Middle East and Africa Butter and Ghee Market Size (2024-2030)

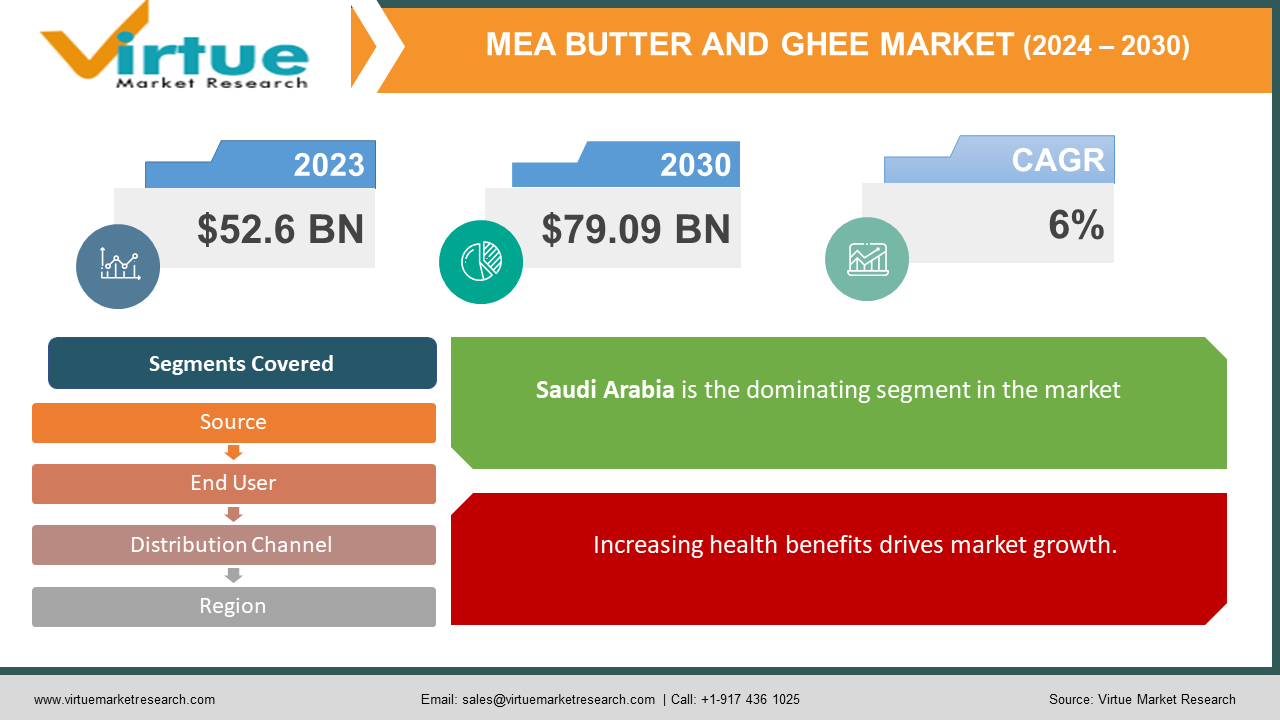

The Middle East and Africa Butter and Ghee Market was valued at USD 52.6 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 79.09 billion by 2030, growing at a CAGR of 6%.

Butter, commonly served chilled, is a dairy product derived from separated butterfat. Primarily utilized as a spread or culinary enhancer, it holds a significant place in various cuisines worldwide. Ghee, a variant of clarified butter, finds its roots in traditional Indian cooking practices. Beyond its culinary applications, ghee serves as a popular choice for natural home remedies, renowned for its efficacy in treating burns, inflammation, and discomfort. Its distinct nutty flavor arises from the meticulous browning process integral to its production. While boasting a high saturated fat content, ghee maintains minimal levels of lactose and milk protein, distinguishing it from conventional butter.

Key Market Insights:

Ghee represents the pure essence of butter, obtained after the removal of milk solids and water. Renowned for its richness in essential nutrients such as protein, vitamins, carbohydrates, calcium, iron, and omega-3 fatty acids, it serves as a potent promoter of brain and heart health while also exhibiting anti-inflammatory properties and therapeutic potential against various diseases. Its consumption is witnessing a global surge owing to its ability to bolster the immune system, facilitate digestion, and alleviate chronic cough and ocular ailments.

With its increasing availability across supermarkets, specialty food stores, and online platforms, ghee has witnessed a significant boost in consumer accessibility, thereby propelling the global ghee market forward. Moreover, recognizing the burgeoning demand in international markets, countries with robust ghee manufacturing capacities are exploring export opportunities, thereby contributing to the expansion of the global ghee market.

Nevertheless, challenges such as stringent food safety regulations, labeling requirements, and trade barriers pose obstacles for ghee producers and distributors, potentially impeding the industry's growth trajectory. Economic fluctuations, currency volatilities, and shifts in disposable income levels can also impact consumer spending patterns, particularly concerning luxury items like ghee, thereby influencing market dynamics adversely.

Middle East and Africa Butter and Ghee Market Drivers:

Increasing health benefits drives market growth.

The increasing recognition of ghee's health advantages, as advocated by Ayurvedic medicine, is poised to propel the global market for clarified butter. Embraced as a nutritious dietary staple, recommended by fitness centers, yoga establishments, and medical professionals, clarified butter is gaining traction among health-conscious consumers.

The rising acknowledgment of ghee as a superfood is anticipated to attract the interest of consumers and dairy product manufacturers alike. In a bid to augment their market presence, stakeholders in the clarified butter industry are channeling investments into innovation and the introduction of novel product offerings.

The wide use of butter and ghee in cuisines increases market growth.

The surge in consumer awareness and prioritization of nutritional enrichment beneficial to health has led to an upswing in the incorporation of clarified butter across diverse culinary traditions. Recognized as a rich source of healthy fats and fortified with fat-soluble vitamins A, D, and E, clarified butter plays a pivotal role in supporting bone development, aiding digestion, and mitigating inflammation.

Furthermore, the escalating utilization of clarified butter across various culinary applications to enhance flavor profiles is driving the expansion of the global clarified butter market. Its integration in the production of bakery items such as croissants, puff pastry, and Danish pastry, among others, has notably bolstered the demand for clarified butter in the food industry.

Middle-East and Africa Butter and Ghee Market Restraints and Challenges:

The potential adverse effects associated with excessive ghee consumption, particularly cardiovascular health, are anticipated to restrain market growth throughout the forecast period. Nevertheless, factors such as burgeoning populations, increasing disposable incomes, enhanced accessibility, heightened public awareness regarding the benefits of ghee, and untapped opportunities in developing nations offer promising growth prospects for the industry.

Furthermore, the relatively elevated price of ghee compared to other cooking oils is projected to hinder the expansion of the clarified butter market. Additionally, the escalating consumer preference for vegan and low-fat dietary choices is expected to curtail market growth in the foreseeable future.

Middle-East and Africa Butter and Ghee Market Opportunities:

Clarified butter finds frequent application in both retail and food service settings, featuring prominently in breakfast and dinner menus for frying or sautéing dishes. The market for clarified butter is poised for favorable growth, propelled by evolving consumer taste preferences and a growing inclination towards healthy food choices.

Consequently, stakeholders in the market must ramp up their advertising and promotional efforts for clarified butter products, accentuating their health benefits to foster the development of a robust global market for clarified butter.

MIDDLE EAST AND AFRICA BUTTER AND GHEE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6% |

|

Segments Covered |

By Source, end user, Consumption, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Kingdom of Saudi Arabia, UAE, Israel, Rest of GCC countries, South Africa, Ethiopia, Kenya, Egypt, Sudan, Rest of MEA |

|

Key Companies Profiled |

Amul, Almarai, Beneficial Blends LLC, Lurpak, Arla Foods amba, Grassland Dairy Products Inc., Heritage Foods Limited, Avera Foods (Pty) Ltd., Britannia Industries, Netherend Farm Ltd., Organic Valley |

Middle-East and Africa Butter and Ghee Market Segmentation

Middle-East and Africa Butter and Ghee Market Segmentation By Source:

- Cow

- Buffalo

- Mixed

The cow segment dominates the market share, buoyed by the growing demand for ghee derived solely from cow's milk, which is perceived to offer specific health benefits and holds cultural significance across various regions. Consumers are drawn to the purity and traditional richness associated with cow ghee, valuing its reputation for being easier to digest and containing essential nutrients, aligning with preferences for health and tradition.

Conversely, the buffalo segment is propelled by the affordability and widespread availability of buffalo milk, rendering buffalo ghee a cost-effective option for a broader consumer demographic. Its creamy texture and distinct flavor further enhance its appeal in the market.

Middle-East and Africa Butter and Ghee Market Segmentation By Distribution Channel:

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Online

- Others

The convenience store segment is anticipated to experience substantial growth in the ghee market throughout the forecast period. This expansion is attributed to the increasing demand for on-the-go and quick meal solutions, which makes ghee more readily available to busy consumers seeking convenient purchases. Convenience stores prioritize accessibility and ease of purchase, ensuring that customers can conveniently access ghee products as part of their daily routines.

Middle-East and Africa Butter and Ghee Market Segmentation By End User:

- Retail

- Institutional

During the forecast period, the retail segment emerges as the dominant force in the global ghee market. This trend is propelled by heightened consumer awareness regarding the health advantages of ghee, coupled with a surge in demand for products boasting clean labels and organic certifications. Consumers are increasingly prioritizing healthier cooking alternatives, and ghee, renowned for its nutritional value and natural attributes, aligns seamlessly with this growing demand.

Middle-East and Africa Butter and Ghee Market Segmentation- by Region

- UAE

- Israel

- Kenya

- Saudi Arabia

- South Africa

- Egypt

- Qatar

- Nigeria

- Rest of the Middle East and Africa

Saudi Arabia is the dominating segment in the market. Turkey and Saudi Arabia are the fastest-growing segments in the market.

The ghee sector in Saudi Arabia thrives on the region's fertile agricultural landscape, ensuring a consistent provision of high-quality milk as its primary raw material for ghee production. A robust dairy industry is facilitated by the presence of numerous dairy farms and cooperatives in the state, supporting the entire ghee manufacturing process. Additionally, its cultural heritage and culinary traditions deeply embed ghee into the daily dietary practices of its inhabitants, creating a sustained demand for this traditional product. The state's sizable population, coupled with a continual rise in disposable incomes, further propels consumer expenditure on ghee products.

Furthermore, the strategic location and well-established transportation networks enable efficient distribution to both domestic and international markets. Government support through various initiatives and incentives for dairy farmers and ghee manufacturers also plays a pivotal role in fortifying the industry's growth. To sum up, the driving forces behind the ghee industry in Saudi Arabia encompass the ample milk supply, cultural significance, expanding consumer base, advantageous geographical positioning, and government backing, collectively contributing to the industry's prosperity and expansion within the region.

COVID-19 Pandemic: Impact Analysis

Latest Trends/ Developments:

- In May 2022, KMF unveiled a new deluxe iteration of ghee within its esteemed brand "Nandini." Branded as "Nandini Gold Ghee," this premium variant is meticulously crafted to cater to the refined preferences of consumers desiring unparalleled flavor and utmost purity. KMF's steadfast dedication to excellence and ingenuity has culminated in the introduction of this noteworthy ghee product, marking a substantial enhancement to its product lineup and bolstering its position within the market.

Key Players:

These are the top 10 players in the Middle East and Africa Butter and Ghee Market: -

- Amul

- Almarai

- Beneficial Blends LLC, Lurpak

- Arla Foods amba

- Grassland Dairy Products Inc.

- Heritage Foods Limited

- Avera Foods (Pty) Ltd.

- Britannia Industries

- Netherend Farm Ltd.

- Organic Valley

Chapter 1. Middle East and Africa Butter and Ghee Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Middle East and Africa Butter and Ghee Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Middle East and Africa Butter and Ghee Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Middle East and Africa Butter and Ghee Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Middle East and Africa Butter and Ghee Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Middle East and Africa Butter and Ghee Market– By Source

6.1. Introduction/Key Findings

6.2. Cow

6.3. Buffalo

6.4. Mixed

6.5. Y-O-Y Growth trend Analysis By Source

6.6. Absolute $ Opportunity Analysis By Source, 2024-2030

Chapter 7. Middle East and Africa Butter and Ghee Market– By End User

7.1. Introduction/Key Findings

7.2. Retail

7.3. Institutional

7.4. Y-O-Y Growth trend Analysis By End User

7.5. Absolute $ Opportunity Analysis By End User , 2024-2030

Chapter 8. Middle East and Africa Butter and Ghee Market– By Distribution Channel

8.1. Introduction/Key Findings

8.2. Supermarkets/Hypermarkets

8.3. Convenience Stores

8.4. Specialty Stores

8.5. Online

8.6. Others

8.7. Y-O-Y Growth trend Analysis By Distribution Channel

8.8. Absolute $ Opportunity Analysis By Distribution Channel , 2024-2030

Chapter 9 . Middle East and Africa Butter and Ghee Market, By Geography – Market Size, Forecast, Trends & Insights

9 .1. Middle East and Africa

9 .1.1. By Country

9 .1.1.1. Saudi Arabia

9 .1.1.2. Qatar

9 .1.1.3. UAE

9 .1.1.4. Israel

9 .1.1.5. South Africa

9 .1.1.6. Nigeria

9 .1.1.7. Kenya

9 .1.1.9 . Egypt

9 .1.1.9 . Rest of the Middle East

9.1.2. By Distribution Channel

9.1.3. By End User

9.1.4. Source

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Middle East and Africa Butter and Ghee Market– Company Profiles – (Overview, Source Type Portfolio, Financials, Strategies & Developments)

10.1. Amul

10.2. Almarai

10.3. Beneficial Blends LLC, Lurpak

10.4. Arla Foods amba

10.5. Grassland Dairy Products Inc.

10.6. Heritage Foods Limited

10.7. Avera Foods (Pty) Ltd.

10.8. Britannia Industries

10.9. Netherend Farm Ltd.

10.10. Organic Valley

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

Ghee represents the pure essence of butter, obtained after the removal of milk solids and water. Renowned for its richness in essential nutrients such as protein, vitamins, carbohydrates, calcium, iron, and omega-3 fatty acids, it serves as a potent promoter of brain and heart health while also exhibiting anti-inflammatory properties and therapeutic potential against various diseases.

The top players operating in the Middle East and Africa Butter and Ghee Market are - Amul, Almarai, Beneficial Blends LLC, Lurpak, Arla Foods amba, Grassland Dairy Products Inc., and Heritage Foods Limited.

In May 2022, KMF unveiled a new deluxe iteration of ghee within its esteemed brand "Nandini." Branded as "Nandini Gold Ghee," this premium variant is meticulously crafted to cater to the refined preferences of consumers desiring unparalleled flavor and utmost purity. KMF's steadfast dedication to excellence and ingenuity has culminated in the introduction of this noteworthy ghee product, marking a substantial enhancement to its product lineup and bolstering its position within the market.

Turkey and Saudi Arabia are the fastest-growing segments in the market.