Middle East and Africa Cultured Meat Market Size (2025 – 2030)

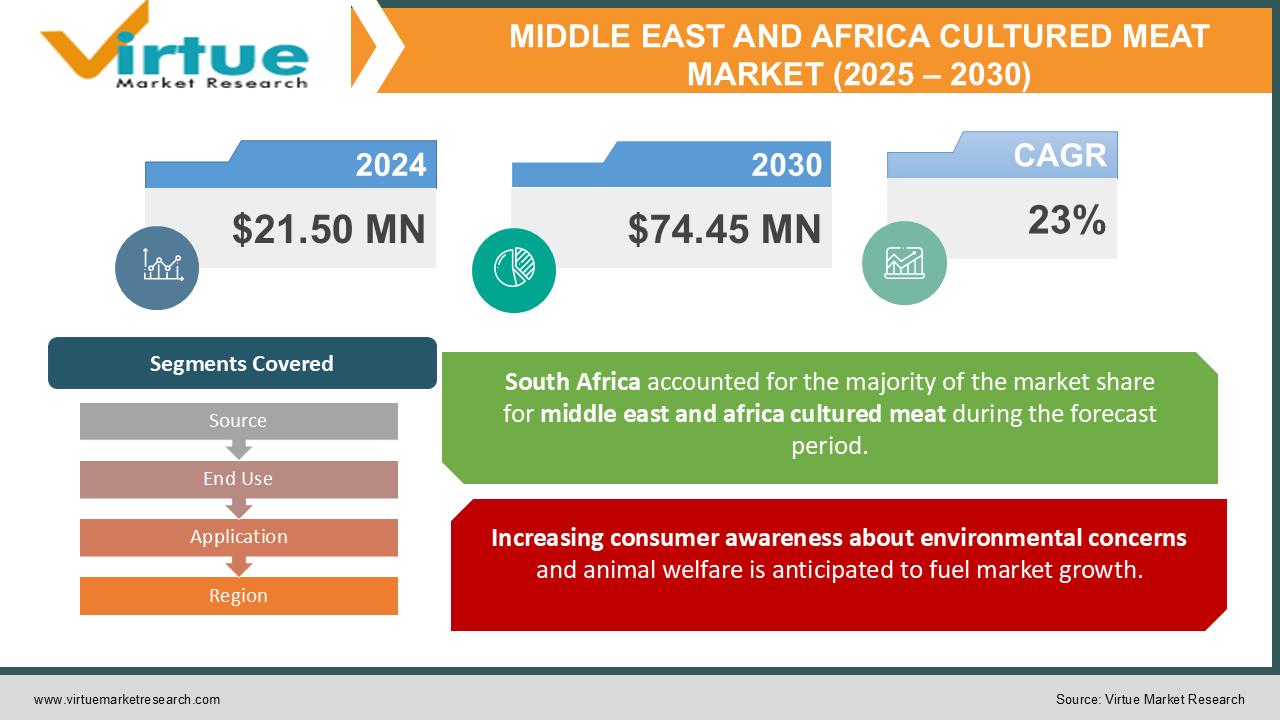

The Middle East and Africa Cultured Meat Market was valued at USD 21.50 Million in 2024. Over the forecast period of 2025-2030, it is projected to reach USD 74.45 Million by 2030, growing at a CAGR of 23%.

Cultured meat, often referred to as lab-grown, clean, or cultured meat, is produced through in vitro cell culture rather than the traditional method of animal slaughter. This method is carried out in a regulated environment, where it mimics the flavor, texture, and aroma of conventionally farmed meat. During the cultivation process, cells from farm animals are introduced into a controlled medium containing essential nutrients and growth factors. These components facilitate the conversion of stem cells into fully developed muscle cells within a bioreactor. The production of cultured meat involves various conditions and substances to ensure the proper nourishment for tissue growth.

Key Market Insights:

The continuous advancements in alternative proteins are propelling the transition towards more sustainable food systems. Meat alternatives and substitute proteins are gaining significant attention due to the growing need to address meat shortages, mitigate environmental impacts, and accommodate the increasing global population.

Middle East and Africa Cultured Meat Market Drivers:

Increasing consumer awareness about environmental concerns and animal welfare is anticipated to fuel market growth.

The growing concern over animal exploitation in meat production is significantly influencing consumer attitudes towards meat consumption. As awareness of environmentally sustainable practices rises alongside the increasing demand for meat, this will become a crucial factor in driving the growth of the cultured meat market during the forecast period.

Additionally, the trend of increased investments across various industries, fueled by advancements in technological cultivation, is expected to further support market growth. Initially, lab-grown hamburgers were expensive, but researchers have since developed affordable, high-quality artificial meat, which is anticipated to contribute to substantial market expansion in the coming years.

Cultured meat is seen as a solution to the challenges posed by industrial farming, as it can address various ecological issues and enhance animal welfare. This aspect is expected to play a pivotal role in market growth, as consumers increasingly seek environmentally friendly products that promote animal well-being.

The rising demand for meat and the consumption of nutritious alternatives are expected to drive market growth during the forecast period, with lab-grown poultry emerging as a key factor in this expansion.

Middle East and Africa Cultured Meat Market Restraints and Challenges:

The lack of consumer awareness is a significant barrier to the growth of the market.

The cultured meat market is currently limited in production, with availability primarily confined to restaurants and specialty stores.This presents a key challenge for manufacturers who must focus on scaling up production to drive market growth during the forecast period.

High investment costs represent another significant obstacle hindering the development of the cultured meat market. Additionally, stringent regulations and policies governing cultured meat production across different countries further complicate market expansion. As cultured meat is still a relatively new concept, many consumers remain unfamiliar with it.

Moreover, some consumers perceive traditionally slaughtered meat as superior to lab-grown alternatives. This reluctance to try cultured meat, due to concerns over its quality and unfamiliarity, may continue to hinder its acceptance compared to conventional meat products available in the market.

Middle East and Africa Cultured Meat Market Opportunities:

The increase in per capita income and urbanization is expected to create lucrative opportunities in the cultured meat market.

The growth of urbanization, coupled with rising per capita income, is a major driver of global meat consumption. In developing countries, meat consumption is nearly double that of developed nations, which can have significant adverse effects on the global climate.

It requires less land, energy, and water compared to traditional meat production, offering a more sustainable solution. Additionally, it supports population growth while reducing the environmental impacts associated with food production, including climate change. Technological advancements are key drivers of market growth, facilitating the development of a diverse range of cultured meat products.

The rapidly growing global population has led to a rising demand for technological innovations to meet protein needs during the forecast period. New advancements in technology are enabling the discovery of various meat alternatives, which in turn is expanding the variety of cultured meat products available in the market.

MIDDLE EAST AND AFRICA CULTURED MEAT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

23% |

|

Segments Covered |

By Source, End Use, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BioFood Systems Ltd, Aleph Farms, Fork & Good, Inc., SuperMeat, Mosa Meat, TysonFoods Inc., Appleton Meats, RedFine Meat Ltd., Biftek INC, Cubiq Foods |

Middle East and Africa Cultured Meat Market Segmentation: By Source

-

Poultry

-

Red Meat

-

Seafood

The poultry segment currently dominates the market, driven by an increasing number of market entrants and startups investing in cellular agriculture technologies to develop poultry-based cultivated products.

Red meat is anticipated to experience the fastest-growing compound annual growth rate (CAGR) during the forecast period. The demand for alternatives to pork products surged notably during the COVID-19 pandemic, highlighting the risks associated with the traditional meat industry and vulnerabilities in animal-based food supply chains.

Middle East and Africa Cultured Meat Market Segmentation: By End Use

-

Burgers

-

Nuggets

-

Meatballs

-

Hotdogs

-

Sausages

-

Other

The burgers segment leads the market, driven by growing consumer preference for ethical and sustainable meat alternatives. The demand for cultured burgers is expected to increase as more consumers seek options that align with their values regarding environmental impact and animal welfare.

Cultured meat burgers can help reduce the ecological footprint of the meat industry. Numerous key players and startups are actively exploring cultivated meats, which is anticipated to drive further growth in this segment. Additionally, the nugget segment is witnessing increased adoption due to the widespread availability of affordable, accessible meat options, with chicken nuggets being particularly popular. The convenience of ready-to-eat food products is driving consumer preference for nuggets, which has led major fast-food chains, including supermarkets and KFC, to offer chicken nuggets as a part of their menu, catering to the growing demand for convenient, prepared meals.

Middle East and Africa Cultured Meat Market Segmentation: By Application

-

Food Services Industry

-

Pet Food Industry

-

Others

The food services industry plays a crucial role as the leading application sector within the cultured meat industry, presenting significant growth opportunities for meat packaging manufacturers. Restaurants, catering companies, and food service providers are increasingly incorporating cultured meat products into their menus to meet the evolving demands of their discerning customers. These businesses have acknowledged the diverse benefits of providing meat alternatives that align with eco-conscious values while also addressing the health-conscious and ethically-driven preferences of consumers.

The versatility of cultured meat is another significant factor driving its prominence in the food services sector. It can be seamlessly incorporated into a wide range of culinary dishes, from traditional burgers and sandwiches to more sophisticated gourmet entrees. This adaptability allows chefs and food service professionals to experiment with diverse flavors and textures, satisfying a variety of palates and dietary needs.

Middle East and Africa Cultured Meat Market Segmentation- by Region

-

United Arab Emirates

-

Saudi Arabia

-

South Africa

-

Egypt

-

Israel

-

Qatar

-

Nigeria

-

Kenya

-

Rest of MEA

The UAE has demonstrated a growing interest in cultured meat, which is produced using cellular agriculture techniques that reduce the need for traditional livestock farming. This trend is in line with the country's broader goals of promoting sustainability and ensuring food security. Cultured meat, derived from animal cells without the necessity of raising and slaughtering animals, has garnered attention for its potential to address environmental and ethical concerns associated with conventional meat production. The UAE government has supported research and investment in this sector, with several startups exploring the production of various cultured meat products, including beef, chicken, and even exotic meats like camel.

Similarly, the cultured meat market in South Africa is growing, fueled by rising concerns about sustainability, animal welfare, and food security. Cultured meat, also referred to as lab-grown or clean meat, is produced through cellular agriculture techniques, offering a more ethical and environmentally friendly alternative to traditional meat production. The market's expansion is further supported by the rising demand for protein-rich food options, advancements in biotechnology, and the need to address challenges inherent in conventional meat production.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic had a notable impact on the emerging cultured meat market in the UAE. While interest in sustainable and alternative protein sources continued to grow, the pandemic disrupted research and development efforts, leading to a slowdown in the market's expansion. Lab-based facilities encountered operational challenges, and investment flows were somewhat limited. However, the crisis also underscored the need for resilient and sustainable food production systems, which could enhance the long-term potential of the cultured meat market in the UAE. This aligns with the country's broader sustainability goals, potentially accelerating the market's growth in the future.

Latest Trends/ D evelo pments:

In March 2022, SuperMeat, an Israel-based food tech company known for its cultured chicken, which has been described as "identical to its animal counterpart" by food experts, announced a strategic partnership with Ajinomoto, a major Japanese food company. The collaboration aims to enhance and accelerate the development of cultured meat products.

Key Players:

These are top 10 players in the Middle East and Africa Cultured Meat Market :-

-

BioFood Systems Ltd

-

Aleph Farms

-

Fork & Good, Inc.

-

SuperMeat

-

Mosa Meat

-

Tyson Foods Inc.

-

Appleton Meats

-

RedFine Meat Ltd.

-

Biftek INC

-

Cubiq Foods

Chapter 1. Middle East and Africa Cultured Meat Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Middle East and Africa Cultured Meat Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Middle East and Africa Cultured Meat Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Middle East and Africa Cultured Meat Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Middle East and Africa Cultured Meat Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Middle East and Africa Cultured Meat Market – By Source

6.1 Introduction/Key Findings

6.2 Poultry

6.3 Red Meat

6.4 Seafood

6.5 Y-O-Y Growth trend Analysis By Source

6.6 Absolute $ Opportunity Analysis By Source, 2025-2030

Chapter 7. Middle East and Africa Cultured Meat Market – By Application

7.1 Introduction/Key Findings

7.2 Food Services Industry

7.3 Pet Food Industry

7.4 Others

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Middle East and Africa Cultured Meat Market – By End User

8.1 Introduction/Key Findings

8.2 Burgers

8.3 Nuggets

8.4 Meatballs

8.5 Hotdogs

8.6 Sausages

8.7 Other

8.8 Y-O-Y Growth trend Analysis By End User

8.9 Absolute $ Opportunity Analysis By End User, 2025-2030

Chapter 9. Middle East and Africa Cultured Meat Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Source

9.1.3 By Application

9.1.4 By End User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Source

9.2.3 By Application

9.2.4 By End User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Source

9.3.3 By Application

9.3.4 By End User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Source

9.4.3 By Application

9.4.4 By End User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Source

9.5.3 By Application

9.5.4 By End User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Middle East and Africa Cultured Meat Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 BioFood Systems Ltd

10.2 Aleph Farms

10.3 Fork & Good, Inc.

10.4 SuperMeat

10.5 Mosa Meat

10.6 Tyson Foods Inc.

10.7 Appleton Meats

10.8 RedFine Meat Ltd.

10.9 Biftek INC

10.10 Cubiq Foods

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The continuous advancements in alternative proteins are propelling the transition towards more sustainable food systems.

The top players operating in the Middle East and Africa Cultured Meat Market are - BioFood Systems Ltd, Aleph Farms, Fork & Good, Inc. and SuperMeat.

The COVID-19 pandemic had a notable impact on the emerging cultured meat market.

In March 2022, SuperMeat, an Israel-based food tech company known for its cultured chicken, which has been described as "identical to its animal counterpart" by food experts, announced a strategic partnership with Ajinomoto, a major Japanese food company.

UAE is the fastest-growing region in the Middle East and Africa Cultured Meat Market.