Middle East and Africa Dried Fruits Market Size (2024-2030)

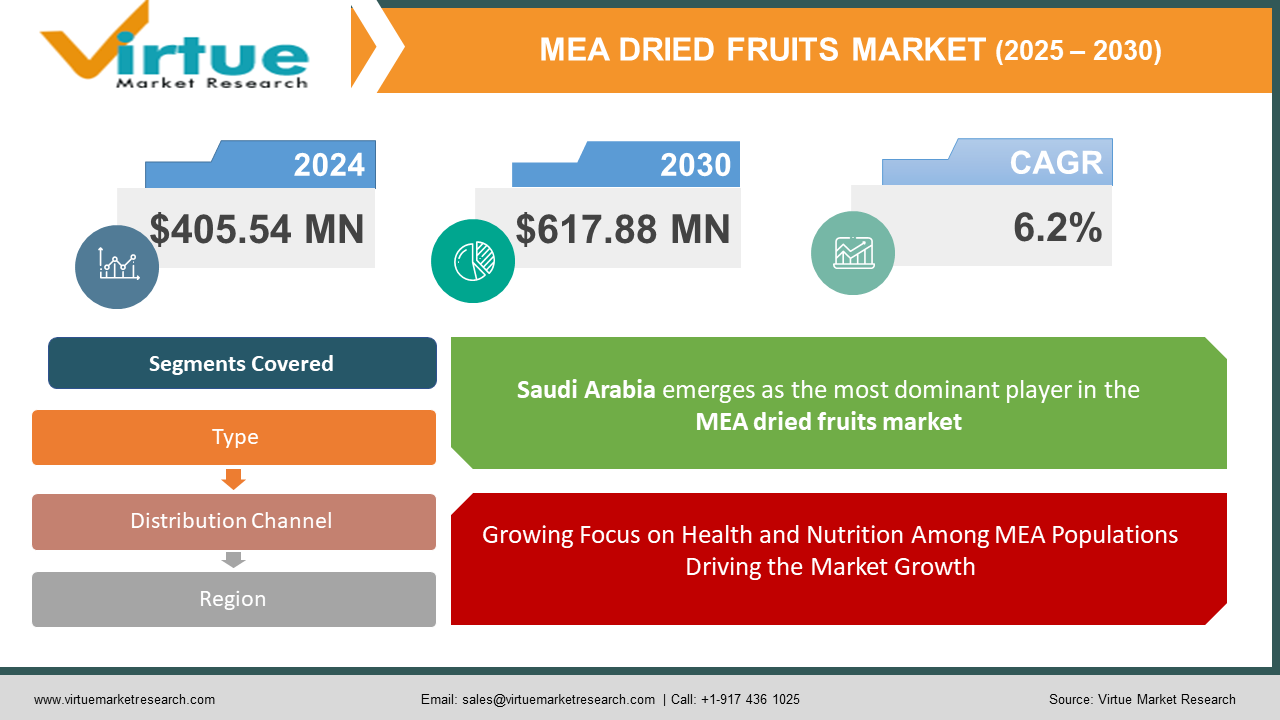

The Middle East and Africa Dried Fruits Market was valued at USD 405.54 Million in 2023 and is projected to reach a market size of USD 617.88 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.2%.

The MEA dried fruits market boasts a delightful variety. Dates, a cornerstone of Middle Eastern cuisine, reign supreme, with diverse varieties like Medjool, Deglet Noor, and Khalas offering distinct textures and flavors. Raisins, apricots, figs, prunes, and mangoes are also popular choices, catering to diverse palates and culinary applications. Local and regional players hold a strong presence, with established brands like Bateel Dates (UAE) and Sun-Dried Industries (Egypt) leading the pack. International companies like Dole (USA) and Sunsweet (USA) are also making inroads, offering familiar options alongside regional specialties. Rapid urbanization across the MEA region is leading to busier lifestyles and a growing demand for convenient and healthy snack options. Dried fruits, with their portability and nutritional value, perfectly cater to this trend. As disposable incomes rise, consumers are also willing to explore premium and exotic dried fruit varieties.

Key Market Insights:

- Dates hold the lion's share of the market, accounting for over 55% of the total dried fruit value in the MEA region.

- Raisins, apricots, figs, and prunes collectively contribute around 30% of the market value.

- The remaining 15% of the market comprises a variety of other dried fruits, including mangoes, bananas, and berries.

- 62% of MEA consumers are actively seeking healthy and nutritious snack options, driving the demand for dried fruits.

- 48% of consumers in the MEA region associate dried fruits with gifting and festive occasions.

- 37% of urban MEA consumers are willing to pay a premium for organic, ethically sourced, and unique dried fruit varieties.

- 54% of online grocery shoppers in the MEA region have purchased dried fruits in the past year, highlighting the growing e-commerce trend.

- The MEA region itself produces a significant portion of the dried fruits it consumes. However, 22% of the total demand is met through imports from countries like the USA, Iran, and China.

- 18% of dried fruit production in the MEA region is lost due to inefficient post-harvest practices and inadequate storage facilities.

- 35% of MEA consumers express concerns about the use of sulfites and preservatives in some commercially produced dried fruits.

- 62% of dried fruit processing companies in the MEA region are implementing stricter quality control measures to ensure food safety and hygiene.

The Middle East and Africa Dried Fruits Market Drivers:

Growing Focus on Health and Nutrition Among MEA Populations Driving the Market Growth

Snacking on sugar is becoming more and more scrutinized. Without the chemical additives or refined sugars included in manufactured candies and treats, dried fruits offer a naturally occurring sweetness. This appeals to customers who are health-conscious and looking for guilt-free pleasure. One common ingredient in Middle Eastern diets, dates, for example, are a natural source of fructose and glucose and provide a steady energy boost without the crash that comes with sugar highs. Nutrient-rich dried fruits are abundant. They are an excellent source of vitamins A, C, and E, which are vital for sustaining a robust immune system and enhancing general health. Dried fruits are also a great source of fiber, which helps with digestion and supports gut health, and potassium, which is necessary for controlling blood pressure.

The MEA region boasts a rich culinary heritage where dried fruits play a significant role.

Dried fruits hold a special place in Middle Eastern and African traditions. Dates, for instance, are a symbol of hospitality and are often exchanged during religious festivals and celebrations. This cultural significance ensures a steady demand for dried fruits throughout the year. Manufacturers are capitalizing on this by offering premium gift boxes featuring exotic dried fruit varieties and visually appealing packaging. Dried fruits are a cornerstone ingredient in many regional cuisines. They are used in sweet and savory dishes, from tagines in Morocco to fragrant rice dishes in West Africa. This ensures a consistent demand for specific types of dried fruits used in traditional recipes. Additionally, the growing popularity of ethnic restaurants worldwide is creating a demand for high-quality dried fruits used in these cuisines. Consumers are increasingly seeking out exciting flavor profiles and culinary adventures. Manufacturers are catering to this by introducing innovative flavor combinations. This could involve coating dried fruits with yogurt, dark chocolate, or spices like cinnamon or ginger. Additionally, exotic dried fruit varieties like kiwifruit or guava slices are being introduced, catering to adventurous palates.

Middle East and Africa Dried Fruits Market Restraints and Challenges:

Unfavorable weather conditions can lead to lower fruit production, impacting the overall availability of dried fruits in the market. This can result in price hikes and strain the ability to meet consumer demand, particularly for specific varieties. The drying process heavily relies on achieving optimal temperatures and sunshine exposure. Inconsistent weather patterns can affect the final texture and quality of the dried fruits, impacting consumer satisfaction. Exploring alternative drying methods like mechanical dehydration or solar dryers can reduce dependence on solely sun-drying. This can help ensure consistent quality and mitigate the impact of unpredictable weather. Dried fruits, if not stored properly, can be susceptible to mold growth and spoilage. This poses a food safety risk and can lead to product recalls, damaging consumer trust. Inadequate quality control measures can increase the risk of contamination with mycotoxins (fungal toxins) or harmful bacteria. This can have serious health implications for consumers.

Middle East and Africa Dried Fruits Market Opportunities:

Offering a wider range of specialty and heirloom dried fruit varieties, catering to adventurous palates and a desire for the exotic. This could involve introducing rare date varieties like Ajwa or Medjool Deglet Noor, or exploring sun-dried mangoes with unique flavor profiles. Ethical sourcing and organic certification are gaining traction. Consumers are willing to pay a premium for dried fruits that are produced using sustainable practices and ensure fair compensation for farmers. Partnering with local cooperatives and organic growers can tap into this growing market segment. Elevating the packaging with premium materials and visually appealing designs can position dried fruits as a luxurious gifting option. Gift baskets featuring exotic dried fruit selections paired with nuts, chocolates, or gourmet teas can be particularly attractive during festive seasons. Offering pre-portioned single-serve packs caters to busy consumers seeking a convenient and mess-free snack option. This is particularly appealing for professionals, gym-goers, or parents packing lunchboxes.

MIDDLE EAST AND AFRICA DRIED FRUITS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.2% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Kingdom of Saudi Arabia, UAE, Israel, Rest of GCC countries, South Africa, Ethiopia, Kenya, Egypt, Sudan, Rest of MEA |

|

Key Companies Profiled |

Sun-Maid Growers of California , Ocean Spray Cranberries, Inc, Sunweet , National Raisin Company , Arimex Ltd. , Olam International, Sunbeam Foods Pty Ltd. , Dhofar Dates , Belmont Dried Fruits , Sun Oasis |

Middle East and Africa Dried Fruits Market Segmentation:

Middle East and Africa Dried Fruits Market Segmentation: By Type:

- Dates

- Raisins

- Apricots

- Figs

- Prunes

- Snack Mixes

Dates reign supreme, dates hold the lion's share of the market, accounting for over 55% of the total dried fruit value in the MEA region. Dates, with their rich history and cultural significance, are deeply woven into the fabric of Middle Eastern and African cuisines. Their cultural significance, diverse varieties, and inherent sweetness make them a staple across the region. The MEA region boasts over 200 date varieties, each with distinct characteristics. Dates are available in whole, pitted, and chopped forms, catering to various consumption preferences. Dates hold special significance during Ramadan and other religious festivals, often served to break the fast.

Fueled by the convenience trend and a desire for healthy snacking options, snack mixes featuring dried fruits are experiencing the fastest growth within the MEA dried fruit market. Snack mixes combine dried fruits with nuts, seeds, and whole grains, offering portable and balanced snack options rich in fiber, protein, and healthy fats. Manufacturers are developing snack mixes with various dietary needs in mind. This includes sugar-free options for diabetics, trail mixes with added protein for athletes, and allergy-friendly mixes free of nuts or gluten. Snack mix brands are experimenting with innovative flavor combinations to cater to adventurous palates. This could involve introducing spicy, Savory, or chocolate-coated dried fruit pieces into the mix.

Middle East and Africa Dried Fruits Market Segmentation: By Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialist Retailers

- Direct-to-Consumer (D2C)

- E-commerce Platforms

- Other Channels

Supermarkets & Hypermarket's channel holds the lion's share, offering a wide variety of dried fruits under one roof. Convenience, brand recognition, and frequent promotions fuel consumer preference for this channel. Deeply rooted in communities, these stores cater to local preferences and offer a personalized shopping experience. They often stock regionally produced dried fruits and cater to those seeking specific varieties. Supermarkets stock a wide variety of dried fruits, catering to diverse preferences. From popular options like raisins and dates to more exotic offerings like dried mangoes and apricots, consumers can find what they're looking for under one roof. Established supermarkets provide valuable shelf space for major dried fruit brands, allowing them to reach a wider customer base. This brand recognition builds trust and encourages repeat purchases.

The D2C online platform segment is experiencing explosive growth. Consumers can browse a vast selection of dried fruits online from the comfort of their homes, making informed purchases without the need for physical travel. D2C platforms provide a platform for smaller producers offering unique or regionally specific dried fruit varieties that might not be readily available in traditional stores. Some D2C platforms offer subscription boxes or curated selections based on consumer preferences. This level of personalization can be highly attractive to discerning consumers seeking unique and tailored options.

Middle East and Africa Dried Fruits Market Segmentation: Regional Analysis:

- United Arab Emirates (UAE)

- Saudi Arabia

- Qatar

- Israel

- South Africa

- Nigeria

- Kenya

- Egypt

- Rest of MEA

Saudi Arabia emerges as the most dominant player in the MEA dried fruits market, commanding a significant 14.8% share. Dried fruits hold a revered place in Saudi Arabian cuisine and culture. The hot and arid climate has historically necessitated the preservation of fruits through drying, making dried fruits an integral part of the local diet. This deep-rooted tradition has fostered a strong demand for a wide variety of dried fruits, including dates, apricots, figs, and raisins. Saudi Arabia is a major producer of dates, which are among the most widely consumed dried fruits in the region. The country boasts advanced data processing facilities and a well-established supply chain, enabling efficient distribution both domestically and internationally.

While Kenya currently holds a relatively modest 3.9% share of the MEA dried fruits market, it is emerging as the fastest-growing country in the region. The adoption of modern drying technologies, such as solar drying and advanced dehydration techniques, has enabled Kenyan producers to improve the quality and shelf-life of their dried fruit products. This has enhanced their competitiveness in both domestic and export markets. The Kenyan government has recognized the potential of the dried fruit industry and has implemented various initiatives to support smallholder farmers and processors. These initiatives include training programs, access to financing, and infrastructure development, all of which have contributed to the industry's growth.

COVID-19 Impact Analysis on the Middle East and Africa Dried Fruits Market:

Lockdowns and travel restrictions disrupted the movement of goods across borders. This hampered the transportation of both raw materials (fresh fruits) and finished dried fruit products, leading to shortages and price fluctuations. Panic buying and stockpiling initially led to a surge in demand for dried fruits perceived as a shelf-stable source of nutrients. However, as the pandemic progressed, economic anxieties and altered spending habits dampened overall demand in some segments. Social distancing measures and lockdown restrictions impacted labor availability in both fresh fruit production and dried fruit processing facilities. This led to production slowdowns and potential quality control issues. Restrictions on movement and a growing focus on hygiene fueled a surge in online shopping. This benefitted D2C platforms and online retailers selling dried fruits, offering a convenient and safe alternative to traditional stores.

Latest Trends/ Developments:

Lockdowns and travel restrictions disrupted the movement of goods across borders. This hampered the transportation of both raw materials (fresh fruits) and finished dried fruit products, leading to shortages and price fluctuations. Panic buying and stockpiling initially led to a surge in demand for dried fruits perceived as a shelf-stable source of nutrients. However, as the pandemic progressed, economic anxieties and altered spending habits dampened overall demand in some segments. Social distancing measures and lockdown restrictions impacted labor availability in both fresh fruit production and dried fruit processing facilities. This led to production slowdowns and potential quality control issues. Restrictions on movement and a growing focus on hygiene fueled a surge in online shopping. This benefitted D2C platforms and online retailers selling dried fruits, offering a convenient and safe alternative to traditional stores.

Key Players:

- Sun-Maid Growers of California

- Ocean Spray Cranberries, Inc

- Sunweet

- National Raisin Company

- Arimex Ltd.

- Olam International

- Sunbeam Foods Pty Ltd.

- Dhofar Dates

- Belmont Dried Fruits

- Sun Oasis

Chapter 1. Middle East and Africa Dried Fruits Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Middle East and Africa Dried Fruits Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Middle East and Africa Dried Fruits Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Middle East and Africa Dried Fruits Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Middle East and Africa Dried Fruits Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Middle East and Africa Dried Fruits Market– By Type

6.1. Introduction/Key Findings

6.2. Dates

6.3. Raisins

6.4. Apricots

6.5. Figs

6.6. Prunes

6.7. Snack Mixes

6.8. Y-O-Y Growth trend Analysis By Type

6.9. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Middle East and Africa Dried Fruits Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2. Supermarkets and Hypermarkets

7.3. Convenience Stores

7.4. Specialist Retailers

7.5. Direct-to-Consumer (D2C)

7.6. E-commerce Platforms

7.7. Other Channels

7.8. Y-O-Y Growth trend Analysis By Distribution Channel

7.9. Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Middle East and Africa Dried Fruits Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Middle East & Africa

8.1.1. By Country

8.1.1.1. United Arab Emirates (UAE)

8.1.1.2. Saudi Arabia

8.1.1.3. Qatar

8.1.1.4. Israel

8.1.1.5. South Africa

8.1.1.6. Nigeria

8.1.1.7. Kenya

8.1.1.8. Egypt

8.1.1.9. Rest of MEA

8.1.2. By Type

8.1.3. By Distribution Channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Middle East and Africa Dried Fruits Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Sun-Maid Growers of California

9.2. Ocean Spray Cranberries, Inc

9.3. Sunweet

9.4. National Raisin Company

9.5. Arimex Ltd.

9.6. Olam International

9.7. Sunbeam Foods Pty Ltd.

9.8. Dhofar Dates

9.9. Belmont Dried Fruits

9.10. Sun Oasis

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

Consumers are increasingly seeking healthy and convenient snack options. Dried fruits, with their concentrated source of vitamins, minerals, and fiber, fit perfectly into this trend. They are perceived as a natural alternative to processed snacks that are often high in sugar and unhealthy fats

The MEA region is susceptible to droughts and other weather extremes that can impact the yield and quality of fresh fruits used for drying. This variability can lead to price fluctuations for dried fruits

Sun-Maid Growers of California, Ocean Spray Cranberries, Inc, Sunweet National Raisin Company, Arimex Ltd., Olam International, Sunbeam Foods Pty Ltd., Dhofar Dates, Belmont Dried Fruits, Sun Oasis.

Saudi Arabia has firmly established itself as the most dominant player in the market, commanding an impressive 16.8% market share.

Kenya emerges as the fastest-growing country in this sector. Its burgeoning population, rising disposable incomes, and rapid urbanization have fueled the demand.