Middle East and Africa Palm Oil Market Size (2024-2030)

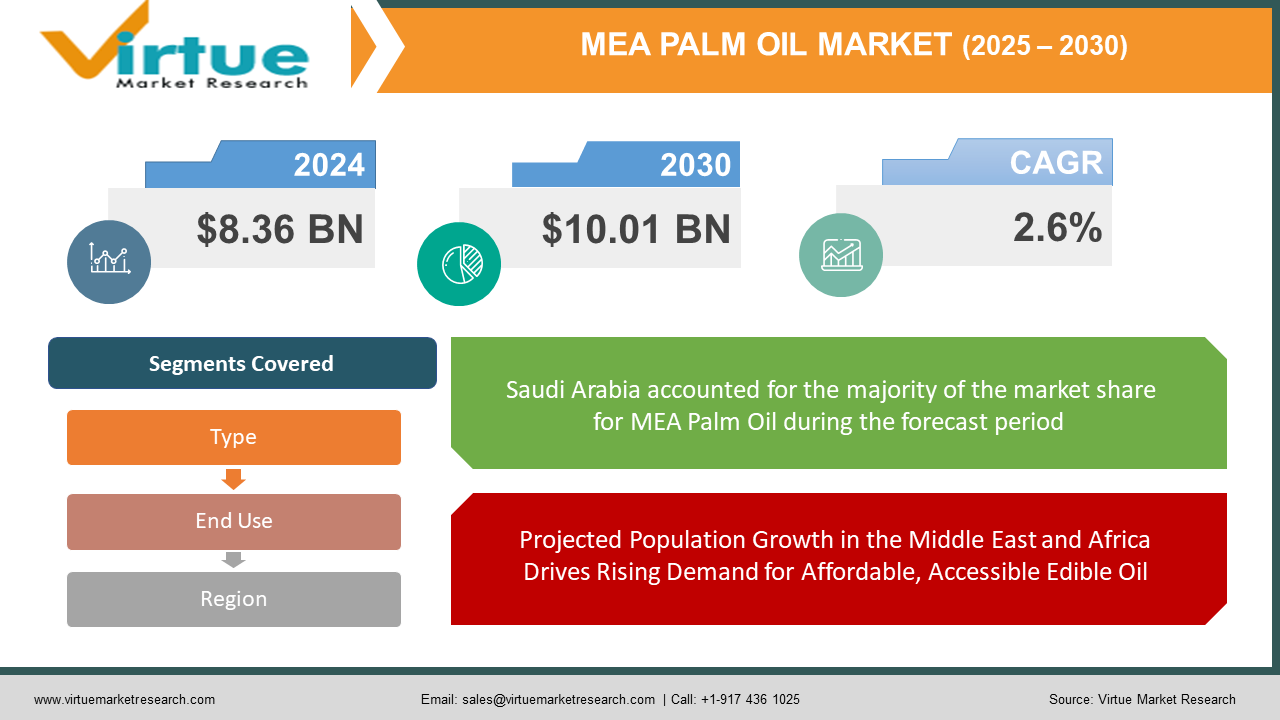

The Middle East and Africa Palm Oil Market was valued at USD 8.36 Billion and is projected to reach a market size of USD 10.01 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 2.6%.

Palm oil is a vegetable oil that is commonly used in the Middle East and Africa, and it comes from the fruit of the oil palm tree. Due to the rising number of people living in urban areas, there is a growing demand for affordable and easily accessible cooking oils. Households across all income levels commonly opt for palm oil because of its affordability and versatility. and versatility. Palm oil finds application in various industrial products like soaps, cosmetics, and lubricants. Its unique properties, such as its creamy texture and stability, make it a valuable raw material for these industries. West Africa, particularly Nigeria, is a major consumer and importer of palm oil. Countries in the Arabian Peninsula, like Saudi Arabia and the United Arab Emirates, also have a high demand for palm oil due to their large populations and growing food processing sectors. Environmental groups raise concerns about deforestation and biodiversity loss associated with palm oil production in Southeast Asia, a major source of imports for the MEA region. Consumers are increasingly becoming environmentally conscious, demanding transparency and responsible sourcing practices from palm oil suppliers.

Key Market Insights:

- The Middle East and Africa palm oil market is expected to create job opportunities for over 250,000 people by 2028, with the palm oil cultivation and processing sectors being the major contributors.

- The Middle East and Africa palm oil market is expected to witness a surge in the demand for sustainable and certified palm oil, with their market share projected to increase from 18% in 2023 to 32% by 2028.

- Driven by the demand from the personal care and cosmetics sectors, the industrial category held the second-highest revenue share of 32% in the Middle East and Africa palm oil market in 2023.

- The Middle East and Africa palm oil market is expected to create job opportunities for over 280,000 people by 2028, with the palm oil cultivation and processing sectors being the major contributors.

- The Middle East and Africa palm oil market is witnessing investments from major players, with over $1.4 billion invested in the last three years (2021-2023) towards plantation expansions and technological advancements.

- Saudi Arabia, Egypt, and Nigeria are expected to account for over 58% of the total Middle East and Africa palm oil market revenue by 2028, driven by the increasing demand from the food and beverage, and personal care industries.

- Throughout the forecast period, the food and beverage category is expected to increase at a rate of 7.6% due to the increasing demand for palm oil in the production of various food products.

- The $2.3 billion palm oil market in the Middle East and Africa was controlled by Saudi Arabia as a result of rising demand from the food and beverage sector.

Middle East and Africa Palm Oil Market Drivers:

Projected Population Growth in the Middle East and Africa Drives Rising Demand for Affordable, Accessible Edible Oil

Compared to other vegetable oils like sunflower or olive oil, palm oil offers a cost-effective option. This affordability is particularly important in regions with lower average incomes, making it a staple ingredient in many households across the MEA. Palm oil's semi-solid consistency and neutral flavor profile make it suitable for a wide range of culinary applications. It can be used for frying, baking, and even in margarine and spreads. This versatility allows food manufacturers to incorporate palm oil into various products, catering to diverse consumer preferences. Palm oil's natural resistance to oxidation contributes to a longer shelf life for food products. This is particularly advantageous in regions with hot climates, where maintaining food quality can be challenging. Palm oil's natural resistance to oxidation contributes to a longer shelf life for food products. This is particularly advantageous in regions with hot climates, where maintaining food quality can be challenging.

Rapid urbanization across the MEA region is leading to a shift in dietary patterns. Consumers are increasingly moving away from traditional, plant-based diets towards processed and convenience foods.

The fast-paced lifestyle associated with urban living fosters a demand for convenient food options. Palm oil's versatility makes it ideal for mass production as it can be easily incorporated into processed food items, catering to busy consumers who seek quick and easy meal solutions. The growing influence of Western culture and cuisine in the MEA region is leading to a rise in the consumption of fried foods, baked goods, and processed snacks. These items often rely on palm oil as a key ingredient, further driving demand. While some regions within the MEA cultivate olive oil or other vegetable oils, palm oil's high yield and affordability often make it a more attractive option for food manufacturers compared to locally produced alternatives.

Middle East and Africa Palm Oil Market Restraints and Challenges:

A major concern surrounding palm oil production is its association with deforestation. Clearing land for oil palm plantations can lead to habitat loss for endangered species and disrupt delicate ecosystems. This raises environmental concerns among consumers and regulatory bodies, potentially leading to boycotts and stricter regulations. Intensive palm oil cultivation practices can lead to soil erosion and depletion of nutrients. Additionally, the use of fertilizers and pesticides can contaminate water sources, impacting water quality and harming aquatic life. Concerns exist regarding potential labor exploitation in the palm oil industry. Issues like low wages, poor working conditions, and child labor can tarnish the reputation of producers and lead to boycotts by ethically conscious consumers.

Middle East and Africa Palm Oil Market Opportunities:

The MEA region boasts a rapidly growing population, particularly in urban areas. This urbanization fuels a demand for convenient and affordable food options, with processed and packaged foods playing an increasingly significant role in diets. Palm oil, with its high yield, long shelf life, and versatility in cooking applications, is well-positioned to cater to this growing need. As economies in the MEA region develop, disposable incomes are on the rise. This empowers consumers to explore a wider variety of food products, including those containing palm oil, such as baked goods, margarine, and instant noodles. Changing lifestyles and a growing taste for Western-style convenience foods are driving demand for products with palm oil. Its functionality in creating crispy textures and enhancing flavors makes it a valuable ingredient for manufacturers. Large swathes of land in Africa boast suitable climates and soil conditions for palm oil trees. This presents an opportunity for increased production within the MEA region, potentially reducing reliance on imports. Several African governments are actively promoting palm oil production. This can involve offering incentives like tax breaks or land leases to attract investors and encourage domestic cultivation.

MIDDLE EAST AND AFRICA PALM OIL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

||

|

Market Size Available |

2023 - 2030 |

||

|

Base Year |

2023 |

||

|

Forecast Period |

2024 - 2030 |

||

|

CAGR |

6.1% |

||

|

Segments Covered |

By Type, End User, and Region |

||

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

||

|

Regional Scope |

|

||

|

Key Companies Profiled |

Wilmar International Limited , Sime Darby Plantation Berhad, Olam International Limited, Golden Agri-Resources Ltd. , Musim Mas Group , New Britain Palm Oil Limited , Cargill Inc. |

Middle East and Africa Palm Oil Market Segmentation:

Middle East and Africa Palm Oil Market Segmentation: By Type

- Crude Palm Oil (CPO)

- Refined Palm Oil (RPO)

- Palm Kernel Oil (PKO)

- Palm Fatty Acid Distillates (PFAD)

Crude palm oil (CPO) reigns supreme in the MEA palm oil market, accounting for an estimated 65-70% share. This unrefined oil, extracted directly from the palm fruit, serves as the foundation for further processing into various products. Compared to other vegetable oils, CPO offers a high yield at a relatively lower cost, making it an attractive option for producers and manufacturers. CPO possesses unique properties that make it suitable for a wide range of applications. Its high smoke point allows for frying, while its semi-solid nature finds use in shortening and margarine production. CPO acts as the primary source material for refining refined palm oil (RPO) and palm kernel oil (PKO), further expanding its reach across food and non-food applications.

While currently a smaller segment, PKO exhibits promising growth potential. Estimated to hold a market share of around 5-10%, PKO caters to specialized applications due to its unique properties. Its demand is projected to grow in the cosmetics and personal care segment. PKO has a higher melting point and a different fatty acid profile compared to CPO. This makes it ideal for specialized applications in the food and non-food sectors.

Middle East and Africa Palm Oil Market Segmentation: By End Use

- Food Industry

- Non-Food Industry

- Other Uses

Food Industry (69.1%) is the undisputed champion, accounting for nearly 70% of the total palm oil consumption in the MEA region. Compared to other vegetable oils, palm oil offers a cost-effective and versatile option for food manufacturers. Its high smoke point makes it ideal for frying, while its neutral flavors and creamy texture enhance baked goods and processed foods. As urbanization and busy lifestyles become more prevalent across the MEA region, the consumption of convenient, ready-to-eat, and packaged foods surges. Palm oil plays a significant role in these products due to its long shelf life and functionality in creating appealing textures. As economies in the MEA region develop, consumers have more disposable income to spend on a wider variety of food products. This includes processed and packaged foods containing palm oil, contributing to the overall market share.

Non-Food Industry (20.9%) While not as dominant as the food sector, the non-food industry presents a growing market for palm oil derivatives. The potential for biofuels derived from palm oil is gaining traction, particularly as a renewable energy alternative. However, concerns regarding sustainability and competition with food production need to be addressed. Palm oil derivatives find application in various personal care products due to their cleansing and moisturizing properties. This segment is well-established and is expected to maintain steady growth. Palm oil can be used as a base for lubricants, offering a potential eco-friendly alternative to petroleum-based options. This segment is still evolving but holds promise for future growth.

Middle East and Africa Palm Oil Market Segmentation: Regional Analysis:

- United Arab Emirates

- Saudi Arabia

- Qatar

- Israel

- South Africa

- Nigeria

- Kenya

- Egypt

- Rest of MEA

In 2023, Saudi Arabia accounted for over 28% of the palm oil market revenue in the Middle East and Africa, giving it the biggest market share. The nation's massive population, increasing urbanization, and rising disposable incomes, particularly in the food and beverage industry, have all contributed to a surge in the demand for products based on palm oil. The Saudi Arabian food processing industry is well-established and heavily relies on palm oil as a main component of a variety of items, including confections, baked goods, and snacks.

It is projected that Nigeria will have the fastest growth in the palm oil market in the Middle East and Africa. Nigeria's palm oil market is expected to develop at the highest growth rate of 8.2% over the projected period, driven by the country's greater emphasis on self-sufficiency in palm oil production and the food and beverage industry's growing demand.

COVID-19 Impact Analysis on the Middle East and Africa Palm Oil Market:

Lockdowns and movement restrictions across the MEA region caused temporary closures of restaurants, hotels, and food processing facilities. This led to a sudden drop in demand for palm oil used in food service and processed food production. Global lockdowns and restrictions on international travel hampered the movement of goods, including palm oil shipments. This caused temporary shortages and price fluctuations in the region. As people stayed home more often, demand for cooking oils for home use rose. Palm oil, due to its affordability and versatility, potentially benefited from this shift in consumption patterns. The surge in e-commerce purchases during lockdowns provided a lifeline for palm oil-based products like packaged foods and cooking oils, catering to homebound consumers. With a growing focus on immunity-boosting foods and a longer shelf life for pantry staples, palm oil's properties as a source of Vitamin E and its extended shelf life could have offered an advantage in certain product categories.

Latest Trends/ Developments:

The UAE government is prioritizing sustainable sourcing practices. Major retailers are increasingly stocking certified sustainable palm oil (CSPO) products, reflecting a growing consumer consciousness about environmental and ethical concerns. This shift necessitates collaboration with suppliers who can demonstrate responsible palm oil production practices. Rapid urbanization and a growing preference for convenient, processed foods are fuelling demand for affordable vegetable oils like palm oil. South Africa's well-established food processing sector is increasingly utilizing palm oil due to its functionality and cost-effectiveness in various food products. Efficient transportation and storage infrastructure are crucial for managing the increasing volumes of palm oil imports. Investments in this area can ensure smooth supply chains and minimize disruptions. Collaboration on research and development of high-yield, disease-resistant palm oil varieties can contribute to increased productivity and reduced environmental impact. Developing regionally specific sustainability standards tailored to the MEA's climate and social context can ensure responsible palm oil production practices.

Key Players:

- Wilmar International Limited

- Sime Darby Plantation Berhad

- Olam International Limited

- Golden Agri-Resources Ltd.

- Musim Mas Group

- New Britain Palm Oil Limited

- Cargill Inc.

Chapter 1. Middle East and Africa Palm Oil Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Middle East and Africa Palm Oil Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Middle East and Africa Palm Oil Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Middle East and Africa Palm Oil Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitute

Chapter 5. Middle East and Africa Palm Oil Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Middle East and Africa Palm Oil Market– By Type

6.1. Introduction/Key Findings

6.2. Crude Palm Oil (CPO)

6.3. Refined Palm Oil (RPO)

6.4. Palm Kernel Oil (PKO)

6.5. Palm Fatty Acid Distillates (PFAD)

6.6. Y-O-Y Growth trend Analysis By Type

6.7. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Middle East and Africa Palm Oil Market– By End Use

7.1. Introduction/Key Findings

7.2. Food Industry

7.3. Non-Food Industry

7.4. Other Uses

7.5. Y-O-Y Growth trend Analysis By End Use

7.6. Absolute $ Opportunity Analysis By End Use, 2024-2030

Chapter 8. Middle East and Africa Palm Oil Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Middle East & Africa

8.1.1. By Country

8.1.1.1. United Arab Emirates (UAE)

8.1.1.2. Saudi Arabia

8.1.1.3. Qatar

8.1.1.4. Israel

8.1.1.5. South Africa

8.1.1.6. Nigeria

8.1.1.7. Kenya

8.1.1.8. Egypt

8.1.1.9. Rest of MEA

8.1.2. By Type

8.1.3. By End Use

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Middle East and Africa Palm Oil Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Wilmar International Limited

9.2. Sime Darby Plantation Berhad

9.3. Olam International Limited

9.4. Golden Agri-Resources Ltd.

9.5. Musim Mas Group

9.6. New Britain Palm Oil Limited

9.7. Cargill Inc.

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The MEA region boasts a rapidly growing population, particularly in urban areas. This surge in population creates a rising demand for affordable and readily available food options, with palm oil playing a crucial role due to its versatility and cost-effectiveness in various food products

Large-scale palm oil plantation development has been linked to deforestation, particularly in Southeast Asia, which serves as the major source of MEA's palm oil. This deforestation disrupts ecosystems, destroys biodiversity, and contributes to greenhouse gas emissions.

Wilmar International Limited, Sime Darby Plantation Berhad, Olam

International Limited, Golden Agri-Resources Ltd., Musim Mas Group, New

Britain Palm Oil Limited, Cargill Inc.

In 2023, Saudi Arabia accounted for over 28% of the palm oil market revenue in the Middle East and Africa, giving it the biggest market share.

It is projected that Nigeria will have the fastest growth in the palm oil market in the Middle East and Africa.