Middle East and Africa Frozen Seafood Market Size (2024-2030)

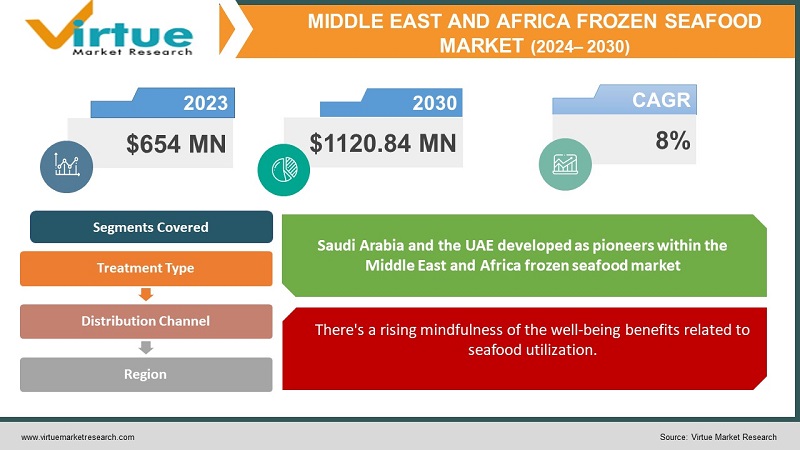

The Middle East and Africa Frozen Seafood Market was valued at USD 654 million and is projected to reach a market size of USD 1120.84 million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 8%.

The Middle East and Africa Frozen Seafood Market is characterized by its burgeoning development, driven by rising customer requests for helpful and nutritious nourishment alternatives. This advertisement includes a wide cluster of fish items, counting angle, shrimp, squid, and other marine luxuries, protected through solidifying to preserve freshness and expand rack life. A noteworthy calculate moving the showcase forward is the expanding urbanization and active ways of life of customers who lean toward ready-to-cook and ready-to-eat suppers. Furthermore, the showcase benefits from headways in solidifying advances and coordinations, guaranteeing the conveyance of high-quality items. The developing mindfulness of the well-being benefits related to fish utilization, such as tall protein substance and basic omega-3 greasy acids, encourage boosts showcase request. Different nations inside the locale, eminently the Joined together Middle Eastern Emirates and Saudi Arabia, have seen a surge in fish utilization due to their differing ostracized populaces and the impact of Western dietary propensities. The advertisement moreover picks up footing from the vigorous dispersion systems, counting general stores, hypermarkets, and online retail stages, which give simple get to an assortment of frozen seafood items. Besides, the Center East and Africa's vital area, with nearness to major fish trading nations, improve the accessibility and assortment of items. In spite of challenges such as fluctuating fish costs and rigid administrative benchmarks, the advertising proceeds to flourish. The accentuation on economical angling hones and certifications includes the market's request, pulling in naturally cognizant shoppers. As a result, the Middle East and Africa Frozen Seafood Market is balanced for sustained development, reflecting the energetic transaction of customer inclinations, mechanical progressions, and key showcase situating.

Key Market Insights:

Consumers are increasingly demanding sustainably sourced frozen seafood. There is a rising demand for convenient and ready-to-cook frozen seafood products.

Blockchain technology is being utilized to ensure transparency and traceability in the seafood supply chain.

The per capita consumption of seafood in the region is expected to rise from 8.5 kg in 2023 to 10.2 kg by 2027.

The UAE is experiencing rapid growth in the frozen seafood market due to its affluent population and increasing demand for high-quality seafood products. Saudi Arabia is another fast-growing market, driven by increasing urbanization, rising disposable incomes, and a growing preference for Western dietary habits, including seafood consumption.

Shrimp accounts for approximately 35% of the total frozen seafood market in the region, followed by tuna at 25% and salmon at 20%.

The average price of frozen shrimp in the region is approximately $8 per kilogram, while frozen salmon and tuna are priced at around $10 and $12 per kilogram, respectively.

Middle East and Africa Frozen Seafood Market Drivers:

Urbanization is changing the Middle East and Africa, essentially affecting dietary habits and food utilization designs.

With more individuals moving to urban regions, there's an expanded request for helpful and quick-to-prepare nourishment alternatives. Frozen seafood fits this requirement flawlessly. Urban inhabitants regularly have active plans, making them appreciate the ease of planning frozen seafood, which needs negligible planning compared to new fish. This move in way of life has brought about a developing preference for frozen seafood, because it offers a fast, nutritious, and delicious feast choice. The comfort calculation may be a significant driver, making frozen seafood a prevalent choice among the urban populace.

There's a rising mindfulness of the well-being benefits related to seafood utilization.

Fish and other seafood are great sources of high-quality protein, omega-3 greasy acids, and basic vitamins and minerals. These supplements are known to back heart well-being, brain work, and in general well-being. Within the Center East and Africa, this developing mindfulness has driven an increment in fish utilization. Be that as it may, the accessibility of new seafood can be restricted due to geological limitations and supply chain issues. Frozen seafood provides a reasonable arrangement, guaranteeing that individuals have access to nutritious fish items in any case of their area. The capacity to protect dietary esteem through freezing innovation makes frozen seafood an appealing alternative for health-conscious buyers.

The development and expansion of cold chain infrastructure across the Middle East and Africa have played a pivotal role in boosting the frozen seafood market.

Cold chain logistics, which include refrigerated transportation and storage, are essential for maintaining the quality and safety of frozen products. In recent years, significant investments have been made to enhance cold chain capabilities in the region. This improvement ensures that frozen seafood can be transported over long distances without compromising its quality, making it accessible to a wider population. The advancement in cold chain technology has also enabled the introduction of a broader variety of frozen seafood products, catering to diverse tastes and preferences. This expansion is a major driver, allowing frozen seafood companies to reach new markets and meet the growing demand efficiently.

Middle East and Africa Frozen Seafood Market Challenges:

The frozen seafood market within the Middle East and Africa is highly competitive, with various neighborhood and universal players competing for market share.

This strong competition applies descending weight on costs, making it challenging for businesses to preserve benefits. Nearby makers regularly confront firm competition from imported fish items, which are now and then seen to be of higher quality or more dependable due to better-established supply chains in trading nations. Cost affectability among buyers in these districts too poses a critical challenge. Numerous customers have restricted expendable wages and are profoundly price-conscious, prioritizing taking a toll over quality. This cost affectability strengthens providers to keep their costs moo, frequently at the cost of benefit edges. In addition, the vacillation in trade rates and the effect of taxes on imported products can cause extra volatility in estimating, making it troublesome for businesses to preserve steady estimating procedures.

The market is additionally influenced by the regular nature of seafood supply, which can lead to cost instability. Amid off-seasons, the supply of certain fish assortments may decrease, driving up costs and making it troublesome for retailers to offer a steady extent of items at steady costs. This irregularity can disappoint shoppers and influence their decisions.

The Middle East and Africa frozen seafood markets face significant hurdles due to underdeveloped infrastructure and logistical inefficiencies.

Many regions within these areas lack the necessary cold chain infrastructure to support the frozen seafood industry effectively. This deficiency poses a considerable challenge as maintaining a continuous and efficient cold chain is critical to preserving the quality and safety of frozen seafood products.

In various parts of Africa and the Middle East, the absence of a reliable power supply further complicates the situation. Frequent power outages can disrupt the cold chain, leading to spoilage and significant financial losses for suppliers and retailers. Moreover, the lack of adequate transportation facilities, such as refrigerated trucks and storage facilities, exacerbates these challenges. Poor road networks in remote areas make it difficult to transport frozen seafood efficiently from ports to inland markets, causing delays and increasing the risk of product spoilage.

Middle East and Africa Frozen Seafood Market Opportunities:

The Middle East and Africa frozen seafood market presents a substantial opportunity in the rise of consumer preference for convenient and nutritious food options.

As urbanization accelerates and lifestyles become more hectic, there's a growing demand for quick, healthy meals that fit into busy schedules. Frozen seafood, with its long shelf life and preserved nutritional value, aligns perfectly with this trend. This shift is particularly evident among the younger population, who are more health-conscious and open to trying diverse cuisines. The increasing awareness of the health benefits associated with seafood consumption, such as high protein and omega-3 fatty acids, further bolster this market. This opportunity is ripe for companies that can effectively market their products as both a convenient and a healthy choice, tapping into the changing dietary habits and preferences in the region.

MIDDLE EAST AND AFRICA FROZEN SEAFOOD MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8% |

|

Segments Covered |

By treatment Type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Kingdom of Saudi Arabia, UAE, Israel, Rest of GCC countries, South Africa, Ethiopia, Kenya, Egypt, Sudan, Rest of MEA |

|

Key Companies Profiled |

Arabian Fisheries Company, Gulfstream Group, Fish Farm LLC, Omarsa, Nissui, AKROPOLIS, Reykjavik Seafood, Les Pêcheries Marinard Inc., Gadre Marine Export Pvt. Ltd., Tokyo Maruha Nichiro Corporation, Norebo Group, Pescanova, High Liner Foods, Marine Harvest ASA, Clearwater Seafoods LP. |

Middle East and Africa Frozen Seafood Market Segmentation:

Middle East and Africa Frozen Seafood Market Segmentation: By Treatment Type:

- Fish

- Shellfish

- Mollusks

- Others

The highest and fastest-growing segment within the Middle East and Africa Frozen Seafood Market is fish. Known for its flexibility and wholesome benefits, angle assortments such as fish, salmon, and cod overwhelm the advertising share due to their ubiquity among shoppers looking for solid dietary choices. Taking after closely behind, the shellfish fragment, which incorporates shrimp, crab, and lobster, is encountering quick development. These shellfish assortments are prized for their juicy flavors and are frequently included noticeably in gourmet cuisines over the locale. In spite of smaller offers, the mollusk fragment, comprising squid, octopus, and clams, is relentlessly picking up footing. These fish alternatives offer to courageous eaters and are indispensable to both conventional dishes and modern culinary developments. The market's differing extend of solidified fish items, counting strength things like ocean urchins and scallops, caters to specialty inclinations and underscores the region's extending craving for high-quality, helpful fish arrangements.

Middle East and Africa Frozen Seafood Market Segmentation: By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

The highest and fastest growing segment in the Middle East and Africa's frozen seafood market is dominated by supermarkets and hypermarkets. These retail giants boast the largest market share, leveraging their extensive networks and consumer trust to offer a wide variety of frozen seafood products conveniently under one roof. Meanwhile, convenience stores are rapidly expanding their footprint, driven by urbanization and evolving consumer lifestyles that favor quick, accessible shopping options. Specialty stores, though catering to a niche market, play a crucial role by offering premium and specialized seafood selections that appeal to discerning consumers seeking quality and unique culinary experiences. Additionally, the online retail sector is burgeoning, fueled by increasing internet penetration and the growing preference for hassle-free shopping experiences, allowing consumers to browse and purchase frozen seafood from the comfort of their homes. This diverse distribution landscape underscores the market's adaptability to consumer needs and preferences across different retail channels in the region.

Middle East and Africa Frozen Seafood Market Segmentation: Regional Analysis:

- United Arab Emirates

- Saudi Arabia

- Qatar

- Israel

- South Africa

- Nigeria

- Kenya

- Egypt

- Rest of MEA

Among the nations analyzed, Saudi Arabia and the UAE developed as pioneers within the Middle East and Africa frozen seafood market, gloating the most elevated market offers. In these nations, well-off populaces and a solid culinary convention centered around fish drive vigorous requests for frozen items such as shrimp, fish filets, and squid. On the other hand, Qatar and Kenya speak to the fastest-growing portions inside the locale. Qatar benefits from a developing ostracized community and a burgeoning seafood eatery scene, whereas Kenya's advertising extension is fueled by expanding urbanization and a rising inclination for helpful, nutritious supper alternatives. Over the board, from South Africa's differing fish offerings to Egypt's extending showcase driven by rising expendable salaries, the MEA frozen seafood market reflects an energetic scene balanced for advanced development and advancement.

COVID-19 Impact Analysis on the Global Middle East and Africa Frozen Seafood Market:

The COVID-19 pandemic altogether affected the Middle East and Africa (MEA) frozen seafood market, reshaping utilization designs and supply elements over the locale. As lockdowns and confinements disturbed worldwide supply chains, the MEA region confronted challenges in sourcing and disseminating solidified fish items. Request variances were articulated, with starting freeze buying taken after by shifts towards more home-cooked suppers as eateries and neighborliness divisions experienced closures or decreased operations. Buyer inclinations moved towards frozen seafood due to its longer rack life and security compared to new choices. Additionally, calculated obstacles and transportation disturbances prevented the convenient conveyance of fish imports, influencing stock levels and estimating elements. The government's measures to contain the infection, counting border closures and exchange limitations, advance compounded supply chain issues. In any case, in the midst of these challenges, the showcase saw developments in online retail and direct-to-consumer models, as companies adjusted to meet advancing customer needs and inclinations. Looking forward, recuperation within the MEA frozen seafood market is expected as immunization endeavors advance and financial exercises continuously continue, yet with progressing watchfulness with respect to supply chain flexibility and shopper behavior adjustment in a post-pandemic period.

Latest Trends/ Developments:

In recent years, the Middle East and Africa (MEA) frozen seafood market has seen energetic shifts and outstanding patterns, reflecting advancing buyer inclinations and advertising elements. One unmistakable slant is the expanding request for comfort nourishments among urban populaces over the locale. Frozen seafood offers comfort, longer rack life, and ease of planning, catering to active ways of life and rising expendable earnings. Additionally, there's a developing mindfulness of the dietary benefits of seafood, driving health-conscious consumers to want solidified fish as a dependable source of protein and fundamental supplements. Another noteworthy slant is the extension of retail channels and online stages, which have upgraded the openness and accessibility of frozen seafood items, indeed in inaccessible zones. This extension is supported by headways in cold chain coordination and capacity innovations, guaranteeing item quality and security all through the supply chain. Moreover, maintainability and moral sourcing hones are picking up footing, provoking advertise players to embrace responsible fishing and aquaculture hones. This move isn't as it was driven by administrative weights but moreover by customer requests for naturally neighborly items. Looking ahead, advancements in item enhancement and bundling designs are expected to encourage impel showcase development, as producers endeavor to meet assorted shopper inclinations and upgrade item offers. In general, the MEA frozen seafood market is balanced for proceeded extension, driven by these transformative patterns that are reshaping the industry scene and making modern openings for partners over the esteem chain.

Key Players:

- Arabian Fisheries Company

- Gulfstream Group

- Fish Farm LLC

- Omarsa

- Nissui

- AKROPOLIS

- Reykjavik Seafood

- Les Pêcheries Marinard Inc.

- Gadre Marine Export Pvt. Ltd.

- Tokyo Maruha Nichiro Corporation

- Norebo Group

- Pescanova

- High Liner Foods

- Marine Harvest ASA

- Clearwater Seafoods LP

Chapter 1. Middle East and Africa Frozen Seafood Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Middle East and Africa Frozen Seafood Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis Chapter 3. Middle East and Africa Frozen Seafood Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Middle East and Africa Frozen Seafood Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Middle East and Africa Frozen Seafood Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Middle East and Africa Frozen Seafood Market– By Treatment Type

6.1. Introduction/Key Findings

6.2. Fish

6.3. Shellfish

6.4. Mollusks

6.5. Others

6.6. Y-O-Y Growth trend Analysis By Treatment Type

6.7. Absolute $ Opportunity Analysis By Treatment Type , 2024-2030

Chapter 7. Middle East and Africa Frozen Seafood Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2. Supermarkets & Hypermarkets

7.3. Convenience Stores

7.4. Specialty Stores

7.5. Online Retail

7.6. Y-O-Y Growth trend Analysis By Distribution Channel

7.7. Absolute $ Opportunity Analysis By Distribution Channel , 2024-2030

Chapter 8. Middle East and Africa Frozen Seafood Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Middle East & Africa

8.1.1. By Country

8.1.1.1. United Arab Emirates (UAE)

8.1.1.2. Saudi Arabia

8.1.1.3. Qatar

8.1.1.4. Israel

8.1.1.5. South Africa

8.1.1.6. Nigeria

8.1.1.7. Kenya

8.1.1.8. Egypt

8.1.1.9. Rest of MEA

8.1.2. By Treatment Type

8.1.3. By Distribution Channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Middle East and Africa Frozen Seafood Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Arabian Fisheries Company

9.2.Gulfstream Group

9.3. Fish Farm LLC

9.4. Omarsa

9.5. Nissui

9.6. AKROPOLIS

9.7. Reykjavik Seafood

9.8. Les Pêcheries Marinard Inc.

9.9. Gadre Marine Export Pvt. Ltd.

9.10. Tokyo Maruha Nichiro Corporation

9.11. Norebo Group

9.12. Pescanova

9.13. High Liner Foods

9.14. Marine Harvest ASA

9.15. AClearwater Seafoods LP

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The Middle East and Africa Frozen Seafood Market was valued at USD 654 million and is projected to reach a market size of USD 1120.84 million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of C%.

The Segments under the Middle East and Africa Frozen Seafood Market by type are Fish, Shellfish, Mollusks, and Others.

Some of the top industry players in the Middle East and Africa Frozen Seafood Market are Arabian Fisheries Company, Gulfstream Group, Fish Farm LLC, Omarsa, Nissui, AKROPOLIS, Reykjavik Seafood, Les Pêcheries Marinard Inc., Gadre Marine Export Pvt. Ltd., Tokyo Maruha Nichiro Corporation, Norebo Group, Pescanova, High Liner Foods, Marine Harvest ASA, Clearwater Seafoods LP.

The Middle East and Africa Frozen Seafood Market is segmented based on type, distribution channel, and region.

The supermarkets and hypermarkets sector is the most common distribution channel of the Middle East and Africa Frozen Seafood Market.