Middle-East And Africa Oats Market Size (2024-2030)

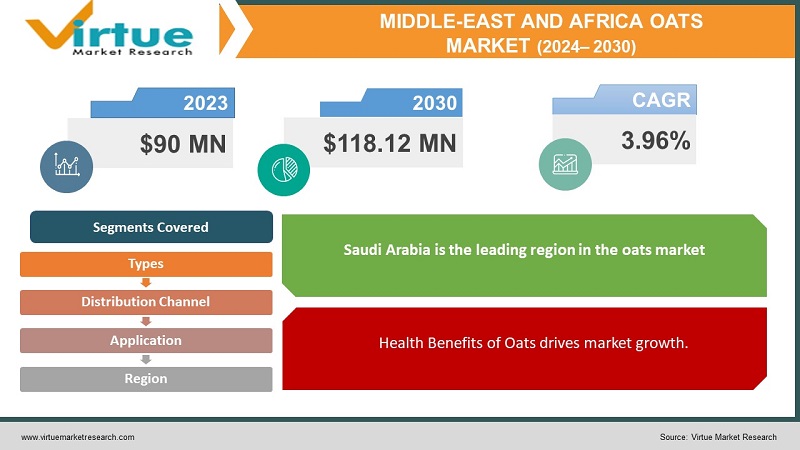

The Middle East And Africa Oats Market was valued at USD 90 million in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 118.12 million by 2030, growing at a CAGR of 3.96%.

Oats (Avena sativa), a whole-grain cereal, are widely consumed for their health benefits, including lowering blood sugar levels, aiding weight loss, and providing essential nutrients. They are rich in dietary fiber, protein, iron, vitamins, and carbohydrates. While much of the production is used in animal feed, their recognition as a healthy food for humans has increased. Oats are commonly available in whole, steel-cut, or rolled forms and have various applications in food. Additionally, a small portion is used in the cosmetic industry for talc replacers and skincare products.

The growing popularity of oat-based products like oatmeal, granola bars, and oat beverages has expanded the market. The Middle East and Africa offer untapped potential due to increasing health awareness and changing diets.

Key Market Insights:

Consumers' changing lifestyles, with a preference for light and healthy meals, are driving demand. The high nutritional content of oats is a key market driver. Additionally, the growing preference for healthy and convenient foods boosts the oats market. Oats' functional properties further enhance their appeal, making them a popular breakfast choice.

Middle-East And African Oats Market Drivers:

Health Benefits of Oats drives market growth.

Oats are an excellent source of soluble dietary fibers, including beta-glucan, which aids digestion, increases satiety, and suppresses appetite, promoting healthy weight management. Their soluble fiber content helps reduce low-density lipoprotein (LDL) cholesterol, stabilize blood sugar levels, and support weight management. This makes oats a popular inclusion in breakfast meals, being gluten-free and nutrient-rich, offering a balanced meal without excess calories. Leading market players will meet the growing demand for nutritious breakfasts through new product launches in the coming years.

Utilization of Animal Feed increases the demand in the Oats Market.

Most oat production is used in the animal feed industry due to its properties that enhance feed value. Oats have a higher fat content compared to other cereals, increasing the feed's energy content. Additionally, oats are more digestible than some other cereals. The dehulled variant significantly improves feed value and palatability, with a balanced amino acid composition suitable for poultry, horses, and piglets. This broad utilization of animal feed supports market growth.

Middle-East And Africa Oats Market Restraints and Challenges:

Availability of Other Grains at Low Prices to Hinder Market Growth

The availability of other whole grains like wheat, barley, sorghum, and quinoa, which have similar nutritional profiles, restrains the growth of the oat market. Wheat, rich in fiber, vitamins, and magnesium, is available at low prices internationally. Barley is widely used in breakfast meals due to its digestive benefits and antioxidant properties, which reduce the risk of cardiovascular diseases. Additionally, barley consumption lowers cholesterol and triglyceride levels, aiding weight loss, and further impeding oat market growth.

Middle-East And Africa Oats Market Opportunities:

Increasing Whole Grains creates opportunities for Market Growth

The rising consumer trend towards whole-grain foods, driven by their health benefits like reduced cardiovascular risk, has fueled market growth. This trend compels manufacturers to incorporate oats into their product lines. The American Journal of Clinical Nutrition advises consuming whole grains rich in phytochemicals and bioactive compounds over refined products. As urbanization and higher education levels drive demand for high-value foods, manufacturers are expected to develop innovative oat-based products.

MIDDLE-EAST AND AFRICA OATS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.96% |

|

Segments Covered |

By Type, application, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Saudi Arabia, Qatar, Israel, South Africa, Nigeria, Kenya, Egypt, Rest of MEA |

|

Key Companies Profiled |

Quaker Oats Company (PepsiCo, Inc.), Aussee Oats Milling Pvt Ltd, Morning Foods Ltd., Glanbia, Plc., The Kellogg Company, Richardson International Ltd., Avena Foods Ltd, Bob’s Red Mill Natural Foods, Inc., The Ancient Grains, Co. and Blue Lake Milling. |

Middle-East And Africa Oats Market Segmentation:

Middle-East And Africa Oats Market Segmentation- By Type:

- Steel Cut

- Whole Oats

- Instant Oats

- Others

The whole oats segment holds a significant market share due to its growing popularity for its health benefits. This has created opportunities for using whole oats in flavorful breakfast meals and bakery products. The National Center for Biotechnology Information (NCBI) highlights that whole grains contain higher levels of proteins, fibers, starch, and fatty acids compared to processed grains. Additionally, oat-based products like bread, cookies, nutritional bars, and biscuits are increasingly popular among consumers, further driving market growth.

Conversely, the fastest-growing segment in the oats market is instant oats. These are pre-cooked and dried to speed up cooking, being thinner and more finely processed than rolled oats. Instant oats are favored for their convenience and quick preparation, appealing to those with busy lifestyles or seeking a rapid, nutritious breakfast. The rising demand for on-the-go and ready-to-eat meals has accelerated the growth of the instant oats segment.

Middle-East And Africa Oats Market Segmentation- By Application:

- Bakery and Confectionery

- Breakfast Cereals

- Animal Feed

- Others

Animal Feed is set to become the dominant application segment. Oat forage is widely used as a vital feed for livestock and poultry. Its high fat content enhances the energy value of the feed and helps prevent allergies and gluten absorption disorders, while also boosting milk yield in cows. Research from Aberystwyth University indicates that ruminants fed oats produce higher milk yields without adverse effects, positively influencing segment growth.

Breakfast Cereal is the fastest-growing segment. Oats, rich in dietary fiber, support a healthy gut microbiome. Increased fiber intake is associated with better health outcomes and a reduced risk of diseases such as cardiovascular disease and colorectal cancer. As consumers increasingly seek nutritious options, the demand for dietary fiber is rising. Oats offer various health benefits, including maintaining bowel health, lowering cholesterol, and controlling blood sugar levels. Additionally, the growing focus on nutraceuticals, driven by health awareness, preference for natural ingredients, and regulatory support, is expected to boost the demand for oats in functional foods and bakery products.

Middle-East And Africa Oats Market Segmentation- By Distribution channel:

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail Stores

- Other Distribution Channels

The largest segment in the oats market is supermarkets and hypermarkets. These well-established retail channels offer a broad range of products, including oats, to a large consumer base. They provide a convenient one-stop shopping experience with dedicated sections for grains and cereals, making it easy for consumers to locate and purchase oats.

In contrast, the fastest-growing segment is online retailers. The rapid expansion of e-commerce and growing preference for online shopping have made digital platforms a crucial distribution channel for oats. Online retailers offer convenience, a wide product selection, and home delivery, appealing to consumers who value the ease of shopping from home. Additionally, online platforms facilitate price comparisons, access to reviews, and detailed product information, helping consumers make well-informed decisions.

Middle-East And Africa Oats Market Segmentation- by Region

- United Arab Emirates

- Saudi Arabia

- Qatar

- Israel

- South Africa

- Nigeria

- Kenya

- Egypt

- Rest of the Middle East and Africa

Saudi Arabia is the leading region in the oats market. With $5.38 million in oat imports, it ranks as the 25th largest importer globally. Oats were the 807th most imported product in Saudi Arabia for that year.

Nigeria imported $506,000 worth of oats, ranking as the 54th largest importer globally. During the same year, oats were the 911th most imported product in Nigeria. The country primarily sources its oat imports from the United Kingdom, United Arab Emirates, South Africa, India, and Argentina.

The United Arab Emirates is the fastest-growing segment. Increased health and wellness awareness among consumers has led to higher demand for natural and whole-grain foods like oatmeal. Oatmeal’s high fiber content and benefits for heart and digestive health make it popular among health-conscious individuals. Additionally, the growing number of busy urban professionals and expatriates in the UAE has heightened the need for convenient, ready-to-eat breakfast options. Marketing efforts by oatmeal manufacturers, emphasizing its nutritional advantages, have further boosted its popularity.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic significantly impacted the oatmeal market in the Middle East and Africa. Early in the pandemic, there was a surge in demand for essential food items, including oatmeal, as consumers sought shelf-stable and nutritious pantry staples. Lockdown measures increased home-cooked meals, further boosting oatmeal consumption as a quick and easy breakfast option. However, the economic downturn and reduced consumer spending during the pandemic affected the demand for premium oatmeal products.

Latest Trends/ Developments:

In February 2023, Saffola launched a new variant of their Masala Oats, named “Karara Crunch.” This version features a blend of crunchy bits, crisp vegetables, and desi millets for added texture and flavor.

In September 2022, Quaker (PepsiCo Inc.) introduced "Quaker Oats Muesli" in the ready-to-eat cereal segment. This product is highly nutritious, comprising five grains and 22% fruit, nuts, and seeds. It is available in two variants: fruit & nuts and berries & seeds.

In October 2022, Kellogg's India released "Pro Muesli," a high-protein muesli made from 100% plant-based ingredients. One serving with 200 ml of milk provides 29% of the daily protein requirement for a sedentary woman.

Key Players:

These are the top 10 players in the Middle East And Africa Oats Market: -

- Quaker Oats Company (PepsiCo, Inc.)

- Aussee Oats Milling Pvt Ltd

- Morning Foods Ltd.

- Glanbia, Plc.

- The Kellogg Company

- Richardson International Ltd.

- Avena Foods Ltd

- Bob’s Red Mill Natural Foods, Inc.

- The Ancient Grains, Co.

- Blue Lake Milling

Chapter 1. Middle East And Africa Oats Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Middle East And Africa Oats Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Middle East And Africa Oats Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Middle East And Africa Oats Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Middle East And Africa Oats Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Middle East And Africa Oats Market– By Type

6.1. Introduction/Key Findings

6.2. Steel Cut

6.3. Whole Oats

6.4. Instant Oats

6.5. Others

6.6. Y-O-Y Growth trend Analysis By Type

6.7. Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Middle East And Africa Oats Market– By Application

7.1. Introduction/Key Findings

7.2 Bakery and Confectionery

7.3. Breakfast Cereals

7.4. Animal Feed

7.5. Others

7.6. Y-O-Y Growth trend Analysis By Application

7.7. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. Middle East And Africa Oats Market– By Distribution channel

8.1. Introduction/Key Findings

8.2. Supermarkets/Hypermarkets

8.3. Convenience Stores

8.4. Online Retail Stores

8.5. Other Distribution Channels

8.6. Y-O-Y Growth trend Analysis By Distribution channel

8.7. Absolute $ Opportunity Analysis By Distribution channel , 2024-2030

Chapter 9 . Middle East And Africa Oats Market, By Geography – Market Size, Forecast, Trends & Insights

9 .1. Middle East and Africa

9 .1.1. By Country

9 .1.1.1. Saudi Arabia

9 .1.1.2. Qatar

9 .1.1.3. UAE

9 .1.1.4. Israel

9 .1.1.5. South Africa

9 .1.1.6. Nigeria

9 .1.1.7. Kenya

9 .1.1.9 . Egypt

9 .1.1.9 . Rest of the Middle East

9.1.2. By Type

9.1.3. By Application

9.1.4. Distribution channel

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Middle East And Africa Oats Market– Company Profiles – (Overview, Type Type Portfolio, Financials, Strategies & Developments)

10.1. Quaker Oats Company (PepsiCo, Inc.)

10.2. Aussee Oats Milling Pvt Ltd

10.3. Morning Foods Ltd.

10.4. Glanbia, Plc.

10.5. The Kellogg Company

10.6. Richardson International Ltd.

10.7. Avena Foods Ltd

10.8. Bob’s Red Mill Natural Foods, Inc.

10.9. The Ancient Grains, Co.

10.10. Blue Lake Milling

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The growing popularity of oat-based products like oatmeal, granola bars, and oat beverages has expanded the market. The Middle East and Africa offer untapped potential due to increasing health awareness and changing diets

The top players operating in the Middle-East And Africa Oats Market are - Quaker Oats Company (PepsiCo, Inc.), Aussee Oats Milling Pvt Ltd, Morning Foods Ltd., Glanbia, Plc., The Kellogg Company, Richardson International Ltd., Avena Foods Ltd, Bob’s Red Mill Natural Foods, Inc., The Ancient Grains, Co. and Blue Lake Milling.

The COVID-19 pandemic significantly impacted the oatmeal market in the Middle East and Africa. Early in the pandemic, there was a surge in demand for essential food items, including oatmeal, as consumers sought shelf-stable and nutritious pantry staples.

In February 2023, Saffola launched a new variant of their Masala Oats, named “Karara Crunch.” This version features a blend of crunchy bits, crisp vegetables, and desi millets for added texture and flavor.

The United Arab Emirates is the fastest-growing segment. Increased health and wellness awareness among consumers has led to higher demand for natural and whole-grain foods like oatmeal. Oatmeal’s high fiber content and benefits for heart and digestive health make it popular among health-conscious individuals.