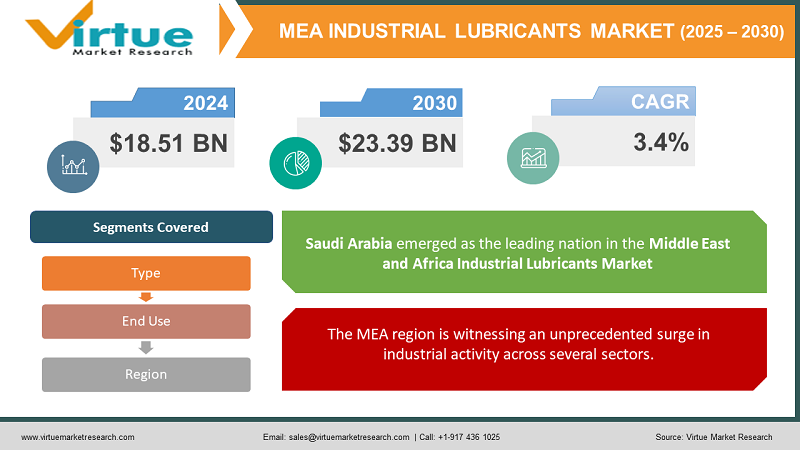

Middle East and Africa Industrial Lubricants Market Size (2024-2030)

The Middle East and Africa Industrial Lubricants Market was valued at USD 18.51 Billion in 2023 and is projected to reach a market size of USD 23.39 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 3.4%.

The MEA region is witnessing rapid industrial growth, particularly in sectors like oil & gas, construction, mining, and manufacturing. This surge in industrial activity translates to a heightened demand for lubricants to keep machinery functioning efficiently. Governments across the MEA regions are heavily investing in infrastructure projects, further propelling the demand for industrial lubricants used in heavy machinery for construction and maintenance purposes. The development of new machinery and equipment necessitates lubricants that can withstand higher operating temperatures, longer drain intervals, and increased efficiency demands. Industries are increasingly recognizing the benefits of preventive maintenance practices, including regular lubrication, to extend equipment life and reduce downtime. The rise of environmentally conscious practices is leading to a growing demand for biodegradable lubricants and those formulated with a reduced environmental footprint.

Key Market Insights:

The mineral oil-based lubricants category had the most market share (52%), primarily due to their extensive industry adoption and affordability.

Due to their better performance and longer service life, synthetic lubricants now hold a 28% market share and are expected to increase at a CAGR of 9.2% over the course of the projection period.

With a 22% market share, the hydraulic fluid category was the largest by product type in the Middle East and Africa Industrial Lubricants Market.

The energy sector, which made up 17% of the market, is expected to grow at a CAGR of 7.6%. The oil and gas and power generation industries' growing need for industrial lubricants is the reason for this rise.

The market value of industrial lubricants in the paper and pulp industry is predicted to expand at a growth rate of 8.4%, from $120

million to $180 million.

Industrial lubricants were valued at $96 million in the marine industry in 2028, and over the forecast period, they are expected to expand at a annual growth rate of 8.2% to $144 million.

Middle East and Africa Industrial Lubricants Market Drivers:

The MEA region is witnessing an unprecedented surge in industrial activity across several sectors.

One important economic pillar that continues to support the MEA is the oil and gas sector. Drilling, refining, and exploration all significantly depend on a wide variety of lubricants. Drilling equipment and heavy-duty vehicles run smoothly thanks to engine oils. The effective operation of sophisticated machinery used in extraction procedures is guaranteed by hydraulic fluids. Specialty lubricants are also essential in refineries because they shield machinery from high temperatures and aggressive chemical conditions. High-performance lubricants designed for these demanding applications are anticipated to become more and more in demand as the region's oil and gas industry develops and grows. The MEA area is going through a period of fast expansion in the building industry. The future of the region is being shaped by construction activity, which is evident in the iconic towers of Dubai and the constantly expanding infrastructural projects across Africa. The increased demand for lubricants used in different construction equipment is a result of this rise. Heavy-duty vehicles and generators operate smoothly thanks to engine oils. The smooth functioning of excavators, cranes, and other hydraulically powered equipment is guaranteed by hydraulic fluids. Grease plays a vital role in shielding equipment's moving parts from the damaging elements on building sites. The need for lubricants that can survive hard conditions and rigorous workloads will continue to be a major market driver as long as the construction industry maintains its increasing trend.

Beyond the immediate needs of a booming industrial sector, a shift in industrial practices is propelling the demand for lubricants.

Traditionally, industrial maintenance was reactive, dealing with equipment failures as they occurred. However, there's a growing shift towards preventive maintenance, which focuses on routine practices like proper lubrication to avert breakdowns and prolong equipment life. Proactive lubrication with premium lubricants at prescribed intervals can reduce friction, wear, and tear, thereby decreasing downtime and maintenance expenses. This change in maintenance strategy ensures a consistent and reliable demand for lubricants, as they become a fundamental aspect of industrial operations. In the current competitive industrial environment, enhancing efficiency and productivity is crucial. High-performance lubricants, formulated for longer drain intervals, are key to this objective. They provide enhanced protection against wear, enabling extended periods between oil changes, leading to less downtime for maintenance and lubrication, and thus, boosting efficiency and production. As industrial operators aim to refine their processes, the need for these advanced lubricants, facilitating extended drain intervals, is expected to rise progressively.

Middle East and Africa Industrial Lubricants Market Restraints and Challenges:

Counterfeit lubricants do not offer the same level of friction reduction and protection against wear as authentic products do. This deficiency can result in accelerated deterioration of machinery, reducing its operational life and potentially causing expensive malfunctions. Counterfeit lubricants that are improperly formulated might lack the required flash point or thermal stability, heightening the danger of overheating and fire hazards. Moreover, harmful contaminants found in counterfeit lubricants could present health hazards to the personnel who manage them. Governments in the MEA region can play a crucial role by implementing stricter regulations and enforcing existing ones to deter the production and sale of counterfeit lubricants. This may involve increased penalties for counterfeiters and stricter import controls. Lubricant manufacturers need to invest in robust brand protection measures, such as security features on packaging and unique identifiers that can be verified by customers.

Middle East and Africa Industrial Lubricants Market Opportunities:

Traditional lubricants, while effective, often pose environmental challenges when disposed of improperly. The demand for biodegradable lubricants, formulated from renewable resources and designed to break down naturally, is expected to rise significantly. This caters to industries striving to minimize their environmental footprint and comply with stricter environmental regulations. Lubricant manufacturers can develop user-friendly digital tools that recommend optimal lubricants based on specific machinery and operating conditions. This can help industrial users make informed decisions regarding lubricant selection, ensuring they choose the right product for their needs. Industrial lubricant suppliers can create customized lubricant management programs for their customers. These programs can include services like oil analysis, used oil collection and disposal, and on-site training for personnel on proper lubricant selection and application practices. By offering such comprehensive solutions, lubricant companies can become trusted partners to their customers, helping them optimize their maintenance practices and reduce overall costs. In conjunction with smart lubricants and IIoT platforms, lubricant suppliers can offer condition monitoring services. This can involve analyzing sensor data from lubricants to provide insights into equipment health and predict potential issues. By offering these services, lubricant companies can add significant value for their customers and strengthen their position within the market.

MIDDLE EAST AND AFRICA INDUSTRIAL LUBRICANTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|||

|

Market Size Available |

2023 - 2030 |

|||

|

Base Year |

2023 |

|||

|

Forecast Period |

2024 - 2030 |

|||

|

CAGR |

3.4% |

|||

|

Segments Covered |

By Type, End Use, and Region |

|||

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|||

|

Regional Scope |

|

|||

|

Key Companies Profiled |

ExxonMobil Corporation, Royal Dutch Shell plc, BP plc , Chevron Corporation, Total Energies SE, ENOC Group, Gulf Oil Middle East Ltd , Qalaa Holdings (ASCOM), ORYX Energies |

Middle East and Africa Industrial Lubricants Market Segmentation:

Middle East and Africa Industrial Lubricants Market Segmentation: By Type:

- Engine Oils

- Hydraulic Fluids

- Gear Oils

- Greases

- Specialty Lubricants

Engine oils reign supreme in the MEA industrial lubricants market, holding the largest share. This dominance stems from the extensive use of internal combustion engines in various industrial applications. From powering generators and heavy-duty construction vehicles to operating drilling rigs and industrial pumps, engine oils are vital for ensuring smooth operation, minimizing wear and tear, and extending equipment lifespan. The demand for engine oils is further fuelled by the growing adoption of diesel generators for backup power in regions with unreliable electricity grids.

Specialty lubricants, while currently occupying a smaller market share (estimated 10-15%), are witnessing the fastest growth rate within the MEA industrial lubricants market. The MEA region is experiencing a diversification of its industrial base beyond oil and gas. This expansion into sectors like food processing, pharmaceuticals, and renewable energy creates a demand for specialized lubricants formulated for specific machinery and processes. Industrial sectors are increasingly prioritizing operational efficiency and environmental sustainability. Specialty lubricants like high-performance greases for extended relubrication intervals or biodegradable lubricants for environmentally sensitive applications cater to these evolving needs.

Middle East and Africa Industrial Lubricants Market Segmentation: By End Use:

- Oil & Gas

- Construction

- Manufacturing

- Power Generation

- Mining & Metals

The oil and gas industry remains the dominant end-user of industrial lubricants in the MEA region. Drilling rigs utilize a range of lubricants for drill bits, mud pumps, and other critical equipment. These lubricants need to withstand extreme pressure, high temperatures, and harsh environments. Exploration vehicles, pipelines, and production facilities require lubricants for smooth operation and protection against corrosion. The MEA region possesses vast oil and gas reserves, necessitating a large network of drilling rigs, pipelines, and refineries. This extensive infrastructure requires ongoing lubrication for efficient operation and equipment longevity.

The manufacturing sector in the MEA region is experiencing significant growth. The region is moving towards a more diversified industrial base, with sectors like pharmaceuticals, food processing, and automotive manufacturing gaining traction. Each of these sectors has unique lubrication needs. The adoption of advanced manufacturing technologies often necessitates lubricants with specialized properties, such as high resistance to wear and tear or compatibility with specific materials. A growing middle class within the MEA region is leading to increased domestic demand for manufactured goods. This fuels expansion within the manufacturing sector, consequently boosting demand for industrial lubricants.

Middle East and Africa Industrial Lubricants Market Segmentation: Regional Analysis:

- United Arab Emirates

- Saudi Arabia

- Qatar

- Israel

- South Africa

- Nigeria

- Kenya

- Egypt

- Rest of MEA

With a startling 25% market share in 2023, Saudi Arabia emerged as the leading nation in the Middle East and Africa Industrial Lubricants Market. Saudi Arabia is a major player in the energy sector globally, with a strong oil and gas industry. Industrial lubricants are needed in large quantities for machinery and equipment in the nation's extensive energy operations, which creates a high demand for these goods. Saudi Arabia has concentrated on increasing its industrial capacity in order to diversify its economy in recent years. The need for industrial lubricants has increased due to the expansion of sectors like automotive, construction, and petrochemicals, further solidifying Saudi Arabia's lead in the industry.

With a predicted 9.3% growth rate, Kenya emerged as the nation with the fastest rate of growth in the Middle East and Africa Industrial Lubricants Market. Kenya's industrial industry has grown significantly, especially in the food and beverage, construction materials, and automotive industries. As a result of this growth, there is now a greater need for industrial lubricants to maintain and operate machinery effectively.

COVID-19 Impact Analysis on the Middle East and Africa Industrial Lubricants Market:

The pandemic triggered a global economic recession, impacting businesses across the MEA region. This resulted in reduced capital expenditure by industrial companies, leading them to postpone or cancel lubricant purchases. Lubricant suppliers prioritized fulfilling the needs of essential industries, such as healthcare, food and beverage production, and power generation, which continued operations throughout the pandemic. Lubricant companies embraced digital technologies for remote customer interaction. Online platforms facilitated communication with customers regarding lubricant selection, application guidance, and even remote monitoring of equipment health through sensor-enabled lubricants. With tighter budgets, industrial companies sought cost-effective lubricant solutions. This led to a rise in demand for extended drain interval lubricants, which minimize the frequency of oil changes and generate cost savings in the long run. With the easing of restrictions and reopening of economies, industrial activity in the MEA region is gradually picking up. This translates to a renewed demand for industrial lubricants across various sectors.

Latest Trends/ Developments:

Sustainability is a growing priority for governments and industries alike. This has led to a surge in demand for bio-based lubricants formulated from renewable resources like vegetable oils or animal fats. These lubricants offer a biodegradable alternative to traditional mineral oil-based lubricants, minimizing environmental impact during their lifecycle. Advancements in bio-based lubricant formulations are addressing concerns about their performance compared to traditional lubricants. New bio-based lubricants are achieving performance levels that meet or exceed the requirements of various industrial applications. The development of synthetic lubricants with superior oxidation resistance, thermal stability, and wear protection capabilities is enabling extended drain intervals. Additionally, sensor-enabled lubricants are being introduced, which can monitor lubricant health and oil condition, allowing for informed decisions on oil changes. The adoption of EDI lubricants necessitates a shift from traditional time-based maintenance schedules to a condition-based approach. This involves monitoring lubricant health and equipment performance to determine optimal oil change intervals.

Key Players:

- ExxonMobil Corporation

- Royal Dutch Shell plc

- BP plc

- Chevron Corporation

- Total Energies SE

- ENOC Group

- Gulf Oil Middle East Ltd

- Qalaa Holdings (ASCOM)

- ORYX Energie

Chapter 1. Middle East and Africa Industrial Lubricants Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Middle East and Africa Industrial Lubricants Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Middle East and Africa Industrial Lubricants Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Middle East and Africa Industrial Lubricants Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Middle East and Africa Industrial Lubricants Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Middle East and Africa Industrial Lubricants Market– By Type

6.1. Introduction/Key Findings

6.2. Hydraulic Fluids

6.3. Gear Oils

6.4. Greases

6.5. Specialty Lubricants

6.6. Y-O-Y Growth trend Analysis By Type

6.7. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Middle East and Africa Industrial Lubricants Market– By End Use

7.1. Introduction/Key Findings

7.2. Oil & Gas

7.3. Construction

7.4. Manufacturing

7.5. Power Generation

7.6. Mining & Metals

7.7. Y-O-Y Growth trend Analysis By End Use

7.8. Absolute $ Opportunity Analysis By End Use, 2024-2030

Chapter 8. Middle East and Africa Industrial Lubricants Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Middle East & Africa

8.1.1. By Country

8.1.1.1. United Arab Emirates (UAE)

8.1.1.2. Saudi Arabia

8.1.1.3. Qatar

8.1.1.4. Israel

8.1.1.5. South Africa

8.1.1.6. Nigeria

8.1.1.7. Kenya

8.1.1.8. Egypt

8.1.1.9. Rest of MEA

8.1.2. By Type

8.1.3. By End Use

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Middle East and Africa Industrial Lubricants Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 ExxonMobil Corporation

9.2. Royal Dutch Shell plc

9.3. BP plc

9.4. Chevron Corporation

9.5. Total Energies SE

9.6. ENOC Group

9.7. Gulf Oil Middle East Ltd

9.8. Qalaa Holdings (ASCOM)

9.9. ORYX Energies

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

Many MEA governments are investing heavily in infrastructure development projects, including roads, bridges, power plants, and renewable energy facilities. This translates to increased demand for lubricants used in construction machinery, equipment, and power generation

The production of lubricants relies on base oils and additives, the prices of which can fluctuate significantly based on global crude oil prices and supply chain disruptions. This volatility can squeeze profit margins for lubricant manufacturers and impact product affordability for end-users.

ExxonMobil Corporation, Royal Dutch Shell plc, BP plc, Chevron

Corporation, Total Energies SE, ENOC Group, Gulf Oil Middle East Ltd.

With a startling 25% market share in 2023, Saudi Arabia emerged as the leading nation in the Middle East and Africa Industrial Lubricants Market.

With a predicted 9.3% growth rate, Kenya emerged as the nation with the fastest rate of growth in the Middle East and Africa Industrial Lubricants Market