Middle East and Africa Pest Control Market Size (2023-2030)

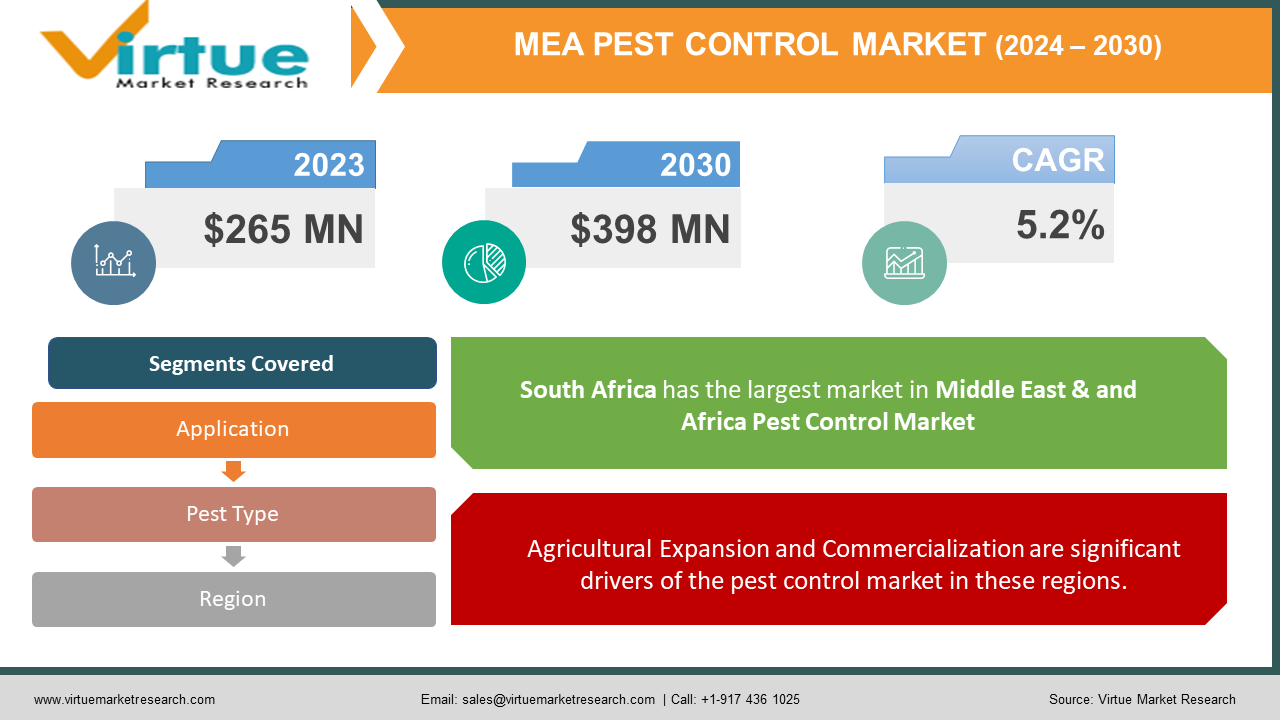

The Middle East and Africa Pest Control Market was valued at USD 265 Million and is projected to reach a market size of USD 398 Million by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 5.2%.

The Middle East and Africa pest control market is characterized by steady growth, driven by increasing urbanization, expanding hospitality and agriculture sectors, and heightened awareness of the importance of pest management. The region faces unique challenges due to its diverse climates and pest species. Integrated pest management (IPM) strategies and environmentally friendly solutions are gaining traction to address these issues, while government regulations and safety concerns are shaping the industry. Additionally, the ongoing COVID-19 pandemic has underscored the significance of pest control in ensuring public health and safety, further propelling market growth.

Key Market Insights:

- By another UNFCCC article, elevated temperatures, and increased precipitation create more favorable conditions for biting insects. Notably, in 2017, approximately 93% of worldwide malaria-related fatalities were concentrated in the African continent.

- Invasive pests like the blue gum chalcid wasp, red gum lerp psyllid, and bronze bug have devastated eucalyptus trees, also known as gum trees, in Zimbabwe, resulting in multimillion-dollar losses for commercial logging companies.

- The impact of the Oriental fruit fly alone is staggering. South Africa's Western Cape Province, a vital fruit-growing region, has experienced annual losses of approximately US$3.2 million since the pests established a presence in the area. In Kenya, losses amount to an estimated US$1.9 million annually since 2003, while the Mozambican government reports losses of US$2.5 million since 2008. Zimbabwe faces the grim reality of discarding half of its annual mango production of 400,000 metric tonnes due to pest-related damage.

- According to the FAO (Food and Agriculture Organization), the fruit fly's rapid proliferation is a growing concern across Africa, affecting all countries in the Southern Africa Development Community region. Fruit farmers in this region grapple with annual losses of around US$2 billion due to this invasive pest.

Middle-East and Africa Pest Control Market Drivers:

Agricultural Expansion and Commercialization are significant drivers of the pest control market in these regions.

The expansion of agricultural activities and the commercialization of farming in Southern Africa and the Middle East have driven the demand for pest control services. As more land is cultivated for crops like maize, cotton, and citrus fruits, the risk of pest infestations and crop damage increases, prompting farmers to seek professional pest management solutions. In South Africa, for example, the agricultural sector accounts for a substantial portion of the country's GDP. In 2020, the agricultural sector contributed 2.9% to the country's GDP, underscoring the significance of pest control in safeguarding agricultural output. Rapid urbanization and commercial development in the Middle East and South Africa have created conducive environments for pests to thrive, particularly in densely populated urban areas and commercial establishments. As cities expand, the demand for pest control services in residential, commercial, and industrial sectors has surged. According to the United Nations, the urban population in Africa is projected to double by 2050. This urban growth, coupled with an expanding hospitality and tourism industry in the region, drives the need for pest control. In the Middle East, the growth of cities like Dubai and Doha has led to increased demand for pest management services.

Pest control is crucial in Global Trade and Food Safety Regulations increasing its demand in Middle East and Africa regions.

The global nature of trade in agricultural products has made adherence to international food safety regulations crucial. To meet stringent phytosanitary and quality standards imposed by importing countries, Southern African and Middle Eastern nations invest in pest control measures to ensure the exportability of their agricultural products. Compliance with these regulations is essential for accessing international markets and maintaining a competitive edge. The Southern African region exports a range of agricultural products, including fruits, vegetables, and grains. For instance, South Africa's agricultural exports reached a value of approximately $11 billion in 2020, highlighting the importance of meeting global food safety standards through effective pest control practices.

Middle-East and Africa Pest Control Market Restraints and Challenges:

Regulatory Hurdles and Compliance challenges pose hurdles for the pest control market.

One of the key challenges in the pest control industry across the Middle East and Africa is navigating complex and evolving regulatory frameworks. Regulations related to pesticide use, safety standards, and environmental protection can vary widely among countries and regions. Compliance with these regulations, obtaining necessary permits, and ensuring the safe handling and disposal of pesticides can be time-consuming and costly. Regulatory hurdles and compliance challenges can impede the growth of pest control businesses, particularly for small and medium-sized enterprises. Failure to comply with regulations can lead to legal issues, fines, and damage to a company's reputation. Additionally, navigating a patchwork of regulations can be a barrier to market entry for international pest control companies.

Limited Awareness and Education on Pest Management is a significant challenge in the growth of the Pest control market in the Middle East and Africa regions.

In many parts of the Middle East and Africa, there is limited awareness and education regarding the importance of effective pest management practices. This lack of awareness can result in inadequate pest control measures, leading to crop losses in agriculture, hygiene issues in urban areas, and public health concerns. Limited awareness hampers the adoption of modern pest control techniques and sustainable pest management practices. It can result in a reactive rather than proactive approach to pest control, where pest infestations are only addressed after they become severe. This, in turn, can lead to increased costs and damage. Raising awareness and educating communities and businesses about the benefits of integrated pest management (IPM) and environmentally friendly pest control methods is crucial for overcoming this challenge.

Middle-East And Africa Pest Control Market Opportunities:

The Middle East and Africa pest control market presents significant opportunities for growth by focusing on innovation and sustainability. Embracing advanced technologies, such as digital pest monitoring and biological control methods, can enhance the efficiency and effectiveness of pest management practices in both urban and agricultural settings. Moreover, as environmental concerns and regulations become more stringent, there is a growing demand for eco-friendly and non-toxic pest control solutions. Leveraging these opportunities can not only meet the region's pest control needs but also contribute to a safer, more sustainable, and healthier environment for communities and businesses across the Middle East and Africa.

MIDDLE-EAST AND AFRICA PEST CONTROL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

5.2% |

|

Segments Covered |

By Application, Pest Type, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Saudi Arabia, Qatar, Israel, South Africa, Nigeria, Kenya, Egypt, Rest of MEA |

|

Key Companies Profiled |

Rentokil Initial plc, Ecolab Inc., Rollins Inc., Anticimex Group, National Pest Control, Rentokil PCI, African Pest Control, Target Pest Control, Pest Managers & Consultants (PMC), Pelsis Group, Orkin Pest Control |

Middle-East and Africa Pest Control Market Segmentation:

Middle-East and Africa Pest Control Market Segmentation: By Application:

- Commercial Pest Control

- Agricultural Pest Control

- Residential Pest Control

The largest segment among these is the agricultural pest control holding over 57% share in the market due to its critical role in safeguarding food production and security. Pests in agriculture can devastate crops, resulting in significant economic losses and food scarcity. To ensure food sustainability and meet growing global demand, extensive pest control measures are required. Additionally, the adoption of integrated pest management (IPM) practices, which emphasize sustainable and environmentally friendly approaches, further fuels the demand for agricultural pest control services. As agriculture remains a cornerstone of economies across the Middle East and Africa, the need to protect crops and ensure food supply makes agricultural pest control a paramount segment in these regions.

The fastest-growing segment among these cultivation methods is Commercial pest control increasing at an approximate CAGR of 10%. As urbanization and globalization continue to expand, commercial establishments such as restaurants, hotels, food processing plants, and healthcare facilities are multiplying rapidly across the Middle East and Africa. These businesses are mandated to adhere to stringent hygiene and safety standards, making professional pest control services indispensable to maintain a pest-free environment, safeguard public health, meet regulatory requirements, and preserve their reputation. Moreover, the rising awareness of pest-borne diseases and increasing emphasis on food safety and quality in the commercial sector are driving the demand for ongoing and proactive pest management solutions, contributing to the rapid growth of this segment.

Middle-East and Africa Pest Control Market Segmentation: By Pest Type

- Insect

- Rodents

- Termite

- Mosquito

- Others

The insects segment is typically the largest segment among the various pest types in this market, holding approximately 42% of the market share. Insects are among the most pervasive pests encountered in both residential and commercial settings. They pose significant health risks, as many insects can transmit diseases, contaminate food, and cause allergic reactions. Additionally, insects infest a wide range of environments, from homes and restaurants to agricultural fields, making their management a top priority. Furthermore, the versatility of insect control solutions, which can include chemical treatments, traps, and preventive measures, ensures that this segment caters to a broad and diverse customer base, contributing to its prominence in the pest control market.

The termite pest control segment is experiencing rapid growth at a CAGR of 5% due to the significant and escalating threat termites pose to infrastructure, particularly in regions like the Middle East and Africa. Termites are notorious for causing extensive and costly damage to wooden structures and buildings. As construction and urban development continue to expand in these regions, the demand for professional termite control services has surged. Moreover, a heightened awareness of the economic and structural risks associated with termite infestations has prompted both residential and commercial property owners to invest in proactive termite management solutions, making this segment the fastest-growing in the pest control industry.

Middle-East and Africa Pest Control Market Segmentation: Regional Analysis:

- Saudi Arabia

- Qatar

- Israel

- South Africa

- Nigeria

- Kenya

- Egypt

- Rest of MEA

South Africa stands out as the largest segment holding approximately 30% of the share due to its diverse and dynamic pest control market. The country's substantial urban areas, agricultural sector, and thriving commercial enterprises all contribute to a high demand for pest management services. Urban centers like Johannesburg and Cape Town require pest control for residential and commercial properties, while South Africa's agriculture relies on effective pest control to safeguard crops. The country's robust economy, combined with increasing awareness of pest-related risks, drives a consistent need for comprehensive pest control solutions, making it the largest regional segment in the Middle East and Africa.

Nigeria stands as the fastest-growing segment in the Middle East and Africa pest control market due to several compelling factors. A burgeoning population, rapid urbanization, and increased commercialization have created ideal conditions for pest infestations, making professional pest control services a necessity. Additionally, Nigeria's expanding agricultural sector relies heavily on pest management to protect valuable crops. Rising awareness of health and hygiene, coupled with a growing hospitality industry, further fuels the demand for pest control services. This dynamic blend of urban, agricultural, and commercial pest control needs positions Nigeria as a high-growth market in the region.

COVID-19 Impact Analysis on the Middle- -East and African Pest Control Market:

The Middle-East and Africa pest control market experienced a multifaceted impact of COVID-19. While the pandemic initially disrupted supply chains, restricted operations, and delayed service appointments, it also underscored the essential nature of pest control for public health and safety. As lockdowns eased, the market demonstrated resilience, driven by heightened awareness of hygiene, food safety, and disease prevention. A shift towards contactless and digital pest control solutions, coupled with increased emphasis on integrated pest management (IPM) and sustainable practices, emerged as key trends. With businesses and communities recognizing the importance of pest control in safeguarding their environments, the market is expected to rebound and adapt to the evolving needs of a post-pandemic world.

Latest Trends/ Developments:

Pest control companies are increasingly adopting digital solutions for monitoring and managing pests. This involves the use of smart devices, sensors, and software to track pest activity and collect data in real time. For instance, automated traps and sensors can provide continuous monitoring, sending alerts when pest activity is detected. Data analytics play a crucial role in processing the information collected. Pest control companies can analyze data trends to predict and prevent infestations, optimize treatment strategies, and provide customers with valuable insights. This proactive approach enhances the efficiency and effectiveness of pest management, reducing the need for reactive, chemical-based treatments.

Companies are increasingly embracing Integrated Pest Management (IPM), which is a holistic approach to pest control that combines preventive measures, biological controls, and judicious pesticide use when necessary. IPM reduces the reliance on chemical pesticides and promotes sustainable, environmentally friendly pest management. Eco-friendly practices, such as the use of non-toxic or low-toxicity treatments, are gaining traction. These practices align with growing consumer demand for environmentally responsible solutions. Pest control companies are offering eco-friendly options like botanical insecticides, biological control agents, and exclusion techniques that focus on preventing pest entry without chemicals.

Key Players:

- Rentokil Initial plc

- Ecolab Inc.

- Rollins Inc.

- Anticimex Group

- National Pest Control

- Rentokil PCI

- African Pest Control

- Target Pest Control

- Pest Managers & Consultants (PMC)

- Pelsis Group

- Orkin Pest Control

In April 2020, Rentokil embarked on an expansion strategy through acquisitions in Africa, where it acquired local companies and subsequently elevated its operational standards to align with its global norms. The company prioritized cities such as Lagos, Abuja, Accra, and Addis Ababa for its expansion efforts.

Chapter 1. Middle East & Africa Pest Control Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Middle East & Africa Pest Control Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Middle East & Africa Pest Control Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Middle East & Africa Pest Control Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Middle East & Africa Pest Control Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Middle East & Africa Pest Control Market– By Application

6.1. Introduction/Key Findings

6.2. Commercial Pest Control

6.3. Agricultural Pest Control

6.4. Residential Pest Control

6.5. Y-O-Y Growth trend Analysis By Application

6.6. Absolute $ Opportunity Analysis By Application, 2023-2030

Chapter 7. Middle East & Africa Pest Control Market– By Pest Type

7.1. Introduction/Key Findings

7.2. Insect

7.3. Rodents

7.4. Termite

7.5. Mosquito

7.6. Others

7.7. Y-O-Y Growth trend Analysis By Pest Type

7.8. Absolute $ Opportunity Analysis By Pest Type, 2023-2030

Chapter 8. Middle East & Africa Pest Control Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Middle East & Africa

8.1.1. By Country

8.1.1.1. United Arab Emirates (UAE)

8.1.1.2. Saudi Arabia

8.1.1.3. Qatar

8.1.1.4. Israel

8.1.1.5. South Africa

8.1.1.6. Nigeria

8.1.1.7. Kenya

8.1.1.8. Egypt

8.1.1.9. Rest of MEA

8.1.2. By Application

8.1.3. By Pest Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Middle East & Africa Pest Control Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Rentokil Initial plc

9.2. Ecolab Inc.

9.3. Rollins Inc.

9.4. Anticimex Group

9.5. National Pest Control

9.6. Rentokil PCI

9.7. African Pest Control

9.8. Target Pest Control

9.9. Pest Managers & Consultants (PMC)

9.10. Pelsis Group

9.11. Orkin Pest Control

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The Middle East and Africa Pest Control Market was valued at USD 265 Million and is projected to reach a market size of USD 398 Million by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 5.2%.

Agricultural Expansion and Commercialization along with Global Trade and Food Safety Regulations are expanding the Middle East And Africa Pest Control market globally

Based on application, the Middle East And Africa Pest Control market is divided into Commercial Pest Control, Agricultural Pest Control, and Residential Pest Control.

South Africa is the most dominant region for the Middle East And Africa Pest Control Market.

Rentokil Initial plc, Ecolab Inc., Rollins Inc., and Anticimex Group are a few of the key players operating in the Middle East And Africa Pest Control Market.