Middle East and Africa Feed Mycotoxin Detoxifiers Market Size (2023-2030)

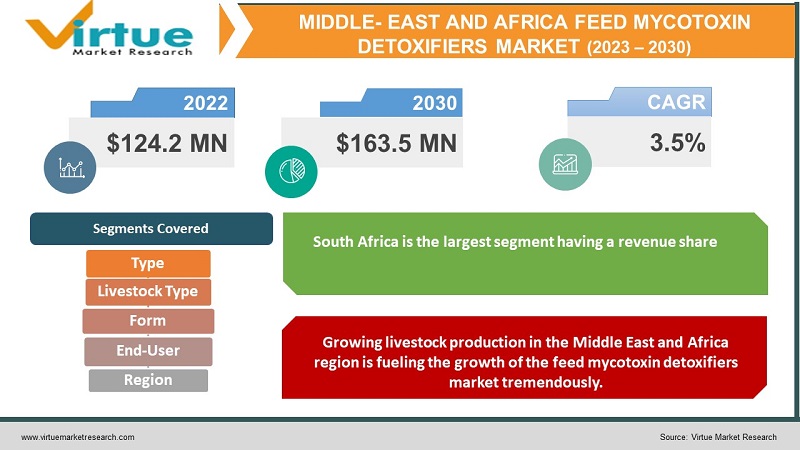

The Middle East and Africa Feed Mycotoxin Detoxifiers Market was valued at USD 124.2 Million and is projected to reach a market size of USD 163.5 Million by the end of 2030. Over the outlook period of 2023-2030, the market is anticipated to grow at a CAGR of 3.5%.

The Middle East and Africa Feed Mycotoxin Detoxifiers Market refers to the industry focused on products designed to counteract the harmful effects of mycotoxins in animal feed. Mycotoxins are toxic compounds produced by molds that can contaminate feed, posing health risks to livestock and affecting animal performance. The market in this region is driven by the growing awareness of mycotoxin-related issues in animal farming and the need to ensure the safety and productivity of livestock. Feed mycotoxin detoxifiers are substances and additives incorporated into animal feed to bind, degrade, or otherwise neutralize mycotoxins. Factors like increasing animal production, expanding agriculture, and a focus on food safety are fueling the demand for these detoxifiers. The market is expected to witness steady growth as the agriculture and animal husbandry sectors continue to evolve in the Middle East and Africa, addressing mycotoxin challenges to enhance animal health and overall productivity.

Key Market Insights:

The Middle East's feed production escalated from 25.5 million tons in 2021 to 31.8 million tons in 2022. Within the Middle East and Africa region, broiler feed emerged as the predominant type of feed produced. The primary segments within the animal nutrition market in this area encompass Broiler, Dairy, and Layer.

Based on data from 2022, the Middle East currently boasts 799 feed mills, marking a slight increase from the previous year's figure of 795. The South African feed market presents a promising opportunity for feed manufacturers due to the rising meat consumption per capita, which consequently boosts the demand for animal products, particularly beef feeds. This demand is enhancing animal productivity and, as a result, contributing to the growth of the livestock production sector. Furthermore, in Middle Eastern countries, the aquaculture feed segment is gaining popularity. Governments in the region are actively working to strengthen trade ties, particularly in meat sales, with other regions. The increasing consumption of seafood, rising per capita income, and the growing seafood trade between countries and regions are major factors propelling the market's expansion.

Middle-East and Africa Feed Mycotoxin Detoxifiers Market Drivers:

Growing livestock production in the Middle East and Africa region is fueling the growth of the feed mycotoxin detoxifiers market tremendously.

The increasing demand for animal-derived products, such as meat, dairy, and eggs, in the Middle East and Africa is driving the growth of livestock production. As the livestock industry expands to meet the rising demand for protein-rich foods, there is a greater need to ensure the health and performance of animals. Mycotoxin contamination in animal feed can lead to reduced feed efficiency, lower growth rates, and various health issues in livestock. Consequently, farmers and producers are increasingly using feed mycotoxin detoxifiers to safeguard animal health and maintain productivity, thereby fueling the market's growth.

Rising concerns for food safety are a long-term driver in increasing the need for feed mycotoxin detoxifiers in the Middle East and Africa.

There is a growing awareness and concern among consumers, regulatory authorities, and the livestock industry about food safety and the quality of animal products. Mycotoxins pose a potential threat to food safety as they can transfer from animal feed to animal products consumed by humans. To address these concerns, there is an increasing emphasis on preventive measures, including the use of mycotoxin detoxifiers in animal feed. This heightened focus on food safety and quality drives the demand for feed mycotoxin detoxifiers, as they help minimize mycotoxin contamination, ensure the safety of the food supply chain, and meet stringent regulatory standards.

Middle-East and Africa Feed Mycotoxin Detoxifiers Market Restraints and Challenges:

Regulatory compliance is a main hindrance for the feed mycotoxin detoxifiers market in the region.

One of the foremost challenges is navigating and complying with varying and often complex regulatory standards across different countries in the Middle East and Africa. These regulations may differ in terms of acceptable mycotoxin levels, approved detoxification methods, and permissible feed additives. Adhering to these diverse regulatory frameworks can be burdensome for manufacturers and producers, making it essential to ensure that their products meet the specific requirements of each market.

High Costs associated with detoxifying agents like feed mycotoxin detoxifiers could pose a challenge, limiting the growth of the market.

The cost of mycotoxin detoxifiers can be a challenge for many farmers and feed manufacturers. High-quality detoxifying agents often come with a price premium, impacting the overall cost of animal feed production. Moreover, as the competition in the industry grows, companies must balance the need for effective detoxification with cost efficiency to remain competitive. Striking this balance is challenging, as it requires continuous research and development efforts to develop cost-effective yet highly efficient detoxification solutions.

Middle-East and Africa Feed Mycotoxin Detoxifiers Market Opportunities:

The Middle East and Africa Feed Mycotoxin Detoxifiers Market presents significant opportunities driven by several factors, including the region's growing livestock and poultry industry, increased awareness of mycotoxin-related health issues in animals, and a rising focus on food safety and quality. As consumer demand for safe and nutritious animal products rises, there is a growing need for innovative and effective mycotoxin detoxification solutions. This market offers opportunities for research and development in the creation of advanced, cost-effective detoxifiers, as well as the expansion of distribution networks to reach a broader customer base. Furthermore, as the agriculture sector in the region continues to modernize and expand, the demand for feed mycotoxin detoxifiers is likely to surge, providing a promising growth trajectory for companies operating in this segment.

MIDDLE-EAST AND AFRICA FEED MYCOTOXIN DETOXIFIERS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

3.5% |

|

Segments Covered |

By Type, Live stock, Form, End User, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Saudi Arabia, Qatar, Israel, South Africa, Nigeria, Kenya, Egypt, Rest of MEA |

|

Key Companies Profiled |

Cargill, Incorporated, BASF SE, DSM Nutritional Products, Alltech, Inc., Novozymes A/S, Adisseo, Kemin Industries, Perstorp Group, Nutreco, Selko (a division of Trouw Nutrition) |

Middle-East and Africa Feed Mycotoxin Detoxifiers Market Segmentation:

Middle-East and Africa Feed Mycotoxin Detoxifiers Market Segmentation: By Type:

- Binders

- Bio-transformers

- Enzymes

- Others

The largest segment is typically the Binders having a market share of 48%. Binders are the most widely used and accepted type of mycotoxin detoxification agent due to their simple and effective mechanism. They physically bind to mycotoxins, preventing their absorption in the animal's digestive system. This straightforward approach makes binders a popular choice as they do not rely on complex biological processes or enzyme reactions. Binders are also often composed of natural and safe materials, which aligns with the increasing demand for clean-label and sustainable solutions in animal feed. The fastest growing segment among these mycotoxin detoxifier types is Bio-transformers growing at a CAGR of 18.3%. This is because bio-transformers, which involve using microorganisms and enzymes to break down mycotoxins, align with the growing trend toward natural and sustainable solutions in agriculture. They offer an eco-friendly and efficient way to address mycotoxin contamination concerns, appealing to consumers who are increasingly conscious of food safety and environmental impact. Bio-transformers often have a broader spectrum of mycotoxin reduction capabilities, making them a versatile choice for various types of mycotoxin challenges in animal feed, driving their accelerated adoption in the market.

Middle-East and Africa Feed Mycotoxin Detoxifiers Market Segmentation: By Livestock Type

- Poultry

- Swine

- Ruminants

- Aquaculture

- Others

Among these segments, Poultry is typically the largest in the Middle East and Africa Feed Mycotoxin Detoxifiers Market has a market share of 39%. This is because the poultry industry, including broilers and layers, is one of the most prominent and fast-growing livestock sectors. Poultry farming requires significant feed volumes, making it more susceptible to mycotoxin contamination, which can impact both meat and egg production. As a result, there is a higher demand for mycotoxin detoxification solutions tailored to poultry, driving the growth of this segment. Poultry farming often involves intensive practices that emphasize productivity, making the prevention of mycotoxin-related issues a priority.

The fastest-growing segment is also poultry growing at a tremendous CAGR of 21.2%. This growth can be attributed to the region's increasing demand for poultry products, driven by population growth and dietary preferences, as well as the expanding commercial poultry farming sector. Poultry-specific mycotoxin detoxifiers are in high demand to ensure the health and productivity of poultry flocks. Poultry is more susceptible to mycotoxin contamination, making the need for effective detoxification solutions even more critical in this segment. As the poultry industry continues to grow in the Middle East and Africa, the demand for poultry-specific mycotoxin detoxifiers is expected to rise significantly.

Middle- -East and Africa Feed Mycotoxin Detoxifiers Market Segmentation: By Form

- Dry

- Liquid

- Others

In the Middle East and Africa Feed Mycotoxin Detoxifiers Market, the Dry segment is the largest having a market share of 58%. This is primarily due to its practicality and ease of use in the region's feed manufacturing processes and livestock farming practices. Dry mycotoxin detoxifiers are convenient for handling and blending into various types of solid animal feed, which is common in the Middle East and Africa. They offer shelf-stability and versatility, making them a popular choice for feed manufacturers and livestock farmers across different sectors, contributing to their dominance in this market. The Liquid segment is the fastest growing having a CAGR of 17.3%. This is attributed to the region's increasing adoption of liquid feeding systems, especially in the poultry and swine sectors. Liquid mycotoxin detoxifiers are well-suited for these systems as they enable precise and uniform distribution, ensuring efficient mycotoxin detoxification. Moreover, liquid detoxifiers are easier to administer in water and can be integrated seamlessly into automated feeding processes, making them an attractive choice for farmers seeking enhanced biosecurity and feed quality in their operations.

Middle East & Africa Feed Mycotoxin Detoxifiers Market Segmentation: By End-User:

- Feed Manufacturers

- Livestock Farmers

- Integrators

- Others

The Feed Manufacturers segment is the largest by end users having a revenue share of 44%. This is primarily because feed manufacturers play a pivotal role in ensuring the quality and safety of animal feed products, which is a top priority in the region due to growing concerns about mycotoxin contamination. These manufacturers incorporate mycotoxin detoxifiers into their formulations to supply feed that meets industry standards and regulatory requirements. Their ability to invest in and integrate detoxification solutions at the production level makes them a critical driving force behind the use of mycotoxin detoxifiers in the market.

The Livestock Farmers segment is the fastest-growing in the Middle East and Africa Feed Mycotoxin Detoxifiers Market. This is driven by a growing number of small and medium-sized livestock farmers in the region who are increasingly recognizing the importance of mycotoxin control in feed to improve animal health and productivity. These farmers are actively seeking mycotoxin detoxifiers as a practical solution, as they often have direct control over feed management and are keen to ensure the well-being and performance of their animals, fueling the demand for detoxification products tailored to their specific needs.

Middle- -East and Africa Feed Mycotoxin Detoxifiers Market Segmentation: Regional Analysis

- Saudi Arabia

- Qatar

- Israel

- South Africa

- Nigeria

- Kenya

- Egypt

- Rest of MEA

In the Middle East and Africa Feed Mycotoxin Detoxifiers Market, South Africa is the largest segment having a revenue share of 35%. South Africa has a well-established and diverse agricultural sector, including substantial livestock farming, which drives the demand for mycotoxin detoxifiers. Additionally, the country places a significant emphasis on food safety and quality, leading to a higher adoption of mycotoxin control measures, making it the dominant market segment in this region.

The fastest-growing regional segment is Saudi Arabia growing at a CAGR of 20%. This is primarily due to the country's growing livestock industry and its commitment to modernizing agricultural practices. Saudi Arabia's increasing focus on food safety, quality, and sustainable animal production has amplified the demand for mycotoxin detoxification solutions, making it a key growth driver in the region. The government's initiatives to support the agricultural sector further boost the market's expansion in Saudi Arabia.

COVID-19 Impact Analysis on the Middle- East and Africa Feed Mycotoxin Detoxifiers Market:

The COVID-19 pandemic had a mixed impact on the Middle East and Africa Feed Mycotoxin Detoxifiers Market. While the demand for safe and high-quality animal products remained a priority, disruptions in supply chains and reduced economic activity posed challenges. The lockdowns and restrictions impeded the distribution of detoxifiers, affecting the market's short-term growth. On the positive side, the pandemic heightened awareness about food safety and quality, emphasizing the need for effective mycotoxin detoxification. As the region gradually recovers, the market is expected to rebound as the livestock industry adapts to new norms, invests in improved feed quality, and bolsters resilience against future disruptions, offering opportunities for market expansion in the post-pandemic era.

Latest Trends/ Developments:

Many companies in the industry are increasingly leveraging digital technologies and data-driven solutions to enhance their product offerings. This includes the use of sensor technologies, data analytics, and AI-driven platforms to monitor feed quality, mycotoxin contamination, and animal health. By collecting and analyzing data in real-time, businesses can provide customized detoxification solutions, improving the efficiency of detoxifiers and ensuring optimal animal health. This trend aligns with the broader agricultural industry's movement toward precision farming and smart agriculture.

There is a growing consumer preference for natural and clean-label products in the feed industry. In response, some businesses are developing mycotoxin detoxifiers that rely on natural and bio-based ingredients. These detoxifiers are often marketed as environmentally friendly and safe for animals, aligning with the increasing demand for sustainable and ethical practices in agriculture. This strategy allows companies to differentiate themselves in the market and meet the evolving preferences of both farmers and consumers.

Key Players:

- Cargill, Incorporated

- BASF SE

- DSM Nutritional Products

- Alltech, Inc.

- Novozymes A/S

- Adisseo

- Kemin Industries

- Perstorp Group

- Nutreco

- Selko (a division of Trouw Nutrition)

In March 2021, Kemin Industries, a global ingredient manufacturer, is strengthening its position in the global vaccine market by acquiring a majority stake in MEVAC, an animal vaccine manufacturer in Cairo, Egypt. Additionally, Kemin is also becoming a shareholder in UVAC, a sister company of MEVAC. This move is part of Kemin's strategy to expand its presence and product portfolio in the global animal vaccine market, aligning with its goal to improve the quality of life worldwide through its products and services.

Chapter 1. Middle- East and Africa Feed Mycotoxin Detoxifiers Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Middle- East and Africa Feed Mycotoxin Detoxifiers Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. Middle- East and Africa Feed Mycotoxin Detoxifiers Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Middle- East and Africa Feed Mycotoxin Detoxifiers Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Middle- East and Africa Feed Mycotoxin Detoxifiers Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Middle- East and Africa Feed Mycotoxin Detoxifiers Market– By Type

6.1. Introduction/Key Findings

6.2. Binders

6.3. Bio-transformers

6.4. Enzymes

6.5. Others

6.6. Y-O-Y Growth trend Analysis By Type

6.7. Absolute $ Opportunity Analysis By Type , 2023-2030

Chapter 7. Middle- East and Africa Feed Mycotoxin Detoxifiers Market– By Livestock

7.1. Introduction/Key Findings

7.2. Poultry

7.3. Swine

7.4. Ruminants

7.5. Aquaculture

7.6. Others

7.7. Y-O-Y Growth trend Analysis By Livestock

7.8. Absolute $ Opportunity Analysis By Livestock , 2023-2030

Chapter 8. Middle- East and Africa Feed Mycotoxin Detoxifiers Market– By Form

8.1. Introduction/Key Findings

8.2. Dry

8.3. Liquid

8.4. Others

8.5. Y-O-Y Growth trend Analysis By Form

8.6. Absolute $ Opportunity Analysis By Form , 2023-2030

Chapter 9. Middle- East and Africa Feed Mycotoxin Detoxifiers Market– By End-User

9.1. Introduction/Key Findings

9.2. Feed Manufacturers

9.3. Livestock Farmers

9.4. Integrators

9.5. Others

9.6. Y-O-Y Growth trend Analysis By End-User

9.7. Absolute $ Opportunity Analysis By End-User, 2023-2030

Chapter 10. Middle- East and Africa Feed Mycotoxin Detoxifiers Market, By Geography – Market Size, Forecast, Trends & Insights

10.1. Middle East & Africa

10.1.1. By Country

10.1.1.1. United Arab Emirates (UAE)

10.1.1.2. Saudi Arabia

10.1.1.3. Qatar

10.1.1.4. Israel

10.1.1.5. South Africa

10.1.1.10. Nigeria

10.1.1.10. Kenya

10.1.1.10. Egypt

10.1.1.10. Rest of MEA

10.1.2. By Type

10.1.3. By Livestock

10.1.4. Form

10.1.5. End-User

10.1.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. Middle- East and Africa Feed Mycotoxin Detoxifiers Market– Company Profiles – (Overview, Form Portfolio, Financials, Strategies & Developments)

11.1 Cargill, Incorporated

11.2. BASF SE

11.3. DSM Nutritional Products

11.4. Alltech, Inc.

11.5. Novozymes A/S

11.6. Adisseo

11.7. Kemin Industries

11.8. Perstorp Group

11.9. Nutreco

11.10. Selko (a division of Trouw Nutrition)

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The Middle East and Africa Feed Mycotoxin Detoxifiers Market was valued at USD 124.2 Million and is projected to reach a market size of USD 163.5 Million by the end of 2030. Over the outlook period of 2023-2030, the market is anticipated to grow at a CAGR of 3.5%.

Growing livestock production and Rising concerns for food safety are expanding the Middle- East, And Africa Feed Mycotoxin Detoxifiers market globally

South Africa is the most dominant region for the Middle East and Africa Feed Mycotoxin Detoxifiers Market.

Cargill, Incorporated, BASF SE, DSM Nutritional Products, and Alltech, Inc. are a few of the key players operating in the Middle East and Africa Feed Mycotoxin Detoxifiers Market.