Middle East And Africa Non Alcoholic Drinks Market Size (2024-2030)

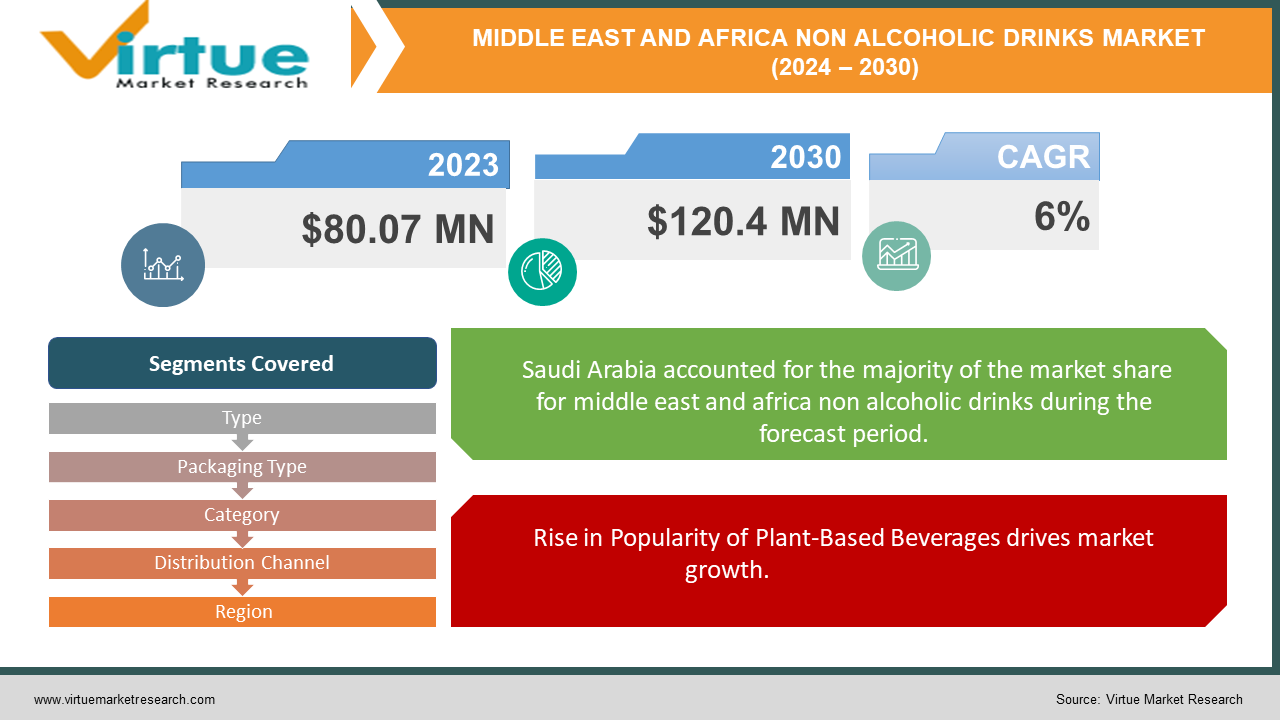

The Middle East And Africa Non Alcoholic Drinks Market was valued at USD 80.07 million in 2023. Over the forecast period of 2024-2030 it is projected to reach USD 120.4 million by 2030, growing at a CAGR of 6%.

The rising interest in rejuvenating beverages and the evolution of societal progress across different human cultures provide investors with a comprehensive view of the industry. Manufacturers are motivated to improve their production capacities owing to decreased trade barriers and tariff restrictions in the market. In the years ahead, substantial opportunities for market growth are expected, fueled by the expansion of emerging markets and changes in consumer preferences influenced by the introduction of novel products.

Key Market Insights:

The market for non-alcoholic beverages is poised for growth across regions, driven by increasing consumer preference for healthy beverages and unique flavor profiles. There is a growing trend among the younger population towards health-conscious choices, resulting in heightened demand for zero-calorie or low-calorie beverages. Additionally, the functional beverages category, particularly sports drinks, is expanding due to rising participation in physical activities. The sports drink segment is notably identified as the fastest-growing sub-segment, fueled by escalating health consciousness and mounting demand from millennials.

Middle East And Africa Non Alcoholic Drinks Market Drivers:

Rise in Popularity of Plant-Based Beverages drives market growth.

The vegan demographic has seen significant growth recently, driven by heightened concerns about health and sustainability. According to the International Food Information Council's 2021 Food and Health Survey, over 40% of consumers perceive plant-based food and beverages as healthier options, even when their ingredient compositions and nutritional profiles resemble conventional counterparts. The increasing popularity of veganism and the rise in lactose intolerance have contributed to a growing demand for dairy alternatives.

In response, beverage manufacturers are increasingly introducing products that emphasize plant-based attributes. These offerings, such as those featuring oat milk and carrying vegan certifications, cater to evolving consumer preferences.

The growing number of launches in the plant-based beverage category is expected to drive demand for non-alcoholic beverages in the foreseeable future.

E-Commerce Platforms help in market growth.

The beverage industry is expected to undergo significant changes as consumers increasingly rely on the internet and e-commerce platforms. Projections indicate that technological advancements and the surge in online shopping behaviors will have a substantial impact on industry dynamics.

Middle East And Africa Non Alcoholic Drinks Market Restraints and Challenges:

Fluctuations in Price hamper the Supply Chain restrain market growth.

Due to its substantial dependence on natural resources like electricity and water, the beverage industry generates several social and environmental externalities. These include indirect greenhouse gas emissions, depletion of water reservoirs, and increased pollution levels. Collectively, these factors disrupt the availability of natural resources and are anticipated to hinder the industry's production capacity.

Acknowledging both the opportunities and risks posed by sustainability challenges, beverage manufacturers have partnered with the alcoholic drinks sector to form the Beverage Industry Environmental Roundtable (BIER). Key players including The Coca-Cola Company, PepsiCo, and other industry leaders have united within the BIER technical coalition. Their collective goal is to promote and advance sustainability practices across the beverage industry.

Middle East And Africa Non Alcoholic Drinks Market Opportunities:

As consumer acceptance of non-alcoholic and low-alcohol categories continues to grow, manufacturers in the market are proactively adjusting their product offerings to align with these evolving trends. This strategic response is expected to drive future expansion. Additionally, increasing consumer awareness of the health benefits associated with bottled water consumption is anticipated to boost demand in this sector. Particularly noteworthy is the preference for bottled water over tap water among younger demographics, which is contributing to increased sales of these products. Consequently, many restaurants are diversifying their beverage menus by offering a variety of bottled water options to cater to consumer preferences.

Furthermore, the non-alcoholic beverage industry is experiencing momentum due to demographic shifts and evolving drinking habits among younger generations. Millennials and Generation Z, in particular, are showing a preference for moderation and balance, opting for reduced alcohol consumption. This shift has spurred the development of innovative and diverse non-alcoholic beverage alternatives, including alcohol-free beer and wine, as well as artisanal mocktails. These products are designed to appeal to a more discerning and sophisticated palate, further driving growth in the non-alcoholic beverage market.

MIDDLE EAST AND AFRICA NON ALCOHOLIC DRINKS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.1% |

|

Segments Covered |

By Type, packaging type, category, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

United Arab Emirates (UAE), Saudi Arabia, South Africa, Kenya, Rest of MEA |

|

Key Companies Profiled |

Bolthouse Farms, Inc., Asahi Group Holdings, Ltd. , Califia Farms, LLC, Keurig Dr Pepper, Inc., Danone S.A., Nestlé S.A., Red Bull; , PepsiCo Inc., SUNTORY HOLDINGS LIMITED, The Coca-Cola Company |

Middle East And Africa Non Alcoholic Drinks Market Segmentation:

Middle East And Africa Non Alcoholic Drinks Market Segmentation By Type:

- Carbonated Soft Drinks

- Juices & Nectars

- Bottled Waters

- Dairy-Based Beverages

- Dairy Alternative Beverages

- RTD Tea and Coffee

- Others

The carbonated soft drinks (CSDs) segment has secured a substantial market share. Known for their frizziness and wide array of flavors, carbonated soft drinks cater to diverse consumer tastes. Their popularity is further bolstered by their convenience and availability in various packaging sizes, making them a favored choice for consumers seeking a quick and satisfying thirst-quencher.

Conversely, the Juices & Nectars segment is expected to witness significant market growth in the near future. This growth is fueled by heightened consumer awareness and focus on health and wellness. There is a growing preference for beverages that not only provide refreshment but also offer functional benefits. Juices & Nectars, enriched with vitamins, minerals, antioxidants, and other health-enhancing ingredients, align well with the contemporary trend towards preventive healthcare and overall well-being.

Middle East And Africa Non Alcoholic Drinks Market Segmentation By Packaging Type:

- Bottles

- Cartons

- Cans

- Pouches

The bottles segment has emerged as the market leader. This dominance is primarily attributed to the convenience of portability and their space-efficient design.

In contrast, the cans segment is poised for growth in the forecast period. Cans are increasingly preferred for their environmental advantages, seen as less detrimental to the environment compared to bottles. This eco-friendly characteristic is expected to fuel the expansion of the cans market in the years ahead.

Middle East And Africa Non Alcoholic Drinks Market Segmentation By Category:

- Sugar-Free

- Conventional

The conventional segment has historically dominated the market, with consumers traditionally preferring beverages containing sugar. However, there has been a noticeable shift in consumer preferences towards sugar-free alternatives, driven by a rising emphasis on healthier lifestyles.

Looking ahead to the forecasted period, the sugar-free segment is expected to undergo substantial growth. This reflects a growing consumer preference for healthier beverage choices. The trend towards sugar-free beverages aligns with broader societal priorities focused on adopting healthier lifestyles.

Middle East And Africa Non Alcoholic Drinks Market Segmentation By Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retail

- Others

The supermarkets & hypermarkets segment holds a significant share in the beverage market due to their ability to offer a diverse range of brands and products in one location, appealing to consumer convenience. These establishments are increasingly expanding their offerings in the alcohol-free market, with major retailers like Whole Foods, Target, Aldi, and Walmart enhancing their selections within this category.

Food service outlets such as restaurants and cafes integrate beverages into their menu offerings to meet consumer preferences. Additionally, vending machines provide quick and convenient beverage options in public settings. Companies can strategically position their products to ensure broad availability and enhance customer convenience through channels such as convenience stores and college campuses.

Middle East And Africa Non Alcoholic Drinks Market Segmentation- by region

|

|

|

|

|

|

|

|

|

South Africa, Saudi Arabia, UAE, and the rest of the Middle East & Africa play pivotal roles in the non-alcoholic beverages market within the region. Energy drinks are gaining significant popularity, driven by a rise in physical activities and an increasing number of gym memberships across Middle Eastern countries, reflecting a growing interest in fitness among individuals. Additionally, fermented and functional probiotic beverages like drinkable yogurt, kefir, and buttermilk enjoy widespread consumer acceptance. Furthermore, fortifying fruit and vegetable juices with probiotic cultures is a key factor driving growth in the Middle East & Africa non-alcoholic beverages market.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic has profoundly influenced the trajectory of the Non-Alcoholic Beverage Market. Despite the challenges it presented, the market is positioned for growth as consumers continue to prioritize health and seek more enriching beverage experiences. In response to shifting consumer preferences, manufacturers and brands are expected to boost investments in research and development efforts focused on developing innovative and healthier beverage choices. Moreover, there is an increasing emphasis on adopting eco-friendly packaging solutions and improving production methods to align with sustainability objectives and meet evolving consumer expectations.

Latest Trends/ Developments:

- In July 2022, Keurig introduced BLK & Bold K-Cup pods, making the largest black-owned coffee brand available to over 36 million households using Keurig brewers.

- In February 2022, Nestlé debuted a new plant-based version of Milo in Thailand. This Ready-To-Drink (RTD) product utilizes soy as its base and incorporates Milo's iconic malt flavor, offering a nutritious plant-based alternative.

Key Players:

These are top 10 players in the Middle East And Africa Non Alcoholic Drinks Market: -

- Bolthouse Farms, Inc.

- Asahi Group Holdings, Ltd.

- Califia Farms, LLC

- Keurig Dr Pepper, Inc.

- Danone S.A.

- Nestlé S.A.

- Red Bull;

- PepsiCo Inc.

- SUNTORY HOLDINGS LIMITED

- The Coca-Cola Company

Chapter 1. Middle East And Africa Non Alcoholic Drinks Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Middle East And Africa Non Alcoholic Drinks Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Middle East And Africa Non Alcoholic Drinks Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Middle East And Africa Non Alcoholic Drinks Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Middle East And Africa Non Alcoholic Drinks Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Middle East And Africa Non Alcoholic Drinks Market– By Type

6.1. Introduction/Key Findings

6.2. Carbonated Soft Drinks

6.3. Juices & Nectars

6.4. Bottled Waters

6.5. Dairy-Based Beverages

6.6. Dairy Alternative Beverages

6.7. RTD Tea and Coffee

6.8. Others

6.9. Y-O-Y Growth trend Analysis By Type

6.10. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Middle East And Africa Non Alcoholic Drinks Market– By Packaging Type

7.1. Introduction/Key Findings

7.2. Bottles

7.3. Cartons

7.4. Cans

7.5. Pouches

7.6. Y-O-Y Growth trend Analysis By Packaging Type

7.7. Absolute $ Opportunity Analysis By Packaging Type , 2024-2030

Chapter 8. Middle East And Africa Non Alcoholic Drinks Market– By Category

8.1. Introduction/Key Findings

8.2. Sugar-Free

8.3. Conventional

8.4. Y-O-Y Growth trend Analysis By Category

8.5. Absolute $ Opportunity Analysis By Category , 2024-2030

Chapter 9. Middle East And Africa Non Alcoholic Drinks Market– By Distribution Channel

9.1. Introduction/Key Findings

9.2. Supermarkets & Hypermarkets

9.3. Convenience Stores

9.4. Online Retail

9.5. Others

9.6. Y-O-Y Growth trend Analysis By Distribution Channel

9.7. Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 10 . Middle East And Africa Non Alcoholic Drinks Market, By Geography – Market Size, Forecast, Trends & Insights

10 .1. Middle East and Africa

10 .1.1. By Country

10 .1.1.1. Saudi Arabia

10 .1.1.2. Qatar

10 .1.1.3. UAE

10 .1.1.4. Israel

10 .1.1.5. South Africa

10 .1.1.6. Nigeria

10 .1.1.7. Kenya

10 .1.1.10 . Egypt

10 .1.1.10 . Rest of the Middle East

10 .1.2. By Type

10 .1.3. By Packaging Type

10 .1.4. Category

10.1.5. Distribution channel

10 .1.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. Middle East And Africa Non Alcoholic Drinks Market– Company Profiles – (Overview, Type Portfolio, Financials, Strategies & Developments)

11.1. Bolthouse Farms, Inc.

11.2. Asahi Group Holdings, Ltd.

11.3. Califia Farms, LLC

11.4. Keurig Dr Pepper, Inc.

11.5. Danone S.A.

11.6. Nestlé S.A.

11.7. Red Bull;

11.8. PepsiCo Inc.

11.9. SUNTORY HOLDINGS LIMITED

11.10. The Coca-Cola Company

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The vegan demographic has seen significant growth recently, driven by heightened concerns about health and sustainability

The top players operating in the Middle East And Africa Non Alcoholic Drinks Market are - Bolthouse Farms, Inc., Asahi Group Holdings, Ltd., Califia Farms, LLC, Keurig Dr Pepper, Inc., Danone S.A., Nestlé S.A., Red Bull, PepsiCo Inc., SUNTORY HOLDINGS LIMITED, The Coca-Cola Company.

The COVID-19 pandemic has profoundly influenced the trajectory of the Non-Alcoholic Beverage Market. Despite the challenges it presented, the market is positioned for growth as consumers continue to prioritize health and seek more enriching beverage experiences.

In July 2022, Keurig introduced BLK & Bold K-Cup pods, making the largest black-owned coffee brand available to over 36 million households using Keurig brewers.

South Africa, Saudi Arabia, UAE, and the rest of the Middle East & Africa play pivotal roles in the non-alcoholic beverages market within the region.