa Plastic Packaging Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Middle East and Africa Plastic Packaging Market– By Material

6.1. Introduction/Key Findings

6.2. Polyethylene (PE)

6.3. Polyethylene terephthalate (PET)

6.4. Polypropylene (PP)

6.5. Polystyrene (PS)

6.6. Expanded polystyrene (EPS)

6.7. Polyvinyl chloride (PVC)

6.8. Y-O-Y Growth trend Analysis By Material

6.9. Absolute $ Opportunity Analysis By Material, 2024-2030

Chapter 7. Middle East and Africa Plastic Packaging Market– By Products

7.1. Introduction/Key Findings

7.2. Bottles

7.3. Jars

7.4. Trays

7.5. Containers

7.6. Y-O-Y Growth trend Analysis By Products

7.7. Absolute $ Opportunity Analysis By Products , 2024-2030

Chapter 8. Middle East and Africa Plastic Packaging Market– By End-User Industry

8.1. Introduction/Key Findings

8.2. Food & Beverage

8.3. Healthcare

8.4. Cosmetics

8.5. Personal Care

8.6. Others

8.7. Y-O-Y Growth trend Analysis By End-User Industry

8.8. Absolute $ Opportunity Analysis By End-User Industry , 2024-2030

Chapter 9 . Middle East and Africa Plastic Packaging Market, By Geography – Market Size, Forecast, Trends & Insights

9 .1. Middle East and Africa

9 .1.1. By Country

9 .1.1.1. Saudi Arabia

9 .1.1.2. Qatar

9 .1.1.3. UAE

9 .1.1.4. Israel

9 .1.1.5. South Africa

9 .1.1.6. Nigeria

9 .1.1.7. Kenya

9 .1.1.9 . Egypt

9 .1.1.9 . Rest of the Middle East

9.1.2. By Material

9.1.3. By Products

9.1.4. By End-User Industry

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Middle East and Africa Plastic Packaging Market– Company Profiles – (Overview, Material Type Portfolio, Financials, Strategies & Developments)

10.1. Saudi Basic Industries Corporation (SABIC)

10.2. Bemis Company, Inc.

10.3. Sealed Air Corporation

10.4. National Petrochemical Industrial Company

10.5. Nampak Limited

10.6. Alpla Group

10.7. RPC Group PLC

10.8. Berry Global Group, Inc.

10.9. Gulf Plastic Industries Company (Gulf Plastics)

10.10. Oman Plastics Industries, LLC

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The Middle East and Africa plastic packaging market, valued at USD 38.3 billion in 2023, is projected to reach a market size of USD 50.40 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 4%.

Saudi Arabia is the fastest-growing region in the Middle East and Africa's plastic packaging market.

Polyethylene (PE) is in demand in the coming years.

The market is expected to see growth through increased adoption of flexible plastic products, which can be recycled and are cost-efficient

The UAE dominates the Middle East and Africa's plastic packaging