Middle East and Africa Frozen Dough Market Size (2024-2030)

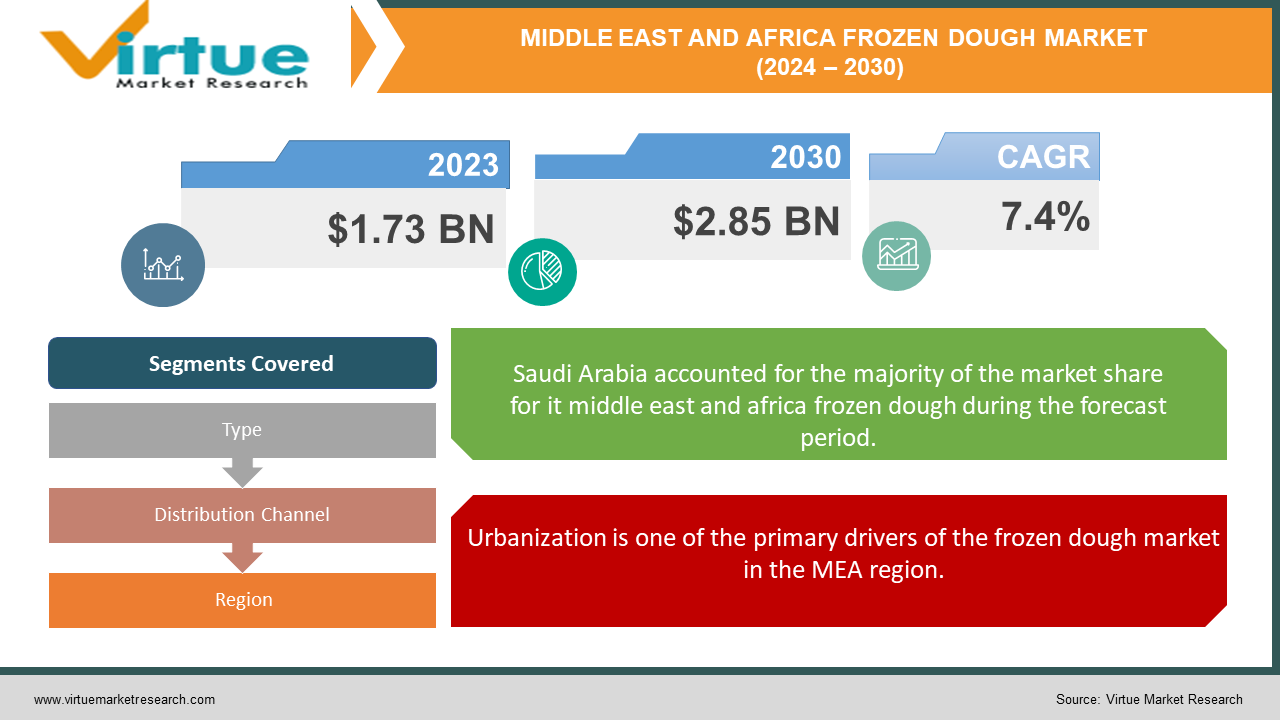

The Middle East and Africa Frozen Dough Market was valued at USD 1.73 Billion in 2023 and is projected to reach a market size of USD 2.85 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.4%.

The Middle East and Africa's frozen dough industry has expanded dramatically in recent years because of changing customer preferences, advancements in food technology, and a growing inclination toward convenience meals. Bread, pastries, and pizza bases are examples of products manufactured with frozen dough that offer the advantages of longer shelf life and convenience without compromising taste or quality. Since making frozen dough requires less time and effort than making fresh dough, many customers have discovered that using it for at-home baking is enjoyable and practical. Technological developments in freezing have resulted in notable improvements to the quality and longevity of frozen dough products. With the use of contemporary freezing technology, the dough is preserved with almost the same texture, flavours, and nutritional content as fresh dough. Particularly significant innovations include cryogenic freezing, which minimizes the production of huge ice crystals that might harm the dough's cellular structure and allows for quick freezing.

Key Market Insights:

The bread dough segment holds a 40% share of the total market. Pastry dough accounts for 25% of the market share.

Pizza dough is the fastest-growing segment, with an anticipated CAGR of 8% from 2024 to 2030.

Supermarkets and hypermarkets contribute 55% to the total distribution of frozen dough products.

Cryogenic freezing technology adoption in the industry has increased by 15% over the past five years.

The price of frozen dough products ranges from $2 to $10 per unit, depending on the type and quantity.

The MEA region imports 30% of its frozen dough products from Europe. Local manufacturers hold a 60% share of the market.

Annual per capita consumption of frozen dough products is approximately 1.5 kg.

Investments in cold chain infrastructure in the MEA region have increased by 20% in the last three years.

The MEA region's frozen dough market is supported by over 100 major manufacturers and suppliers.

The number of new product launches in the frozen dough market increased by 12% in 2023.

Middle East and Africa Frozen Dough Market Drivers:

Urbanization is one of the primary drivers of the frozen dough market in the MEA region.

The fast pace of urbanization has caused a major shift in consumer lives. Convenient meal alternatives that fit into hectic schedules are in higher demand as more people move to metropolitan regions. Products made from frozen dough are becoming more and more popular among city people since they need less preparation time. Convenience food consumption has been further boosted by the growth of working professionals and nuclear families. Due to time constraints, consumers in metropolitan areas tend to favour quick and simple meal alternatives. Products created using frozen dough, such ready-to-bake bread and pastries, provide the ideal answer since they spare customers the trouble of making dough from scratch and let them enjoy fresh, handmade cuisine.

Technological advancements in freezing techniques have played a significant role in the growth of the frozen dough market.

Modern freezing techniques, such as cryogenic freezing, have completely changed how frozen dough is made and kept cold. By using these methods, the dough is kept consistent with its fresh preparation in terms of quality, texture, and flavor. Particularly, cryogenic freezing has had a significant effect on the market. By quickly freezing the dough at extremely low temperatures, this approach reduces the possibility of big ice crystals forming and potentially damaging the dough's cellular structure. Consequently, the dough keeps its natural flavor and texture, giving customers high-quality goods. Furthermore, the market's expansion has been aided by developments in packaging technology. Innovative packaging techniques that preserve the freshness and quality of frozen dough products include vacuum-sealed and individually portioned packets.

Middle East and Africa Frozen Dough Market Restraints and Challenges:

The high cost of storage and shipping is one of the major obstacles facing the frozen dough industry in the MEA region. For frozen dough products to retain their quality and shelf life, certain storage facilities and transportation techniques are needed. To keep these goods fresh until they are used, they must be kept in storage at a certain temperature to avoid spoiling. Another major obstacle facing the frozen dough business is the increased emphasis on sustainability and environmental concerns. There is a significant energy consumption and carbon emission involved in the manufacturing, storing, and shipping of frozen dough goods. Manufacturers are under growing pressure to implement sustainable practices and lessen their carbon impact as customers grow more ecologically aware.

Middle East and Africa Frozen Dough Market Opportunities:

Food products that are both handy and of good quality are becoming more and more in demand as the middle class expands in these growing economies. This demand is excellently satisfied by frozen dough, which gives customers the convenience of ready-to-bake pastries, bread, and pizza bases. By increasing their presence in these regions and customizing their products to suit regional tastes and preferences, manufacturers may take advantage of this opportunity. The frozen dough industry has a large window of opportunity for expansion due to innovation in product offerings. Variety and unusual tastes are becoming more and more desirable to consumers. Producing fresh and inventive frozen dough goods allows producers to reach a wider audience and expand their market share. For example, the increased demand for natural and nutrient-dense food alternatives may be met by the development of healthier and organic frozen dough products. Customers are searching for items that fit their dietary preferences as they become more health aware. Products made with whole grains and organic ingredients that don't include artificial additives or preservatives can compete in this market.

MIDDLE EAST AND AFRICA FROZEN DOUGH MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.4% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Saudi Arabia, Qatar, UAE, Israel, South Africa, Nigeria, Kenya, Egypt, Rest of the Middle East |

|

Key Companies Profiled |

General Mills (US), Nestlé (Switzerland), Bimbo Group (Mexico), PepsiCo (US), Saudi Arabian Food Products, Company (Savola Group) (Saudi Arabia), Dubai Mills (UAE), Agronomics Limited (South Africa), Orascom Construction Industries (OCI) (Egypt), National Food Industries (NFI) (Egypt), Premier Foods (South Africa), Bakewell (South Africa), Blandi (Morocco), Modern Bakery (Egypt), AAA Manufacturing LLC (UAE). |

Middle East and Africa Frozen Dough Market Segmentation:

Middle East and Africa Frozen Dough Market Segmentation: By Types:

- Bread Dough

- Pastry Dough

- Pizza Dough

- Others

Bread dough is one of the most well-known segments in the frozen dough industry. Fresh bread is becoming more and more in demand as people look for healthier and more natural food options. Frozen bread dough makes it simple to bake fresh bread at home without requiring a lot of preparation. Given how common bread consumption is in the MEA region, it is expected that this category would continue to lead.

In the frozen dough industry, the pizza dough category is expanding at the quickest rate. The demand for frozen pizza dough has been fuelled by the popularity of pizza as a quick and simple supper alternative. Customers may personalize their pizzas with the toppings of their choice, and making pizza at home is made easy with frozen pizza dough. The MEA region's rapid expansion of pizzerias and fast-food restaurants has also increased demand for pizza dough.

Middle East and Africa Frozen Dough Market Segmentation: By Distribution Channel:

- Supermarkets and Hypermarkets

- Online Retail

- Direct Sales

- Wholesale and Distributors

The leading distribution channels for frozen dough products are supermarkets and hypermarkets, which cater to a broad spectrum of consumer preferences. These retail formats offer an extensive selection of frozen dough alternatives, including various brands and product types, to meet the diverse tastes of customers. Supermarkets and hypermarkets are favoured for frozen dough purchases due to the convenience of one-stop shopping and the wide availability of options, making it easier for consumers to find their preferred products.

Online division channels have discerned a sharp boost in the trade of frozen dough particulars. E-commerce has fully changed the expressway people buy food products because of its release of use. Online coffers give guests the capability to make well-grassed selections by furnishing a substance of product information, stoner reviews, and competitive freight. The excrescency of online grocery quittance services has also swelled client luxury and driving the demand for frozen dough particulars through online channels.

Middle East and Africa Frozen Dough Market Segmentation: Regional Analysis:

- United Arab Emirates (UAE)

- Saudi Arabia

- Qatar

- Israel

- South Africa

- Nigeria

- Kenya

- Egypt

- Rest of MEA

With an astonishing 21.3% share, Saudi Arabia has emerged as the main player in the MEA frozen dough industry. Recent years have seen a major increase in urbanization in Saudi Arabia, which has altered consumer food and lifestyle choices. The need for quick and easy meal alternatives, such as frozen dough goods that are ready to bake, has surged due to the fast-paced lifestyle of cities. The kingdom's thriving food service sector, which includes bakeries, cafés, and restaurants, has been a significant factor in the frozen dough business. These businesses frequently rely on frozen dough products to minimize preparation time and guarantee consistency in quality.

Kenya is the MEA's fastest-growing nation, while having a very small 4.2% market share for frozen dough at the moment. Kenya's middle class is expanding, and the country is rapidly becoming more urbanized, which is changing consumer tastes in food and leisure. There is now a desire for quick meal choices, such as frozen dough items, due to this shift in demographics. Modern retail forms like supermarkets and convenience stores are expanding, causing a dramatic upheaval in Kenya's retail industry. These establishments are reaching a larger audience of customers with frozen dough goods.

COVID-19 Impact Analysis on the Middle East and Africa Frozen Dough Market:

In major cities across the MEA region, a growing urban population with increasingly busy schedules fueled the demand for convenient food solutions. Frozen dough offered a time-saving alternative to traditional bread and pastry making, appealing to working professionals and families seeking quick and easy meal options. Consumers were increasingly drawn to convenient yet flavourful food options. Frozen dough manufacturers responded by offering innovative product lines with various fillings, flavors, and ethnic inspirations, catering to diverse palates. Lockdowns and restrictions on movement hampered the smooth flow of raw materials and finished products. Flour, sugar, and other essential ingredients faced shortages, impacting production capacity and product availability. The initial phase of the pandemic witnessed panic buying and stockpiling of essential goods, including staples like flour and yeast. This temporarily diverted consumer attention away from frozen dough products, impacting sales. Social distancing measures and lockdown restrictions disrupted production lines due to labor shortages. This resulted in reduced production capacity and potential product shortages on store shelves. With lockdowns and restrictions on movement, people spent more time at home, leading to a surge in home baking activities. Frozen dough offered a convenient and reliable base for baking bread, pastries, and pizzas, leading to increased demand from home cooks.

Latest Trends/ Developments:

These pre-prepared doughs require minimal preparation, often just thawing and shaping before baking. This caters to busy lifestyles and offers a more convenient alternative to traditional bread-making from scratch. Popular options include pizza doughs, bread doughs, and even pastry doughs like croissants and puff pastry. Traditional flatbreads like pita bread, naan, and roti are finding their way into the frozen dough market, catering to local preferences and simplifying the preparation of these staple foods. From flaky samosas filled with spiced vegetables to decadent baklava pastries, frozen dough manufacturers are introducing a wider selection of sweet and savory regional specialties, allowing consumers to experience diverse flavors without the hassle of elaborate preparation. Offering increased fiber content and a more wholesome profile, whole-wheat and multigrain dough options cater to consumers seeking healthier alternatives to traditional white flour doughs. Doughs enriched with additional vitamins, minerals, or protein are emerging to address specific dietary needs and cater to health-conscious consumers. This could include doughs fortified with calcium for stronger bones or iron for improved energy levels. The growing demand for gluten-free products is extending to the frozen dough market. Gluten-free pizza doughs, bread doughs, and even pastry options are becoming available, providing those with celiac disease or gluten sensitivity with convenient baking solutions.

Key Players:

- General Mills (US)

- Nestlé (Switzerland)

- Bimbo Group (Mexico)

- PepsiCo (US)

- Saudi Arabian Food Products Company (Savola Group) (Saudi Arabia)

- Dubai Mills (UAE)

- Agronomics Limited (South Africa)

- Orascom Construction Industries (OCI) (Egypt)

- National Food Industries (NFI) (Egypt)

- Premier Foods (South Africa)

- Bakewell (South Africa)

- Blandi (Morocco)

- Modern Bakery (Egypt)

- AAA Manufacturing LLC (UAE)

Chapter 1. Middle East and Africa Frozen Dough Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Middle East and Africa Frozen Dough Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Middle East and Africa Frozen Dough Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Middle East and Africa Frozen Dough Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Middle East and Africa Frozen Dough Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Middle East and Africa Frozen Dough Market– By Type

6.1. Introduction/Key Findings

6.2. Bread Dough

6.3. Pastry Dough

6.4. Pizza Dough

6.5. Others

6.6. Y-O-Y Growth trend Analysis By Type

6.7. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Middle East and Africa Frozen Dough Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2. Supermarkets, hypermarkets and Retail stores

7.3. Online Retail

7.4. Direct Sales

7.5. Wholesale and Distributors

7.6. Y-O-Y Growth trend Analysis By Distribution Channel

7.7. Absolute $ Opportunity Analysis By Distribution Channel , 2024-2030

Chapter 8. Middle East and Africa Frozen Dough Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Middle East & Africa

8.1.1. By Country

8.1.1.1. United Arab Emirates (UAE)

8.1.1.2. Saudi Arabia

8.1.1.3. Qatar

8.1.1.4. Israel

8.1.1.5. South Africa

8.1.1.6. Nigeria

8.1.1.7. Kenya

8.1.1.8. Egypt

8.1.1.9. Rest of MEA

8.1.2. By Type

8.1.3. By Distribution Channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Middle East and Africa Frozen Dough Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 General Mills (US)

9.2. Nestlé (Switzerland)

9.3. Bimbo Group (Mexico)

9.4. PepsiCo (US)

9.5. Saudi Arabian Food Products Company (Savola Group) (Saudi Arabia)

9.6. Dubai Mills (UAE)

9.7. Agronomics Limited (South Africa)

9.8. Orascom Construction Industries (OCI) (Egypt)

9.9. National Food Industries (NFI) (Egypt)

9.10. Premier Foods (South Africa)

9.11. Bakewell (South Africa)

9.12. Blandi (Morocco)

9.13. Modern Bakery (Egypt)

9.14. AAA Manufacturing LLC (UAE)

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

A growing middle class with rising disposable incomes is creating a demand for convenient and time-saving food options. Frozen dough fits perfectly into this category, offering a delicious and hassle-free alternative to traditional bread making from scratch.

The MEA region experiences significant income disparity. While frozen dough caters to a growing middle class, affordability remains a concern for low-income consumers. Balancing convenience with competitive pricing will be crucial for wider market penetration

General Mills (US), Nestlé (Switzerland), Bimbo Group (Mexico), PepsiCo (US), Saudi Arabian Food Products, Company (Savola Group) (Saudi Arabia), Dubai Mills (UAE), Agronomics Limited (South Africa), Orascom Construction Industries (OCI) (Egypt), National Food Industries (NFI) (Egypt), Premier Foods (South Africa), Bakewell (South Africa), Blandi (Morocco), Modern Bakery (Egypt), AAA Manufacturing LLC (UAE).

The market is dominated by Saudi Arabia, which commands a market share of around 21.3%.

With a market share of about 4.2%, Kenya is expanding the quickest.